- Hamster Kombat was listed across major exchanges with 100 million users.

- HMSTR prices declined by 30.42% over the past day.

As a seasoned researcher with years of experience in the ever-evolving crypto market, I have witnessed numerous ups and downs. The story of Hamster Kombat (HMSTR) is one that has piqued my interest, given its rapid growth and subsequent decline after listing on major exchanges.

As a researcher delving into the dynamic world of blockchain gaming, I’ve recently found myself captivated by Hamster Kombat (HMSTR), an engaging tap-to-earn game that’s been creating quite a stir within the cryptocurrency community on the Ton Blockchain.

Since its launch six months ago, it has amassed more than 300 million users.

HMSTR listed across major exchanges

2024, on the 26th of September, the market behavior for HMSTR noticeably changed following several cryptocurrency platforms adding it to their listings.

The cryptocurrency, other than Bitcoin, was added to prominent trading sites like Binance, OKX, and Kucoin. Notably, its addition on Binance led to a surge in popularity, allowing it to surpass other platforms in terms of handling market transactions.

Consequently, Binance had more than 6.2 billion tokens deposited ahead of time, and after the listing, the balance hit an all-time high of 18 billion tokens, accounting for 18% of the total.

As a researcher, I’ve observed that when compared to platforms like Bybit, OKX had a smaller percentage of pre-deposited tokens. Specifically, Bybit held approximately 4.6% of their total tokens in pre-deposits, while OKX only held around 4.1%. This suggests a potential difference in token reserve management between the two platforms.

HMSTR plummets after listing

While the listing was highly anticipated, the market had an immediate negative reaction.

As a researcher, upon the initial public offering of HMSTR, I observed a significant drop in its stock price immediately following the listing. Contrary to the optimistic projections suggested by the pre-market futures high of $0.3865, the opening prices fell short of expectations.

At first, the trading price started at $0.014, then dropped by 32.6%, reaching $0.011. Subsequently, HMSTR fell even more to $0.0088.

Consequently, the value of the altcoin has been gradually falling since it was listed. Currently, at the point of this writing, HMSTR is being traded for $0.006791.

Today saw a drop of 30.42%, which translates to nearly one-third, compared to the previous day. Similarly, over this duration, its market capitalization decreased by approximately 30% and currently stands at around $437 million, as reported by Coinmarketcap.

On the upside, although HMSTR prices had declined, its monthly active addresses soared.

