FTX Recovery Trust sues Genesis Digital Assets for $1.15B, alleging Sam Bankman-Fried misused customer funds before collapse.

The FTX Recovery Trust has launched a lawsuit so dramatic it could make a Discworld novel blush. Genesis Digital Assets (GDA), a crypto mining company, now finds itself in the crosshairs of a $1.15 billion legal saloon brawl. The trust claims former FTX CEO Sam Bankman-Fried (think: crypto’s version of a man who thought he could out-scheme gravity) allegedly siphoned customer funds into GDA at prices so inflated they’d make a balloon animal jealous 🎈.

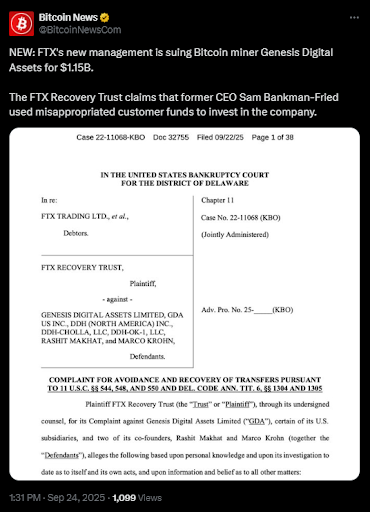

The complaint, filed in the US Bankruptcy Court for the District of Delaware, accuses Bankman-Fried of transferring over $1 billion into GDA between 2021 and 2022. For context, that’s about the price of a small asteroid, if asteroids came with a warranty 🪨.

FTX Recovery Trust Targets Genesis Digital in New Case

According to court documents, Alameda Research (Bankman-Fried’s other hat, if you’ll pardon the metaphor 🎩) spent $500 million on 154 preferred shares of GDA at “outrageously inflated prices.” Meanwhile, Bankman-Fried personally sent another $550.9 million to GDA co-founders Rashit Makhat and Marco Krohn. The trust argues these were not investments but “deliberate misuse of funds”-a phrase that sounds like it could be the next bestseller in the “How to Lose Friends and Irritate Customers” series 🤷♂️.

The lawsuit also claims Bankman-Fried ignored red flags like Kazakhstan’s energy crisis (which, if you’re not in a dystopian novel, is a *huge* red flag 🔥). The company’s financial statements were allegedly “bogus,” a term that would make even the most hardened accountant wince.

Alleged Misuse of Customer Funds

By 2021, Alameda had already borrowed billions in customer deposits from FTX.com. Despite this, Bankman-Fried pushed for more GDA purchases. The trust argues this was a pattern of fraud, not just poor judgment. After all, who *wouldn’t* want to overvalue a company in Kazakhstan during an energy crisis? It’s like investing in a desert during a sandstorm-brave, if not entirely sane 🌪️.

Recovery Efforts Already Returning Billions

So far, the FTX Trust has returned over $6 billion to creditors. Payments started with $1.2 billion in February, then $5 billion in May. Another $1.6 billion is due by September 30. That’s enough to buy a small country, if small countries come with Wi-Fi and a coffee bar ☕.

However, creditors are still left with fractions of their original assets. Why? Because repayments are calculated based on crypto prices from November 2022-when Bitcoin was $20,000. Now it’s $90,000-$112,000. So, while you’re getting paid in 2022 dollars, you’re living in 2025, and the math is doing the emotional equivalent of a facepalm 😬.

Challenges for Creditors

Some creditors argue the system is unfair, but bankruptcy law says “sue us if you can.” And honestly, who wants to spend their retirement on a legal battle? It’s like trying to catch smoke with a net-possible, but not advisable 🕳️.

Meanwhile, the FTX Trust continues its legal chess match with Genesis. Whether they’ll recover all $1.15 billion or just enough to fund a lavish office party for lawyers remains to be seen. But hey, at least the legal fees will be worth it 🎉.

Read More

- When Is Hoppers’ Digital & Streaming Release Date?

- Sunday Rose Kidman Urban Describes Mom Nicole Kidman In Rare Interview

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- 10 Movies That Were Secretly Sequels

- Best Shazam Comics (Updated: September 2025)

- 10 Best Pokemon Movies, Ranked

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- The 10 Best Episodes Of Star Trek: Enterprise

- 10 Best Anime to Watch if You Miss Dragon Ball Super

2025-09-25 12:18