- An FTX/Alameda staking address has unstaked $28M worth of Solana, which will likely be deposited to exchanges.

- However, despite this possible sale, SOL bulls are defying the bearish sentiment as price targets $172.

As an analyst with over a decade of experience in the volatile world of cryptocurrencies, I’ve seen more than my fair share of market surprises and twists. The recent developments surrounding Solana (SOL) have certainly been no exception. Despite the potential sale of millions of dollars worth of SOL by FTX and Alameda Research, the bullish sentiment around this altcoin is defying gravity, with its price targeting $172 at press time.

Over the past period, Solana (SOL) has recovered in tandem with the overall crypto market. Notably, after Bitcoin (BTC) surged to prices over $66,000, Solana, similar to numerous other altcoins, mirrored this trend and attained its highest point for the week.

At the moment of reporting, Solana was valued at approximately $154, showing a 1.47% increase over the past day. Notably, trading volumes also experienced a surge of roughly 45%, as indicated by CoinMarketCap data.

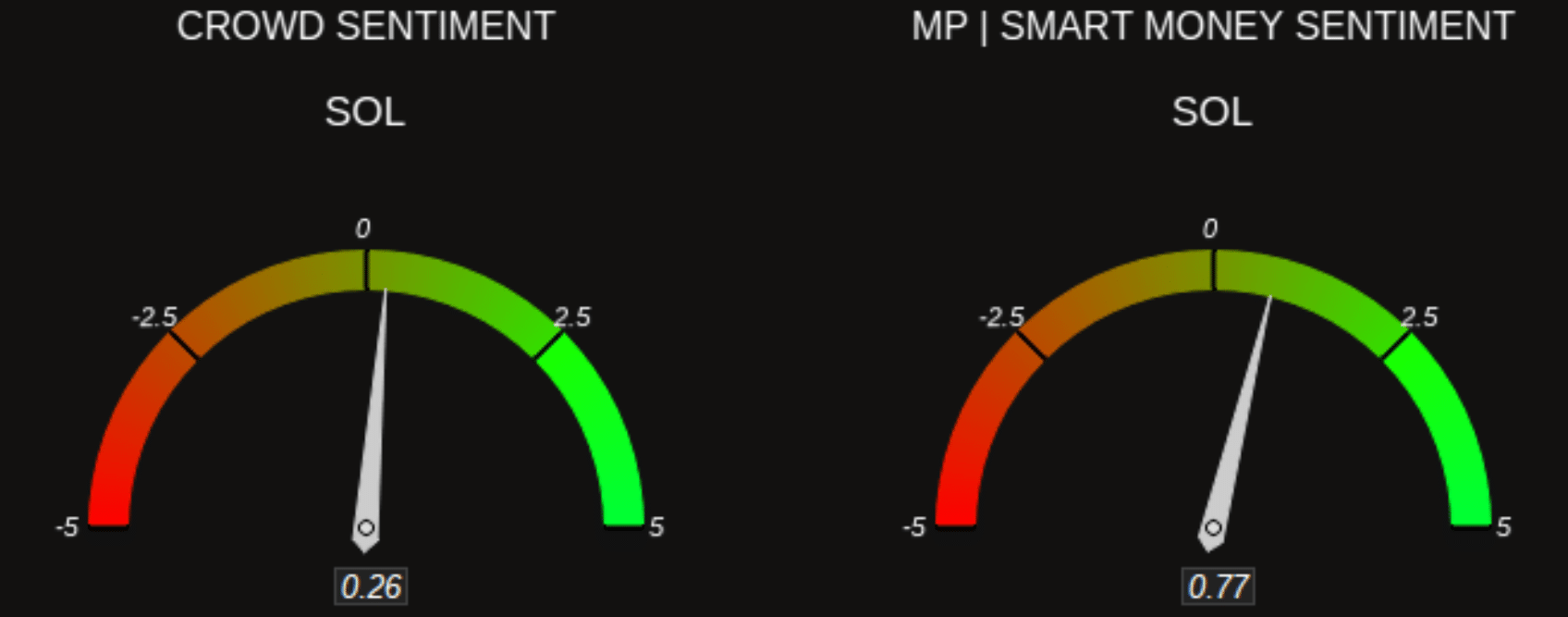

These gains have flipped the crowd and smart money sentiment around Solana to bullish.