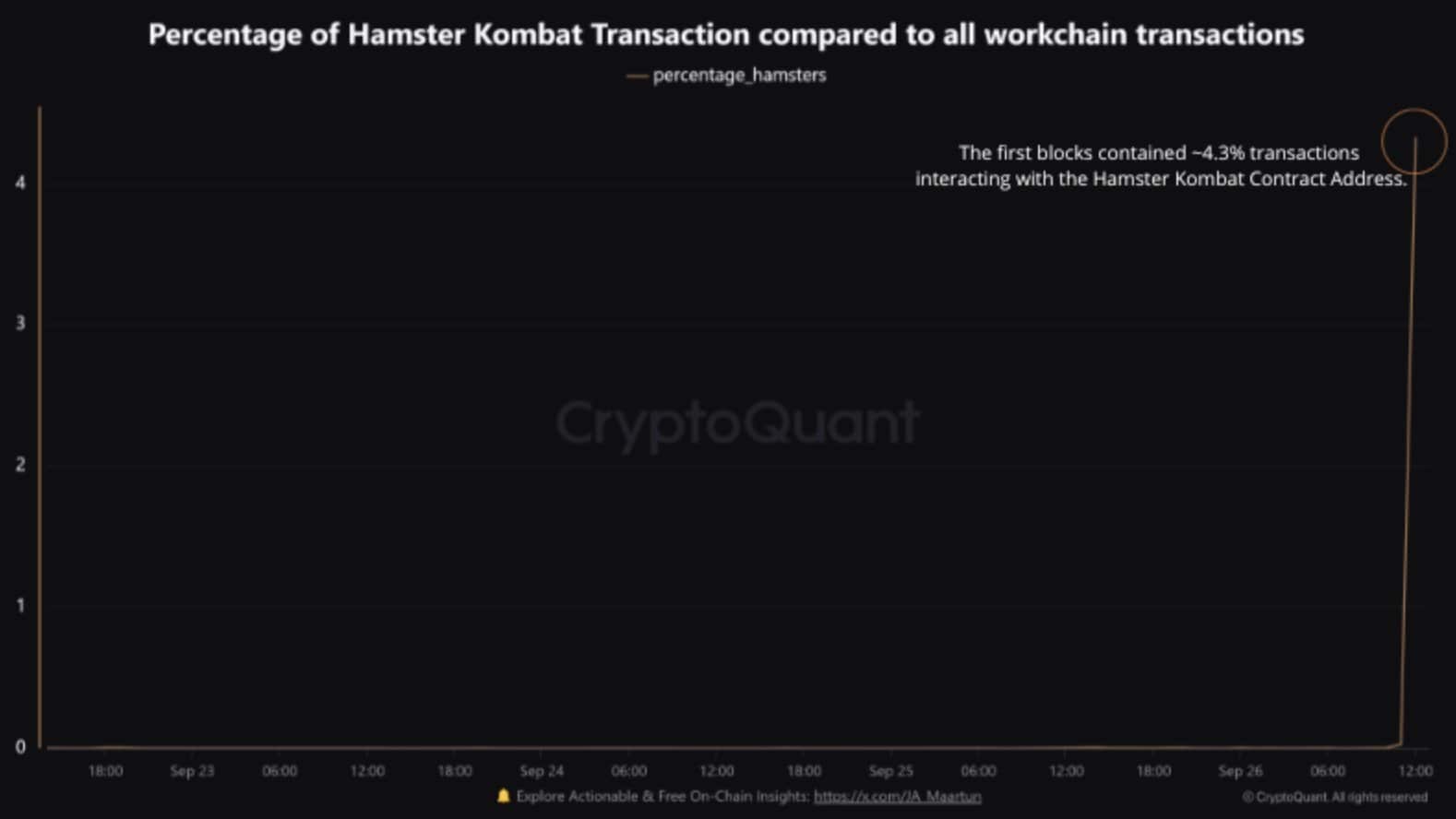

As reported by Cryptoquant, the user base for Hamster Kombat has exceeded 100 million monthly active users, and they’ve recently introduced their HMSTR token on The Open Network (TON).

To put it another way, approximately 4.3% of the initial set of transactions engaged with the Hamster Kombat contract address.

Impact on price charts?

According to AMBCrypto’s analysis, HMSTR failed to meet market expectations.

Ever since its debut, the altcoin has experienced an uptick in pessimistic market attitudes. Given this prevailing mood, it seems plausible that HMSTR may continue to slide.

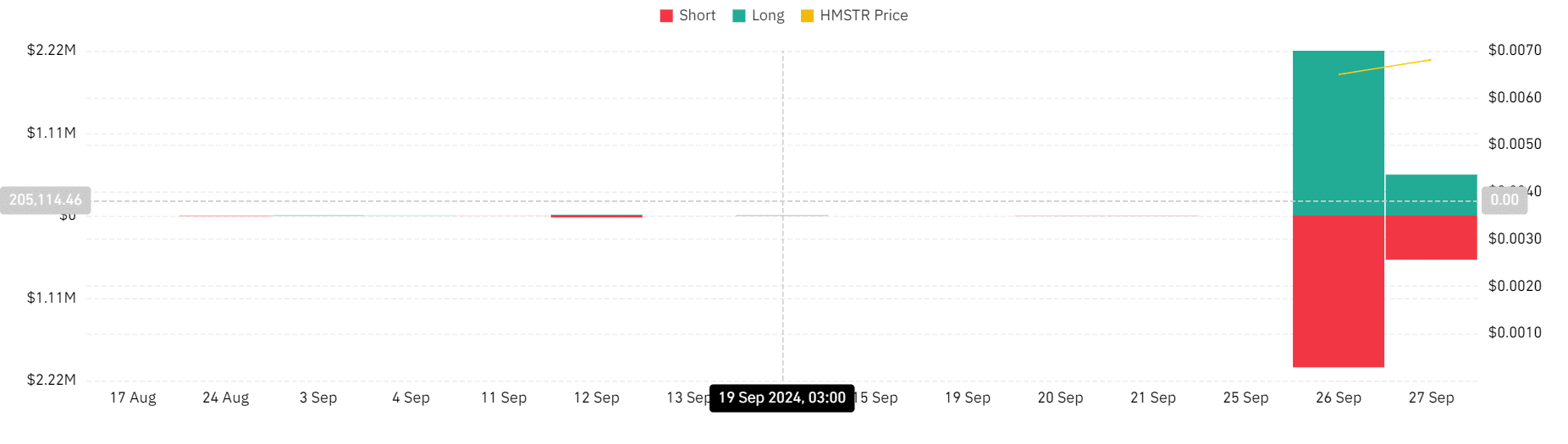

Over the last day, the amount of liquidated assets significantly increased, reaching approximately $5.1 million, as reported by Coinglass.

Over these past days, the market value for closing short positions amounted to $2.5 million and $2.6 million. This indicates a predominantly bearish market sentiment, as those holding long positions seemed uncertain about the future trajectory of the altcoin.

As a crypto investor, I’ve noticed that HMSTR’s Relative Strength Index (RSI) currently stands at 26, suggesting the stock may be oversold. Meanwhile, its RSI-based Moving Average (MA) is at 36.17, which could potentially signal a trend reversal in the near future.

The implication here is that the alt (short for alternative asset) had been bought too cheaply, leading to a situation where sellers were more active than buyers. In other words, the demand to sell was greater than the desire to buy, giving sellers control over the market.

Essentially, HMSTR has been witnessing a significant drop in its value. If the ongoing market situation continues, we can expect the price to fall even lower to approximately $0.005.

However, a correction will see it push above $0.010.

Read More

2024-09-28 01:44