Discussions about who contributed the most value in Disney’s corporate leadership often revolve around high-profile acquisitions and blockbuster movies. Yet, when we focus on concrete figures – particularly stock price growth – it becomes evident that Michael Eisner significantly outperformed his successor Bob Iger at Disney CEO, with a substantial lead.

According to industry expert Caroline Reid in Forbes, Michael Eisner’s 21-year leadership at Disney resulted in an impressive 19.2-fold increase in the company’s share price, while Bob Iger saw a more moderate 5.4-fold increase during his first term. This data doesn’t just add up to a footnote; it strongly suggests that Michael Eisner, not Bob Iger, deserves the title of Disney’s most successful CEO.

The Key Metric: Stock Growth as a Measure of Leadership

The rise in stock prices can directly reflect a CEO’s influence, encompassing factors such as strategic moves and investor trust. Initially, for Michael Eisner who took over as Disney CEO on September 22, 1984, the situation was challenging to say the least.

Disney stocks were valued at approximately $1.24, facing financial strains due to expensive delays at Walt Disney World and less-than-impressive movies. However, by his departure on September 30, 2005, the price had surged to $23.80, resulting in a significant increase of 19.2 times for investors’ value.

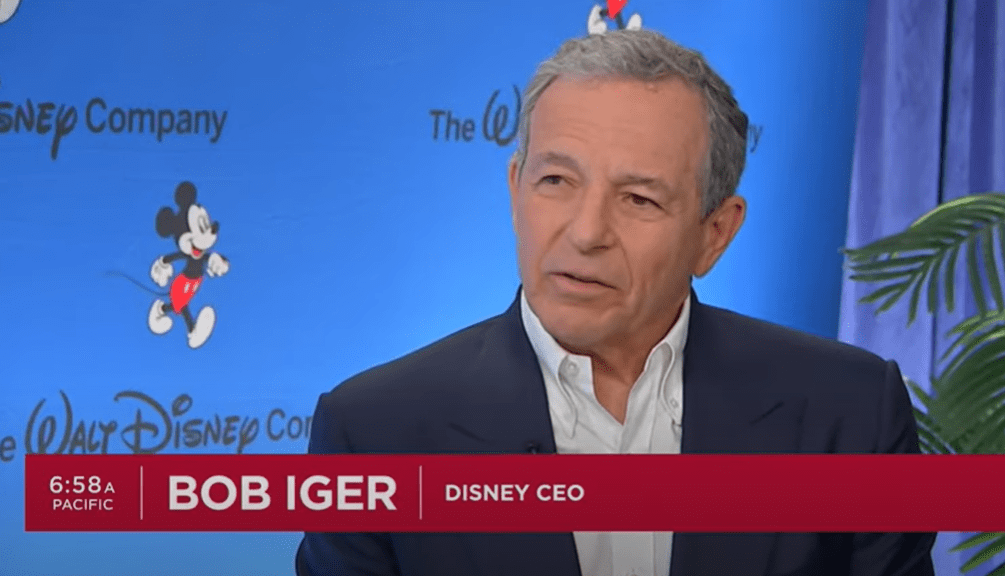

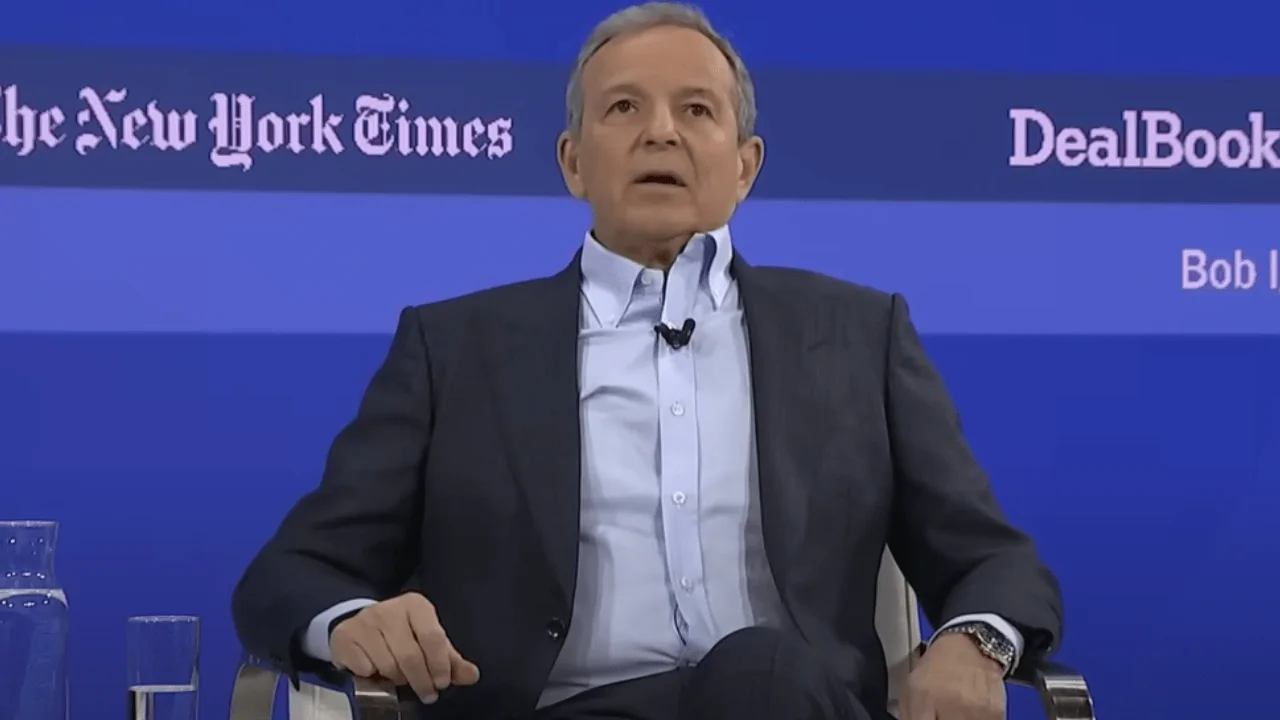

