HBAR price has stirred from its slumber, vaulting a daring 2.6% in the last 24 hours, now languidly draped around $0.219 like a bored debutante at a country house weekend. Still, let us not pop the champagne just yet-our monthly chart is nursing a rather unflattering 7% bruise. Over the past year, however, HBAR’s performance has been frankly indecent, skyrocketing over 330%. “Bullish,” they say, though one hopes they’re not just being frightfully optimistic.

The daily price structure could best be described as fragile-rather like Aunt Edna after a sherry too many. Yet the indicators whisper tales of momentum and dip-buying, suggesting the bears are clinging on by their claws, desperately searching for dignity. 🐻💅

Early Buyers Flirt Shamelessly on the 4-Hour Chart

On the 4-hour chart, the Money Flow Index (MFI)-one of those delightfully cryptic indicators tracking capital inflows-has been putting in higher highs while HBAR itself continued its swoon. Classic! Clearly, short-term dip-buyers love to be first to the party, even if it’s only on the lower timeframes.

Translation: capital is already spinning into HBAR, like society matrons jostling for a glimpse of the latest eligible bachelor. If the MFI waltzes above 35.90 (the previous high), one could reasonably expect a full-on bullish soiree. 🎩

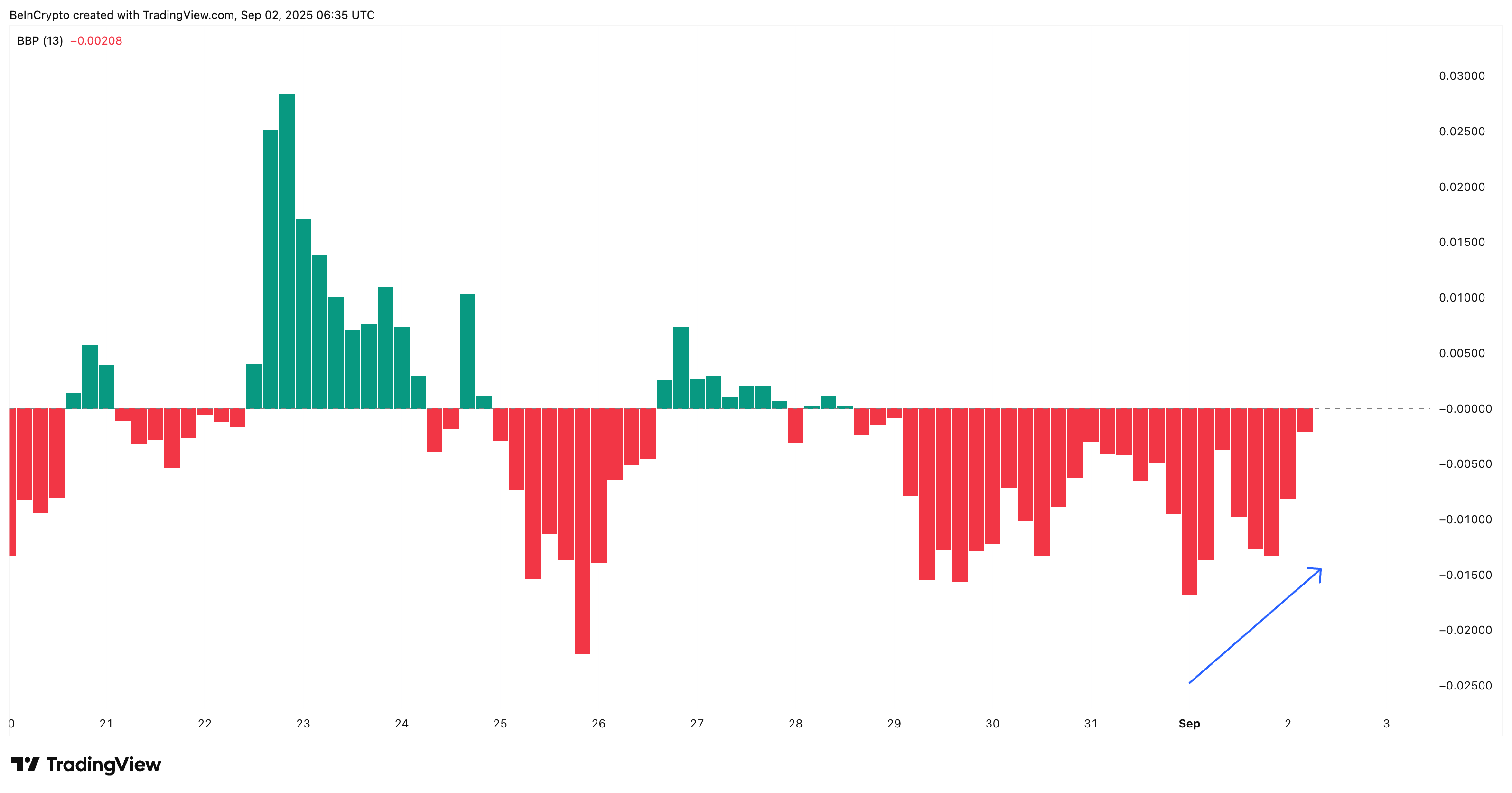

Meanwhile, Bull-Bear Power (BBP) has been sagging since September 1, suggesting the bears are fading like last season’s fashion. Dip buyers, in contrast, still seem busily at work. How thrilling.

So: while HBAR price is not yet out of the haunted woodland, the signs hint that the fortunes may be changing, provided the fates don’t intervene.

For scandalous token gossip and market intrigue: If you’re hungry for more, consider subscribing to Editor Harsh Notariya’s Daily Crypto Newsletter-presumably delivered with less drama than this narrative.

Can Daily Chart Divergence Save Our Hero from Doom?

The daily chart shows HBAR skulking about within a descending triangle, Fibonacci retracement levels acting as stern governesses. Should $0.210 buckle, HBAR could tumble headlong to $0.187-a fate worse than no pudding at dinner. On the other hand, recapturing $0.235-$0.249 would finally send the bears packing to the cloakroom for a long sulk.

But behold! There is cause for hope (bring out the cocktails!):

Between July 13 and September 2, HBAR formed a higher low, while the Relative Strength Index (RSI)-that moody metric of market momentum-set a lower low. Hidden bullish divergence! The sort of clandestine optimism Noël Coward would toast with gin and a raised eyebrow. 🍸

Given last year’s thrilling 330% gains, it’s not mad to presume the grander trend remains unruffled, even as short-term jitters pirouette about. If buyers can defend $0.210 and snatch back $0.235-$0.249, this divergence may light the fuse for a splendid rebound… Or, dare one dream, a rally worthy of a West End encore? Curtains up-watch this space. 🎭

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Gold Rate Forecast

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Order of the Sinking Star – Arc Games and Thekla Unveil Narrative Puzzle Adventure for 2026

2025-09-02 13:22