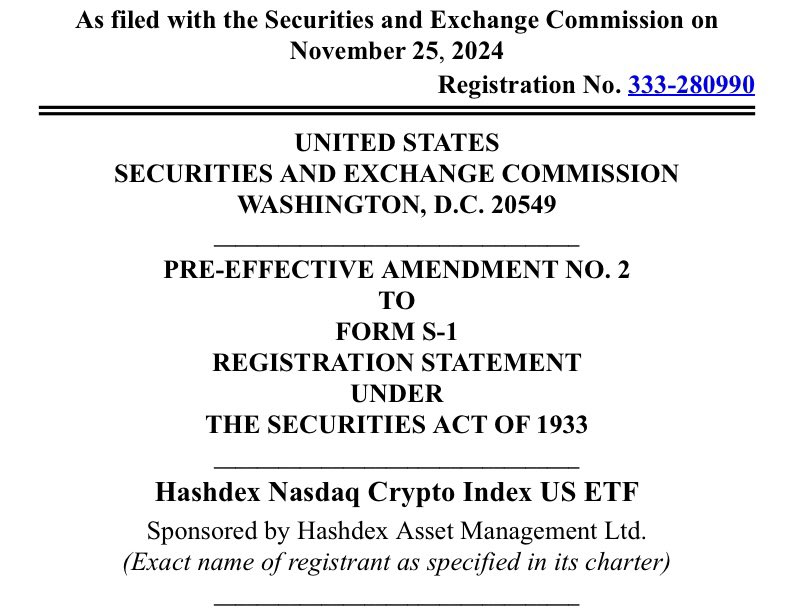

- Hashdex files S-1 amendment for Nasdaq Crypto Index US ETF.

- Bitcoin ETFs record a new weekly inflow peak.

As a seasoned crypto investor with a decade-long journey in this dynamic digital frontier, I find the recent developments in the ETF market particularly intriguing. The news of Hashdex filing for a Nasdaq Crypto Index US ETF and the record inflows into Bitcoin and Ethereum ETFs are clear indicators that institutional investors are increasingly warming up to digital assets.

25th November saw Hashdex, a company specializing in managing cryptocurrency assets, reveal they had submitted an updated version of their S-1 form to the United States Securities and Exchange Commission (SEC). This filing is for a potential Nasdaq Crypto Index US Exchange-Traded Fund (ETF).

Hashdex’s crypto ETF pursuit

The most recent modification is based on Hashdex’s original S-1 submission, which underwent alterations in October due to the SEC’s request for additional time to examine it thoroughly.

The Exchange-Traded Fund (ETF) plans to start off with Bitcoin (BTC) and Ethereum (ETH), the two cryptocurrencies followed by the Nasdaq Crypto US Index at present. As time goes on, there’s potential for the fund’s holdings to grow and include more digital currencies, as suggested in the documents submitted.

In similar fashion to Hashdex’s aspirations, major players such as Franklin Templeton are making significant strides. Just like Hashdex, Franklin Templeton plans an ETF (Exchange Traded Fund) called the Crypto Index ETF which incorporates Bitcoin (BTC) and Ethereum (ETH).

Instead of focusing on just one area, Grayscale’s Digital Large Cap Fund aims to provide a broader investment experience. This exchange-traded fund (ETF) incorporates various cryptocurrencies like Solana [SOL], Avalanche [AVAX], and Ripple [XRP] within its investment portfolio for a more diversified approach.

Spot BTC and ETH ETF trends

During this period, the broader market for cryptocurrency exchange-traded funds (ETFs) is reaching new heights. For the week of November 18th to 22nd, Spot Bitcoin ETFs saw a significant jump in net inflows, totaling $3.38 billion—a substantial 102% rise from the previous week’s $1.67 billion.

As reported by SoSo Value, this period experienced the highest weekly investment influx ever recorded, marking the seventh straight week with positive cash flows. However, on November 25th, a reverse trend was observed as a total of $438.38 million was withdrawn from these ETFs, indicating negative daily flows.

Over the past six days, there were continuous withdrawals from ETH ETFs, but on November 22nd, they surprisingly bounced back. As we speak, the ETF saw a positive daily inflow of approximately $2.83 million.

Moreover, the total net assets for Ethereum ETFs exceeded $10 billion for the very first time since their launch, amounting to $10.28 billion specifically on the 25th of November.

Another ETF for XRP?

The excitement surrounding Exchange Traded Funds (ETFs) isn’t confined just to Bitcoin (BTC) and Ethereum (ETH). A significant event has occurred: WisdomTree, a well-known asset manager and global ETF provider with over $100 billion in assets under management, has registered for an Exchange Traded Fund focusing on Ripple (XRP) in Delaware.

As reported by Eleanor Terrett from Fox Business, it’s anticipated that this action will be followed by a Securities and Exchange Commission (SEC) S-1 filing. Similarly, WisdomTree has joined Bitwise, 21Shares, and Canary Capital in submitting comparable applications to the SEC.

Gensler out, crypto ETFs in?

As the Securities and Exchange Commission’s (SEC) regulations continue to develop, there’s a growing interest in the potential of cryptocurrency exchange-traded funds (ETFs) in this dynamic new setting.

Earlier, it was reported by AMBCrypto that Gary Gensler, a chairman of the SEC who is well-known for advocating strict regulations in the cryptocurrency sector, has announced his resignation, which takes effect on January 20th, 2025.

His leaving coincides with the inauguration of Donald Trump’s second term as President. The newly elected president has pledged to transform the United States into a leading force in the global cryptocurrency landscape.

Consequently, this might create a friendlier atmosphere for the launch of crypto ETFs and various other cutting-edge digital asset solutions.

As significant changes loom within the Exchange-Traded Fund (ETF) sector, the query arises: Will the Securities and Exchange Commission (SEC) adapt to this new phase, or will the approval process persist as an obstacle?

Well, the coming months promise to be a defining chapter in the evolution of the crypto market.

Read More

2024-11-26 14:16