FTX, that once-mighty titan of the crypto realm, now a shadow of its former self, prepares for its third round of creditor repayments—a spectacle that might as well be a theatrical performance where the audience is both the actors and the spectators. 🎭💸 The bankrupt company, through the FTX Recovery Trust and FTX Trading, announced on Wednesday that it will distribute $1.9 billion to eligible claim holders starting September 30. The final list of recipients will be based on a record date of August 15, with no further claim disputes holding up the process. 🧾

This new payout follows a $1.2 billion distribution in February and a massive $5 billion allocation announced in May, signaling steady progress in the recovery process for thousands of creditors worldwide. However, not everyone is convinced this is the full picture. 🤨 The question lingers like a ghost: Is this a genuine effort, or merely a masquerade? 🕵️♂️

Key data from Arkham Intelligence has sparked renewed speculation over how FTX is managing its crypto holdings. Recent on-chain movements involving large ETH and SOL deposits by wallets tied to FTX and Alameda Research suggest that the firm could be staking assets instead of liquidating them for creditor repayments. This raises serious questions: Are these funds really earmarked for customers—or is there more happening behind the scenes? 🤔💰

Arkham Flags Suspicious Activity By FTX And Alameda Ahead of Repayments

Just weeks before a scheduled $1.9 billion creditor repayment, blockchain analytics firm Arkham has flagged eyebrow-raising activity involving FTX and Alameda wallets. According to Arkham data, FTX Cold Storage staked $45 million worth of SOL overnight, while Alameda-linked addresses deposited $80 million in ETH to institutional staking provider Figment. These actions have stirred controversy across the crypto space—especially given the question posed by Arkham itself: “Aren’t they supposed to be paying their customers back with that?” 🤯💸

The timing of these moves is puzzling. On-chain transactions indicate that both entities continue managing large crypto positions, despite their bankrupt status and ongoing legal obligations. The FTX Recovery Trust and FTX Trading recently confirmed the upcoming third distribution round, set to begin on September 30. However, the optics of staking assets instead of liquidating them for cash repayments may erode the fragile trust left among creditors. 🧱💔

Adding further uncertainty, over $4.3 billion in claims remain under dispute. It’s still unclear which specific claims will be approved for this upcoming payout. According to FTX creditor Sunil Kavuri, many creditors—especially those in China and other jurisdictions flagged by a recent motion—will “nearly certainly” be excluded from this round of distributions. This could lead to growing dissatisfaction and potential legal battles as the final phase of creditor repayments unfolds. As of now, transparency remains limited, and concern is rising. 🕳️📉

Altcoin Market Pulls Back After Sharp Rally

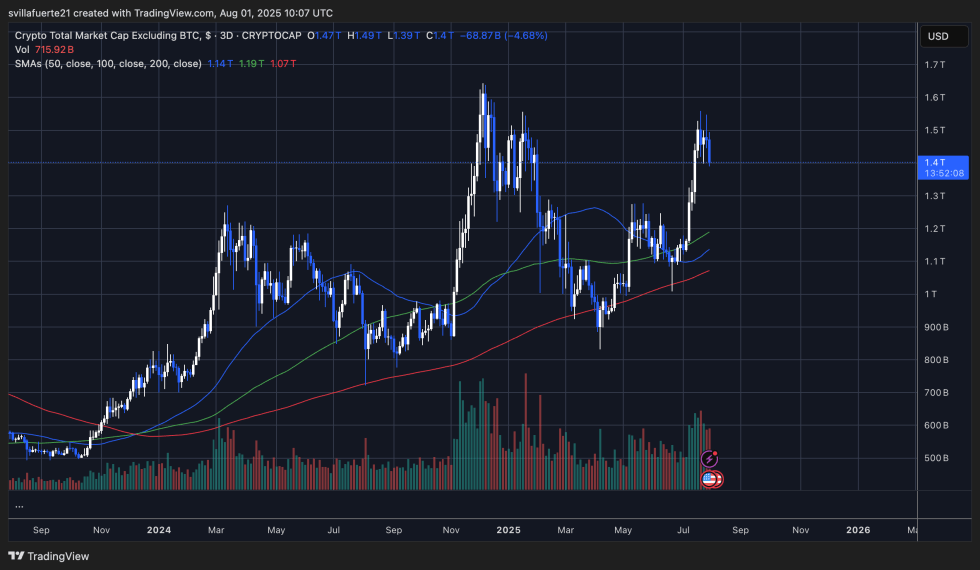

The total crypto market cap excluding Bitcoin (TOTAL2) has experienced a sharp pullback, dropping nearly 4.7% from its recent peak of $1.49 trillion to around $1.40 trillion. This move comes after a strong multi-week rally that saw the altcoin market cap surge from below $1.1 trillion to new yearly highs. However, the recent correction highlights growing selling pressure and short-term exhaustion among altcoins. 📉😴

From a technical perspective, the chart shows a rejection from the local highs after the market encountered resistance near the 1.5T level. Despite the drop, the structure remains bullish, with price still above the 50-day, 100-day, and 200-day simple moving averages (SMAs), which are now stacked in bullish alignment. The 50-day SMA, currently at $1.14 trillion, could act as key support if downside pressure increases. 📈🛡️

The volume profile reveals significant activity during this recent breakout, suggesting the rally was driven by strong participation. However, the red bars during the current retracement phase indicate growing profit-taking. If TOTAL2 manages to hold above $1.35T, the broader altcoin market could resume its upward momentum. But failure to do so might open room for a deeper correction toward the $1.25T support zone. 🚨📉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Felicia Day reveals The Guild movie update, as musical version lands in London

- Best Controller Settings for ARC Raiders

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Goat 2 Release Date Estimate, News & Updates

- Best Thanos Comics (September 2025)

2025-08-01 22:54