-

GME has lost over 55% of its value in the past seven days.

If selling persists, its price might fall to the $0.006 level.

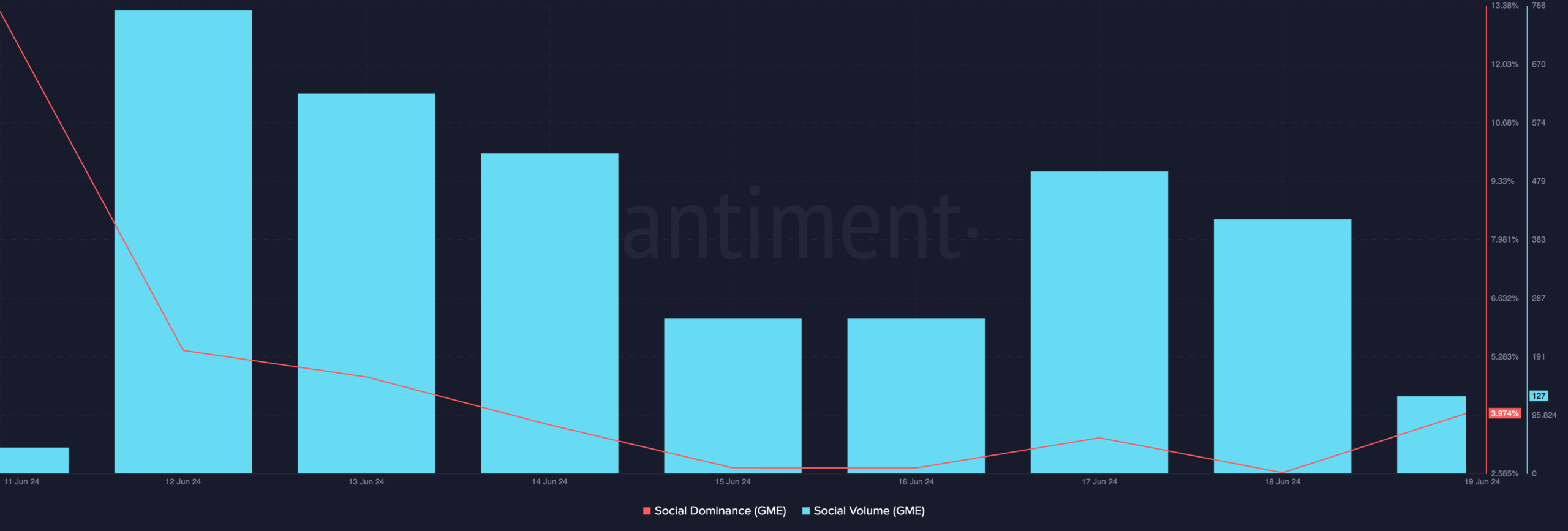

As an experienced analyst, I believe that GameStop (GME) is experiencing a significant downtrend, with over 55% of its value lost in the past week. The selling pressure has intensified since its all-time high (ATH) of $0.032 on June 7th. This decline is evident in the drop in social activity, which was a major contributor to the token’s earlier rally. GME’s social dominance and volume have both dropped significantly, indicating reduced discussion about the asset.

Over the past week, the value of GameStop’s [GME] stock on the traditional market has dropped by a significant 55% or more, surpassing all other cryptocurrencies in terms of percentage loss based on the latest information from CoinMarketCap.

At the current moment, the altcoin was being traded for $0.008006. The price drop of GME occurred following its peak at a record-breaking $0.032 on the 7th of June.

As market participants scamper to take profits, the token’s value has since declined by 76%.

GME sees decline in social activity

Previously, AMBCrypto noted that GME experienced a surge in social media buzz, fueling its price rise to an all-time high. Remarkably, the chatter surrounding this token surpassed that of the popular meme coin, Dogecoin [DOGE], on social media platforms.

Since the price of GameStop (GME) started decreasing, there has been a significant drop in its social activity. Based on Santiment’s findings, the token’s social influence has declined by 84%, and its social media chatter has dwindled by 52%.

