- The token’s fear and greed index flashed a sell signal.

- A price correction could push HBAR don to $0.14 again.

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I must admit that Hedera’s [HBAR] recent surge has caught my attention. The 38% price increase over the last week and another nearly 24% hike in the past 24 hours have left me both impressed and cautious.

Over the past week, Hedera [HBAR] has been performing exceptionally well, surprising investors. Yet, significant price spikes usually lead to corrections. Could HBAR experience a correction as well in this case?

Hedera’s meteoric rise

Investors of HBAR surely had reason to rejoice last week, as it was shown in CoinMarketCap’s statistics that the token’s value increased by a substantial 38% over that timeframe.

The bullish trend continued in the past 24 hours because the token witnessed another nearly 24% hike. With this, the token’s price reached $0.205 with a market capitalization of over $7.8 billion.

As the worth of Hedera grew, so did its social indicators – an evidence of the coin’s growing recognition within the cryptocurrency world.

Meanwhile, well-known cryptocurrency analyst Crypto Tony highlighted that the recent surge might present an advantageous buying opportunity for investors. However, it’s worth questioning whether that’s truly the situation.

Why HBAR’s price might drop

While rapid price increases may seem beneficial for investors initially, these situations often lead to subsequent price adjustments or decreases.

After the excitement subsides, there could be a minor dip in the value of the token, offering an excellent chance for innovators to establish fresh holdings instead.

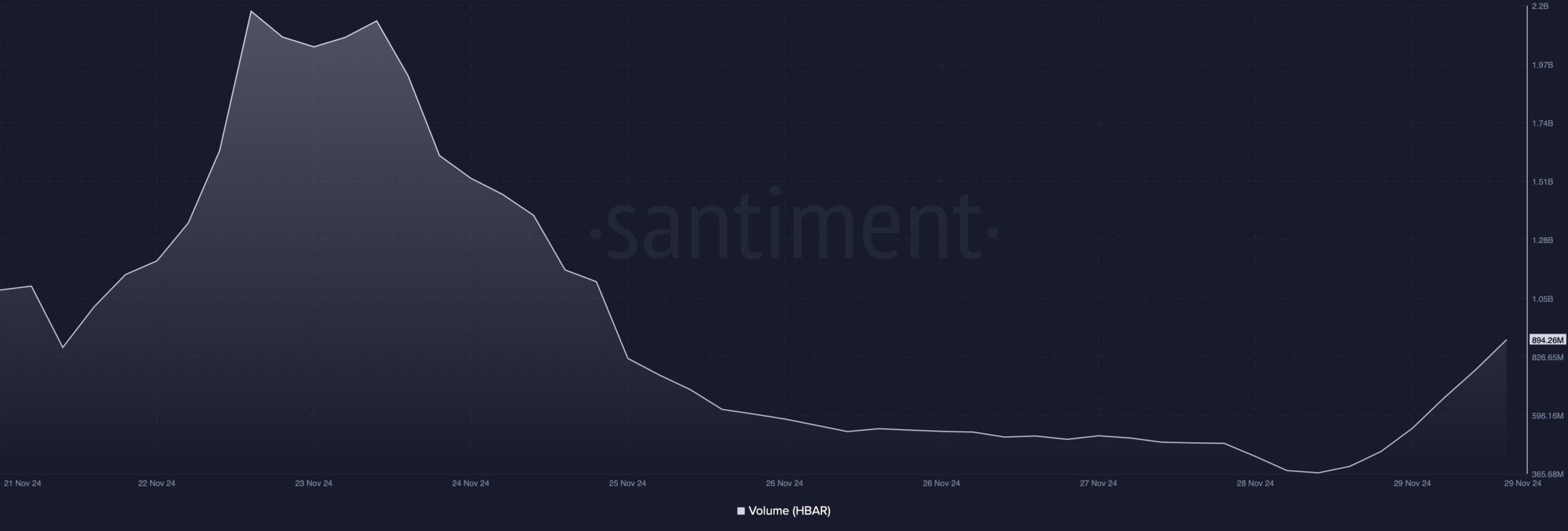

The decrease in trading activity for this token suggests that it might be undergoing a bearish trend reversal, as shown by the data from Santiment. Specifically, HBAR’s volume dropped significantly while its price increased dramatically.

Additionally, it’s worth noting that the Fear and Greed Index has shifted to a bearish stance. At this moment, the reading stands at 86%, indicating that the market is currently in an “extremely greedy” state.

A very large number typically triggers a warning for selling, which might lead to a decrease in an asset’s value within the short term.

On top of that, Hedera’s long/short ratio registered a down tick in the 4-hour timeframe.

