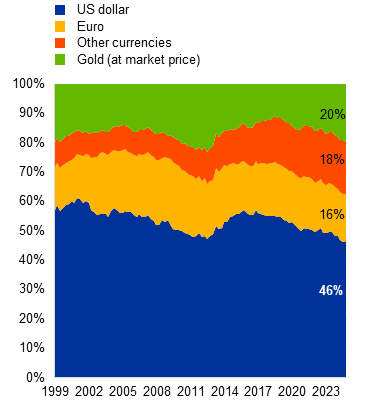

In a most curious twist of fate, the European Central Bank (ECB) has unveiled a report that, like a bolt from the blue, reveals gold‘s triumphant rise to the status of the second-largest asset held by central banks. Ah, but let us not forget the U.S. dollar, that old stalwart, still clinging to over 46% of the funds like a desperate lover!

In this report, which one might say is as enlightening as a candle in a dark room, the ECB acknowledges that gold, propelled by the insatiable appetite of central banks, has indeed dethroned the euro. The euro, once a proud contender, now languishes at a mere 15.9%, while gold gleefully occupies 19.6% of the reserves. How the mighty have fallen! 😂

Yet, one must ponder: what has happened to the euro? It seems to have stagnated, like a forgotten book gathering dust on a shelf, unchanged since 2016. Meanwhile, the U.S. dollar, once the undisputed champion, has seen its share plummet from over 60% to a mere 46.5%. A “rush to quality,” they call it, but one wonders if it’s more of a frantic scramble! 🏃♂️💨

The ECB, in its infinite wisdom, cites a poll from the World Gold Council, revealing that gold’s allure lies in its reputation as a long-term store of value and a hedge against inflation. It performs admirably in times of crisis, much like a hero in a Dostoevskian novel, and serves as a diversifier for portfolios. Who knew gold could be so multifaceted? 💎

While the specter of de-dollarization looms, it is not the primary cause of this shift. No, dear reader, it is the geopolitical turmoil that has stirred the pot, particularly following Russia’s audacious invasion of Ukraine in 2022. The report notes a sharp surge in interest, as if the world were suddenly awakened from a long slumber. 🥱

As we gaze into the crystal ball of market trends, analysts suggest that a slowdown may be on the horizon. Yet, the international backdrop remains tumultuous, fueling the fire of gold accumulation. Janet Mui, a sage of market analysis at RBC Brewin Dolphin, opines that the uncertain geopolitical landscape will continue to bolster gold’s status as a reserve. Ah, the irony of it all! 🧐

Read More

2025-06-12 18:27