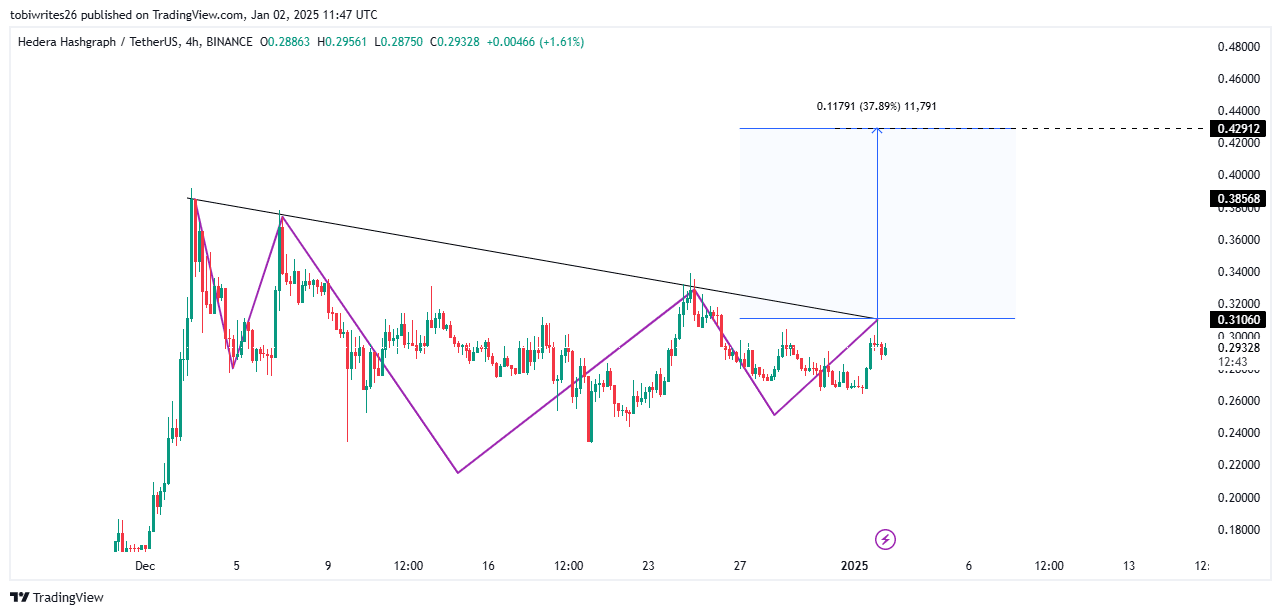

- A technical inverse head-and-shoulders pattern suggested that HBAR may be gearing up to breach a crucial resistance level

- Both technical indicators and on-chain metrics flashed signs of a potential rally

As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless patterns and trends unfold before my eyes. However, the current technical setup for HBAR is particularly intriguing. The inverse head-and-shoulders pattern, combined with the bullish signals from both on-chain metrics and technical indicators, suggests that we might be on the brink of a significant rally.

I have seen this pattern play out numerous times in my career, and when it aligns with other positive signs, it often indicates a robust upward move. If HBAR can successfully breach its critical resistance level, I am confident that we could see prices surge by as much as 37% or more.

That being said, the markets are unpredictable beasts, and no analysis is ever foolproof. But based on my experience, the odds seem to be in HBAR’s favor at this juncture. Just remember, even a stopped clock is right twice a day, so don’t count your HBARs before they hatch!

Joke: Why did the HBAR cross the road? To get to the other side of the resistance level and start its bull run!

Over the past day, I’ve seen a 3.34% increase in HBAR’s value on the charts. Notably, it’s also built upon a 6.86% surge over the last few weeks. This consistent upward trend might be an indication of continued growth, potentially hinting at more price increases to come in the days ahead.

Indeed, our analysis suggests that HBAR might experience a significant jump of around 37% or even higher if it manages to breach the suggested resistance point.

Critical resistance marks the final hurdle for HBAR rally

Currently, when I’m writing this, HBAR appears to be transacting inside a typical inverse head-and-shoulders configuration – a pattern frequently suggesting an upcoming price increase.

As a seasoned cryptocurrency investor with over a decade of experience in the market, I believe that HBAR could be poised for a significant bullish move if it manages to break through its key resistance level, often referred to as the neckline. Based on my analysis and past observations of similar market patterns, a successful breach of this level could potentially propel the price of HBAR by around 37.89%, pushing it up towards $0.429. However, it’s important to remember that investing in cryptocurrencies carries inherent risks, and I always advise conducting thorough research before making any investment decisions.

