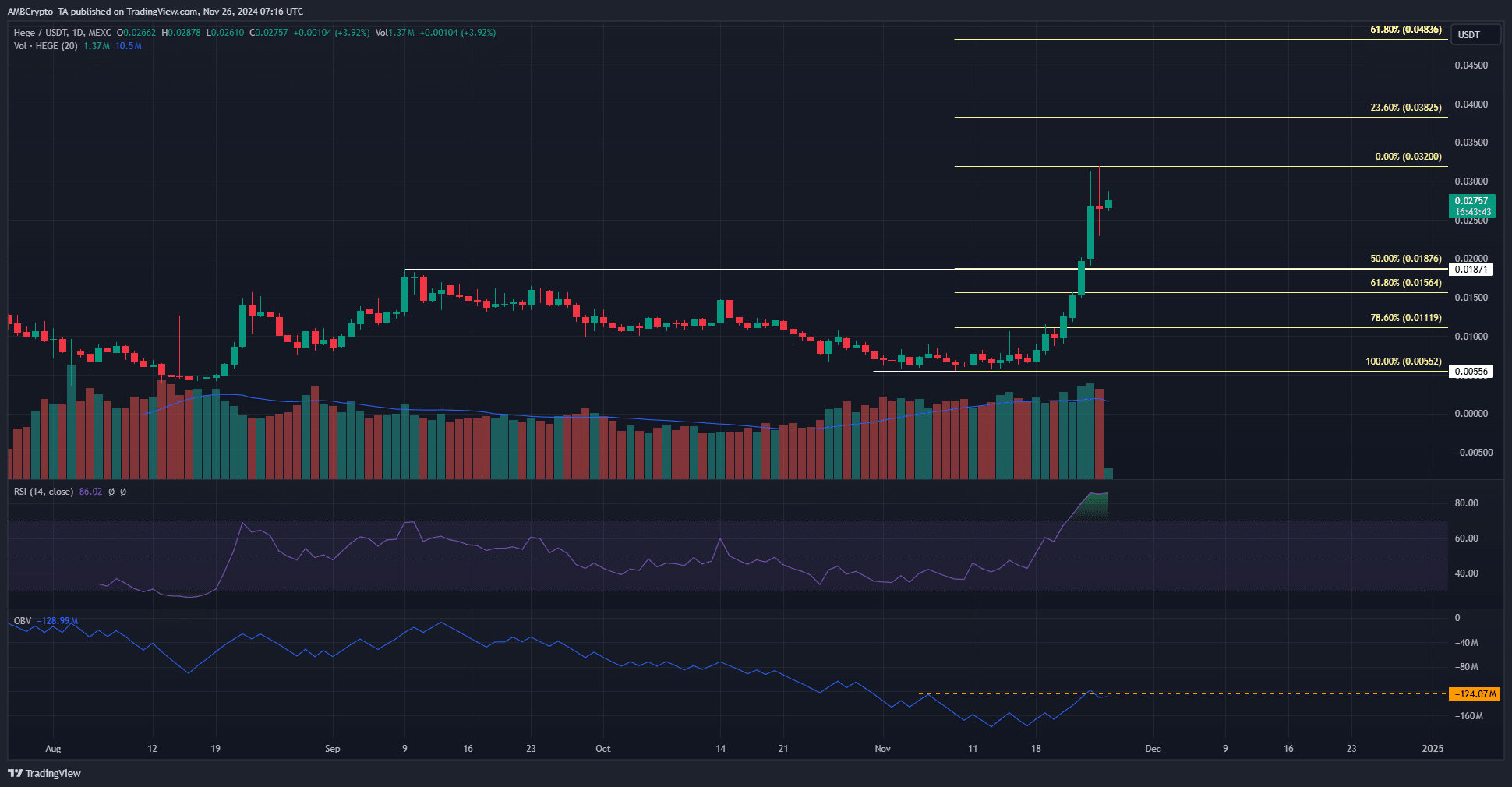

- HEGE can retrace toward $0.02 due to the bearish momentum divergence on the lower timeframes

- The lack of a strong OBV movement meant demand was weak

As a seasoned researcher with over two decades of market analysis under my belt, I have seen bull runs like HEGE’s come and go. While the current rally is impressive, I can’t shake off a sense of caution due to the bearish momentum divergence on lower timeframes.

Over the last seven days, HEGE showed a robust upward momentum. Starting from November 19th, its value increased significantly by approximately 234%, as observed at the current reporting time. The technical analysis hinted at an impending price drop towards around $0.02.

Hege rallies past psychological $0.025

As a researcher, I observed a significant bullish pattern emerging in my daily analysis. The initial hint of a trend reversal occurred on November 19th, when the price approached the resistance area around $0.0107, which Hege encountered.

This resistance had been in play since the 27th of October.

Over the last three weeks, the trading activity has gradually gained momentum. For most of November, it has consistently exceeded the 20-day moving average.

Yet, the OBV showed that it was barely able to climb past a local high.

Just as the price has been decreasing since September, the On-Balance Volume (OBV) has followed suit with a downward trend. However, unlike the price, the OBV did not manage to form a consistent uptrend.

This caused concern as it suggested that the impressive growth HEGE had experienced lately wasn’t based on real consumer demand.

Realistic or not, here’s HEGE’s market cap in BTC’s terms

In simpler terms, the Strength Index (RSI) for today reached 86, signifying a robust upward trend. However, in this timeframe, there’s no evidence of a bearish divergence yet. On shorter durations like the 4-hour chart, a bearish divergence has emerged instead.

In simpler terms, the potential price floor we’re looking at is around $0.0187, which represents a 50% Fibonacci retracement level. Additionally, the range between $0.0208 and $0.0236 could act as a temporary area of increased demand for buyers in the short term.

Read More

2024-11-26 22:15