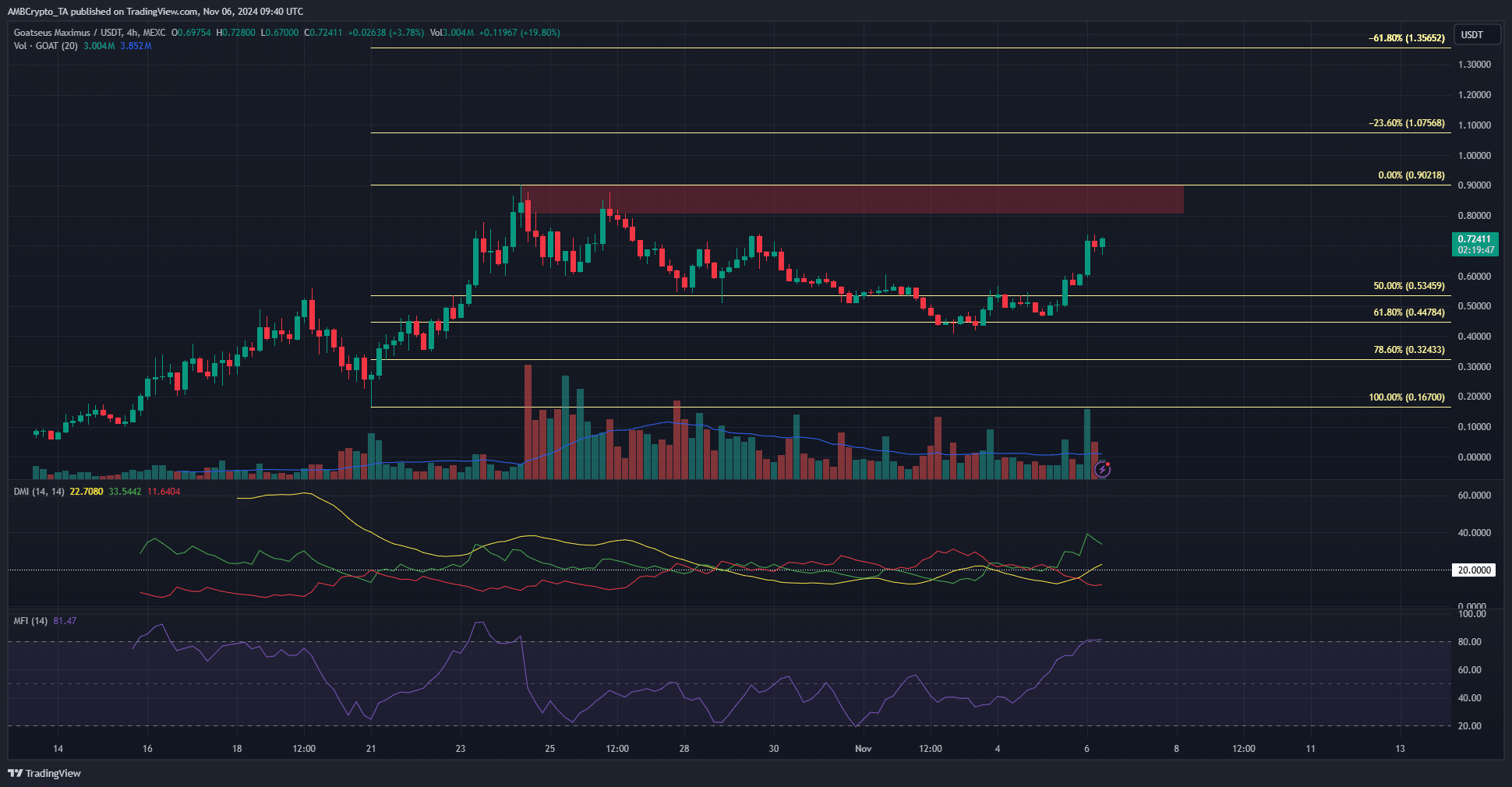

- GOAT has a bullish lower timeframe market structure.

- The DMI index showed that a strong uptrend was in progress.

As a seasoned crypto investor with battle scars from numerous market cycles, I can confidently say that the current bullish trend of Goatseus Maximus (GOAT) is reminiscent of the 2017 Bitcoin surge. The 56% gain in just 32 hours is a testament to the memecoin’s meteoric rise, and I believe it has further room to grow.

Goatseus Maximus [GOAT] is up by 56% in 32 hours and is likely to go further higher.

Over the last ten days, this memecoin with a market value of about $722 million has experienced a period of decline. However, it started to rebound quite rapidly from the 4th of November onwards.