Under Bob Iger’s leadership, which began in October 2005 and continued until February 25, 2020, the stock price increased from an initial level of $23.80 to $128.19. This represents a growth of approximately 5.4 times, though much of this increase can be attributed to inflation and broader market expansion, rather than being a purely transformative period for the company.

During Iger’s tenure, Disney made notable acquisitions that broadened its dominion, but the multiplier indicates that while his accomplishments were substantial in dollar value, they didn’t reach the exponential increase in proportion that Eisner experienced, starting from a smaller base.

The Forbes analysis shows that Michael Eisner stands out as Disney’s most prosperous CEO, with the company’s stock price skyrocketing during his tenure. When he came on board, the share price was just $1.24; however, upon his departure, it had soared to an impressive $23.80 – a staggering 19.2 times increase compared to Bob Iger’s 5.4x growth. At the time of his exit in 2020, Disney’s stock was valued at $128.19 per share ($DIS).

— Movieconomics (@movieconomics) August 5, 2025

The analysis conducted by Caroline Reid on historical Google Finance data brings attention to this notable difference or gap.

Under Eisner’s leadership, there was a significant phase of restructuring, as indicated by his multiplier of 19.2 times, which paved the way for future triumphs, in contrast to Iger’s multiplier of 5.4 times during his tenure. This suggests that Eisner laid a strong foundation for the company’s later achievements.

