- Grayscale files to convert its multi-crypto fund into spot ETF.

- Analysts warn of challenges because of XRP, SOL, and AVAX inclusion.

As a seasoned researcher who has witnessed the rollercoaster ride that is the crypto market, I find myself intrigued by Grayscale’s bold move to convert its multi-crypto fund into a spot ETF. The inclusion of XRP, SOL, and AVAX in this proposed ETF is indeed a daring step given the regulatory uncertainties surrounding these assets.

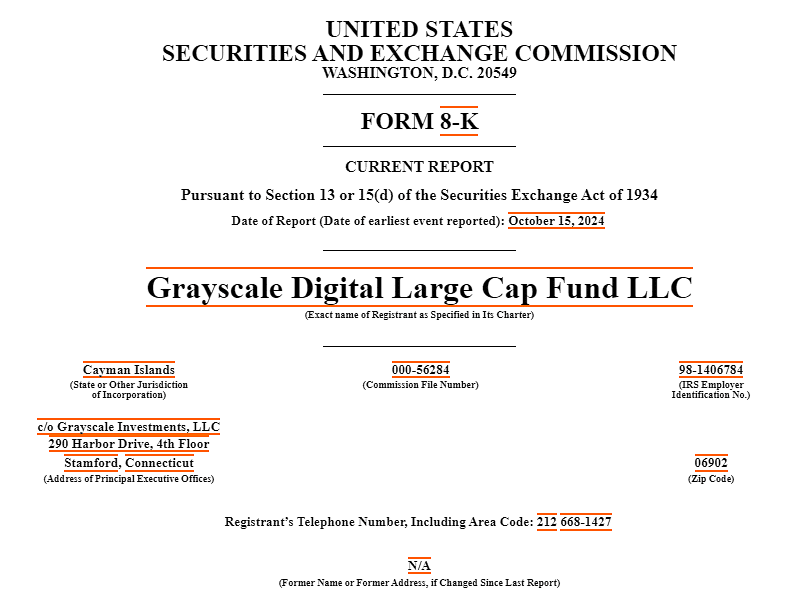

As a researcher, I find myself reporting that on the 14th of October, I observed Grayscale, a renowned crypto asset manager, submitting an application to the U.S. Securities and Exchange Commission (SEC) for the transformation of their multi-crypto fund into an Exchange Traded Fund (ETF).

As a researcher within our firm, I’m currently overseeing the Digital Large Cap (GDLC) fund, which manages a whopping $524 million in assets. This diverse portfolio encompasses not just traditional players like Bitcoin [BTC] and Ethereum [ETH], but also emerging giants such as Solana [SOL], Ripple [XRP], and Avalanche [AVAX].

BTC and ETH dominated over 90% of the fund.

As a researcher, I’m excited to share that if the proposal is accepted, our fund will start trading on the New York Stock Exchange (NYSE), as outlined in our recent filing. Meanwhile, it’s important to note that in another filing, our asset management team has communicated proposed rule changes for the fund to our valued investors.

Crypto index ETF race

Transforming a fund into a standard ETF simplifies the process of purchasing and offloading its shares significantly. For instance, Grayscale has turned two Bitcoin and Ethereum-linked funds (GBTC and ETHE) into standard ETFs in 2021.

Currently, it’s just Bitcoin (BTC) and Ethereum (ETH) that the Securities and Exchange Commission (SEC) considers as commodities. Interestingly, other companies seeking crypto index ETFs, such as Hashdex and Franklin Templeton, have only applied to include BTC and ETH in their proposals as well.

However, it’s worth noting that Grayscale has also added XRP to their portfolio, despite the fact that its regulatory status remains unclear due to its ongoing legal dispute with the SEC.

As per Nate Geraci of ETF Store, this action might represent a wager on potential policy shifts following the November U.S. elections, based on his statement.

It seems that many entities are placing their bets on the possibility of a shift in administration, essentially positioning themselves for a Trump victory. They assume that this new administration could be more favorable towards cryptocurrencies.

In terms of their perspective, Presto Research, a company specializing in cryptocurrency research, saw this particular application as a possible route towards the approval of an Exchange Traded Fund (ETF) for altcoins.

Granting its approval might open a path for possible future Altcoin Exchange Traded Funds (ETFs), like Solana, Ripple, and Avalanche, whose potential eligibility for ETF status remains uncertain under the present Securities and Exchange Commission (SEC).

But Prestor Research analysts also noted that the application’s road could be ‘bumpy’, citing spot SOL ETFs challenges in August.

It’s been noted that since their conversion, Exchange-Traded Funds (ETFs) like GBTC and ETHE have experienced significant withdrawals, with GBTC losing approximately $20 billion and ETHE seeing about $3 billion in outflows.

The future progress of the application is uncertain following the U.S. elections, and it’s yet to be determined if other cryptocurrencies with ambiguous regulatory standing will receive approval.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-10-16 19:03