- Helium surged by about 10% in the last 24 as its trading volume spiked.

- The token’s rising Open Interest and liquidation levels underscored optimism but warned of potential volatility near key resistance levels.

As a seasoned crypto investor with a knack for spotting trends and interpreting market indicators, I can’t help but feel a sense of excitement when I see Helium (HNT) surging by about 10% in just 24 hours. The rising trading volume and the surge in investor interest are clear signs that something significant is brewing.

In my research as a analyst, I’ve noticed that Helium [HNT] has been drawing attention in the market with a significant 10% price increase over the past 24 hours. At this moment, the upward trend is also accompanied by a noteworthy 12% spike in trading volume, suggesting a marked rise in investor enthusiasm.

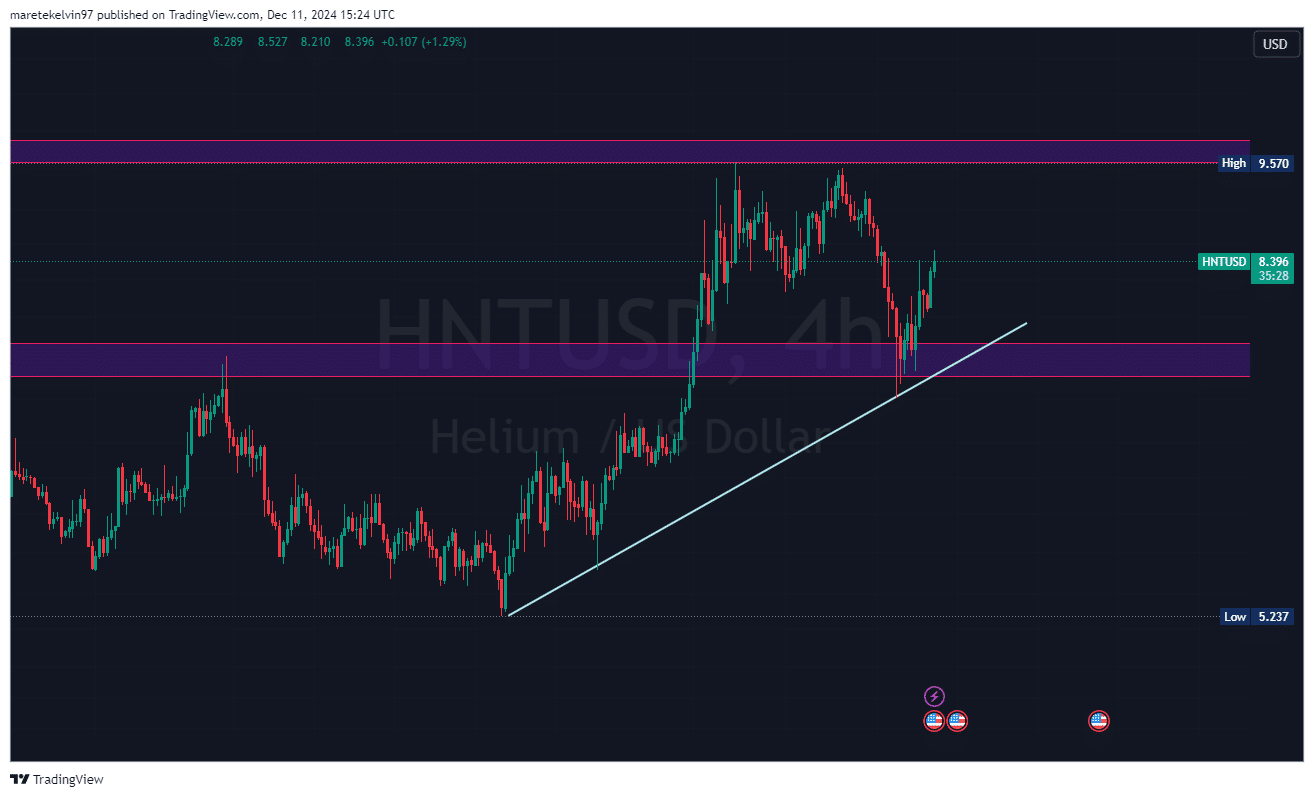

With Helium’s price edging close to the significant barrier at $9.5, traders are questioning if the momentum behind this rise will remain robust or start to lose steam.

