Hey, remember that guy who lost a whopping $100 million after betting $1 billion on Bitcoin longs earlier this year? Yeah, James Wynn is back, and he’s not playing it safe this time. After weeks of silence, on-chain data shows that Wynn has returned to trading, placing risky bets on PEPE and BTC. 🤑💸

Wynn’s 10x PEPE Bet: A Meme Coin Gamble

After vanishing from social media and experiencing one of the most dramatic crypto trading collapses, Wynn is making a comeback, and this time, he’s betting big on a volatile meme coin, PEPE. The notorious Bitcoin trader has reportedly resumed trading the perpetual version of PEPE with fresh leveraged exposure on the decentralized derivatives platform Hyperliquid. 🚀🐸

According to blockchain analytics platform Lookonchain, Wynn returned to the market through the same crypto wallet address tied to his previous trades. On-chain data reveals that his latest position involves a 10x long on kPEPE, funded almost entirely by his recently claimed referral reward of 6,792.53 USDC—a striking contrast to the billion-dollar positions he previously commanded.

Updated information from HyperDash reveals that the trader opened a long position of approximately $89,000 on kPEPE. The position is running at 10x leverage, meaning the actual capital backing it is around $8,800, while the exposure exceeds $89,000. Notably, Wynn had bought over 6.8 million kPEPE, betting entirely on the token’s upside. At this leverage level, just a 10% drop in PEPE’s price could entirely wipe out the margin used to back this trade, making this an extremely high-risk move. 🤯💸

Interestingly, Wynn’s comeback follows his public fallout in May 2025, when his massive $1 billion leveraged BTC longs were liquidated during a price dip below $105,000, resulting in a staggering $100 million (949 BTC) loss. This incident caught the attention of the crypto community, sparking controversy and widespread discussions. Now the Bitcoin trader is facing renewed scrutiny from various crypto community members, with some labeling him a degen trader and others questioning his risk management skills. 🤔💸

Wynn’s 40x Bitcoin Bet: A High-Stakes Gamble

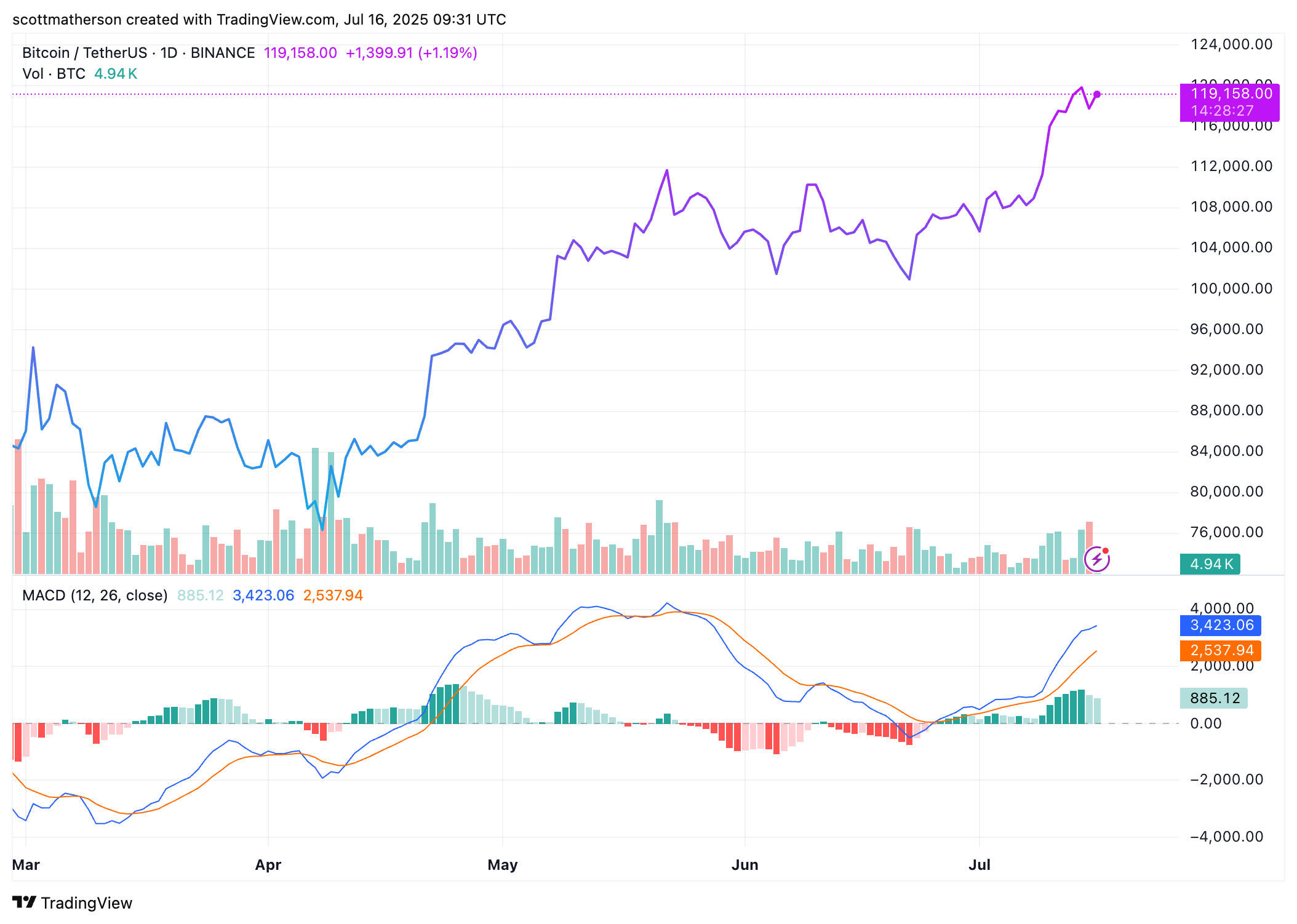

Despite accruing massive losses that forced him offline, Wynn is making another extremely high-risk Bitcoin trade, involving a $468,000 position and 40X leverage. In an earlier post, Lookonchain reported that the trader had deposited 468,000 USDC into Hyperliquid and opened a new leveraged long on Bitcoin, with a liquidation price of $115,570. 💸🚀

Updated data from HyperDash revealed that Wynn has opened a $23.9 million long position on Bitcoin with 40x leverage on Hyperliquid. The position size includes over 202 BTC, and the trader is fully committed to the cryptocurrency’s potential upside movement. 💸🚀

At 40x leverage, only 2.5% price movement against the trade would be enough to trigger a complete BTC liquidation, wiping out the entire margin backing Wynn’s position. This significantly high-risk strategy leaves no room for error, especially in a market as volatile as Bitcoin. 😱💸

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Fishing Guide in Where Winds Meet

- Pumuckl and the Crown of the Pirate King announced for Switch, PC

2025-07-17 02:49