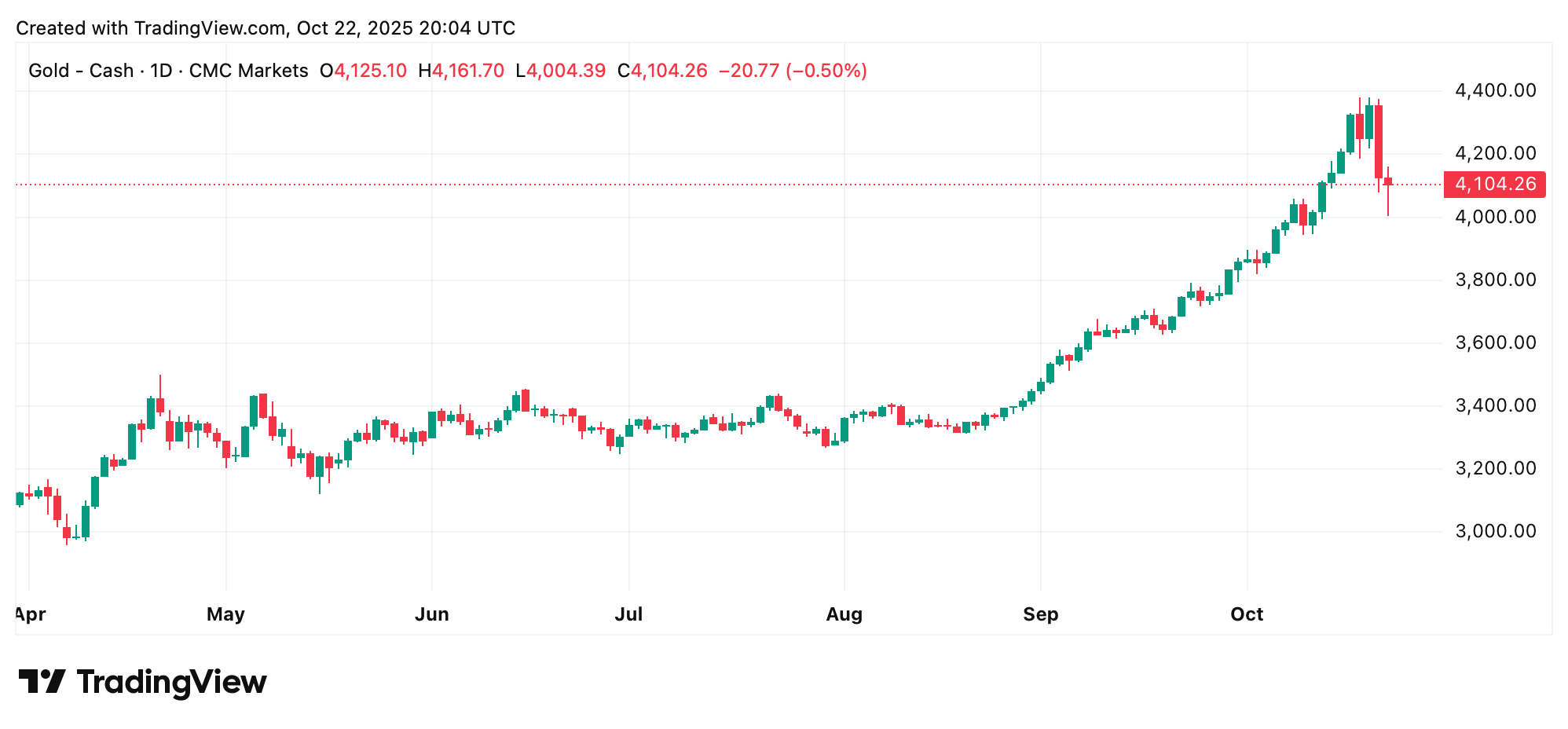

Gold’s price took a steep tumble between Oct. 21 and Oct. 22, falling about 8% from recent record highs above $4,400 per ounce and erasing roughly $2.43 trillion in market value – its sharpest two-day drop since 2013.