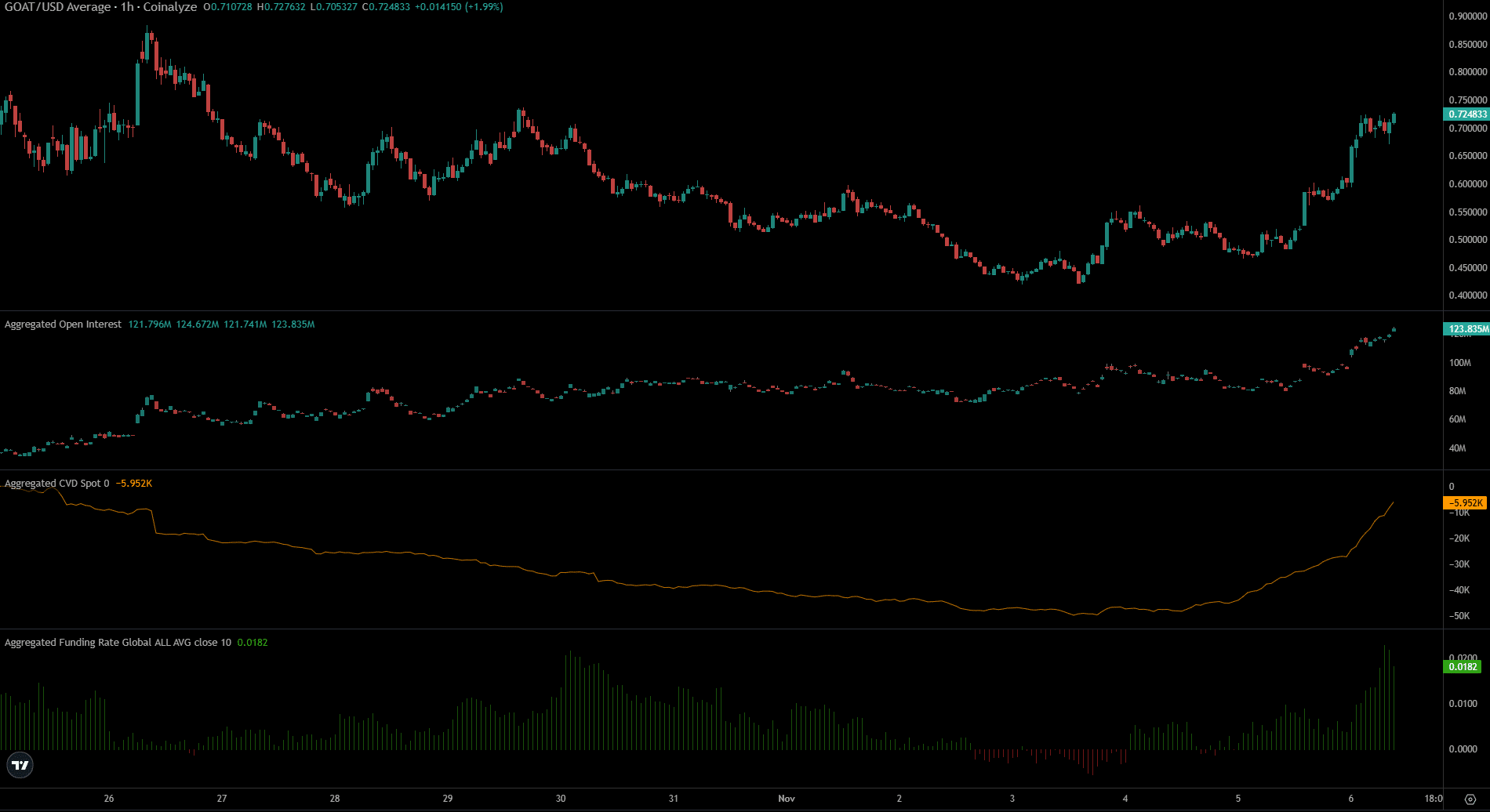

The trading activity has been decreasing too, but there are signs of a shift. On smaller time scales, the bullish trend seems to be gaining strength, and funds are increasingly flowing in.

Goatseus Maximus begins trending upward

On the four-hour chart, the market trend appears optimistic with GOAT surpassing the $0.566 mark. Since November 4th, it has been forming a pattern of increasing highs followed by higher lows.

As a crypto investor, I’m observing an encouraging bullish pattern that aligns with the Daily Moving Average Indicator (DMI). This trend appears to be robustly climbing, suggesting an ongoing upward trajectory. Interestingly, both the Average Directional Index (ADX, represented in yellow) and the Plus Directional Indicator (DI, depicted in green) are above 20, signaling a strong trend directionality.

At the same time, the MFI had pushed northward and was in the overbought territory.

In the upcoming days, a bearish pattern called divergence might suggest a potential drop in price after the $0.9 resistance area. It’s likely that the price will trend towards this level soon.

A breakout depends on market sentiment and the trend behind Bitcoin [BTC].

Short-term sentiment and demand favors bulls

In the last 24 hours, both the activity related to Cardiovascular Disease (CVD) and the number of open contracts increased noticeably. This surge suggests strong market demand for these subjects and indicates heightened speculative curiosity.

Together, they pointed toward a sustainable run northward, which could extend beyond $0.9.

A substantial Funding Rate suggested a very optimistic market outlook, yet it also signified a discrepancy between the actual and derivative asset prices. In essence, the peaks around the $0.9 region functioned as a potential resistance level or supply area.

Investors and traders might choose to hold off on taking new long positions until the $0.9 and $1 price points have been turned into areas of support, instead of resistance.

Read More

2024-11-06 20:07