The positive narrative comes despite concerns around a possible sale of millions of dollars worth of Solana by defunct crypto firms FTX and Alameda Research.

FTX unlocks Solana worth $28M

According to Solscan’s data, an account linked to both FTX and Alameda released approximately 178,631 SOL tokens on October 15th, which was equivalent to roughly $28 million based on the then-current Solana price.

Based on findings from EmberCN’s on-chain analysis, it appears that these tokens are likely being transferred to cryptocurrency exchanges like Binance or Coinbase. A staking address has been consistently redeeming approximately 170,000 SOL between the 12th and 15th of each month, which is then moved to either Binance or Coinbase.

If the recently unstaked tokens are sold, it will likely increase the selling pressure on Solana. However, a look at the one-day chart shows that bulls are taking charge and overpowering the bearish sentiment.

Solana price analysis

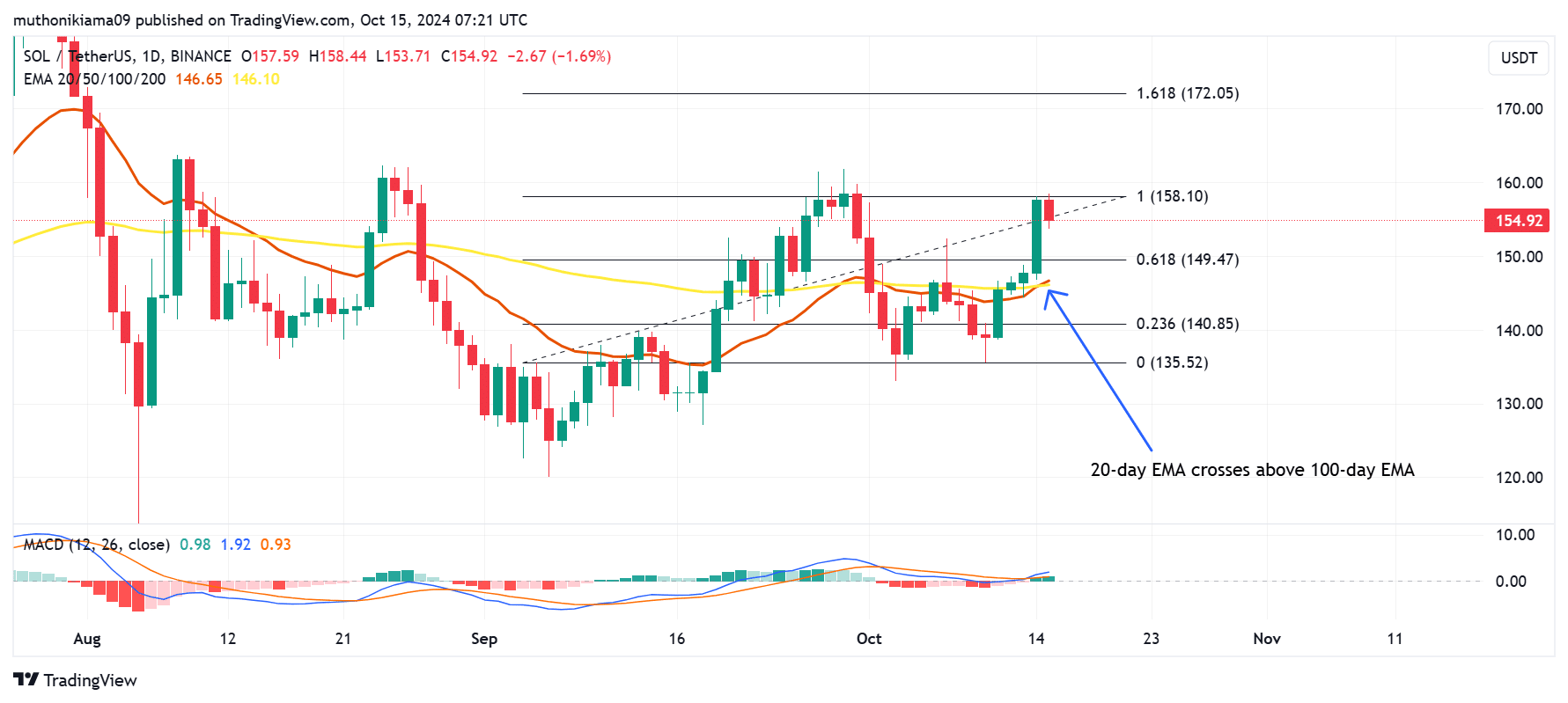

On Solana, we’ve seen a positive crossover event where the short-term moving average (20 days) surpassed the long-term one (100 days). This is typically a bullish signal in technical analysis.

