Well, folks, if you thought HBAR was going to be the next big thing, you might want to sit down. The price action across hourly and daily charts is as exciting as watching paint dry, and the speculative traders are about as engaged as a high schooler in a Monday morning math class. 🤦♂️

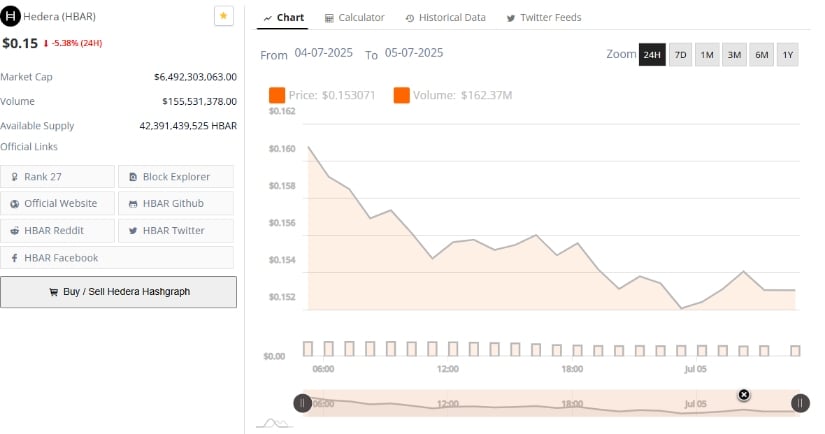

As of July 5, 2025, HBAR is trading just above $0.153, which is like finding a nickel on the street after you’ve already spent your last dime. The steady downtrend has been as predictable as a sitcom plot, and the bullish momentum is as strong as a wet noodle. 🍝

Market Activity Shows Weak Bullish Participation

The 24-hour HBAR chart from July 4 to July 5 is a real laugh riot. The token fell from just above $0.160 to a session low around $0.152, and it did so without a single price recovery that would make a trader’s heart skip a beat. It’s like watching a clown trying to ride a unicycle on a tightrope—entertaining, but you know it’s not going to end well. 🤹♂️

The final price of $0.153071 represents a 5.38% drop over the period, which is about as bearish as a bear in a honey factory. The price trajectory shows minimal buying interest, with resistance as firm as a brick wall. 🛡️

Trading volume followed a similar pattern, peaking early before tapering off like a New Year’s resolution in February. With $162.37 million in volume, there was substantial market activity, but the flow was skewed heavily toward exits. It’s like a party where everyone’s leaving early because the punch bowl is empty. 🥤

Reduced volume late in the session suggests market participants are as uncertain as a cat in a dog park, waiting for external catalysts to give them a reason to stay. Hedera’s market cap has declined to approximately $6.49 billion, keeping it ranked at 27 despite ongoing price weakness. It’s like being the 27th best thing in a world where being number one is the only thing that matters. 🏆

Open Interest and Range-Bound Structure Underscore Indecision

On the 1-hour HBAR/USDT chart from Open Interest, price fluctuations have been confined within a narrow range between $0.153 and $0.162 since the post-June rally. A sharp move above $0.162 on June 30 was quickly reversed, triggering a consolidation pattern that has since remained intact. It’s like a yo-yo that can’t decide whether to go up or down. 🤹♂️

As of the latest hourly candle, the token trades near $0.15314 with a marginal decline of 0.23%. This price level marks the lower boundary of the recent range, placing pressure on bulls to defend support. It’s like a defensive line in football that’s about to get blitzed. 🏈

Aggregated open interest (OI) data shows reduced trader engagement following the price retracement. From June 28 to June 30, open interest rose sharply alongside the price spike, but both metrics declined during the pullback. It’s like a roller coaster that starts with a big climb but then just kind of peters out. 🎢

Despite a modest recovery in early July, OI has not reclaimed earlier highs, suggesting a lack of speculative momentum. A confirmed breakout above $0.158 with rising OI may be required to validate a bullish trend reversal, while failure to hold current levels could expose HBAR to a test of $0.146. It’s like waiting for a miracle to happen, but the odds are not in your favor. 🙏

Indicators Signal Weak Momentum Near Key Support

The daily chart reveals that HBAR remains under downside pressure following a multi-month decline from its yearly high near $0.40. The token is now trading near the bottom of a sideways structure, with recent daily candles showing limited volatility and reduced volume. Price closed at $0.15296 on July 5, sitting near local support and failing to show significant recovery signals. It’s like a boxer who’s been knocked down and can’t seem to get back up. 🥊

The Relative Strength Index (RSI) currently reads 48.22, slightly below the neutral midpoint, indicating subdued buying strength. A modest bullish divergence appears as the RSI remains above its signal line, though it lacks the strength to prompt a definitive reversal. It’s like a spark trying to start a fire in a rainstorm. 🌦️

Meanwhile, the MACD indicator shows a weak crossover, with the MACD line at -0.00303 and the signal line at -0.00509. While the histogram has turned marginally positive, both lines remain below zero, emphasizing that bearish momentum has not fully dissipated. Until HBAR reclaims resistance near $0.165, the token is likely to remain within a tight and uncertain trading range. It’s like being stuck in a traffic jam with no end in sight. 🚗

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Felicia Day reveals The Guild movie update, as musical version lands in London

- Best Controller Settings for ARC Raiders

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Goat 2 Release Date Estimate, News & Updates

- Best Thanos Comics (September 2025)

2025-07-05 13:44