- Biggest gainers: Onyxcoin [XCN], Fartoin [FARTCOIN], JasmyCoin [JASMY].

- Biggest losers: Tezos [XTZ], Eos [EOS], Movement [MOVE].

The week began with the crypto market resembling a hangover after a wild party—groggy, disoriented, and regretting its life choices. The U.S. economy, too, was feeling the weight of rising trade tensions, like a man who’d accidentally worn his neighbor’s shoes to work. But then, as if by divine intervention (or perhaps just a well-timed tariff exclusion), the market perked up. By week’s end, it was strutting around like it owned the place, with a few risk assets even flaunting triple-digit gains. 🕺

Weekly winners

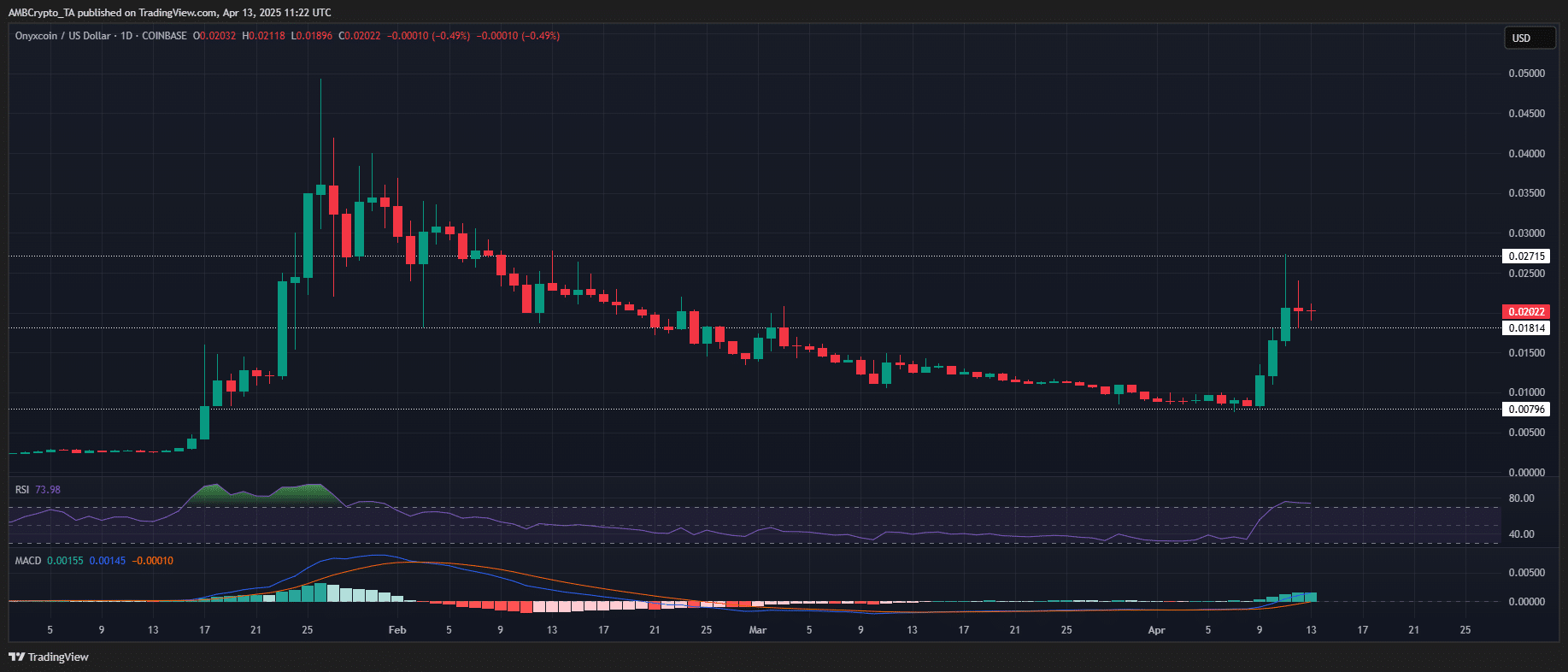

Onyxcoin [XCN]: The Comeback Kid

Onyxcoin [XCN] had a mid-week epiphany, spiking 43.88% in a single day on April 9th. It was as if the coin had suddenly remembered it had a purpose in life. Two more days of relentless buying followed, with price increases of 36.78% and 24.65%, respectively. By the end of the week, XCN had erased two months of losses and breached $0.027, leaving everyone wondering if it had secretly hired a motivational speaker. 🎤

Of course, profit-taking ensued, and the RSI hit an overbought condition at 81.09. But if XCN’s January performance is any indication, where bulls absorbed sell-offs like a sponge, a similar rebound could be on the horizon. Or, you know, it could just crash and burn. Such is life in crypto. 🔥