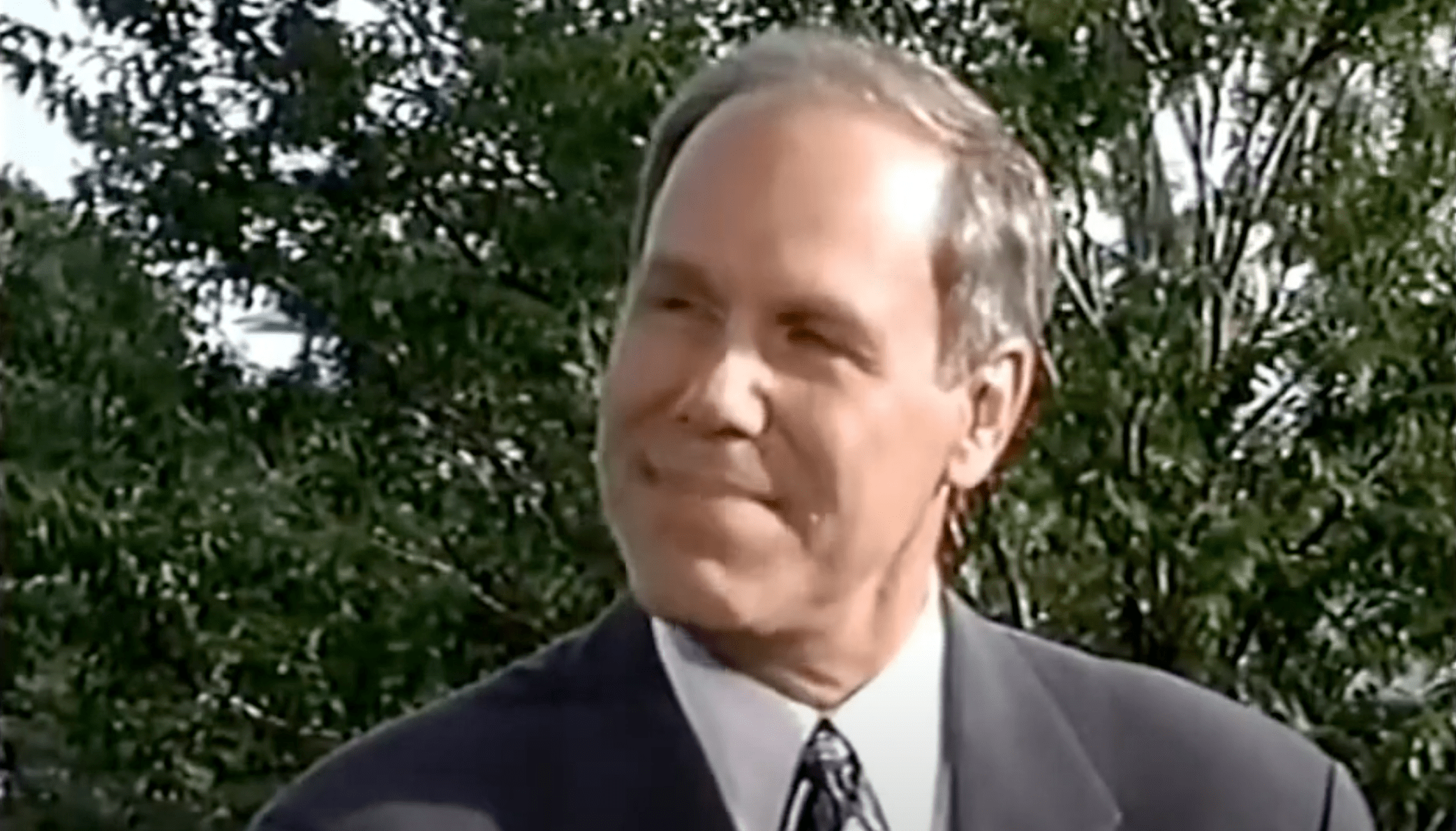

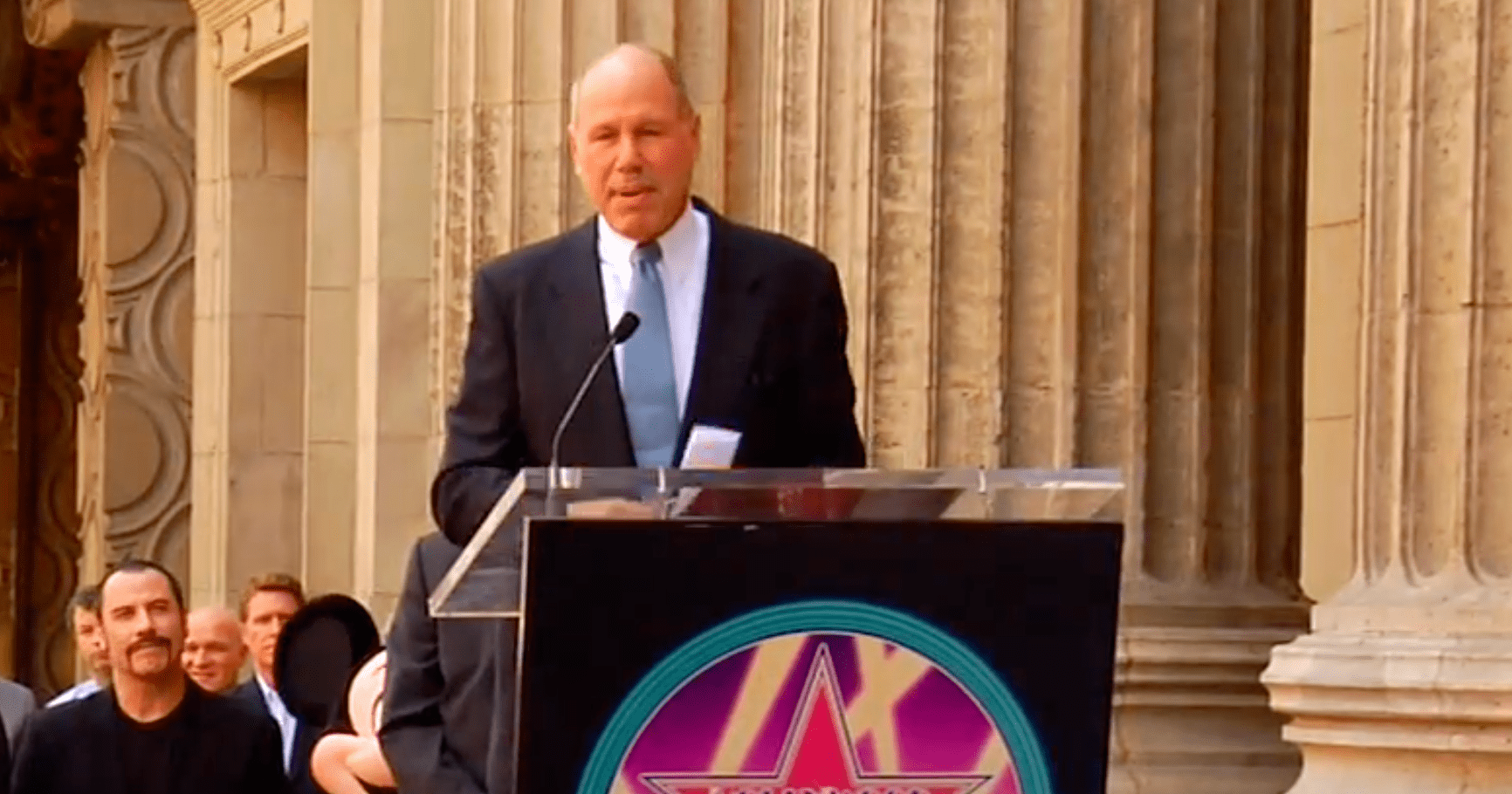

Eisner’s Era: Rebuilding Disney from the Brink

Eisner’s achievements were rooted in a practical, transformative approach that rejuvenated Disney, turning it from a struggling business into a powerful global force.

According to Reid’s account, the company in 1984 was facing serious financial trouble due to debt concerns stemming from the Disney brothers’ cautious approach, rooted in their Depression-era mentality. This attitude resulted in stock sales and a creative rut. However, Eisner, who had a successful track record at Paramount with hits like “Raiders of the Lost Ark,” brought new vitality to the company.

He shifted his attention back to fundamental abilities, revitalizing animation through classic musicals such as “Beauty and the Beast” and “The Lion King.” Collaborations, like the one with George Lucas for theme park rides, and expansions into various markets, including Europe, Japan, and Hong Kong, established a cycle of content, attractions, and merchandise that reinforced itself.

Eisner himself reflected on this.

He focused on revitalizing animation, and in doing so, he traveled to Europe and Japan. These moves weren’t just beneficial for Disney; they catapulted their stocks to unprecedented levels, solidifying his reputation as a CEO who increased value more than anyone else.

Where Iger Falls Short: Building on Foundations Without Matching the Magic

In my view, Iger’s impact is indisputable; he skillfully orchestrated acquisitions that catapulted Disney into a content powerhouse. By incorporating Pixar, Marvel, and Lucasfilm, he has solidified Disney’s dominance in Hollywood. However, the stock performance charts suggest a steady growth trajectory instead of the exponential leap witnessed during Eisner’s tenure.

Initially building upon a more solid foundation established by Eisner, Iger’s growth of 5.4 times was significantly bolstered by an extensive theme park network and rejuvenated animation production line. While external factors such as the surge in streaming services and economic recoveries contributed to some extent, their influence on the overall outcome was relatively minor compared to the groundwork that had already been laid.

