-

Grayscale saw positive BTC ETF inflows for the first time in over four months.

BTC was trading above the $64,000.

As a long-term crypto investor, I’ve witnessed the ups and downs of the Bitcoin market for years. The recent news about positive BTC ETF inflows from Grayscale and other providers has piqued my interest.

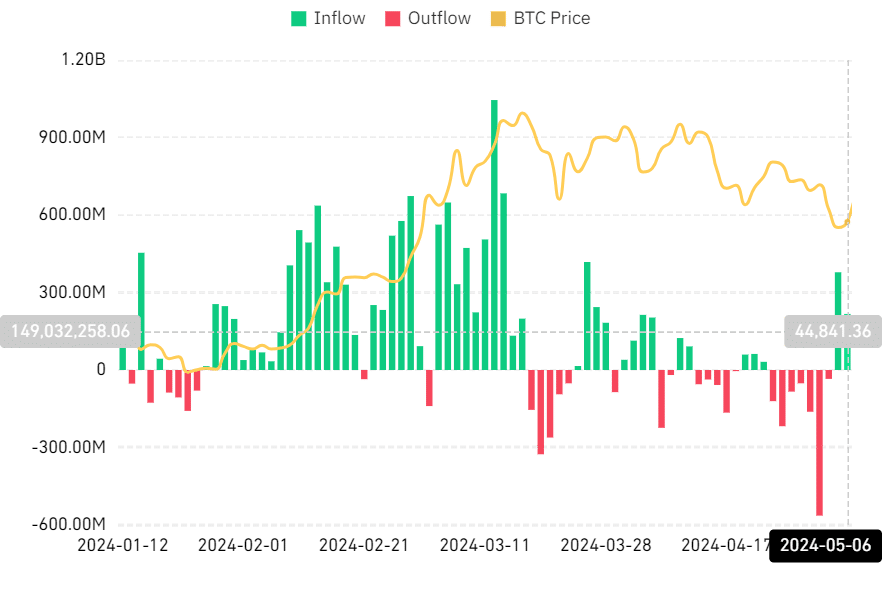

Over the last few weeks, I’ve noticed significant outflows from the Bitcoin Spot ETF. The biggest outflow occurred on May 1st, marking a peak in withdrawals from this particular exchange-traded fund.

As a seasoned crypto investor, I’ve noticed that Grayscale, with its substantial Asset Under Management (AUM) and ETF market cap, has experienced outflows up until now. The recent shift in ETF flows could potentially impact the price trend of Bitcoin.

Bitcoin ETF sees the second day of inflow

As a crypto investor, I’ve closely monitored the Bitcoin ETF net inflow data, and I’ve noticed an intriguing turnaround. After several consecutive days of outflows, the trend reversed, and the net inflow returned to positive territory once again. This shift suggests that investors have been putting more money into Bitcoin through this particular ETF recently.

As an analyst examining the data from AMBCrypto’s flow chart, I observed that the spot ETF underwent significant outflows starting from the 24th of April and continuing until the 2nd of May. The largest outflow occurred on the 1st of May, surpassing $563 million in volume.

On May 5th, there was a notable shift as over $378 million flowed in for the first time in weeks.

On May 6th, there was a consecutive influx of $217 million, marking a positive trend that had persisted since then. It represented Grayscale’s first intake during this four-month span.

Grayscale records its first Bitcoin ETF inflow in months

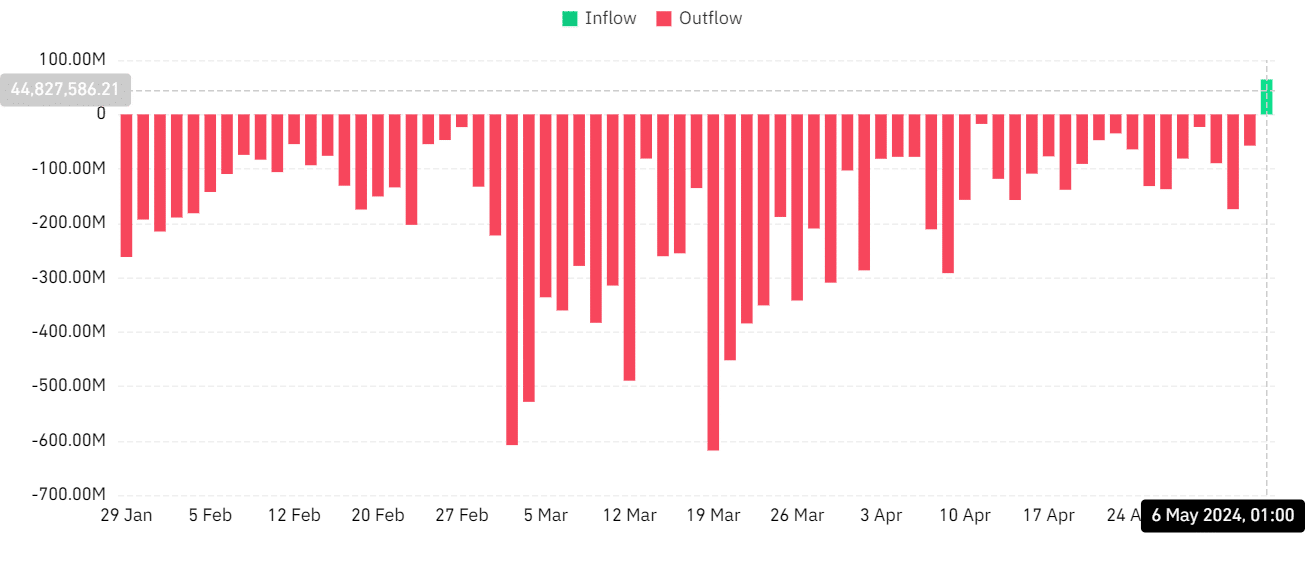

Based on an analysis by AMBCrypto using the Netflow metric from Coinglass, there has been a persistent pattern of Bitcoin outflows from the Grayscale Bitcoin ETF since the beginning of this year.

