-

Outflows from crypto funds climbed to a three-month high last week.

While BTC recorded significant outflows, inflows into ETH-backed products were above $10 million.

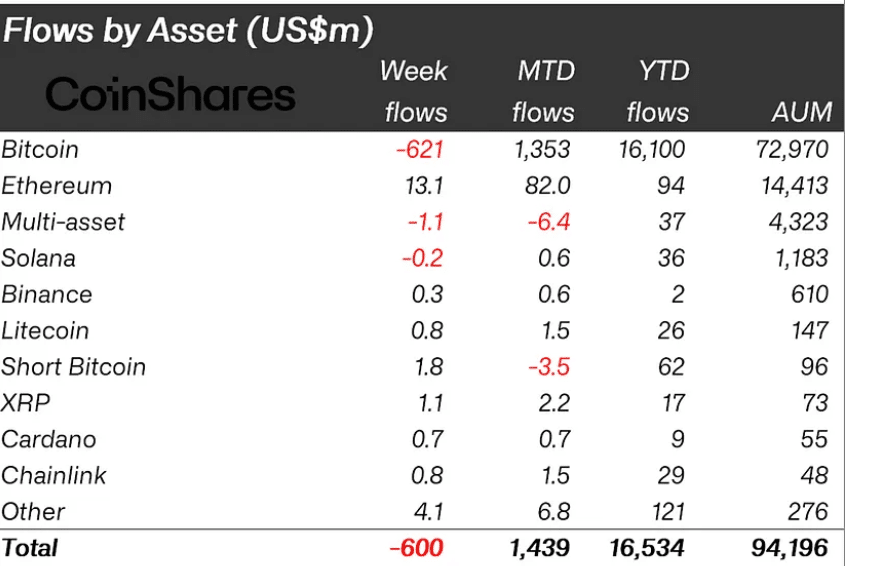

As a crypto investor with some experience in the market, I find the recent developments in digital asset investment products quite intriguing. Last week’s data from CoinShares revealed that outflows totaled an impressive $600 million, marking the largest weekly withdrawals since March. This trend was primarily driven by a more hawkish-than-expected Federal Open Market Committee (FOMC) meeting that led investors to reduce their exposure to fixed-supply assets, including Bitcoin.

Last week, digital asset investment products experienced withdrawals amounting to $600 million, according to a recent report from the digital asset investment company, CoinShares.

Last week marked the biggest withdrawal of funds from my crypto investment portfolio since late March, based on recent reports.

The unexpectedly aggressive stance taken by the Federal Open Market Committee (FOMC) in its recent meeting led investors to reduce their holdings of assets with limited supply, according to CoinShares.

For the seventh meeting in a row, the Federal Open Market Committee members chose not to make any adjustments to the interest rates, keeping them within the range of 5.25% and 5.50%.

Towards the close of CoinShares’ observation span, the cumulative value of cryptocurrency investment funds under their management amounted to $94 billion. This represented a 6% decrease from the $100 billion reported just a week prior.

During the week in question, trading volumes significantly decreased as a result of reduced trading activity.

CoinShares found that:

The trading volume was relatively low during the past week, amounting to $11 billion, which is significantly less than the average weekly volume of $22 billion recorded this year. However, it is important to note that this figure represents a substantial increase compared to the weekly volume of approximately $2 billion observed in the same period last year.

Last week, I noticed a significant trend in crypto investments. Specifically, I saw that over 90% of the total withdrawals from digital asset funds came from the US region, amounting to approximately $565 million. As a crypto investor, it’s important for me to keep an eye on these regional trends to make informed decisions about my own investments.

How did Bitcoin and Ethereum fare?

Last week, there were withdrawals totaling $621 million from investment vehicles backed by Bitcoin. These outflows resulted in a decrease in Bitcoin’s YTD inflows.

As a crypto investor, I’ve observed that Bitcoin’s total year-to-date inflows decreased by 4% over the past week, bringing the current value to approximately $15.8 billion.

Regarding short-Bitcoin products, they recorded inflows during that period.

CoinShares stated,

“The bearishness also prompted US$1.8m inflows into short-bitcoin.”

It’s worth mentioning that the altcoin sector performed quite well according to the report. For instance, Ethereum (ETH), the top altcoin, attracted investments amounting to $13 million over the past week, adding up to a total of $94 million in inflows year-to-date.

Approximately $2 million, $1 million, $800,000, and $300,000 worth of investments flowed into the altcoins LDO, XRP, LINK, and BNB respectively.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-06-18 20:07