Gold’s Rally Snaps With 8% Drop in 48 Hours

Spot gold fell 6.3% on Oct. 21 alone, then extended losses by another 1% to 2% the following day before stabilizing near $4,000 to $4,130 per ounce. One might say the market was performing a tragicomedy, with investors clutching their pearls and wallets alike. 🤡💸

The correction followed a 55% rally in 2025 fueled by economic uncertainty, job losses, and trade war fears. Analysts now say the decline may be a healthy reset for the metal’s overheated run-up. A “reset,” of course, being a euphemism for “panic.” 🧠💥

Several factors fueled the selloff. Gold became technically overbought after months of massive gains, prompting significant profit-taking. A 1.5% rise in the U.S. dollar made gold more expensive for international buyers, while optimism over renewed U.S.-China trade talks reduced demand for safe-haven assets. It’s as if the market collectively decided, “Why buy gold when we can buy peace?” 🌍🕊️

Traders also positioned themselves ahead of key U.S. consumer price index (CPI) data, which could influence future Federal Reserve policy decisions. A game of chess, but with more spreadsheets and fewer pawns. 🎲📉

The downturn was amplified by liquidations in leveraged positions and outflows from gold exchange-traded funds (ETFs), which shed around $2 billion in a matter of days. Analysts dubbed the episode a margin paradox, where forced selling cascaded across asset classes, including gold and silver. A paradox, indeed-a situation where everyone loses, but no one is surprised. 🤷♂️

“If gold can drop by 6.5% in one day on panic selling, imagine what can happen to bitcoin,” Peter Schiff said, taking to his keyboard during the mid-afternoon drawdown. “Such a crash may not be imaginary for long,” the gold bug added. A warning, perhaps, for those who think digital assets are immune to chaos. 🧙♂️⚡

Despite the chaos, market observers say the pullback may not signal the end of gold’s bull market. Technical analysts point to support levels at $4,000 and $3,945 as critical zones to watch. If those levels hold, renewed buying could emerge, especially if upcoming inflation data suggests easing monetary policy. A hopeful note, but one that feels as fleeting as a goldfish’s memory. 🐠📉

Meanwhile, social media is buzzing with contrasting reactions. Some crypto traders mocked the metal’s volatility as bitcoin’s price jumped around 2% to 3% upward during gold’s mega dip. Others speculate that some capital fleeing gold may have rotated into digital assets, though some analysts cautioned that the evidence remains anecdotal. A dance of speculation, with no clear choreographer. 💃🕺

Still, the debate points to shifting investor sentiment on what truly qualifies as a safe haven in 2025 – the timeless shine of gold or the digital scarcity of bitcoin. Of course, some will argue that both do well. A philosophical conundrum wrapped in a financial crisis. 🤔

“Gold has dropped 8% in two days,” crypto entrepreneur Anthony Pompliano wrote on X on Wednesday. “I don’t see any headlines claiming it is a bad store of value, so why do people write those headlines when bitcoin does the same thing? The bitcoin critics are on the wrong side of history.” A bold claim, but one that might be as fleeting as the gold price itself. 🚀

FAQ 💡

- Why did gold prices fall this week?

Gold’s decline was driven by profit-taking, a stronger dollar, easing U.S.-China tensions, and exchange-traded fund (ETF) liquidations. A perfect storm of factors, each more predictable than the last. 🌩️ - How much value did gold lose during the drop?

Roughly $2.43 trillion was wiped out in market value over two days. A sum so large, it’s hard to imagine what you could buy with it-except maybe a small island. 🏝️ - Did bitcoin benefit from gold’s decline?

Bitcoin rose around 4% during the selloff, though direct capital rotation remains speculative. A coincidence, or a sign of things to come? Only the market knows. 🤷♀️ - What levels are traders watching next?

Key support zones sit around $4,000 and $3,945 per ounce, with CPI data likely to guide the next move. A tightrope walk, with no net below. 🪜

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Gold Rate Forecast

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- 10 Movies That Were Secretly Sequels

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Best Werewolf Movies (October 2025)

- Goat 2 Release Date Estimate, News & Updates

- A Quiet Place 3 Confirms John Krasinski’s Return (& Gets a Release Date)

2025-10-23 00:55