Although it’s possible that HBAR’s price could momentarily halt before reaching its resistance point, technical signals seem to imply a potential rise might be on the horizon.

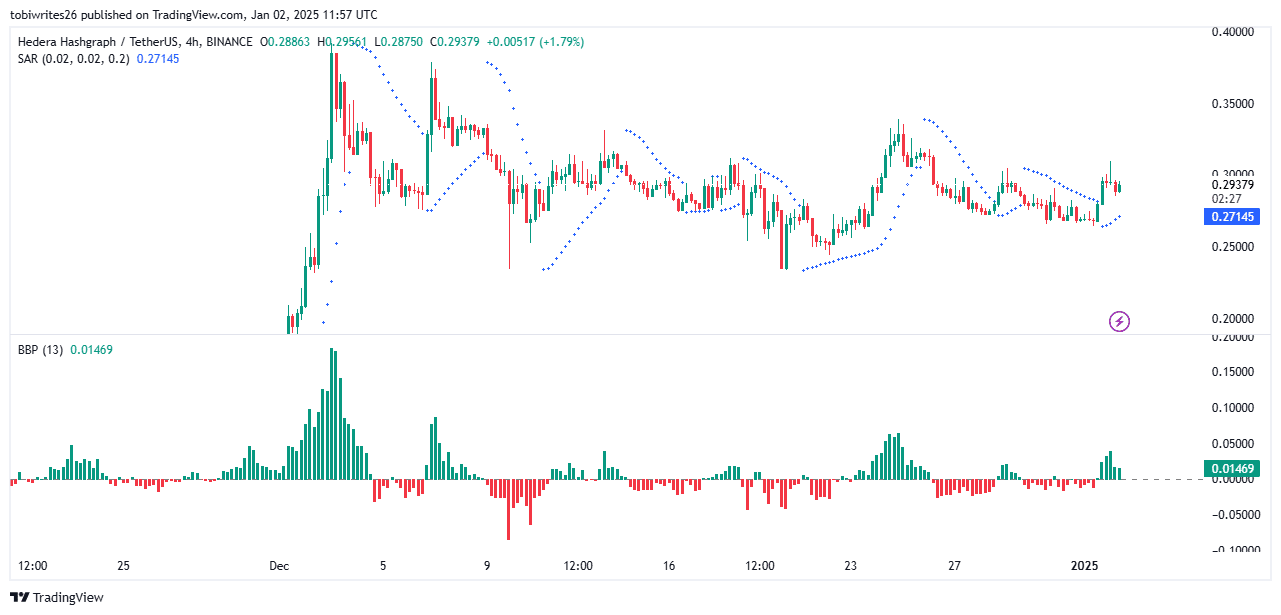

Indicators point to increasing buying activity

In simpler terms, the Parabolic SAR (Stop and Reverse) line is positioned beneath HBAR’s price bars, suggesting increased buying interest and a potential increase in price, or in other words, a possible upward trend.

Should these dots persist beneath the price candles, it suggests persistent upward pressure, possibly resulting in reaching new peak prices as HBAR moves closer to its projected price level.

In a similar vein, for the past six days, the Bull Bear Power (BBP) has shown only green bars, suggesting that optimistic traders have been leading the charge in HBAR’s current surge.

If the count of bullish candlesticks continues to rise, it strengthens the belief in a sustained price rise. Such a trend suggests growing optimism among traders about HBAR’s upward trend.

