- Hedera price in decline despite the looming institutional interests.

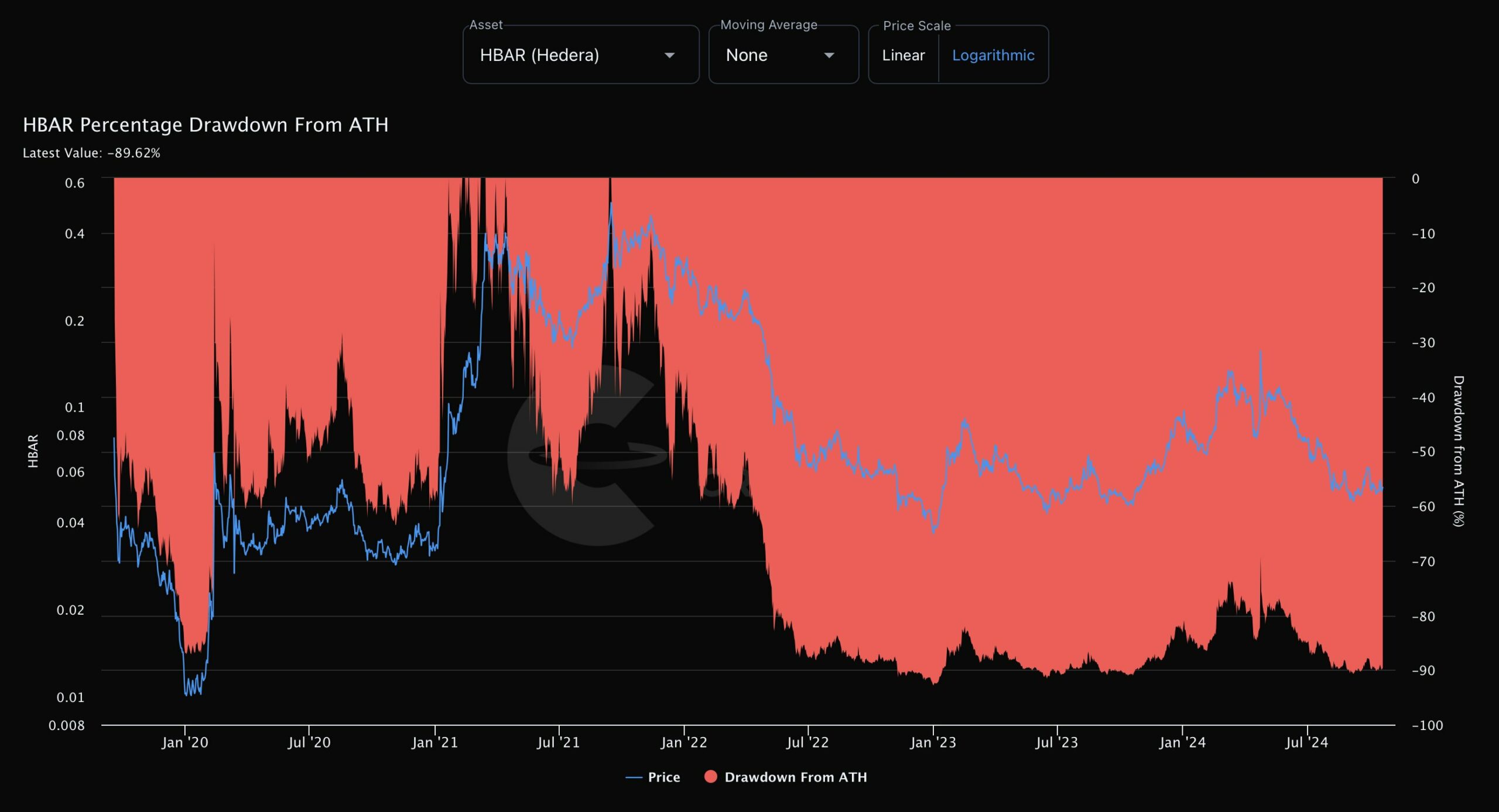

- HBAR, as of press time, was 90% below its all-time high.

As an analyst with over two decades of experience in the ever-evolving crypto market, I must say that the current state of Hedera (HBAR) leaves me both intrigued and concerned. On one hand, the recent attention from enthusiasts and institutional interest, coupled with partnerships such as Morocco’s 2030 digital strategy and the US HBAR Trust’s launch of Canary Trust, paint a promising picture for the future. However, the short-term bubble risk and the current price decline make me hesitant to jump in headfirst.

The short-term speculative trend for Hedera’s [HBAR] has become less optimistic, suggesting a potential downward pressure on the value of the HBAR token. This development prompts discussions about the token’s future pricing. Lately, Hedera has been garnering increased interest from cryptocurrency enthusiasts.

Over the next few months and years, it’s anticipated that large financial institutions will invest substantial amounts of money into HBAR. This could result in a notable increase in its value or price jump.

