- 69.9% of top HBAR’s traders on Binance hold long positions.

- HBAR’s RSI remains below the overbought zone, suggesting there is still significant room for further upward movement.

Hedera’s digital currency, HBAR, is generating buzz within the crypto world due to its strong performance and a surge in bullish market trends.

The unexpected change in market opinion seems to have occurred before the scheduled political event on January 20, 2025. This change, in turn, has led to a substantial increase in the value of HBAR over the last day.

Based on information from CoinMarketCap, Hedera Hashgraph (HBAR) surged by a significant 16% over the last day and is now hovering around the $0.345 mark in current trades.

Over that specific timeframe, there’s been a notable surge in enthusiasm from both traders and investors, leading to an impressive 101% increase in trading activity.

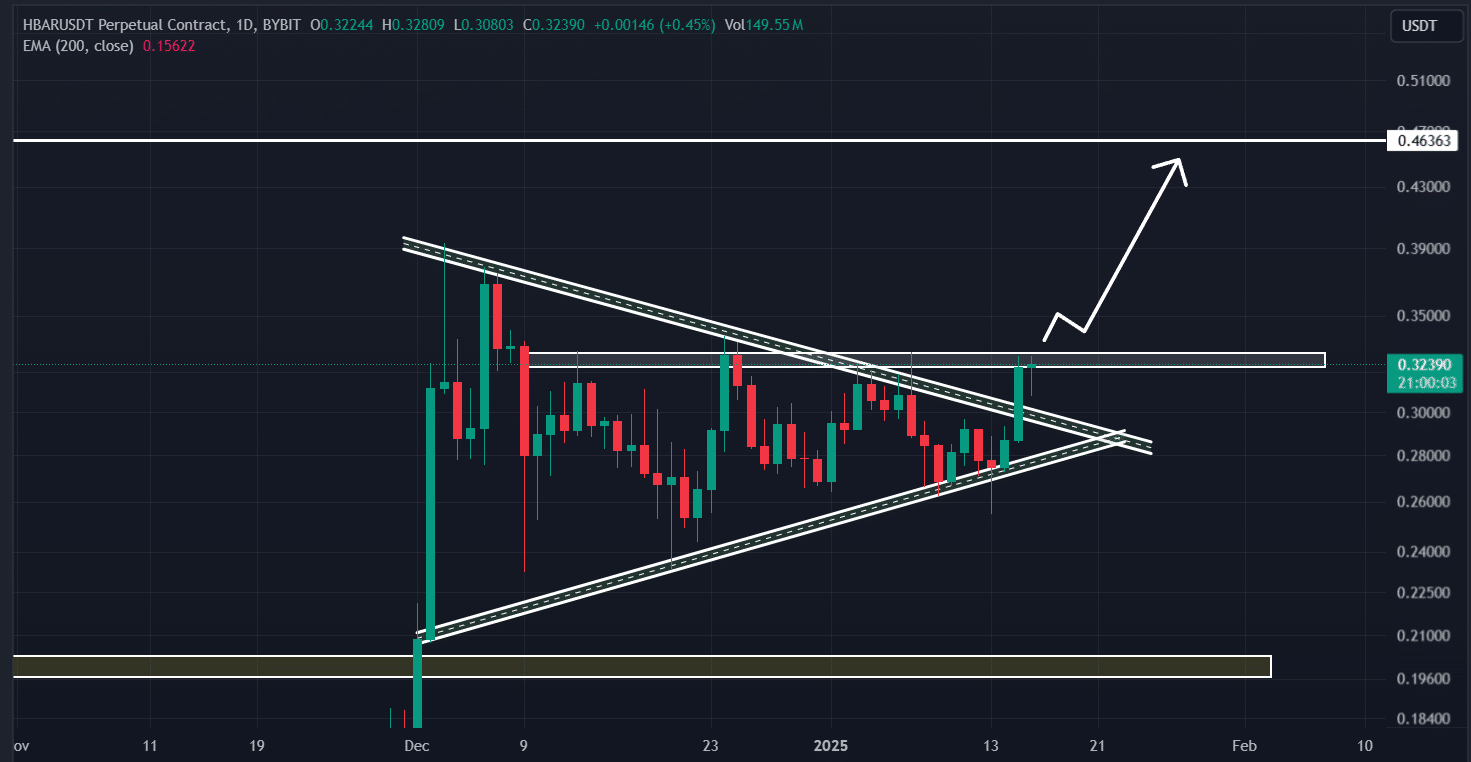

HBAR price action and technical analysis

The recent price spike has drawn considerable interest from both investors and traders. It led to a burst out of the long-standing consolidation, breaking the symmetrical triangle that HBAR had established in its daily chart.

With this breakout, the altcoin appears bullish and poised for massive upside momentum.

