- FTX has announced a plan to repay creditors up to $16.3 billion

- Analysts believe repayments could balance market dynamics, leading to a bullish 2nd half in 2024

As a researcher with a background in crypto markets, I find the recent developments at FTX extremely intriguing. The exchange’s announcement to repay up to $16.3 billion to its creditors has brought renewed optimism and potentially bullish sentiments to the market.

FTX, the bankruptcy-filing cryptocurrency exchange from the previous year, unveiled an extensive plan for settling debts, which may invigorate the crypto market. On May 8th, it was revealed that FTX might repay up to 98% of its outstanding obligations, totaling around $16.3 billion.

Individuals whose claim amounts for cryptocurrencies fall under $50,000 can look forward to a maximum recovery of 118%, as determined by November 2022’s digital currency valuations. This announcement has been met positively by the market, with CEO Ray expressing approval.

“We’re excited to present a Chapter 11 reorganization plan that guarantees non-governmental creditors will receive 100% of their claims, including accrued interest.”

According to a recent analysis by K33 Research penned by experts Vetle Lunde and Anders Hesleth, FTX’s repayment plan is projected to generate substantial waves throughout the crypto market.

Based on the information, it’s predicted that the cash distributions from FTX could result in an optimistic sentiment in the market, possibly causing more demand and purchasing activity.

Analysts weigh In: FTX repayments vs. market dynamics

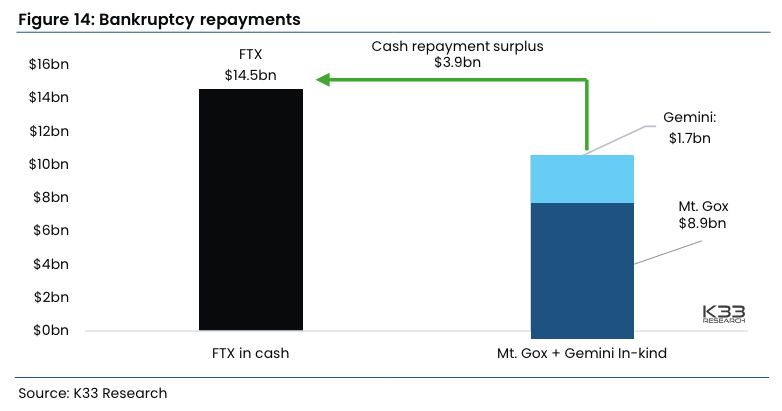

K33 Research’s analysts argue that not every creditor payment results in a bearish outcome. Specifically, they expect FTX’s cash repayments to contrast the crypto repayments anticipated from Mt. Gox and Gemini, collectively worth $10.6 billion.

As a researcher examining the FTX market dynamics, I’ve come across an intriguing perspective. Some analysts suggest that opposing forces might balance out in the crypto exchange’s buying and selling pressure. Specifically, they argue that those receiving cash payouts from FTX may create selling pressure, but this could be counteracted by buying pressure generated by users who receive their crypto earnings as payouts from the platform. It’s essential to note that not all creditor repayments result in bearish market sentiment; thus, the overall impact on the exchange might be more nuanced than initially anticipated.

Although it’s difficult to determine the precise effect of these repayments on the market beforehand, the timing of these payments will play a significant role in evaluating their overall influence.

The repayment of $1.7 billion by Gemini is predicted to occur in early June, and Mt. Gox’s $8.9 billion is projected for October 2024. However, the payback plan from FTX is yet to be approved by the court, with most creditors believing they will receive their payments towards the end of this year.

As a seasoned crypto investor, I’ve noticed that the disparate repayment schedules suggest a sluggish summer in the market. However, there are signs pointing towards a robust conclusion to the year.

Market trends and future outlook

Currently, the cryptocurrency market is exhibiting robust bullish trends. In the past day, Bitcoin and Ethereum have breached significant resistance levels. As a result, the market has experienced a notable increase of approximately 5.8%, leading to an addition of over $100 billion to the total crypto-market capitalization.

