French banking institution ODDO BHF has just launched a euro-backed stablecoin, EUROD. The token will be listed on the Madrid crypto platform Bit2Me. Because nothing says “trust me” like a token that’s as stable as a house made of Jenga blocks 🧱💸.

1 ratio and is aimed at both retail and institutional users. Because nothing says “financial freedom” like a token that’s as exciting as watching paint dry. 🎨

The move marks a significant step for the traditional financial institution, which manages more than €150 billion or approximately $173 billion in assets across Europe. ODDO BHF aims to provide a secure and regulated digital asset option for investors seeking stability within the volatile crypto market. Because nothing says “security” like a bank’s version of crypto. 🏦🔐

“The listing of ODDO BHF’s euro stablecoin is another important step in Bit2Me’s mission to offer trusted, regulated digital assets,” said Bit2Me CEO Leif Ferreira in a press release sent to CoinDesk. Because nothing says “trust” like a crypto platform that’s already raised $35 million from Tether. 💸

Earlier this year, Bit2Me successfully raised €30 million or $35 million in an investment round led by the stablecoin issuer tycoon Tether. Through the listing of ODDO BHF’s EUROD, it hopes to narrow the gap between tradition finance and the crypto market. Because nothing says “bridge the gap” like a bank and a crypto exchange teaming up to make everything even more confusing. 🤯

ODDO BHF’s first venture into crypto

The launch of the euro-backed stablecoin marks the first dive into the crypto space. The firm joins a number of financial institutions in Europe that have jumped on the stablecoin bandwagon. Earlier this month Societe Generale’s digital asset arm launched its U.S dollar-backed and euro-pegged stablecoins on Morpho and Uniswap. Because nothing says “innovation” like a bank trying to play catch-up. 🕒

As previously reported by crypto.news, SG-FORGE aims to position is stablecoins as options instead of replacements for fiat currency. The firm views stablecoins as regulated instruments meant for specific use cases. Because nothing says “regulation” like a bank pretending they’re not trying to disrupt the system. 🧠

On the other hand, nine European banks including UniCredit SpA, ING Groep NV, DekaBank, Banca Sella, KBC Group NV, and Danske Bank AS have teamed up with the intention of launching a joint-stablecoin venture powered by the euro. The token will also be MiCA-compliant. Because nothing says “collaboration” like banks finally agreeing on something. 🤝

A few days prior, Citigroup announced that it would be joining the consortium of nine banks to launch a euro-backed stablecoin. Because nothing says “I’m in” like a bank hopping on the stablecoin train just to avoid looking left behind. 🚂

The heightened interest surrounding euro-backed tokens is influenced by the need to challenge the U.S dollar’s domination in the stablecoin market. According to data from DeFi Llama, the number one stablecoin in the world by market cap is Tether’s USDT (USDT), with a market domination of 59.01%. Meanwhile, euro-backed stablecoins only contribute around $573.9 million out of the total $306 billion stablecoin market cap. Because nothing says “underdog” like a euro stablecoin trying to compete with a titan. 🦁

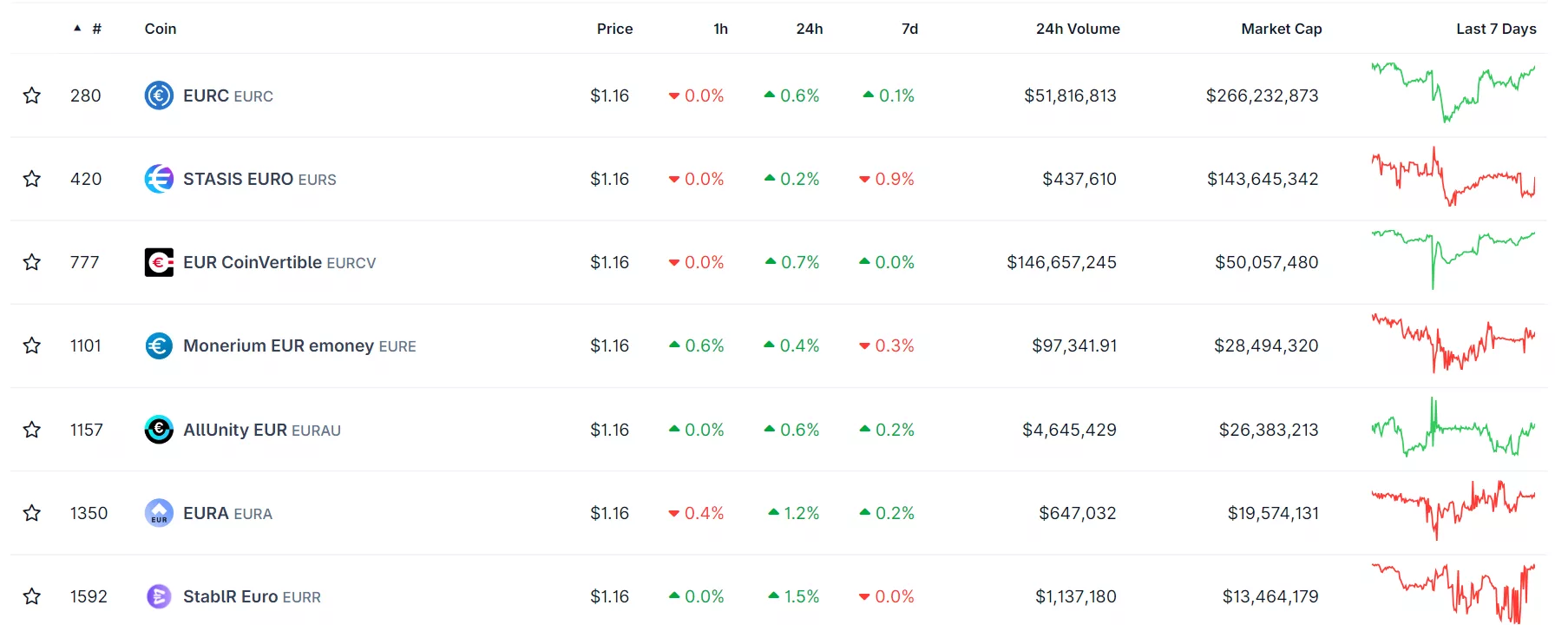

Meanwhile, euro-backed stablecoins only contribute around $573.9 million out of the total $306 billion stablecoin market cap. The largest euro stablecoin is Circle’s EURC (EURC) with a market cap of $266 million. In second place is EURS (EURS), followed by EUR CoinVertible’s EURCV (EURCV). Because nothing says “success” like a stablecoin that’s barely a blip on the radar. 📉

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Build a Waterfall in Enshrouded

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Get the Bloodfeather Set in Enshrouded

- Jamie Chung Reveals Why She & Bryan Greenberg Love Thanksgiving

- 10 Ridley Scott Films With the Highest Audience Scores on Rotten Tomatoes

- Superman Confirms a Major Arrowverse Figure Already Exists in the DCU

2025-10-15 15:21