Based on the technical analysis by AMBCrypto, HBAR surpassed a symmetrical triangle formation and exceeded the previously obstructing resistance point, which was slowing its upward progression.

According to current market trends, if HBAR manages to stay above the $0.34 mark, it might experience a significant increase of approximately 35%, possibly rising to around $0.465.

Regarding HBAR, its Relative Strength Index (RSI) stayed below the overly bought region, even with a strong upward push. This suggests there’s potential for further significant growth in the asset yet.

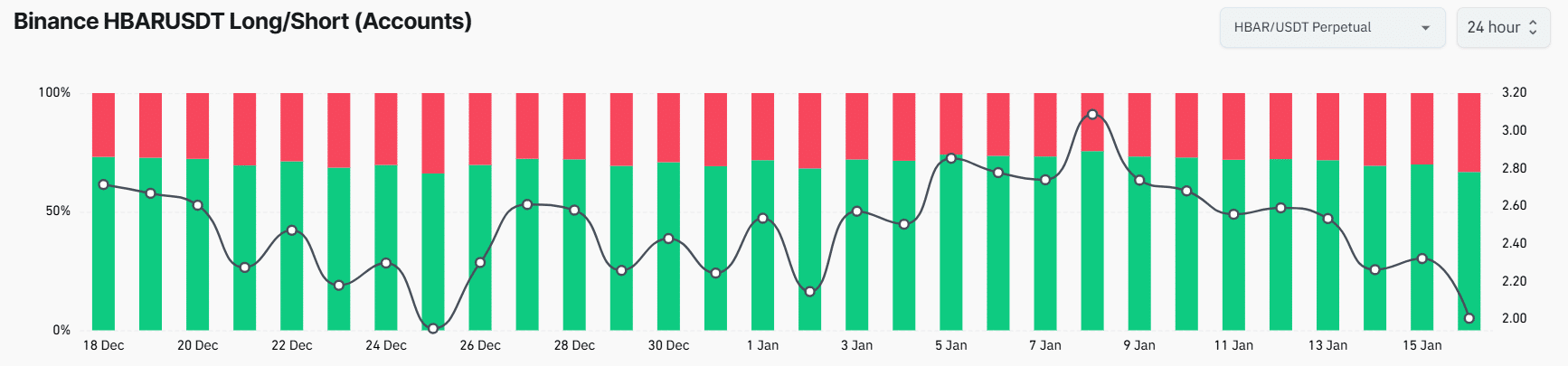

70% of top traders hold long positions

It seems that this optimistic perspective is drawing a lot of focus from short-term traders, according to the reports from CoinGlass, an on-chain analysis company.

On Binance, the ratio of HBAR/USDT long to short positions was 2.32, meaning that for every 2.32 long trades, there was only one short trade.

Currently, 69.9% of top traders on Binance hold long positions, while 30.1% hold short positions.

Is your portfolio green? Check the Hedera Profit Calculator

As a researcher, I find an intriguing pattern when merging the on-chain metric with technical analysis. It seems that at present, the bulls are firmly in control of the asset, which suggests potential for the altcoin to attain the projected level in the foreseeable future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-01-17 03:35