- Earn users received $2.18 billion in digital assets as part of the repayment.

- Gemini’s announcement follows FTX’s plan to repay its creditors.

As an experienced financial analyst, I’ve closely followed the tumultuous journey of crypto exchanges and their users over the past few years. The recent news of Gemini’s plans to reimburse its affected users brings a glimmer of hope amidst the uncertainty that has plagued the industry.

Surprisingly, Gemini announced their intention to compensate users who were impacted when they discontinued the Gemini Earn crypto lending program.

In a recent blog post, the tech billionaire twins Cameron and Tyler Winklevoss, who own the company, made an announcement.

In a recent post on X, Gemini Trust Co. noted,

As a crypto investor, I’m excited to share that today, the long-awaited initial Earn distributions have been deposited into my Gemini account. This represents approximately 97% of the digital assets that were owed to me prior to the suspension date on November 16, 2022.

It further elaborated,

Geminis’ repayment plan

On May 29th, Earn users were distributed a staggering $2.18 billion worth of digital assets as indicated by the founders. This distribution accounted for an impressive 97% of the total assets owed to these users, exceeding the previous holdings by a substantial $1 billion, following Genesis’ withdrawal suspension.

This achievement marks an impressive 232% recovery from the point when Genesis halted withdrawals.

The story so far

In the beginning of 2021, Gemini introduced its Earn platform, allowing users to lend their cryptocurrencies directly to Genesis Global Capital, LLC (GGC). GGC, in turn, would re-lend these digital assets.

Despite Gemini’s promises of thorough investigation, the default and subsequent bankruptcy of GGC in November 2022 brought to light neglected oversight and insufficient safeguards. Over 200,000 users, including nearly 30,000 New Yorkers, were left unable to retrieve their funds as a result.

Approximately a month ago, FTX – the cryptocurrency exchange that declared bankruptcy not long ago – unveiled an extensive strategy to reimburse its creditors. This announcement could invigorate the crypto market once more.

On the 8th of May, it came to light that the exchange intends to reimburse around 98% of its debtors, totaling up to $16.3 billion.

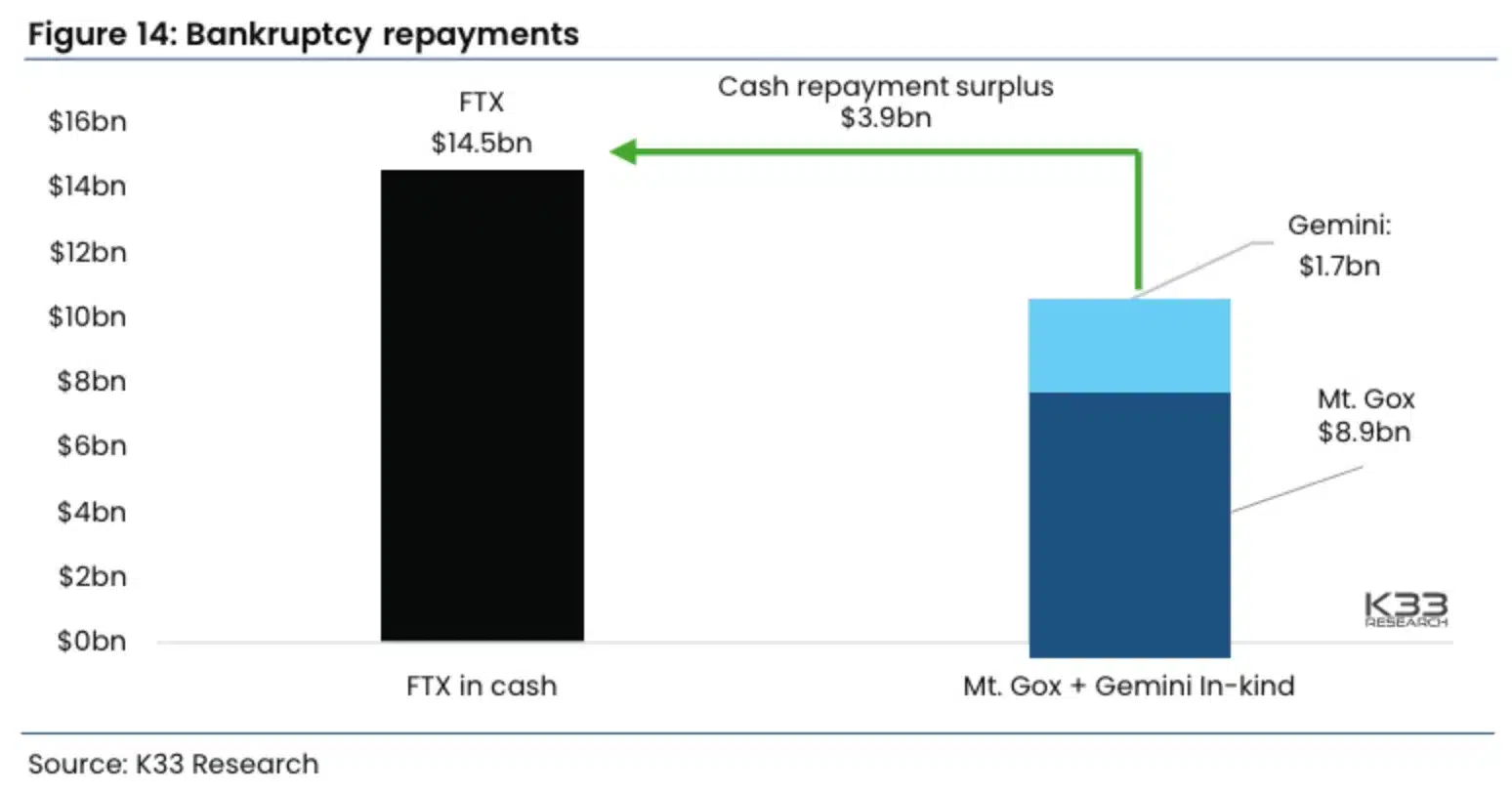

Some people thought that creditor repayments could have a negative influence on the market as a whole, but according to K33 Research’s analysis, not every creditor repayment causes a bearish outcome.

As a crypto investor, I’ve noticed some debates surrounding FTX’s cash-based repayment plans versus the crypto-based repayments of other entities such as Mt. Gox and Gemini, collectively worth over $10.6 billion. The key distinction here is that FTX intends to use traditional currency for its redemptions, whereas Mt. Gox and Gemini have previously planned crypto repayments. This could potentially result in different outcomes depending on market conditions and the specifics of each platform’s implementation.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-05-30 19:03