- Bitcoin’s price has declined by nearly 5% in the last seven days.

- Most metrics and market indicators hinted at a continued price decline.

As a researcher with experience in analyzing cryptocurrency markets, I’ve been closely monitoring Bitcoin’s [BTC] price movements and trends. The recent decline of nearly 5% in BTC’s price over the past seven days has left many investors feeling uncertain about the future direction of the king of cryptos.

As a Bitcoin investor, I’ve noticed that bulls have faced some challenges in regaining control of the market lately. The weekly chart for Bitcoin has remained bearish, with red indicators signaling a downtrend.

As a crypto investor, I’ve been keeping a close eye on Bitcoin (BTC). Recently, some intriguing data has emerged suggesting that BTC may be gearing up for a significant price surge. Despite the market noise and volatile swings, the charts indicate that BTC has been quietly forming a bullish pattern. If this trend continues, we could be in for new record-high prices.

Bitcoin targets $127k

As a researcher examining current cryptocurrency markets, I’ve discovered that Bitcoin (BTC) experienced a significant price drop of approximately 5% within the last week. At present, BTC is being traded at around $66,147.26, falling below the $67k mark. The market capitalization for Bitcoin stands impressively high above one trillion dollars, reaching over $1.3 trillion.

As a crypto analyst, I recently came across an intriguing observation made by Gert van Lagen in a tweet.

Based on the tweet I’ve read, it seems that the recent decline in Bitcoin’s price could be part of a larger bullish flag pattern. In other words, instead of seeing this dip as a reason to panic, I believe we might be witnessing a temporary correction before the price continues its upward trend.

If the tweeted information is accurate that Bitcoin (BTC) has passed its support test, it’s possible that we could see an imminent bull market for BTC. This bullish trend could potentially push Bitcoin’s price up to reach $127k within the next few weeks or months.

BTC’s next move

Given that reaching $127k for Bitcoin appeared to be an unlikely scenario in the near future, AMBCrypto examined its key indicators to determine what lay ahead in the immediate term.

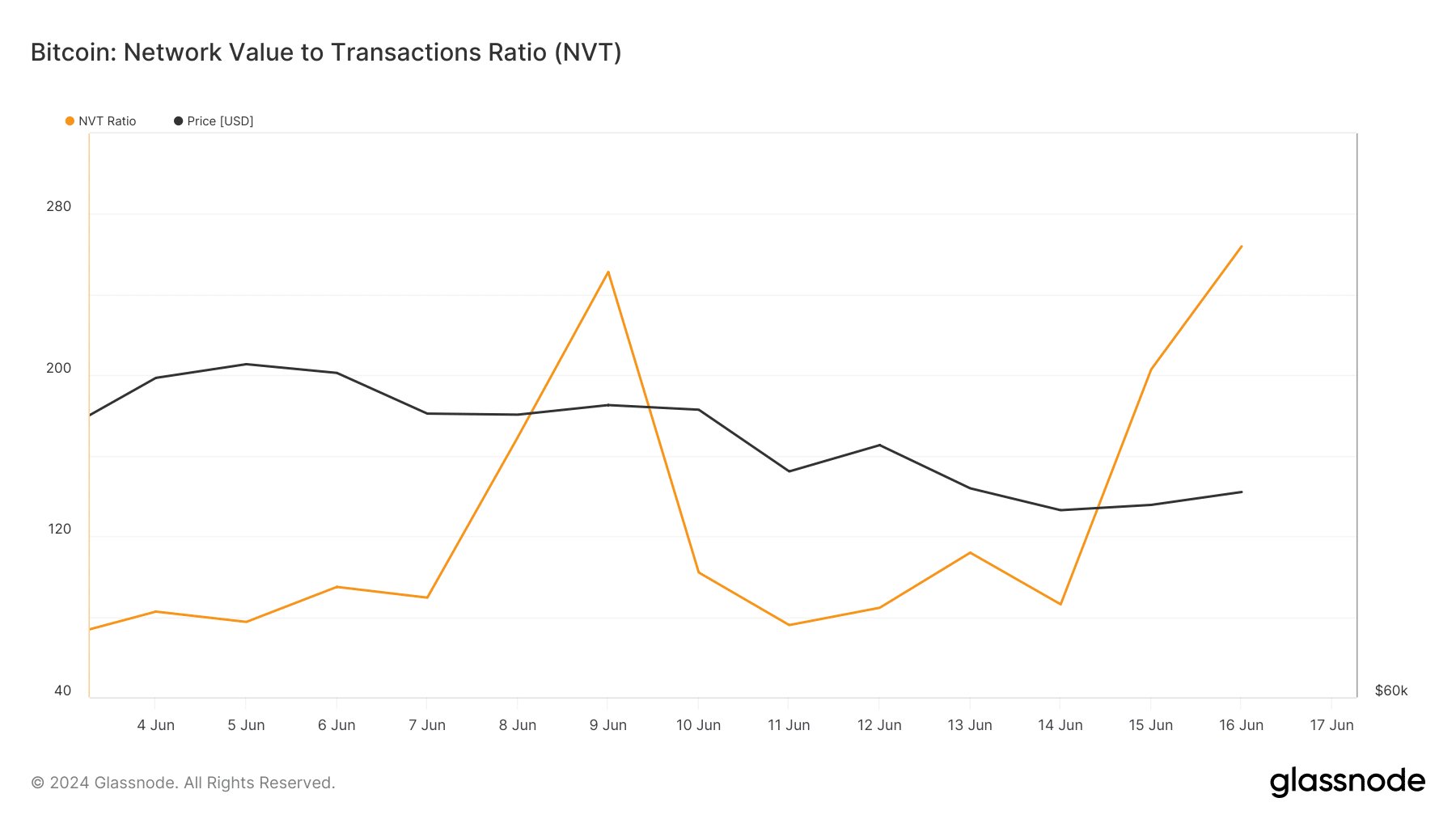

Based on our examination of Glassnode’s statistics, Bitcoin’s NVT ratio experienced a significant surge. An increase in this indicator suggests that the asset may be overpriced, potentially signaling a downward trend in its value within the near future.

