- HNT has gained by over 12% on growing buyer interest.

- Helium’s Open Interest has surged by over $50% to above $6 million.

As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I’ve seen my fair share of ups and downs, bull runs, and bear markets. But the recent surge of Helium (HNT) has caught my attention like never before. With gains of over 12% in just 24 hours, it’s hard not to be intrigued.

After a rise over the weekend, the cryptocurrency market has taken a step back, causing Bitcoin‘s [BTC] price to dip below $63,000. However, while most alternative coins are experiencing losses, Helium [HNT] is bucking the trend and has climbed by more than 12% in the past day.

At the moment of this writing, Helium Network Token (HNT) was priced at approximately $7.09. Notably, trading volume saw a significant increase of about 161% as reported by CoinMarketCap.

What’s behind HNT’s gains?

As a crypto investor, I’m seeing that buyers seem to be leading the trading activity, fueled by their pursuit of capitalizing on HNT’s surge while the broader market is experiencing a downturn. In other words, they are seizing the opportunity to make profits with HNT.

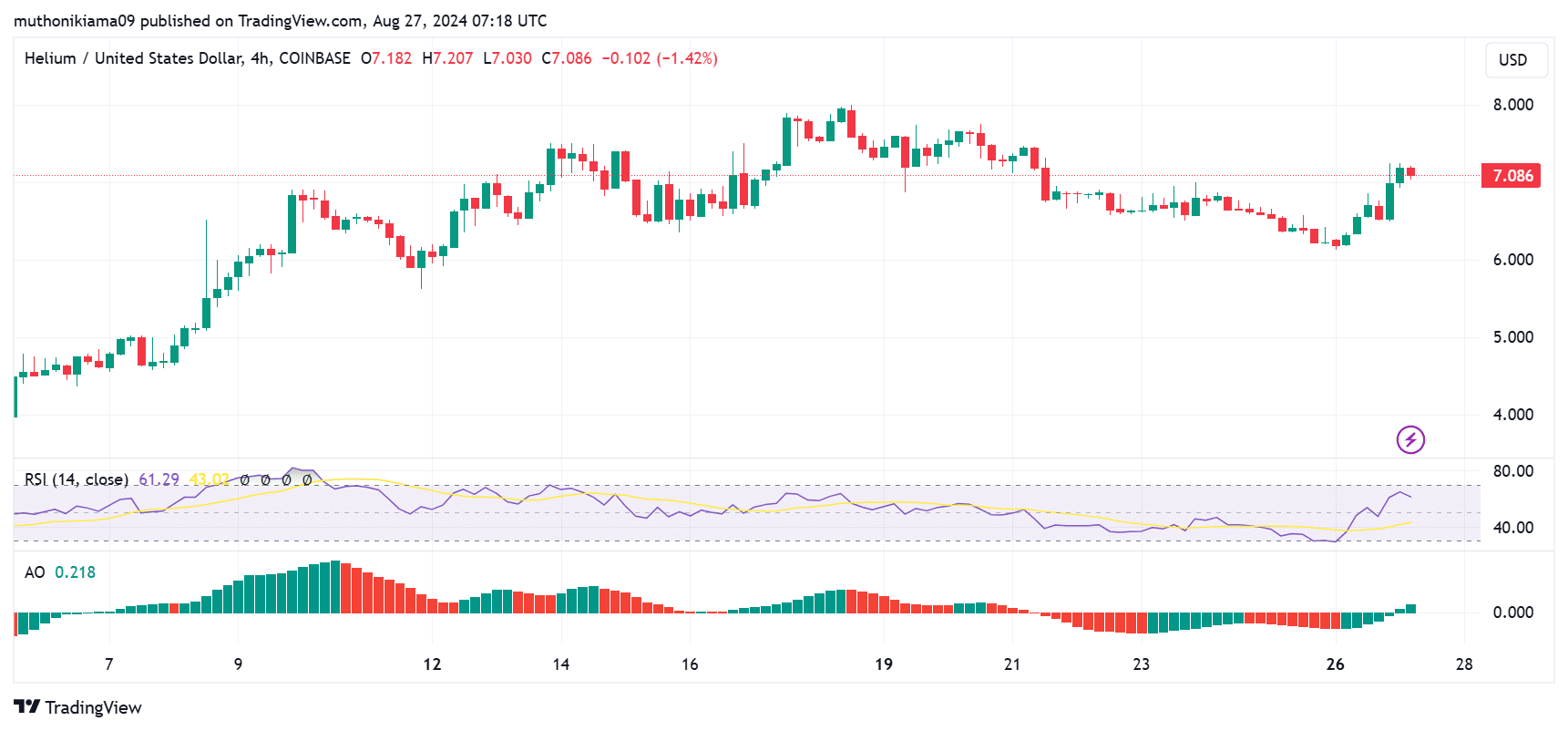

From being almost oversold at a level of 30 on August 26th, the Relative Strength Index has risen to its current value of 61, suggesting a surge in buying activity.