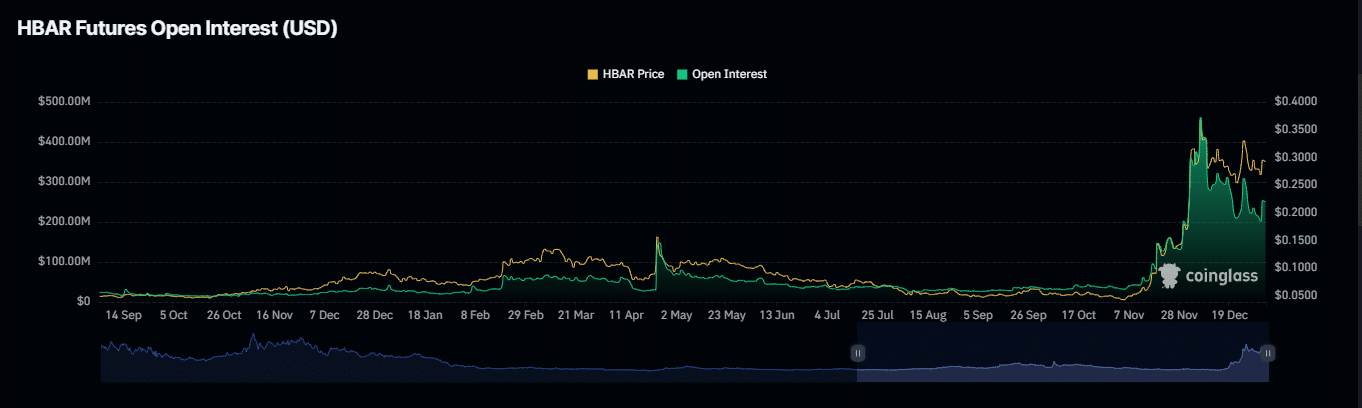

More underlying buying pressure

As someone who has been actively trading and investing in cryptocurrencies for a few years now, I have learned to pay close attention to changes in Open Interest (OI) when analyzing a digital asset like HBAR. In the past 24 hours, I’ve noticed a significant surge in OI for this particular coin, according to data from Coinglass. The increase was a substantial 9.90%, bringing the total Open Interest to an impressive $269.71 million. This trend could be indicative of increased market activity and potential growth for HBAR, making it an interesting asset to keep an eye on in my portfolio.

A significant increase often signals a rise in the quantity of open derivative agreements related to HBAR. Added to its 3.34% price increase and favorable funding rate, this suggests that most of these contracts are being owned by investors who have taken long positions.

At the moment of reporting, the funding rate – a factor that decides if long or short traders are paying an extra fee for their positions – stood at 0.0125%. This suggests a significant degree of conviction among bullish investors, potentially leading to prolonged price increases.

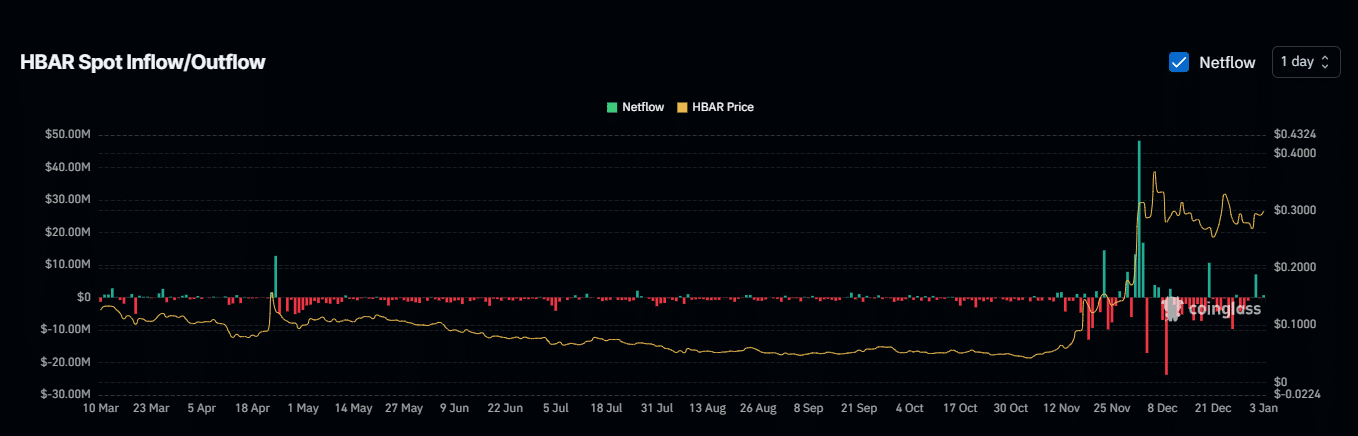

Currently, an influx of positive exchange flows is momentarily hindering HBAR from breaching the resistance line. In simpler terms, while I’m writing this, a temporary surge in positive trades is stopping HBAR from breaking through its resistance level.

As reported by Coinglass, around $1.79 million in HBAR was just transferred to exchanges – This could indicate a decrease in buying momentum as users seem to be selling, potentially slowing down the recent upward trend.

If net outflows occur, suggesting that traders are moving their assets off exchanges for long-term storage, HBAR may continue its uptrend and possibly surpass the crucial resistance barrier.

Read More

2025-01-03 15:04