-

On 2 September, WazirX held a digital townhall meeting to discuss their plan to recover stolen funds

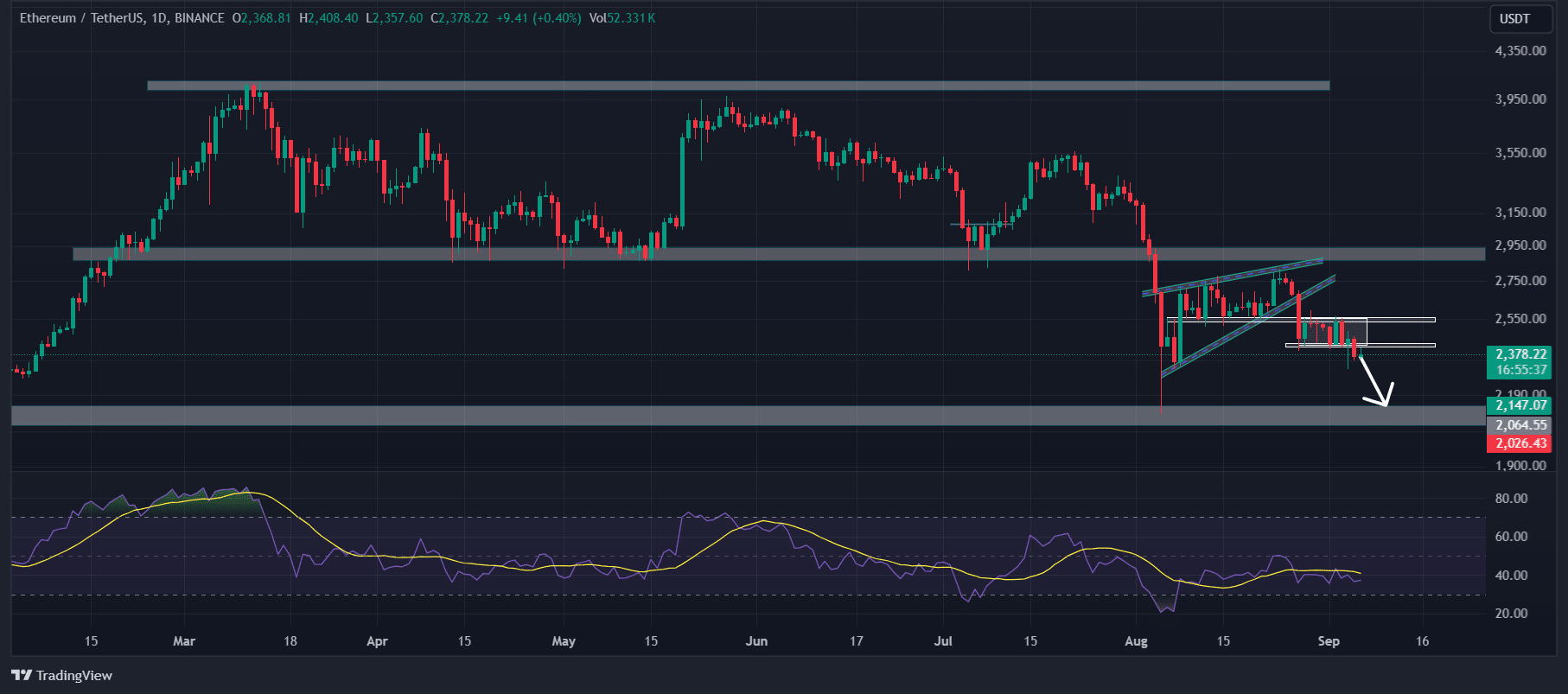

ETH could fall to $2,200 or even lower as it breaks out of the week-long consolidation zone

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself constantly monitoring the latest developments and trends. The recent spate of exploits by WazirX, Penpiexyz, and Fenbushi has sent shockwaves through the community, especially given the substantial funds involved.

The questionable activities of the individuals behind WazirX, Penpiexyz, and Fenbushi, who are accused of theft, have become a hot topic. This is particularly noteworthy given their recent movement of substantial amounts of allegedly stolen assets amidst the current downward trend in the market.