Reid’s assessment indicates that Iger’s transactions transformed Disney into a colossus, yet when examined using stock multiplier perspective, they seem to be continuations of Eisner’s foundation instead of exceeding it. By August 2025, with Disney stocks roughly at $119.35, the company has not regained the initial pace of Iger’s early years (nor those of his potential successor Bob Chapek), encountering challenges in streaming and consumer expenditure.

Eisner’s Ongoing Proof: Success Beyond Disney

Evidence of Eisner’s exceptional skillset transcends his time at Disney. His 2017 purchase of Portsmouth Football Club, a soccer team in the UK that was struggling with debt, demonstrates similarities to his problem-solving approach.

Through prudent investment of $46.8 million, Eisner’s strategy, emphasizing content and quality, proved successful. This endeavor not only resulted in his promotion but also established a debt-free status and increased attendance. As we delve deeper, this venture underscores the continued effectiveness of Eisner’s approach, providing additional evidence to support its superiority over Iger’s methods.

In summary, although Iger’s bold actions garner headlines, it is the raw numbers that speak the loudest. Eisner’s remarkable 19.2-fold increase in growth surpasses Iger’s 5.4-fold growth, positioning him as Disney’s most triumphant CEO.

While Iger’s dazzling decisions catch the eye, it is the cold hard facts that hold the truth. Eisner’s staggering 19.2x growth outshines Iger’s 5.4x growth, making him Disney’s most successful leader at the helm.

Caroline Reid’s Forbes reporting lays out the narrative, and the numbers don’t lie.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- XRP’s Cosmic Dance: $2.46 and Counting 🌌📉

- Bitcoin or Bust? 🚀

- JRR Tolkien Once Confirmed Lord of the Rings’ 2 Best Scenes (& He’s Right)

2025-08-05 15:10