After examining the information provided by CryptoQuant, it was noted that the amount of Bitcoin being transferred into exchanges recently was greater than the typical amount over the past week. This signifies a significant selling pressure for Bitcoin.

During a bull market, a red accumulation distribution RSI (asymmetric moving average ratio profile) for Bitcoin implies that an increased number of investors have sold their profits. This could potentially signal the approach of a market peak.

As a market analyst, I observed a favorable trend in the derivatives market based on its taker buy-to-sell ratio. This ratio suggested that more futures investors were buying rather than selling, signaling a predominantly bullish attitude towards the market.

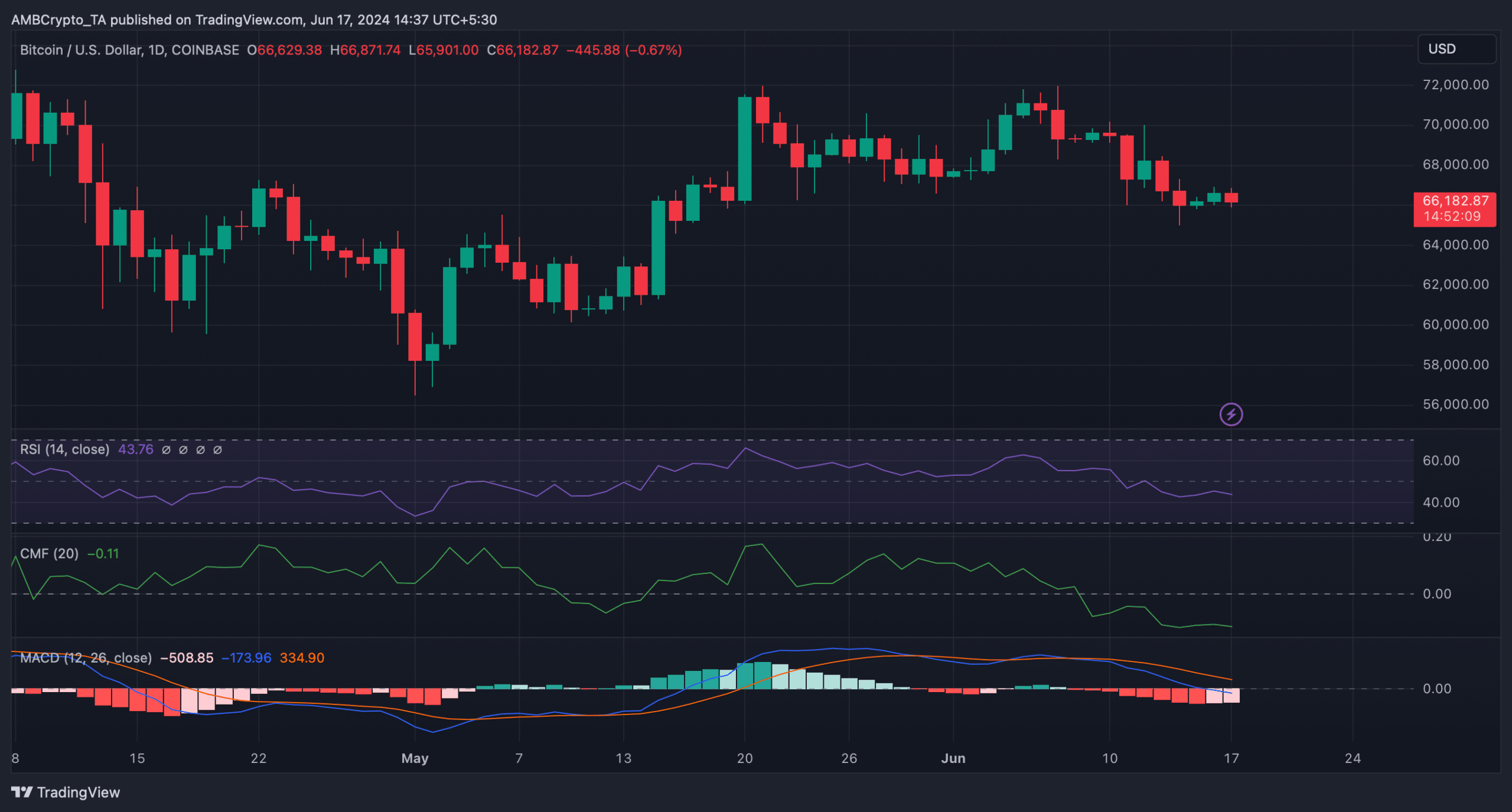

As a crypto investor, I closely monitor market indicators for signs of trend reversals. Unfortunately, the coin’s outlook remained bearish based on my observations. For instance, BTC‘s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both showed downticks and were sitting below their neutral marks. These indicators suggest that selling pressure is stronger than buying pressure in the market, increasing the likelihood of further price declines.

The MACD displayed a bearish advantage in the market, hinting at a continued price decline.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on AMBCrypto’s analysis of Hyblock Capital’s data, I as a crypto investor would prepare myself for the possibility that if Bitcoin continues its bearish trend, it could dip down to hit the $65,000 mark this week.

As a crypto investor, I believe that if Bitcoin (BTC) dips below its current level, there’s a possibility it could fall as low as $60,000 in the coming days. On the other hand, should BTC exhibit bullish behavior, it may first touch $67,650 before continuing its upward trend.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-18 02:15