- Bitcoin miners confront uncertainties amidst price surges preceding the fourth halving.

- Strategic decisions on Bitcoin holdings and regulatory challenges impact mining profitability.

As someone who closely follows the cryptocurrency market and the intricacies of Bitcoin mining, I find myself both intrigued and concerned by the current state of affairs. The upcoming fourth halving of Bitcoin has created a unique set of circumstances for miners. With the price surging beforehand, there’s a sense of uncertainty regarding its impact on profitability.

In the ever-changing world of cryptocurrencies, Bitcoin [BTC] miners face a pivotal decision. The recent Bitcoin halving defied expectations with an uptick in price prior, fueling buzz and uncertainty among market insiders.

As Bitcoin reaches unprecedented peak prices prior to its scheduled halving event, a pressing concern arises: will this development bring prosperity or hardship for the miners?

Bitcoin halving impacts miners

As an assistant, I’d suggest paraphrasing it as follows in the first person perspective:

As an observer, I ponder over the intriguing query surrounding Bitcoin’s potential for further escalation. One possible answer lies with the ETF (Exchange-Traded Fund). This financial instrument could serve as a catalyst, enabling easier access for both institutional and retail investors to the market, potentially fueling Bitcoin’s parabolic growth even more.

Drawing parallels with the previous cycles, he added,

As I observe the situation post-mining reward reduction, it seems that a significant number of miners will barely break even and will continue operation for roughly three to six months. Consequently, the process unfolding appears to be considerably prolonged compared to what transpired in 2022.

During the post-halving adjustment, miners might continue to operate even when profits are slight, prolonging this phase.

As a result, the mining industry might experience a longer period of solidification with a higher risk of setbacks, potentially reaching into 2025.

Bitcoin miners strategy

Another point to consider when discussing Bitcoin management for mining businesses is whether to keep or sell the mined Bitcoins during market fluctuations.

In response, Sullivan said,

“We are currently selling our Bitcoin on a daily basis.”

Through his comments, he placed greater importance on reducing potential losses and enhancing stockholder benefits, as opposed to hoarding Bitcoin primarily for self-interest.

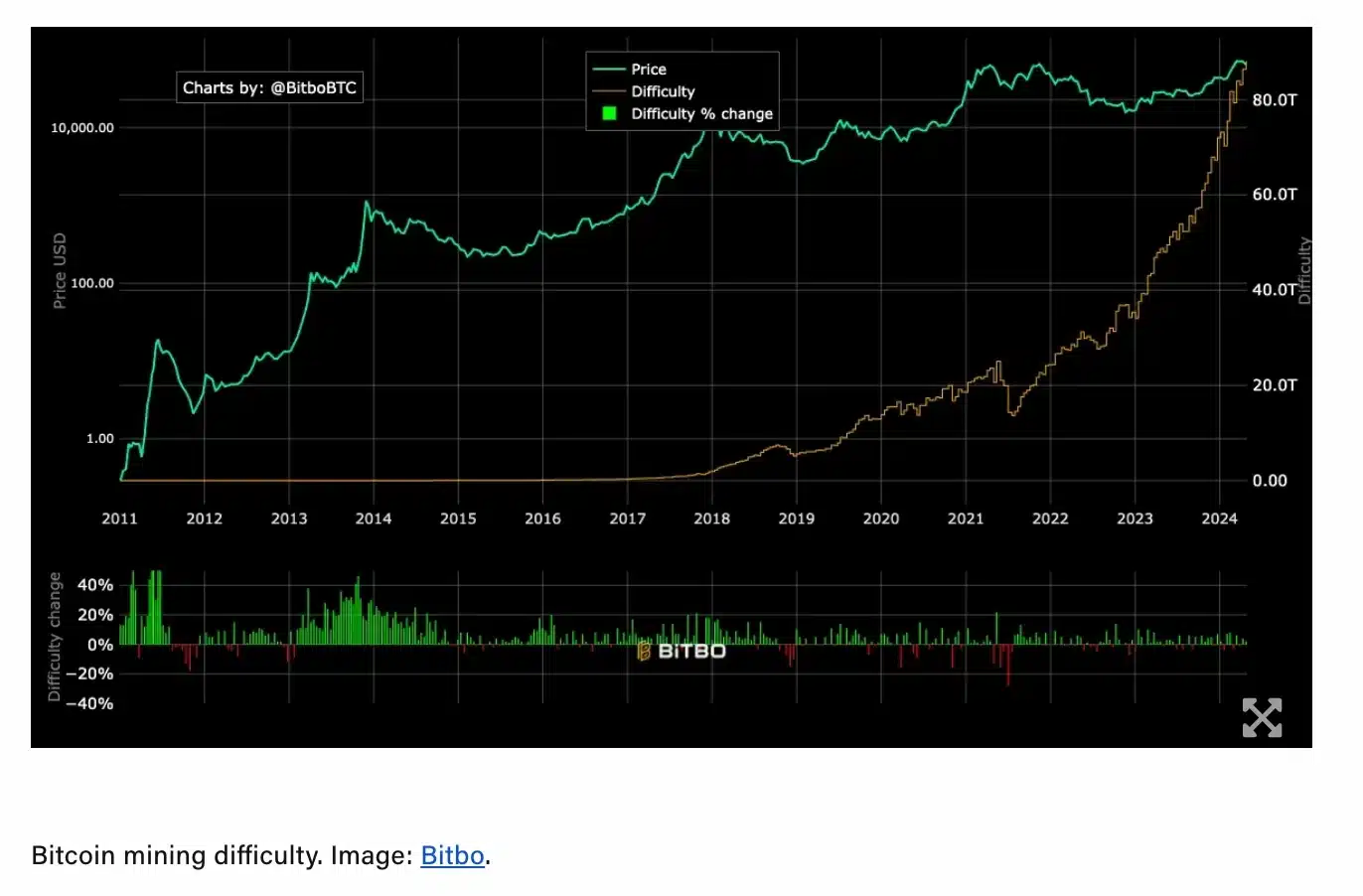

The Bitbo data added evidence to this finding, revealing a 2% increase in the challenge of Bitcoin mining, resulting in a new record of 88.1 trillion at block height 840,672.