Based on my years of trading experience and observing market trends, this crossover indicates that the current market sentiment is gradually tilting towards buyers. This shift could potentially drive further upward momentum, making it a promising time for those who are bullish like myself to consider entering or increasing positions in the market. However, it’s essential to remain cautious and keep a close eye on the indicators to ensure that we don’t miss any potential reversals or corrections along the way. After all, even the most favorable conditions can be quickly disrupted by unforeseen factors.

An increase in purchasing activity is noticeable through the MACD histogram bars turning green, while the MACD line itself has moved upward and now sits above the signal line, indicating a bullish trend.

Prolonging this upward momentum might propel SOL towards the upcoming resistance at approximately $172.

As a crypto investor, if the price of SOL dips down to the support level of $149, it might present an attractive buying chance for me, especially if the overall market keeps growing and there’s a continued optimistic outlook on SOL.

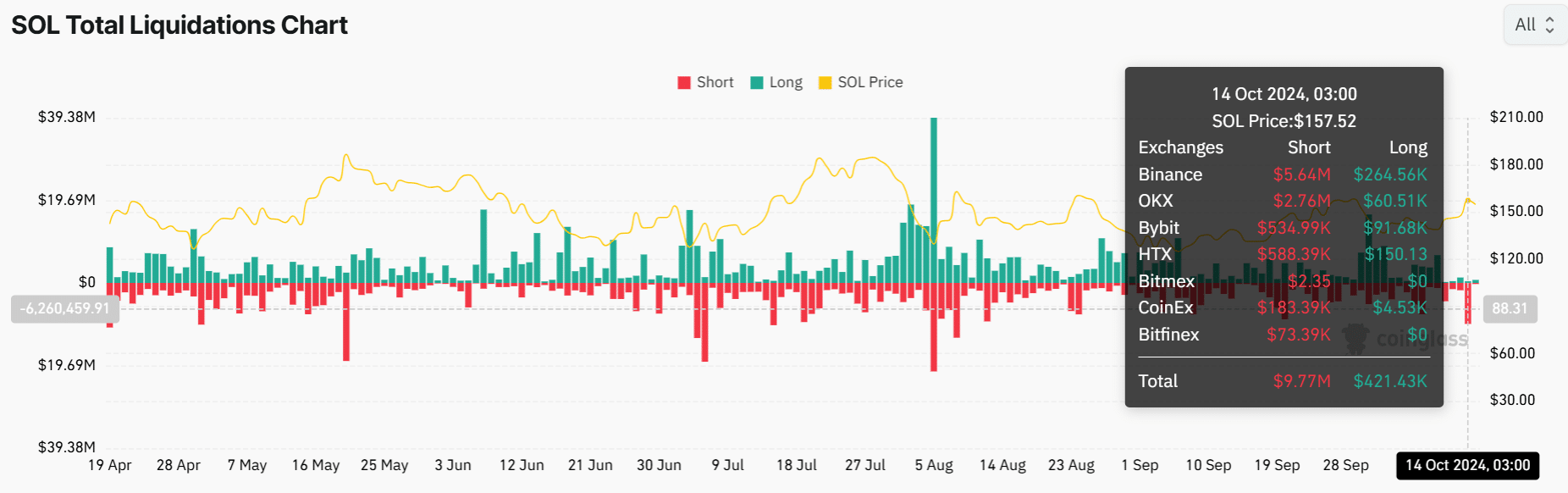

It appears that the recent increases in Solana’s value might be due to an increase in lending fees (funding rates) reaching a seven-day peak, which put pressure on those who had bet against it (the shorts).

14th October saw a staggering $9 million worth of Solana short positions being closed (liquidated), which represents the greatest amount of short liquidations since early August.

These liquidations forced short sellers to become buyers to close their positions.

Read Solana’s [SOL] Price Prediction 2024, 2025

In addition to the increase in demand due to short sellers, the surge in popularity of meme coins built on the Solana platform is also contributing significantly to their rise in value.

As reported by CoinGecko, the total value of Solana’s meme-based cryptocurrencies has increased by 17% over the past week, now standing at approximately $11 billion.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-16 00:08