As a crypto investor, I’m always keeping an eye on the latest market data from reliable sources like Coinglass. And right now, I’m excited to share that Grayscale’s spot Bitcoin ETF has the largest market capitalization among its peers, currently sitting at over $18 billion.

Furthermore, with over $18 billion in assets under management, it boasts the largest AUM among its peers. However, due to its significant asset base, recent outflows have raised concerns.

On May 6th, there was a noteworthy change as Grayscale recorded its initial influx, amounting to $64 million. This signified the conclusion of the consecutive outflows depicted on the chart.

After transforming from a trust into an easily tradable Exchange-Traded Fund (ETF), GBTC has experienced approximately $17.46 billion in redemptions.

As a researcher studying the trends in cryptocurrency markets, I have come across some data indicating that certain outflows could potentially be linked to crypto companies that were on the brink of bankruptcy in recent times. These firms may have been making repayments to mitigate their financial woes.

What the ETF inflow means

Investment flows into a Bitcoin spot ETF represent the funds contributed by investors towards the ETF. An uptick in these inflows boosts the ETF’s total assets under management, often indicating growing demand among investors for Bitcoin investment opportunities.

From my perspective as an analyst, when I observe outflows for a Bitcoin Spot ETF, it signifies that investors are selling off their shares in the ETF. Consequently, the total assets under management (AUM) decrease due to these outflows.

Flows of funds can arise from various reasons. For instance, investors might choose to cash out their gains, rebalance their portfolios, or respond to changes in market conditions.

Impact of BTC’s price?

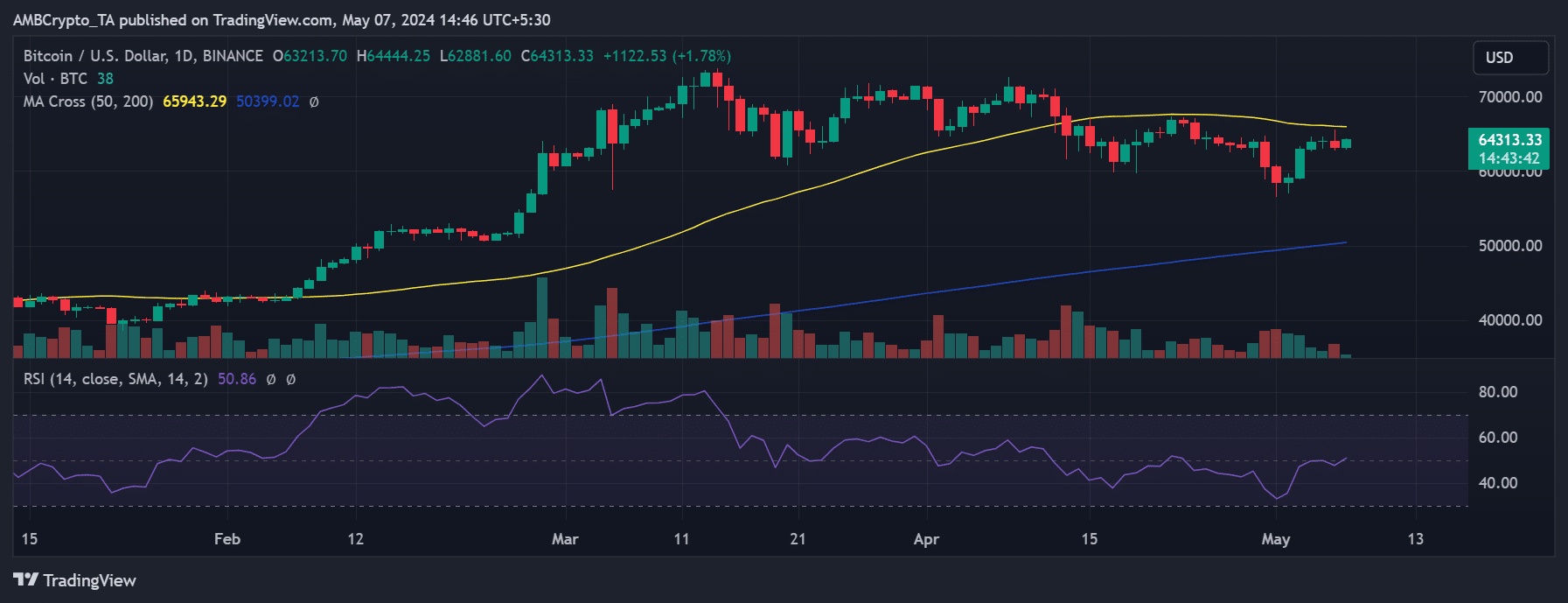

The recent surge in investments into Bitcoin ETFs might indicate a revival of investor enthusiasm after a period of selling for profits. This newfound interest could potentially boost Bitcoin’s price in the near future.

Although modifications in Bitcoin’s ETF inflows may cause temporary price changes, these adjustments represent just one aspect of the bigger market dynamics.

Read Bitcoin’s [BTC] Price Prediction 2024-25

There are many factors beyond the one mentioned that could impact the overall trend of prices in the long term.

According to AMBCrypto’s analysis, Bitcoin experienced a significant rebound from its previous slide under $60,000, with the cryptocurrency currently priced at approximately $64,290 – representing a rise of more than 1.7%.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PGA Tour 2K25 – Everything You Need to Know

2024-05-08 03:03