-

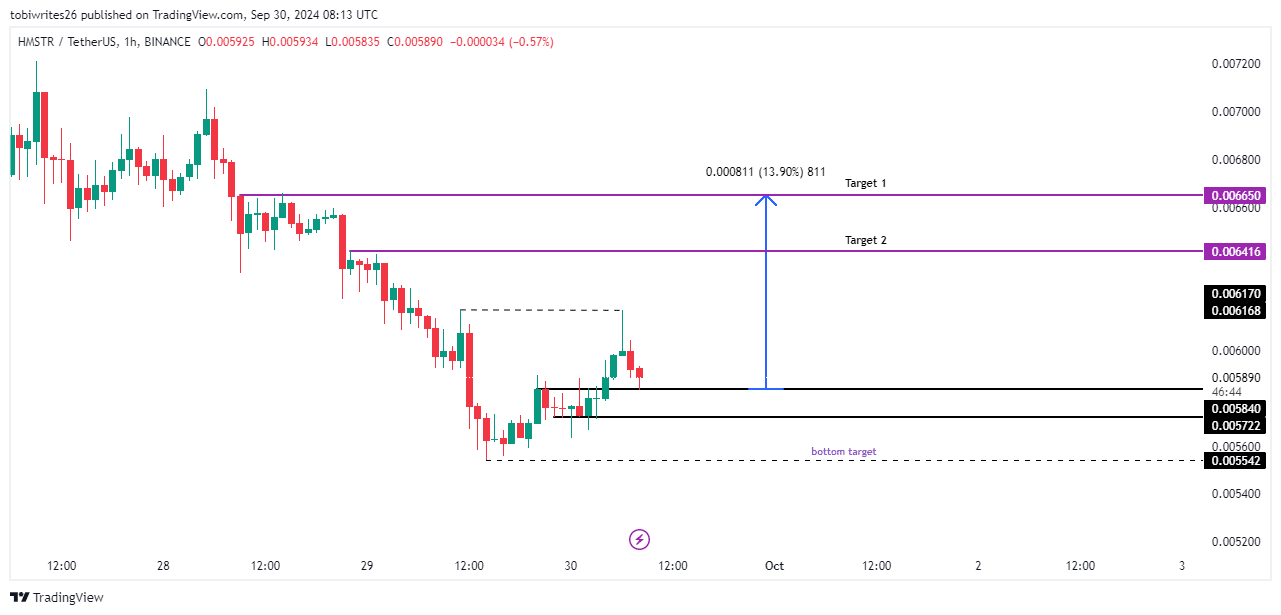

HMSTR is positioned for an upward move as it trades within a key demand zone, setting the stage for potential gains.

If market conditions align, HMSTR could see an increase of 13.90%. However, there is still a risk of further declines.

As a seasoned crypto investor with battle scars from numerous market battles, I’ve learned to read charts like a fortune teller reads tea leaves. Hamster Kombat [HMSTR] has been a rollercoaster ride since its debut, but I’m not one to shy away from a good challenge.

🌪️ EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

New research shows euro-dollar volatility about to spike — are you ready?

View Urgent ForecastSince its initial launch, the stock trading under the symbol Hamster Kombat (HMSTR) has experienced significant downturns. Last week alone, it saw a decrease of around 40.34%, substantially lowering its overall market worth.

Over just the past day, it dropped by 3.94%. This potential dip might provide an attractive opportunity for investors who are speculating on a subsequent recovery.

HMSTR enters a demand zone: Will it hold sufficient buying pressure?

Currently, HMSTR has dropped into a potential buy zone, indicated by a recent decline of approximately 3.94%. This range, situated between 0.5840 and 0.5722 as shown on the 1-hour chart, is believed to attract significant buying activity due to its history of price stabilization.

If the purchase volume exceeds the present downward market direction for HMSTR, it could possibly increase by as much as 13.90%, reaching approximately $0.006650. Yet, a more cautious outlook might see it reaching $0.006416 instead.

