- Bears aggravated Cardano’s descent over the past few months as the crypto fear and greed index slipped into the ‘fear’ zone.

- The altcoin’s Funding Rates took a hit, but the long/short ratio still showed some hope for the bulls.

As a researcher with extensive experience in cryptocurrencies and technical analysis, I’ve been closely monitoring Cardano [ADA]’s price action over the past few months. And it’s clear that bears have taken control of the altcoin’s market direction.

I’ve observed the market mood shift negatively in recent hours, and Cardano [ADA] has followed suit by extending its existing downward trend based on its daily chart’s bearish configuration.

After the recent pattern break, the downward trend in the market gained momentum, and the bears’ influence became stronger due to the prevailing market-wide uncertainties.

If the price dips below the $0.37 support level, it could trigger a change in sentiment and allow buyers to push the price back up and surpass the daily moving averages.

At the time of writing, ADA traded near the $0.37 region, down by around 2% in the last 24 hours.

Can ADA bulls stop the bleeding?

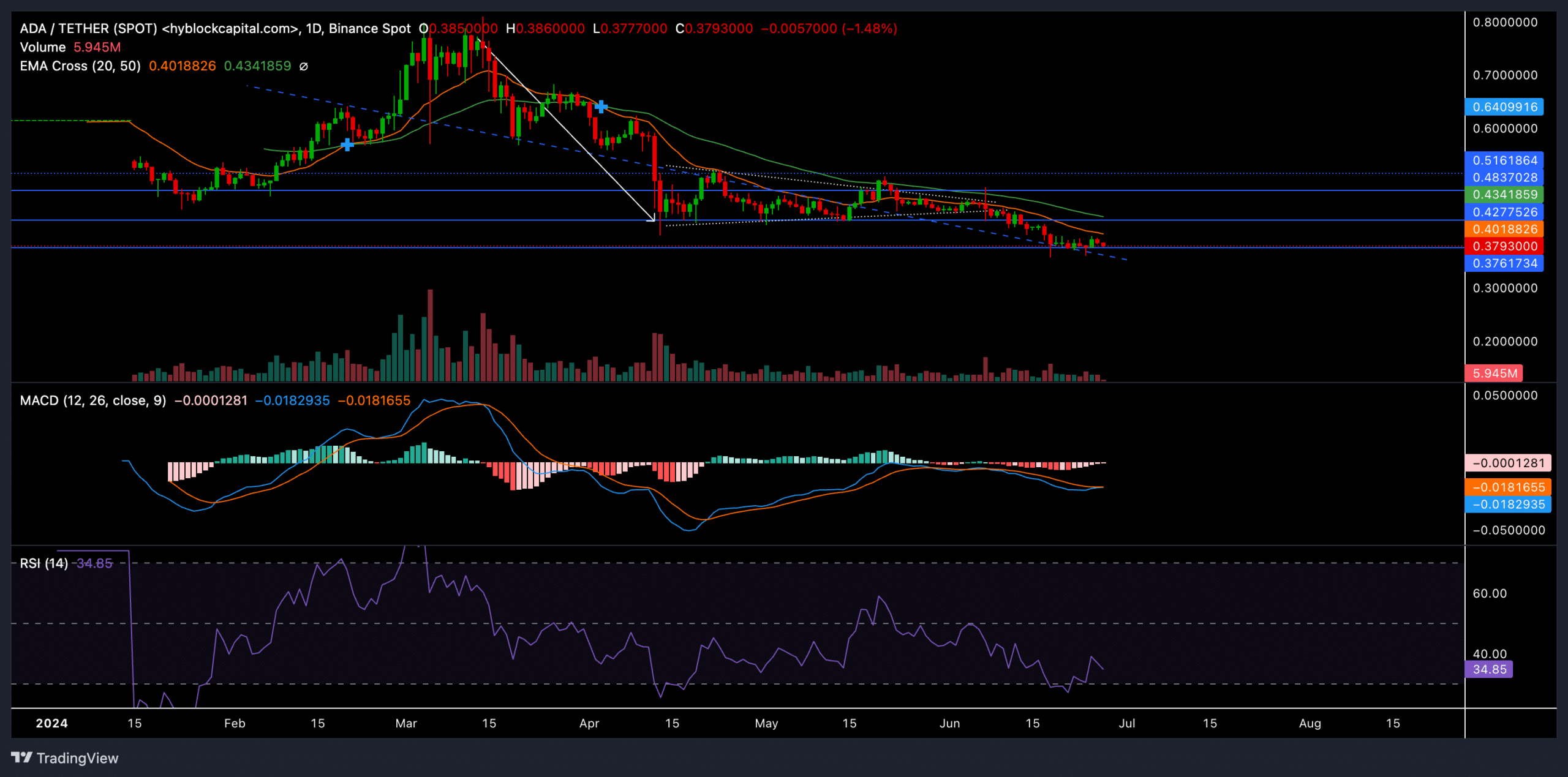

For approximately three months, ADA has had difficulty surpassing the 50-day exponential moving average (denoted by the green line) and reaching a new high point.

The crossing over of the 20-day Exponential Moving Average (orange line) below the 50-day Exponential Moving Average marked the beginning of an prolonged price decrease.

The purchasers made efforts to initiate a rise in price, yet they were unable to surpass the $0.48 to $0.51 resistance level. Subsequently, the market behavior formed a triangular pattern reminiscent of a symmetrical triangle on Cardano’s (ADA) daily price chart.

The drop in price beneath the significant $0.42 support level now serves as resistance has strengthened the bearish outlook and validated the symmetrical triangle’s rupture.

In the past three weeks, the value of the altcoin dropped by almost 15%, reaching a support level around $0.37 at present.

If ADA manages to convincingly break above its current support level, it may initiate a recovery process to regain its previous losses. However, the altcoin might encounter resistance around its 20-day and 50-day moving averages.

If we hover just above current prices, the bulls may have a chance to initiate a short-term rally for Cardano (ADA). This potential price action could allow ADA to challenge the $0.48 mark once more before potentially turning bearish again.

Should bears apply greater force, it is possible that Cardano (ADA) will encounter its next significant support at approximately $0.35 without delay.

As a crypto investor, I closely monitor the Relative Strength Index (RSI) to gauge market conditions. Lately, the RSI has hovered close to the oversold territory, suggesting that the selling pressure may be weakening. If we see any significant price reversals from this level, it would be a strong indication of easing bearish sentiment in the market.

The MACD and Signal lines remained under the zero line, indicating a bearish trend, for more than three months with a noticeable downward slope.

A likely bullish crossover of these lines can temporarily halt the streak of red candles.

Long/short ratio keeps hopes alive

As a researcher studying the cryptocurrency market, I’ve observed that there’s been a decrease in funding rates for ADA on various exchanges recently, reflecting the uncertain market conditions. Nevertheless, an intriguing finding emerged when examining the long/short ratio of ADA against USDT on Binance during the past 24 hours: it was 3.7.

Thus, showed there are significantly more long positions than short positions.

As a researcher studying the cryptocurrency market, I’ve noticed that recent developments could indicate a possible shift in Cardano (ADA) from its current support level. However, it’s essential to remember that ADA has shown a strong correlation of 90% over the past 30 days with Bitcoin. Consequently, monitoring Bitcoin’s movements closely will help me evaluate ADA’s potential trends in the near term.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-28 04:08