It strongly indicated that there were more bets on the market going down (short positions) compared to those betting on it going up (long positions). This is a reflection of growing pessimism or bearishness among traders.

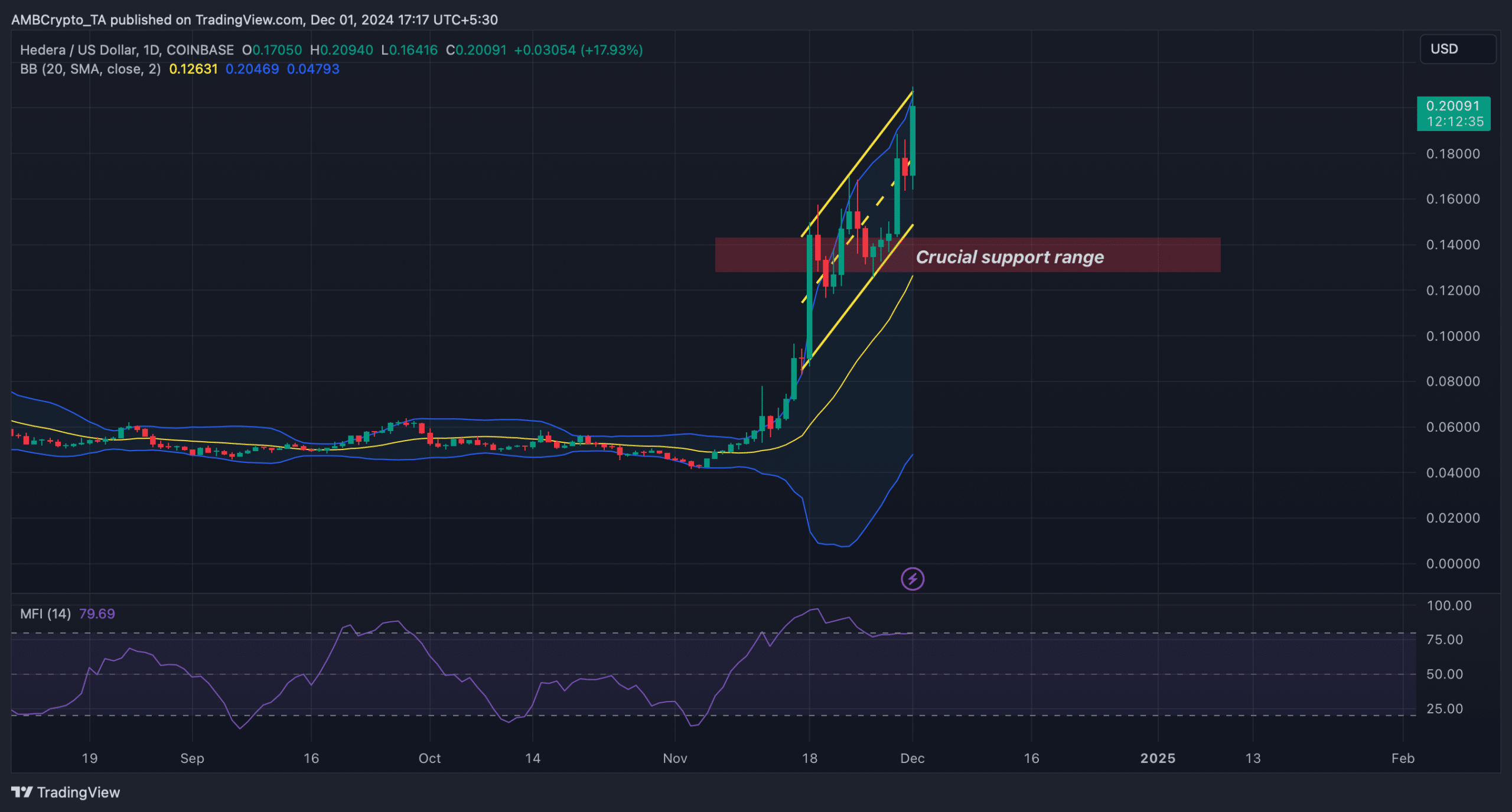

According to the technical signals from Hedera, there was a strong indication that its price might experience a correction. However, the price of HBAR has been moving within an upward trendline, quite steeply.

Reaching the maximum point within the Bollinger Bands for this item led to a correction in its price.

As the Relative Strength Index (RSI) approached the overbought region, a potential entry could trigger increased selling activity, potentially causing the asset’s price to decline.

Should this event transpire, investors may notice HBAR falling into its significant support zone between $0.142 and $0.128.

Read More

2024-12-02 08:07