As a cryptocurrency analyst, I would describe an asset’s social dominance as the proportion of social media discourse dedicated to it among the top 100 cryptocurrencies, measured in terms of market capitalization.

On the other hand, social volume tracks the total number of online mentions of an asset.

When these indicators decrease, it implies a diminished level of conversation surrounding the asset. This is a bearish indication typically signaling low market engagement.

The lack of buzz in the GME market was underscored by a significant decrease in daily trading activity. Over the last week, this decline reached approximately 205%, as reported by Santiment.

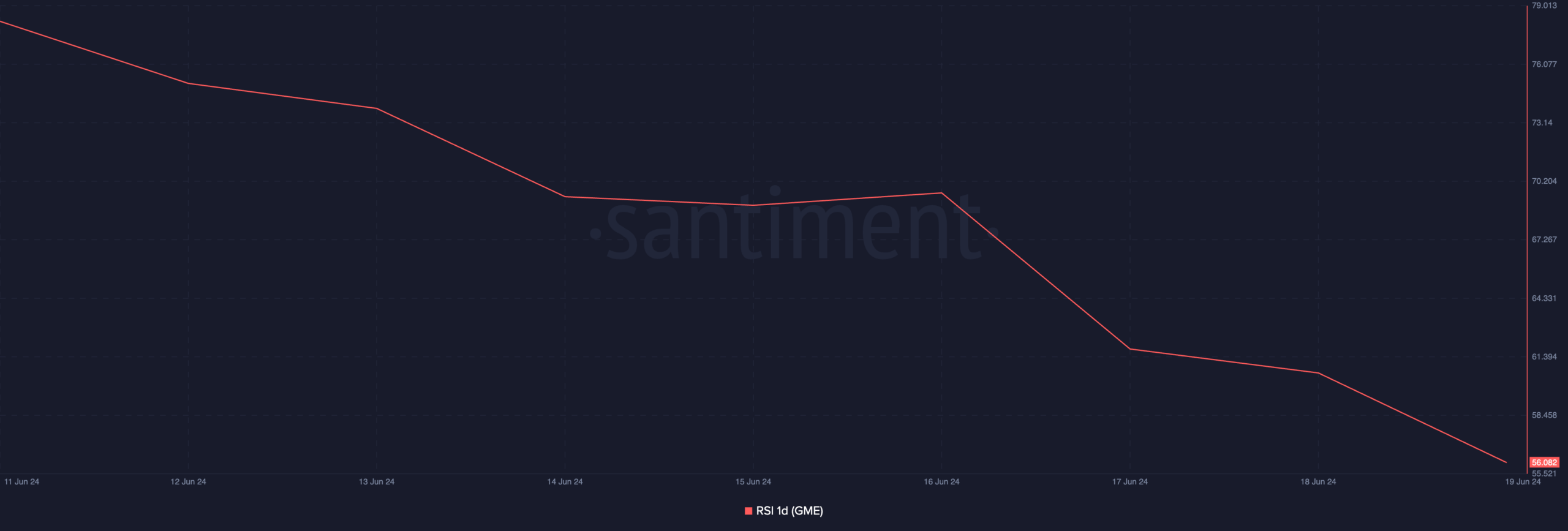

Additionally, the Relative Strength Index (RSI) of GameStop Corporation’s (GME) stocks, indicating their overbought and oversold levels, was on a decline as of the current moment. The RSI reading stood at 56.08.

With this value, the Relative Strength Index (RSI) of GME signaled a decrease in purchasers’ interest. The on-chain indicator indicated that sellers exerted more influence over trading activities among investors.

Brace for more declines

The daily chart analysis of GME‘s Aroon indicator readings indicated a strong downward trend, with the Down Line reaching 92.86% as of this moment.

“The Aroon indicator assesses an asset’s trend intensity and probable turning points. When the Aroon Down Line hovers around 100%, it suggests a robust downtrend, meaning the latest low was attained not long ago.”

As a researcher studying the cryptocurrency market, I would caution that if selling pressure persists, the token’s value could potentially drop below the $0.008 mark and reach a new trading price of around $0.006.

However, if the bulls re-emerge and regain market control, they may initiate a rally toward $0.012

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-19 23:03