Behold, the prophetess of ARK Invest, Cathie Wood, doth declare with the fervor of a madman in a cathedral: “I shall forsake gold, that ancient, gilded idol, and embrace Bitcoin, the digital serpent of modernity!” Her words, a tempest of logic and delusion, arise from the abyss of market whims, where gold, once the king of assets, now appears but a pawn in the game of liquidity’s capricious dance. Yet, even as Bitcoin’s supply dangles like a carrot before the donkey, its long-term allure persists, though the year hath been a sluggish waltz.

In the hallowed halls of The Rundown, Wood, that architect of the “great acceleration,” weaves her tapestry of AI-driven expenditure, a vision as grand as it is delirious. Here, robotics, energy storage, blockchain, and life sciences converge in a S-curve of chaos, a symphony of progress that only the most deluded could find comforting.

Sell Gold, Buy Bitcoin Now?

Yet, lo! The prophetess scoffs at the notion that Bitcoin hath lost its luster, its mojo, while gold ascends. “First, know this: Bitcoin and gold are not kin,” she proclaims, as if the very fabric of the universe hinges on their lack of correlation. “In the last two cycles, gold led, but Bitcoin, like a phoenix, shall rise again.” A statistical truism, perhaps, but one cloaked in the garb of prophecy.

Her warning, sharp as a dagger, cuts through the veil of complacency: “Gold, that fickle lover, now rides the crest of M2’s tide, higher than ever before. Recall the 70s, the Great Depression-times of ruin, of despair. Gold, like a drunkard, feasts on its own hubris, unaware of the fall awaiting.”

Stablecoins, she argues, have siphoned Bitcoin’s “emerging markets” narrative, yet this, she insists, is but a substitution of checking accounts for savings. “When the time comes for true wealth, they shall turn to Bitcoin, the savior of the desperate,” she intones, her voice a blend of hope and madness. A $1.5 million target by 2030? A dream as lofty as the towers of Babel.

Her core thesis, a battle between gold’s supply and Bitcoin’s, unfolds with the gravity of a sermon. “Gold’s growth, a mere 1%, pales beside Bitcoin’s 0.8%, a rate that shall dwindle further. Yet, the mines, those beasts of greed, may outpace even this digital ascetic.” And what of intergenerational wealth? A tale of legacy, perhaps, or a masquerade of hope.

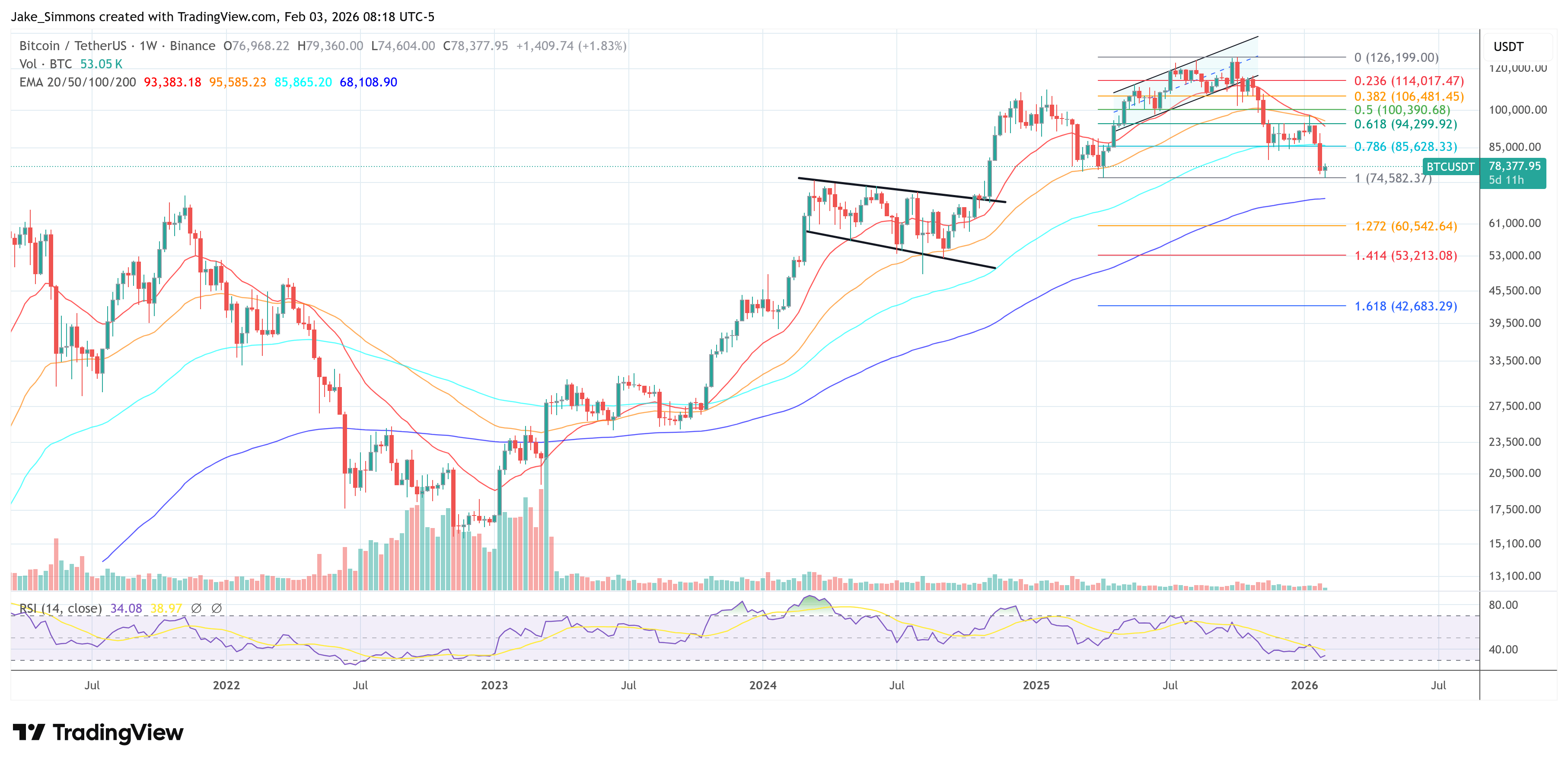

Wood, ever the tactician, points to the October “flash crash” as a specter haunting Bitcoin’s ascent. “A software glitch at Binance, an auto-deleveraging cascade-28 billion dollars called in a moment’s breath. The system, still reeling, bears the scars of this tempest.” Yet, she dares to predict stability, a fragile peace before the next storm.

And so, in the shadow of a $74,600 plunge, she whispers, “The market tests 80,000 again. Hold, unless Iran’s chaos reignites Bitcoin’s store-of-value glory.” A prophecy, perhaps, or a prayer. At press time, BTC hovers at $78,377-a number as fleeting as the dreams of men.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Goat 2 Release Date Estimate, News & Updates

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Felicia Day reveals The Guild movie update, as musical version lands in London

- Best Thanos Comics (September 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- 10 Movies That Were Secretly Sequels

2026-02-04 09:19