The bullish momentum is further seen in the RSI line, which has tipped north.

In simpler terms, the colorful bars of the Green Awesome Oscillator switched from being negative to positive, which suggests a strong uptrend or ‘bullish’ trend. This change indicates that the market is primarily being pushed up by the buyers.

This is usually a buying signal that could pave the way for further gains.

The rising interest around HNT can also be seen in the Open Interest (OI), which has increased by over 50% according to Coinglass. At press time, HNT’s OI stood at $6.84M, a significant jump from the previous day’s $4.2M.

Another significant contributor to HNT’s growth is the surge of Decentralized Physical Infrastructure Networks, often referred to as DePINS. Notably, Helium is progressing in this field by developing its own decentralized wireless network systems.

Recently, Helius Labs’ CEO, Mert Mumtaz, tweeted that DePIN, stablecoins, and the tokenization of Real-World Assets (RWAs) would change how people interacted with crypto.

Key levels to watch

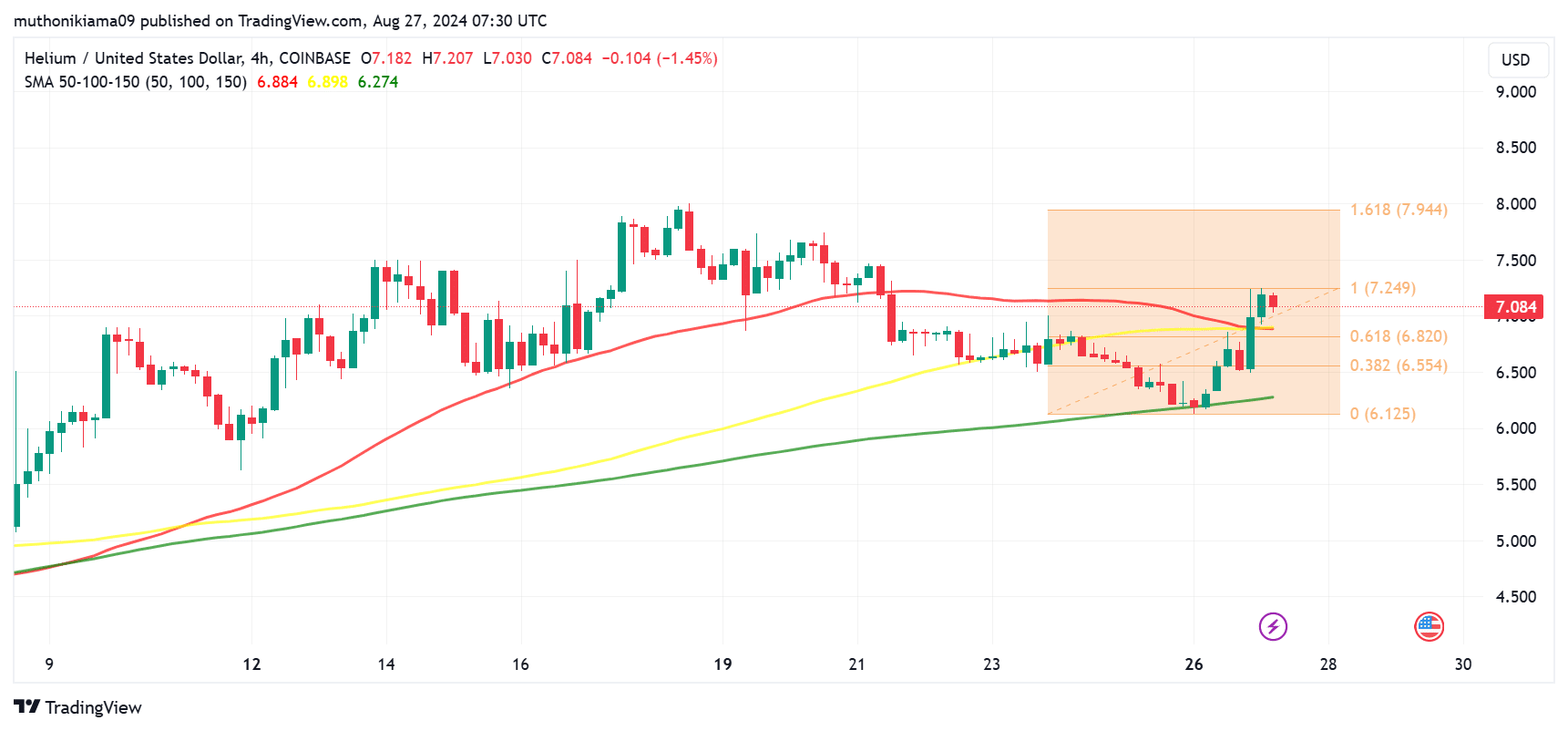