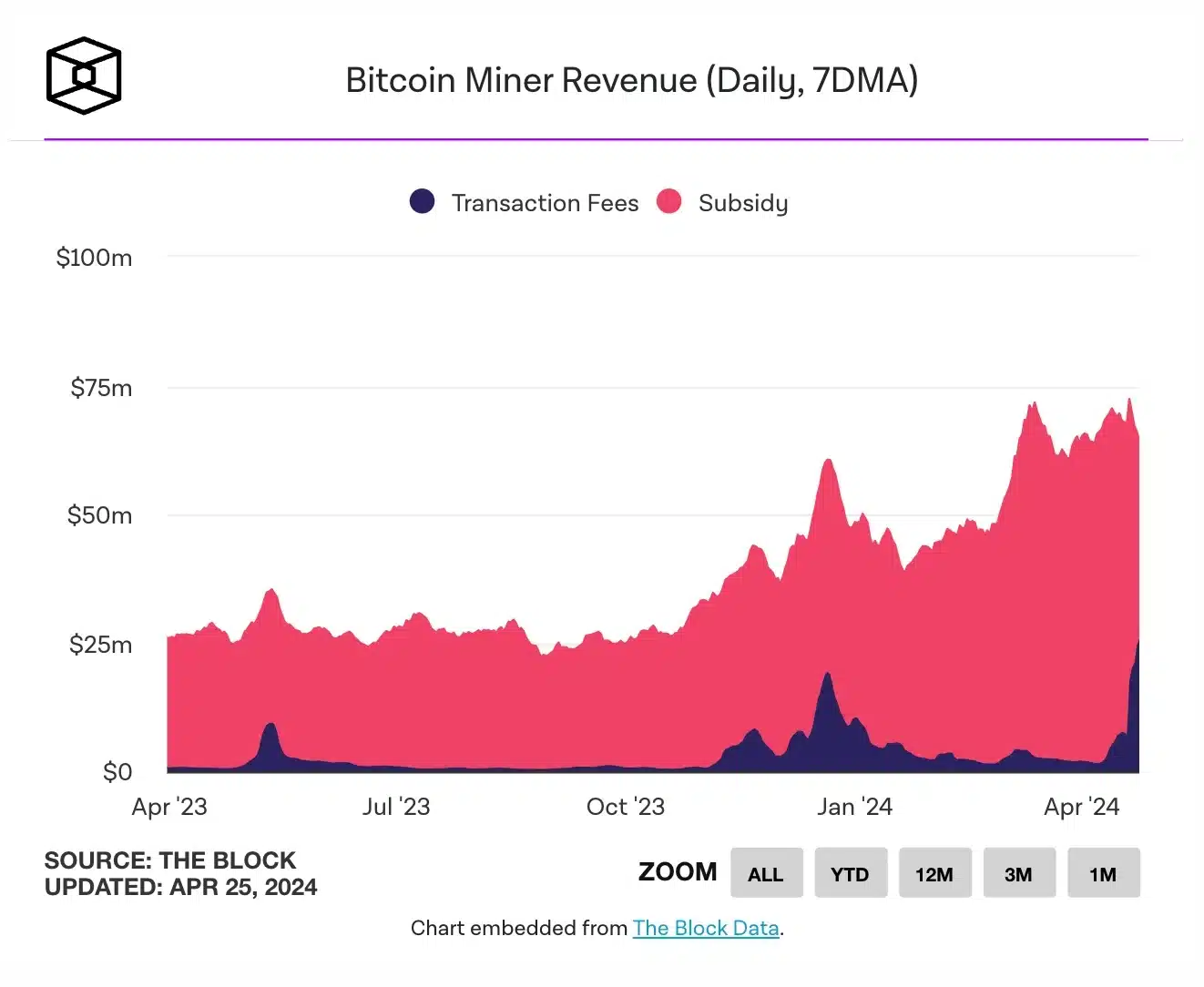

Despite this, The Block’s data indicates that miners maintain stable revenue post-halving.

Based on the chart’s data, approximately 40% of the rewards earned by miners come from transaction fees today. This is a substantial increase from the 10% that was derived from transaction fees prior to the halving event.

Joe Biden’s big move

It’s worth noting that President Joe Biden implemented a 30% tax on Bitcoin mining operations. This move drew criticism from Senator Cynthia Lummis.

“It would be a historic mistake to slap Bitcoin miners with a 30% tax that is a de facto ban.”

From my perspective, the intricacies of the Bitcoin mining landscape are revealed through the ongoing dance between market forces, regulatory influences, and miners’ strategic choices.

In intriguing turn of events, it remains captivating to observe how the future unfolds for miners within the next few days, weeks, or even months.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-04-25 20:08