- HBAR crypto has gained by over 34% in 24 hours to a five-month high.

- The rising Open Interest and DeFi TVL suggested that the rally could continue.

As a seasoned crypto investor who has seen my fair share of market fluctuations, I must admit that the recent surge in HBAR has caught my attention. A 30%+ gain in 24 hours is not something you see every day, especially for an altcoin like HBAR.

In just the past day, Hedera [HBAR] has surged over 30%, making it the top performer among the top 30 cryptocurrencies ranked by market cap.

Currently, this altcoin is being exchanged for a record high of $0.118 per unit, and its total market value stands at an impressive $4.22 billion.

Will HBAR crypto continue rising?

The increase in HBAR’s value lately can be attributed to a rise in purchasing actions, evident by the upward trend in the green volume bars over the past five straight days.

Currently, the Relative Strength Index (RSI) is on an upward trend and stands at 88, indicating that HBAR may be overbought as of now.

Typically, whenever the RSI hits overbought levels, it hints at an upcoming short-term correction.

On the other hand, traders could decide to keep their positions rather than sell, given that other technical signals hint at an increasing bullish power.

According to the Directional Movement Index (DMI), the market’s upward movement appears robust. In this case, the positive DI, represented by blue, surpassed the negative DI, symbolized by orange. This discrepancy, growing wider, suggests a bullish trend, indicating strong buying momentum.

Furthermore, the Average Directional Index (ADX) was pointing upward, signifying a favorable trend at the given moment. A reading of 42 on the ADX further implied that the upward momentum was growing stronger.

Should the bullish trend persist, HBAR could potentially reach a resistance point aligned with the 1.618 Fibonacci level (approximately $0.13). Notably, the last occasion when HBAR overturned this resistance, it soared up to $0.18.

Therefore, if buyers continue accumulating, a similar rally could occur.

Instead, keep an eye on the $0.0546 level as a potential source of support among traders. If this level isn’t maintained, it might lead to a shift in the trend’s direction.

Rising speculative activity

In the derivatives market, there has been a significant surge in speculative interest related to HBAR. Currently, the daily trading volume for this alternative coin is approximately $1.37 billion, marking a more than doubling (over 104%) within the past 24 hours.

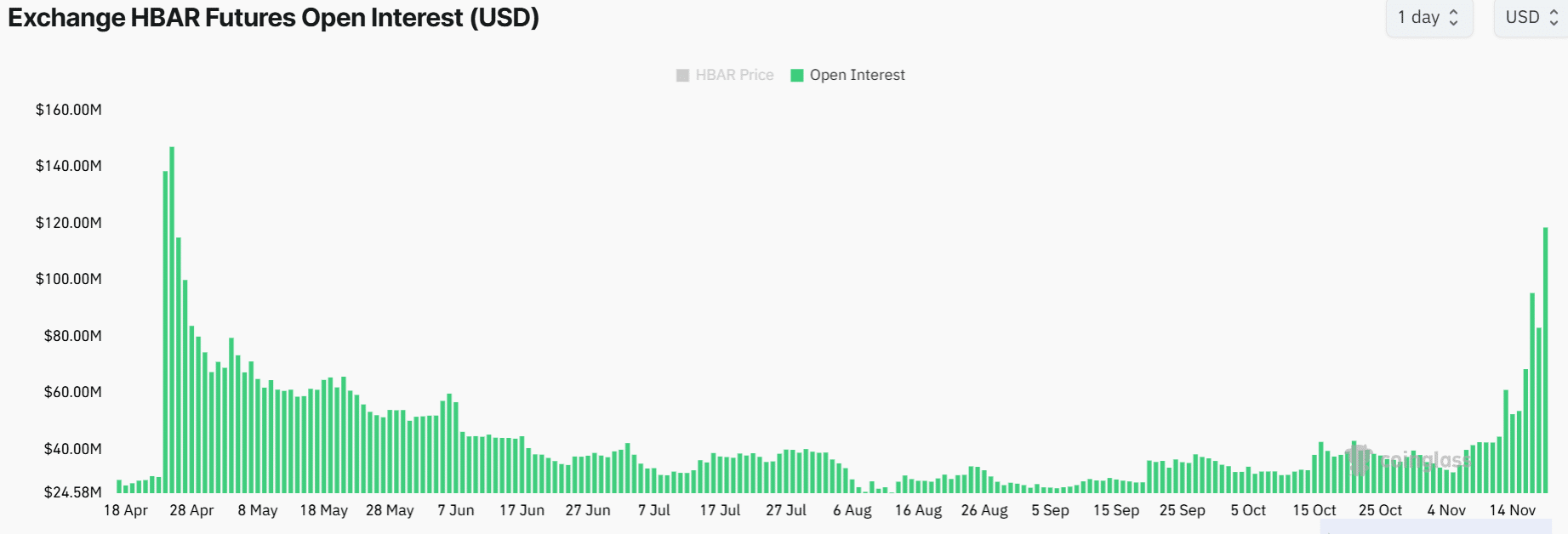

The number of open trades has climbed up to $118M, which is its peak since the end of April, showing that traders are creating fresh investment opportunities.

As an analyst, I observe that when Open Interest concurrently increases with the price, it signifies strengthening bullish momentum and a firm belief in the uptrend. Additionally, I note that Funding Rates continue to be positive, indicating a greater appetite for long positions, suggesting increased demand among market participants.

Should the market continue to be optimistic, HBAR may see further growth. Yet, an increase in Open Interest indicates higher levels of leverage, potentially leading to more volatile price fluctuations.

Rising DeFi activity could fuel the rally

It’s worth noting that the Hedera blockchain has been witnessing an increase in decentralized financial (DeFi) transactions, potentially contributing to the upward trend of its native token, HBAR.

According to data from DeFiLlama, the total value locked (TVL) in Hedera’s DeFi sector experienced an 82% surge over the course of a week, reaching approximately $93 million as of the current press time.

Read Hedera’s [HBAR] Price Prediction 2024–2025

The DeFi volumes have experienced a substantial rise as well, increasing noticeably during the last seven days.

An increase in decentralized finance (DeFi) activities often triggers price increases. So, if Total Value Locked (TVL) keeps growing, it might fuel positive market trends and potentially lead to further profits for HBAR.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-18 19:36