Currently, HNT is found above its 150-day Moving Average, indicating that it’s continuing its long-term upward trajectory as of now.

Keep an eye on the possibility of a downward crossover where the 50-day Simple Moving Average (SMA) falls beneath the 100-day SMA, which could signal a bearish trend for traders.

The fast-moving 50-day Simple Moving Average (SMA) and the slower 100-day SMA have met. If it ends below this point, it suggests a decrease in short-term strength, potentially leading to the HNT uptrend not holding up.

Should the positive trend persist, Helium Network Token (HNT) could potentially challenge the upcoming resistance near the 1.618 Fibonacci level, which is approximately $7.94.

Read Helium’s [HNT] Price Prediction 2024–2025

If bears gain power, HNT may fall to retest a crucial support point at $6.554. If this support isn’t maintained, it could heighten the potential for further declines.

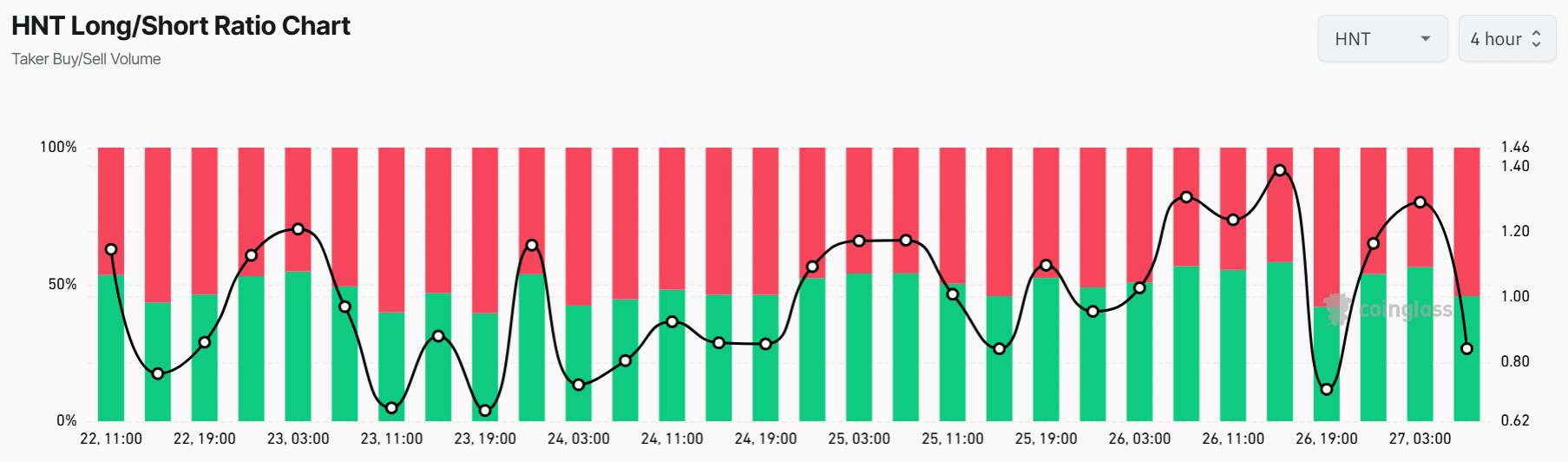

Looking at the HNT’s long/short ratio of 0.84 indicates a rise in short trades, with long trades decreasing. This suggests that futures traders are preparing for a potential price adjustment or correction.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-08-28 01:12