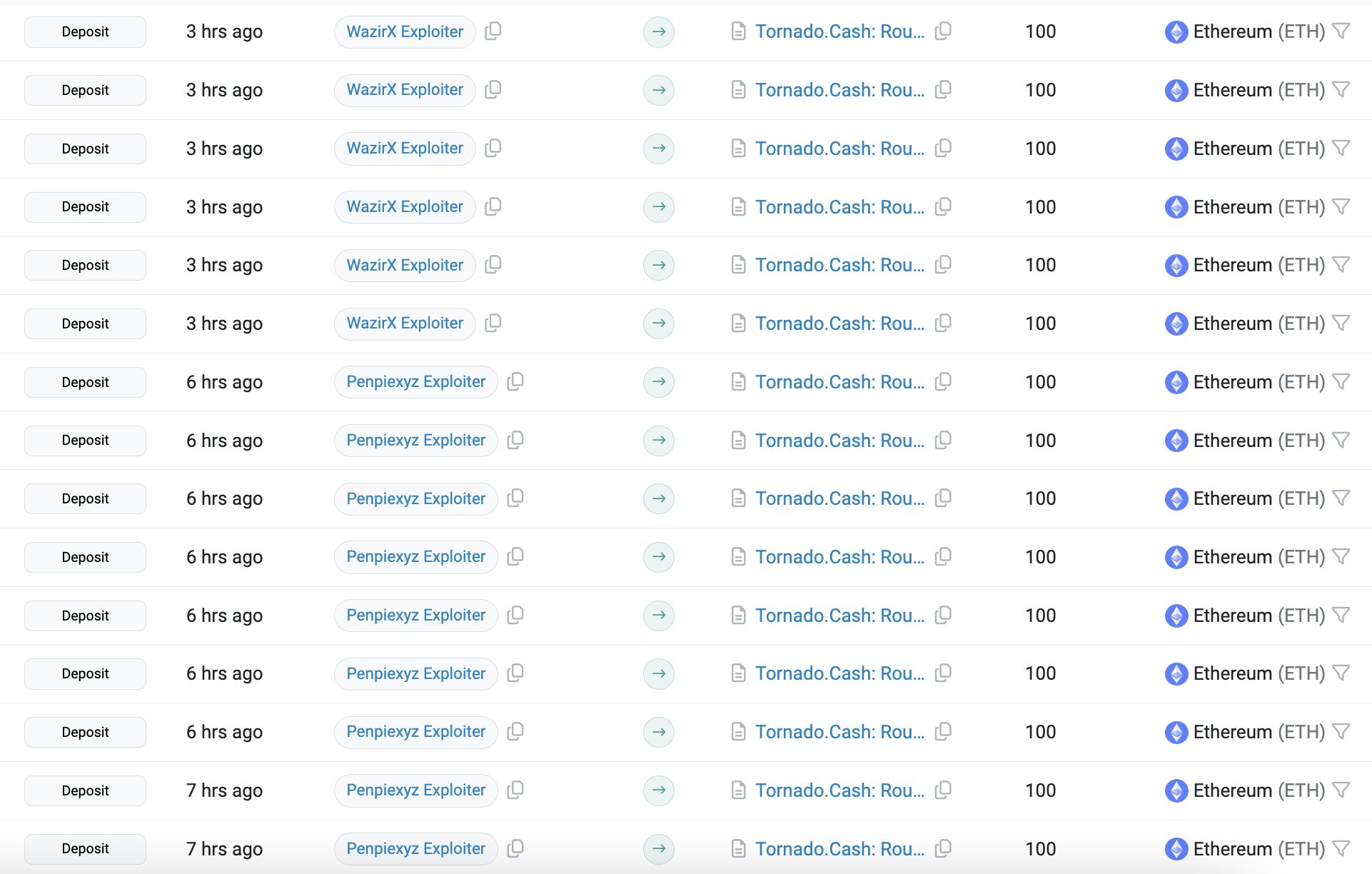

Three days ago, Lookonchain, an on-chain analysis company, disclosed that cybercriminals transferred approximately 17,800 Ether, equivalent to around $42.7 million, into Tornado Cash.

WazirX exploiter moves millions worth of ETH

As a crypto investor, I’m not immune to worries shared by others in the community regarding the recovery of funds that have been stolen. On the 2nd of September, 2024, WazirX took an important step towards addressing this issue by hosting a digital townhall meeting. The purpose was to share their strategy for retrieving the stolen funds from the culprit who exploited their system.

After the meeting, it’s been discovered that the individual responsible for exploiting WazirX has moved approximately 7,200 ETH, equivalent to around $17.3 million, into Tornado Cash. It seems they have no intention of returning over $235 million in cryptocurrency that was obtained through this incident.

Furthermore, individuals known as Penpiexyz thieves, responsible for the theft of approximately $27 million in assets, have additionally transferred around 9,600 Ether (ETH), equivalent to roughly $23 million, into Tornado Cash.

Given the delicate nature of the current market environment, large-scale transactions could potentially spark fear and intensify the urge to sell.

Ethereum technical analysis and key levels

On the day-to-day graphs, Ethereum’s price behavior appeared extremely bearish. Following the break down of the ascending wedge price pattern on a daily time scale, there was a week-long period of consolidation.

As I was composing this, the price was escaping from its consolidation phase by ending the daily trade beneath the specified range.

Looking at past trends in ETH‘s price movement, it seems likely that Ethereum might drop as low as $2,200 or possibly even further.

Conversely, the Relative Strength Index (RSI) indicated an oversold region, suggesting a possible price turnaround. Yet, considering current market circumstances and whale activity, such a reversal seems rather improbable.

ETH’s price momentum

Currently, ETH is being traded around $2,374, a decrease of 1% in the past 24 hours as reported by CoinMarketCap. Simultaneously, the trading volume decreased by 6%, suggesting less involvement from traders during this period of market downturn.

Instead, it’s worth noting that there was a 1.2% increase in ETH‘s Open Interest over the past 24 hours, suggesting an uptick in ETH Future contracts despite a drop in price.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-09-06 17:11