In the specified timeframe, approximately 58,875 traders faced forced exits from their short positions, resulting in a total of $159.13 million in losses. The recent surge in liquidations can be attributed to a significant increase in price for certain assets, such as ETH and PEPE, leading to substantial losses for short traders who had bet on their prices to decrease.

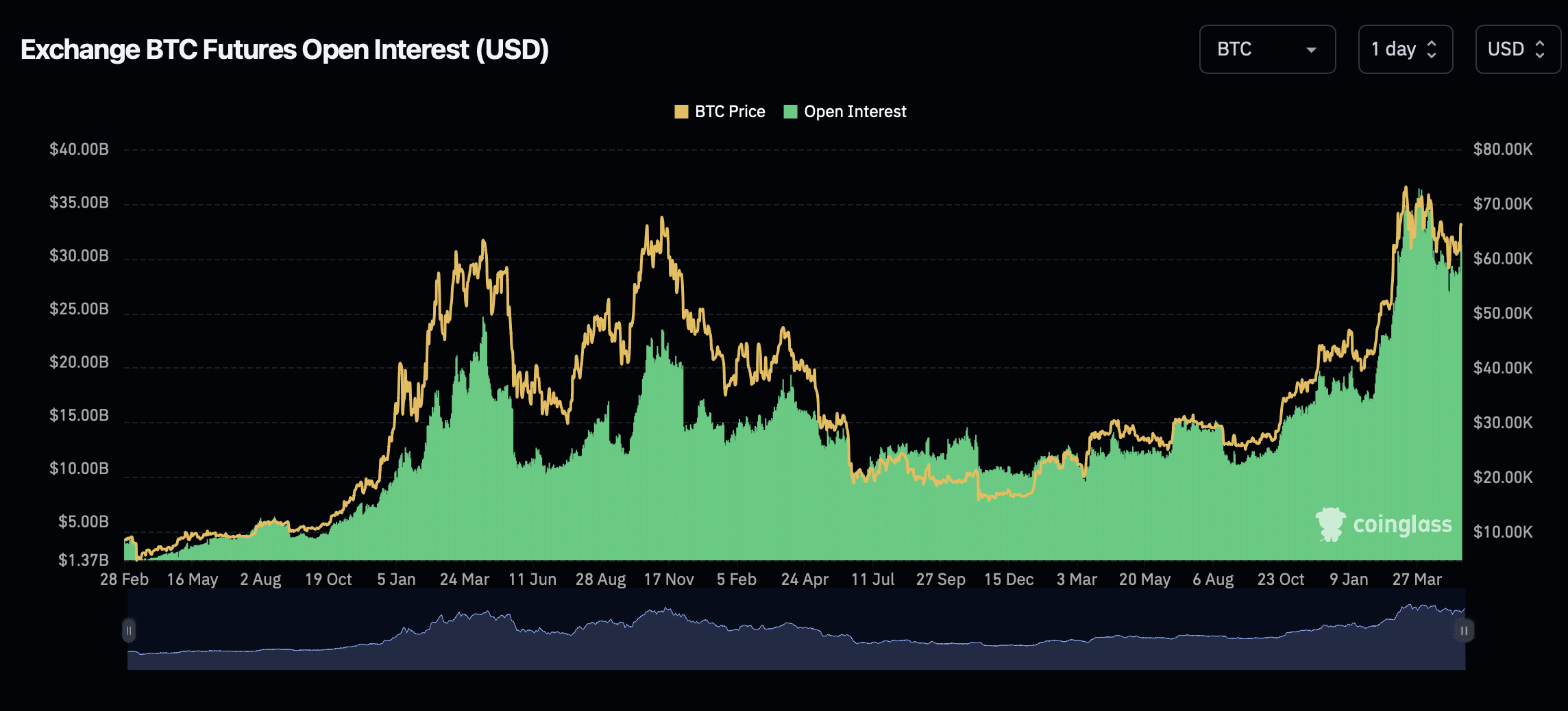

Additionally, the significant increase of around 10% in Bitcoin’s open interest within the past day suggests a surge of investment capital entering the market. This trend implies that investors are growing more optimistic regarding the market’s future trajectory.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-05-17 04:07