Okay, let’s get down to business. Short-term charts are looking pretty optimistic for HBAR, with a modest recovery and increased activity hinting at renewed interest from buyers. Because who doesn’t love a good underdog story? 🐕

A combination of rising open interest, strengthening intraday support, and improving volume metrics is painting a picture of cautious optimism. It’s like the crypto equivalent of a first date – we’re not getting too excited just yet, but there’s potential. 🤔

Volatility and Open Interest: The Ultimate Party Crashers

On the 1-hour HBAR/USD chart from Open Interest, things got a little wild. The asset dropped sharply on June 6, then entered a phase of tight consolidation between June 7 and June 9, fluctuating around USDT 0.165. Open interest remained relatively stable, indicating limited speculative movement and a temporary balance between buyers and sellers. It’s like the calm before the storm… or a really boring party. 🎉

But then, between June 10 and early June 11, HBAR posted a notable rally, pushing the price near USDT 0.185. This upward move was accompanied by a significant increase in aggregated open interest, which suggested new capital entering the market, likely from participants anticipating a bullish breakout. It’s like the party’s getting started, and everyone’s invited! 🎉

However, this rally was short-lived, as the price quickly reversed below USDT 0.165. The retracement, paired with a decline in open interest, suggested long position liquidations and profit-taking as market sentiment shifted once again. It’s like the party’s over, and everyone’s going home. 🏠

Following the abrupt correction, the asset has begun to recover. As of June 14, the price found support near USDT 0.152 and has since risen to around USDT 0.1595. Open interest has also started to climb, signaling fresh participation. If the asset can sustain momentum and break above the USDT 0.165 resistance level with volume confirmation, further upside could be triggered in the near term. It’s like the party’s back on, and everyone’s dancing! 💃

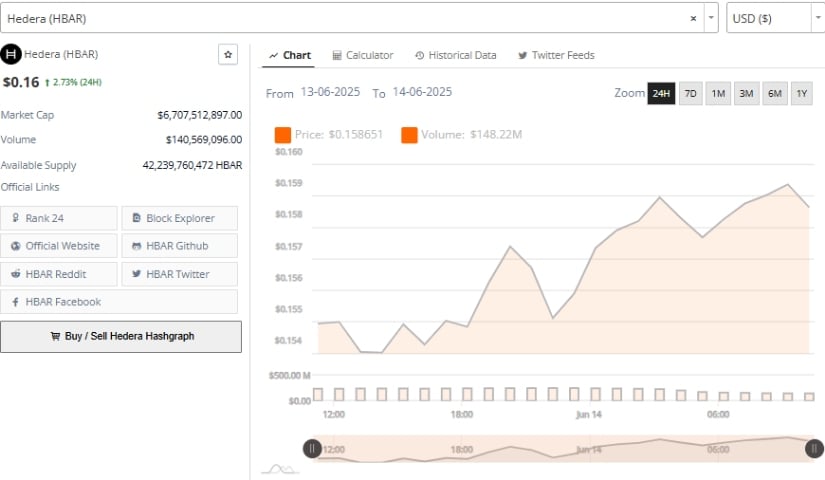

Hedera Price Prediction: 24-Hour Price Action Shows Bullish Activity and Growing Volume

Over the 24 hours from June 13 to June 14, HBAR price prediction displayed a steady price ascent, beginning around USDT 0.154. Minor price fluctuations occurred during the early hours, but a clear upward pattern developed by the evening of June 13. The rise continued into June 14, with the price peaking close to USDT 0.160, supported by increasing buying pressure. It’s like the price is saying, “Hey, I’m back, and I’m not going anywhere!” 💁♀️

A significant feature of this 24-hour uptrend was the surge in trading volume. Volume levels reached approximately USDT 148.22 million, signaling heightened activity from market participants. These volume surges suggest that the recent price increase was backed by solid market participation, often viewed as a key factor in validating short-term price movements. The volume bars remained elevated throughout the session, indicating consistent interest from buyers during the climb. It’s like the price is saying, “I’m not alone, I’ve got friends!” 👫

As of the latest data, Hedera maintains a market capitalization of around USDT 6.71 billion and holds the 24th position by market cap. With an available supply exceeding 42 billion tokens and a 2.73% daily price increase, the coin’s liquidity remains strong. If this pace of volume and price alignment continues, the conditions may support a potential continuation of the uptrend. It’s like the price is saying, “I’m on fire, and I’m not stopping!” 🔥

Weekly Chart Highlights Longer-Term Pressure but Early Rebound Signs

On the other hand, the broader trend captured in the weekly Hedera price prediction chart outlines a more extended cycle. Between late 2024 and early 2025, the asset recorded significant gains, reaching highs near USDT 0.401. It’s like the price is saying, “I’ve been around the block a few times, I know what I’m doing!” 😎

That bullish phase was marked by expanding Bollinger Bands and long green candles, typical of volatile upside momentum. However, the following months saw the asset enter a correction phase, marked by consecutive lower highs and lows, indicating waning bullish strength. It’s like the price is saying, “I’m not as strong as I used to be, but I’m still kicking!” 💪

Currently, the asset trades around USDT 0.1596, which places it below the middle Bollinger Band (USDT 0.19215). The price is gradually nearing the lower Bollinger Band (USDT 0.13063), which could act as potential support. The narrowing of the bands reflects reduced volatility and suggests a likely directional move ahead. The latest red candle shows a 5.78% drop over the week, reinforcing the need for caution in the short term. It’s like the price is saying, “I’m not out of the woods yet, but I’m working on it!” 🌳

The MACD indicator further supports the bearish trend. The MACD line at -0.00271 remains beneath the signal line at 0.00396, with a negative histogram. Despite this, the histogram’s decreasing red bars suggest that downward momentum may be fading. It’s like the price is saying, “I’m not giving up yet, I’ve still got some fight left in me!” 💥

If this trend continues and a MACD crossover occurs, it could indicate a possible shift toward recovery. However, at this stage, the overall trend still leans bearish, requiring confirmation of reversal through sustained buying and rising momentum indicators. It’s like the price is saying, “I’m not there yet, but I’m getting closer!” 📍

This structured recovery, supported by volume and market behavior, may lay the groundwork for HBAR to climb out of its recent lows. Yet, traders remain cautious, looking for key resistance breaks and broader market signals to determine if this rebound can transform into a longer-term reversal. It’s like the price is saying, “I’m on the road to recovery, but I’m not alone – I’ve got my eyes on the prize!” 🏆

Read More

2025-06-14 22:33