Fartoin [FARTCOIN]: The Silent But Deadly Climber

Fartcoin [FARTCOIN] had a week to remember, rallying over 90% and breaking out of a multi-week accumulation range. It decisively cleared the key resistance at $0.64, flipping it into intraday support. The breakout began on April 9th with a sharp 50% intraday gain, and within two sessions, it was retesting the $0.98 level. Currently, $0.87 has established itself as a short-term supply zone, with price action showing signs of exhaustion. The rally toward the psychological $1.00 level has stalled, coinciding with profit-taking. The RSI is trending lower from overbought conditions, and the MACD has flipped bearish, indicating waning upside pressure. In other words, FARTCOIN might need a breather before it can attempt to reclaim the $1.00 resistance level. Or, as some might say, it needs to let one rip. 💨

JasmyCoin [JASMY]: The Data-Driven Darling

JasmyCoin [JASMY] started the week with a modest 4.85% bounce from a fresh 52-week low of $0.00897. What followed was a sharp and steady recovery, and by the week’s end, JASMY was trading at $0.01656, up 68.91%. The rally followed a clean breakout from its multi-month downtrend, supported by rising buying volume and a bullish crossover in indicators like the RSI. The price action suggests accumulation at lower levels, with steady green candles and limited volatility—unlike the more speculative spikes seen elsewhere. This indicates stronger hands stepping in, possibly leaving room for further upside. For now, the key resistance sits at $0.018–$0.0194. A decisive breakout above that could open the door for a move toward the next target at $0.022. Or, it could just sit there and do nothing. Who knows? 🤷♂️

Other notable gainers

Beyond the top performers, the broader market exhibited notable price action. Edge [EDGE] spearheaded the rally with a meteoric 825% surge, outperforming the top 1,000 tokens in terms of price momentum. Aergo [AERGO] and Retard Finder Coin [RFC] followed with substantial price gains of 332.8% and 270%, respectively. It’s like the crypto market decided to throw a party, and everyone was invited—except, of course, the losers. 🎉

Weekly losers

Tezos [XTZ]: The Election Hangover

Tezos [XTZ] finished the week as the largest underperformer, with a 17.20% decline, extending its consecutive week-on-week losses. On the 1D timeframe, price action remains under significant bearish pressure, with no discernible bid-side absorption to halt the selling momentum. As a result, XTZ has formed a new lower low, breaking below its post-election peak of $1.90 and establishing a fresh support at $0.53. Despite the retracement, demand remains weak, with no signs of strong dip-buying. The absence of accumulation at these levels suggests that XTZ’s downside momentum could persist unless a strong support base materializes to absorb sell-offs. Without a shift in market structure or a bounce off key support, the asset is likely to continue its downtrend in the short term. In other words, it’s not looking good, folks. 😬

Eos [EOS]: From Hero to Zero

EOS [EOS] experienced a significant pivot this week, moving from last week’s biggest winner to second on the loser chart, posting a 12.34% weekly drawdown. The altcoin initiated the week with a 7.28% rally, showing early signs of a breakout attempt after forming three consecutive lower lows. However, momentum quickly reversed as bears took control, leading to a sharp 12.83% bearish engulfing candle, erasing the week’s early gains and pushing price back to $0.65. On the 4H timeframe, the price structure remains firmly bearish, with consecutive red volume bars indicating strong distribution. The absence of bid-side absorption suggests a lack of liquidity support, and without substantial buy-side interest, EOS could face a deeper pullback to test the next support at $0.53. It’s like watching a promising athlete trip over their own shoelaces. 🏃♂️💨

Movement [MOVE]: The Fitness Flop

Movement [MOVE] posted a 12.78% weekly drawdown, retracing from last week’s close at $0.37, placing it third among the top decliners. Price action continues to reflect a distribution phase, as bulls fail to generate sufficient momentum for a structural breakout. In fact, throughout the week, MOVE traded within a consolidation channel between $0.24–$0.40. However, the absence of demand-side absorption near local lows confirms weak market participation, with no signs of accumulation or base formation. Despite a 21% increase in volume (up to $76.88M), the uptick appears to reflect opportunistic liquidity sweeps rather than a true shift in order flow dynamics. The RSI remains in a downward trajectory, reinforcing bearish bias, while the lack of a confirmed higher low suggests MOVE could be setting up for another liquidity purge below the $0.24 range low. It’s like a gym membership you never use—expensive and pointless. 🏋️♂️

Other notable losers

In the broader market, several tokens underwent significant price retracements. MetFi [METFI] led the declines, facing a steep 51% drawdown, while MMX [MMX] and Comedian [BAN] followed with 41.7% and 40% pullbacks, respectively. It’s like the crypto market decided to play a game of musical chairs, and these tokens were left standing when the music stopped. 🎶

Conclusion

And there you have it—the weekly recap of the top gainers and losers. It’s important to remember the highly volatile nature of the market, where price fluctuations can occur faster than you can say “Fartcoin.” As such, conducting thorough due diligence (DYOR) before making any investment decisions is strongly recommended. Or, you know, just throw your money at the wall and see what sticks. Your call. 🤷♀️

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2025-04-13 22:21