If the price of HMSTR fails to maintain its position within the current support zone, there’s a possibility of seeing further drops, potentially reaching as low as $0.05542 or even lower.

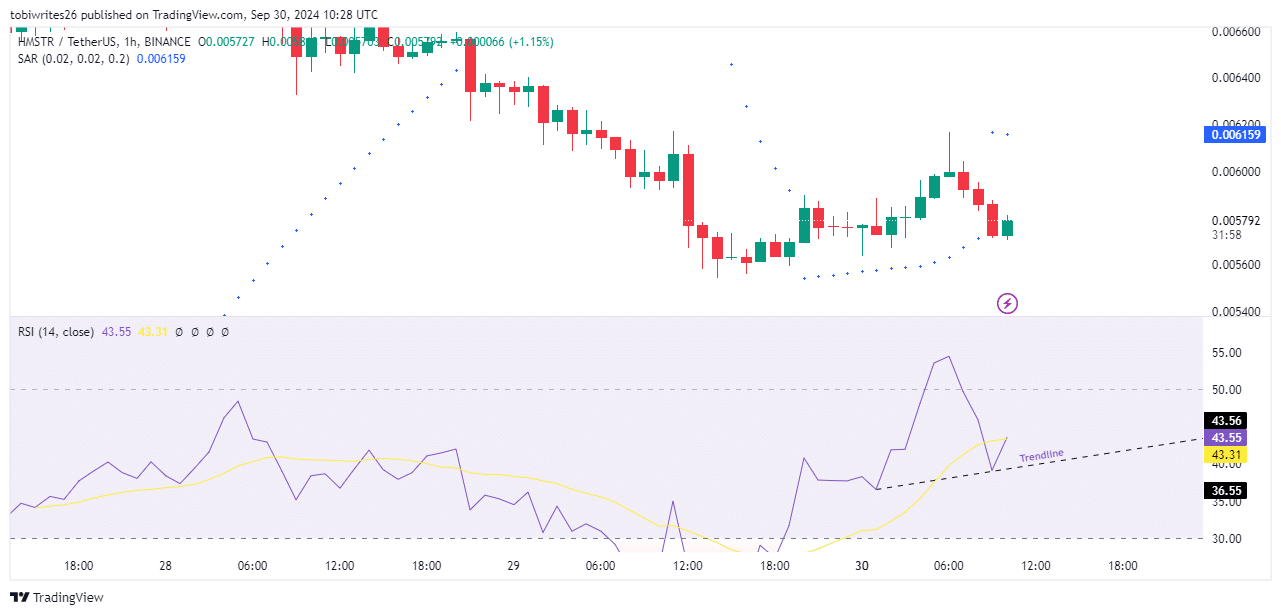

Mixed signals among market participants on HMSTR’s direction

Based on the Parabolic SAR indicator, it appears that HMSTR‘s trend is shifting towards a downward direction. This is suggested by the appearance of dots above the price bars in its trading pattern, which typically signal a bearish outlook.

As a researcher, I find the Relative Strength Index (RSI) to offer a more encouraging perspective. Following our support trend line, the RSI has noticeably shifted upwards, implying that the bullish momentum might persist.

The RSI evaluates market direction by measuring the speed and change of price movements.

Given the present market scenario, AMBCrypto predicts a possible upward trajectory, as the demand area seems robust and here’s why:

Open interest suggests a bullish outlook for HMSTR

As an analyst, I find that Open Interest – a measure of outstanding derivative contracts on an asset – provides insights into the market’s sentiment. A substantial Open Interest typically indicates that traders are expanding their positions, usually suggesting a positive, or bullish, price trend.

As an analyst, I observed a significant increase in the open interest of HMSTR over the past 24 hours. Specifically, it surged by approximately 6.81%, escalating from $60.81 million to $17.37 million as of press time.

This substantial increase suggests that traders are actively putting money into HMSTR, predicting the stock’s price will rise even more from its current point.

However, if the overall market sentiment turns bearish, this could drive HMSTR’s price even lower.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-01 11:03