Significantly, Morocco unveiled its 2030 digital blueprint, which is backed by Hedera, intending to incorporate the network nationwide. Moreover, the American HBAR Trust has expanded its reach with the debut of Canary Trust, offering institutional support.

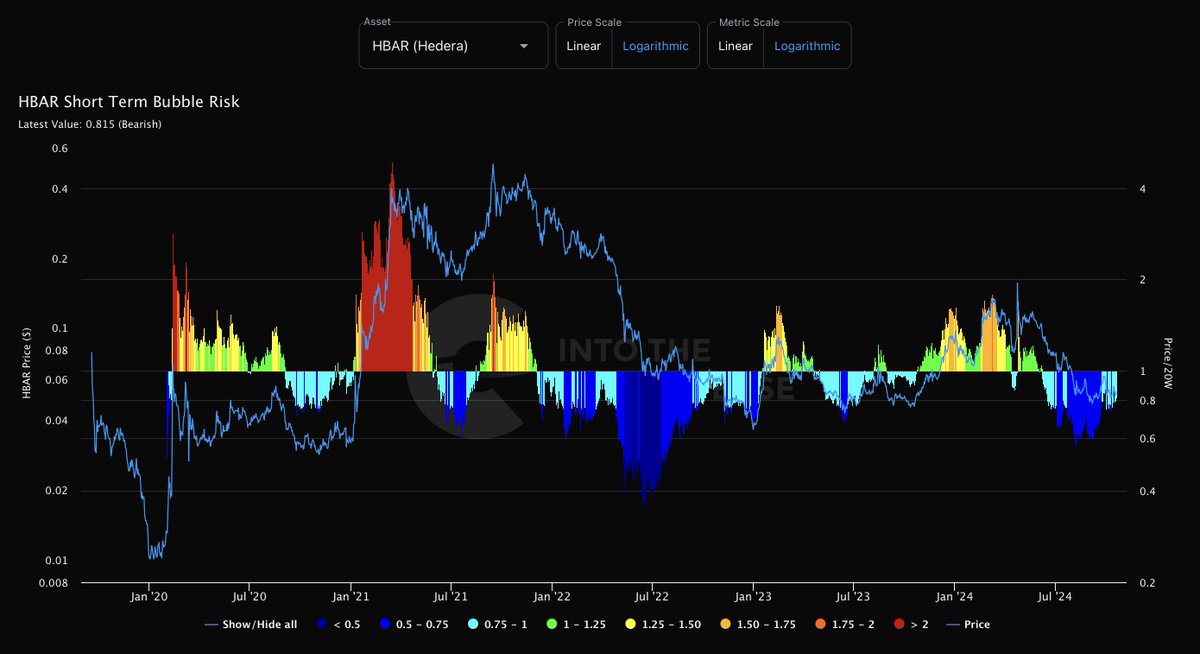

Regardless, HBAR is presently vulnerable to a short-term price bubble and has been experiencing difficulties maintaining its token value, yet it’s seeing an expansion in adoption and practical use cases.

HBAR price action and BTC valuation

Looking at today’s HBAR price trends, it shows a downward movement, which is backed up by a signal from our short-term bubble risk indicator suggesting potential bearish activity.

As a crypto investor, I’ve got my eyes on an important mark: $0.036. If the current price drops below this level, it could signal a shift in the bullish momentum we’ve been experiencing. The reason being, the ascending trendline that had been supporting our upward movement has been invalidated first. Despite maintaining a positive long-term outlook, this development warrants caution and close monitoring of market movements.

At the moment, it’s uncertain if we’re looking at a bullish trend, as the price action appears to follow a sloping trendline rather than a straightforward increase. HBAR seems to be moving in a direction that suggests a downward shift from its current path which is gradually decreasing.

For the bulls to potentially make a return, they need to push prices significantly above $0.064. Multiple timeframe analysis indicates the formation of a double bottom, which implies that the ongoing downtrend might be short-lived.

Furthermore, it seems that HBAR is struggling in comparison to Bitcoin, suggesting that the current downtrend could continue before a potential upturn. The value of HBAR relative to Bitcoin (BTC) is at its lowest point since 2020, fueling worries about HBAR’s short-term prospects.

Percentage drawdown

At the moment of reporting, Hedera’s price was significantly low, sitting approximately 90% below its record high, which supports the notion that HBAR may be headed down. However, it’s worth noting that when the decline from a record high reaches 90%, it typically signals potential future growth.

Indeed, although its price is currently dropping, Hedera is a project worth keeping an eye on. Its practical applications might eventually bolster and elevate the value of its token.

Although Hedera currently encounters temporary hurdles, its long-term prospects continue to look encouraging. The institutional attention and practical applications of HBAR might fuel its expansion in the future.

Investors would be wise to keep track of crucial price points and market patterns as HBAR goes through a significant phase. By staying informed about market changes and big-player actions, they can gain insights into Hedera’s possible future trajectory and potential for further growth.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-10-21 09:11