- Grayscale joins firms applying for a spot SOL ETF.

- It currently has over $120 million AUM from its GSOL.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed the evolution of various investment vehicles and their impact on asset classes. Grayscale’s move to convert its Solana Trust into a spot ETF is a strategic decision that aligns with market trends favoring such offerings.

Grayscale Investments is intensifying its efforts to broaden its cryptocurrency portfolio by submitting a plan to the U.S. Securities and Exchange Commission (SEC) for transforming its Grayscale Solana Trust (GSOL) into a traditional stock market fund known as an exchange-traded fund (ETF). If this proposal is accepted, trading of the fund would occur on NYSE Arca, aligning with a trend where other companies are also submitting similar applications.

Current Grayscale offering: Solana Trust

The Grayscale Solana Trust, currently structured as a private investment vehicle, provides accredited investors with exposure to Solana (SOL) without the complexities of direct asset management.

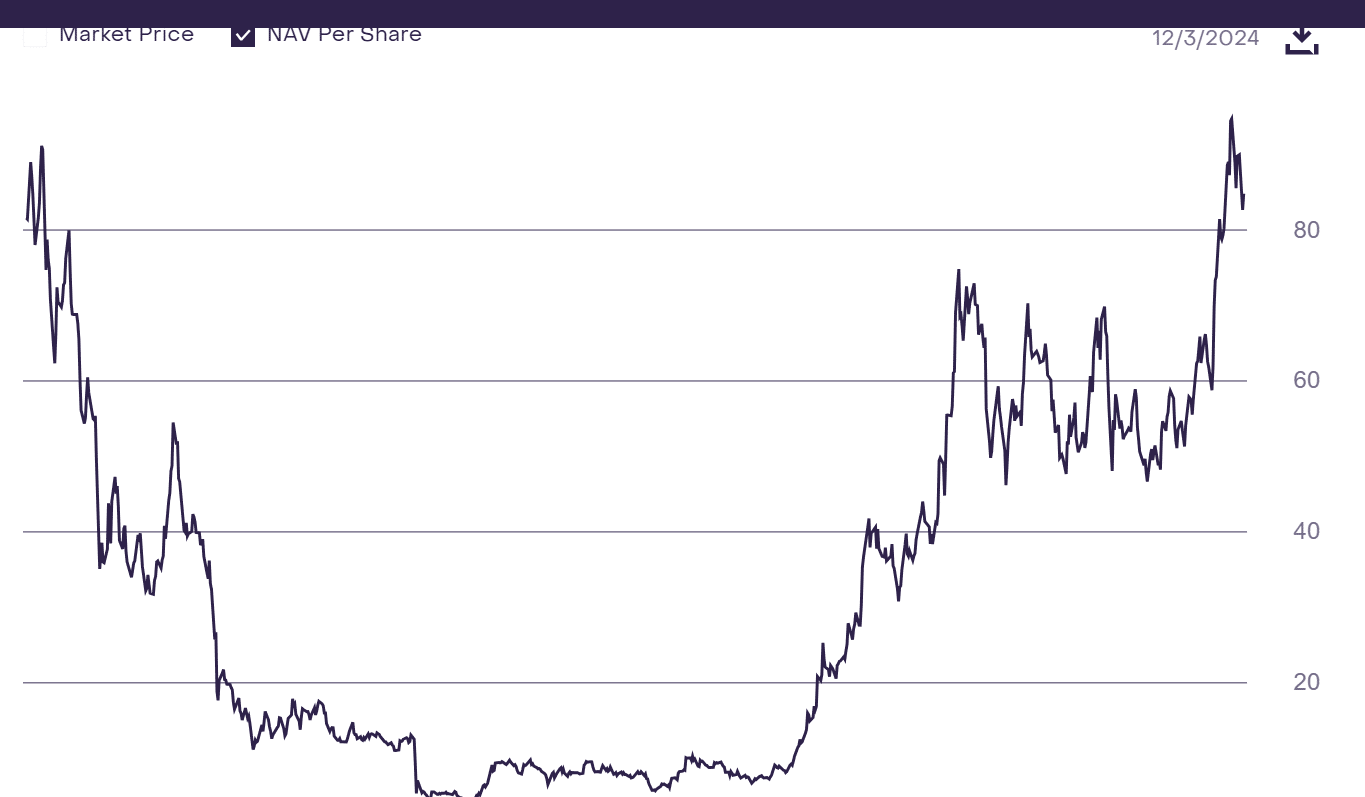

Based on current figures, the trust’s total assets under management (AUM) stand at approximately $120,140,670.86. Its net asset value (NAV) per share is around $84.82. Over time, the NAV has shown significant growth, indicating a growing institutional interest in Solana.

Grayscale is planning to convert the trust into an exchange-traded fund (ETF) that trades in spot markets. This move intends to boost liquidity and make it easier for investors to get involved, as it mirrors the current market preference for ETFs of this type.

Analyzing the Solana market trends

The market for Solana has shown strong activity, evident in its price graph. Currently, SOL is being traded at around $235.70, with the 50-day and 200-day moving averages offering support at $202.37 and $163.23 respectively.

As an analyst, I’m observing that the Relative Strength Index (RSI) currently stands at 55.86, signifying a neutral market sentiment. This means there’s potential for further market upswings. The recent price fluctuations suggest positive trends, even in the context of broader market volatility. These trends bolster the argument for increased institutional involvement, implying a potential increase in buying activity.

As I analyze the Net Asset Value (NAV) per share chart for GSOL, it’s clear that this graph follows Solana’s price path, underscoring a surge in investor confidence in this asset. The upward trajectory of NAV suggests a maturing market, where there’s increasing demand for expertly managed investment solutions linked to Solana.

Industry-wide context: Solana ETF momentum

Grayscale’s filing follows a slew of applications for spot Solana ETFs in 2024.

Over the summer, both VanEck and 21Shares put forth proposals aimed at the rapidly growing Solana network. In October, Canary Capital followed suit by submitting an application. More recently, Bitwise Asset Management has also joined this competition.

This flurry of activity indicates strong market anticipation for Solana ETFs.

Translating Grayscale’s decision to transform its Solana Trust into an Exchange-Traded Fund (ETF) in spot form can be seen as a confident step taken by the asset manager, indicating the increasing institutional interest in gaining crypto exposure.

It’s yet unknown if the SEC will grant approval to these applications, but the growing interest in Solana ETFs signifies a significant turning point within the cryptocurrency sector.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2024-12-04 22:15