Helium’s strong performance

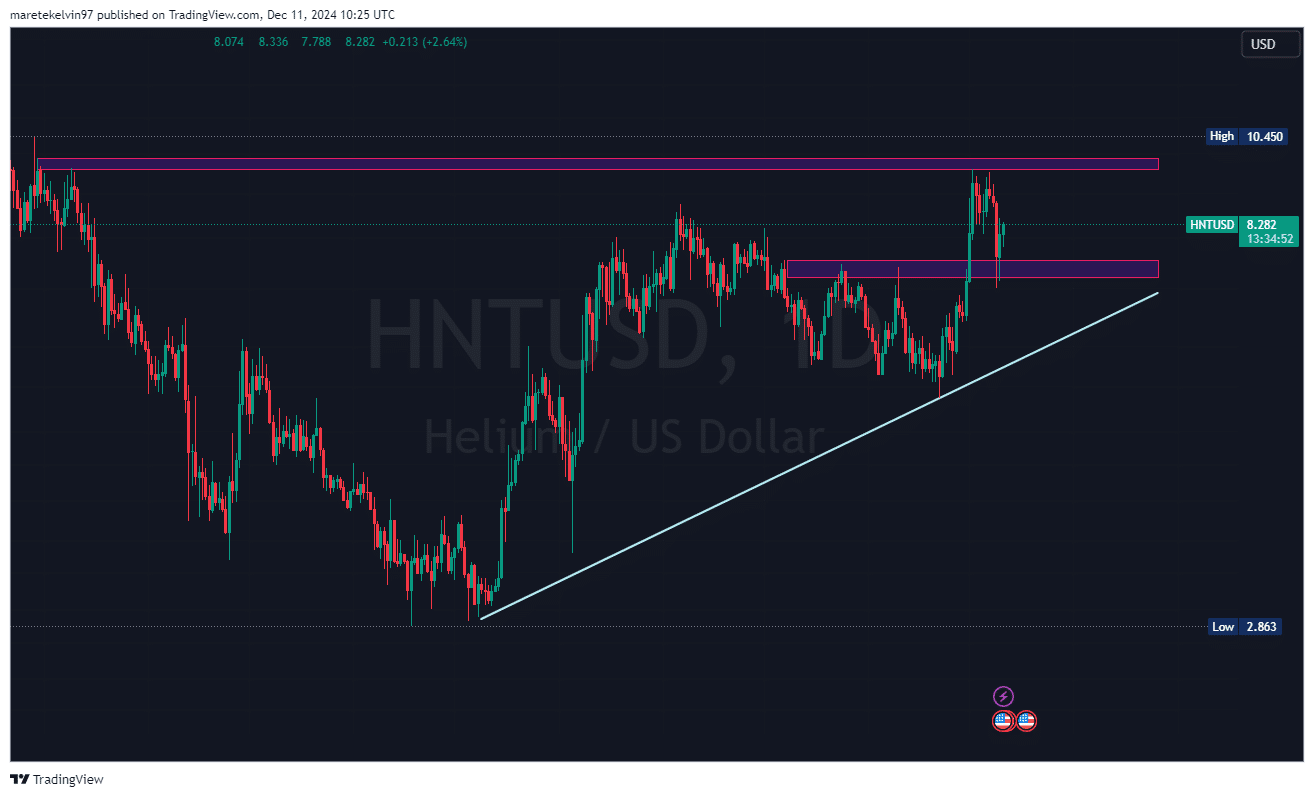

Over the past 24 hours, helium has been one of the standout performers, bucking the trend of overall market volatility. A closer look at its day-to-day chart suggests an upward surge aiming at $9.5, a crucial point that could influence the token’s direction in the near future.

If we surpass this current resistance, it could open the door for an even stronger upward trend, possibly reaching the significant $10 mark.

However, failure to breach it could trigger a pullback.

The market indicators point to a potential rally

On the day-to-day graph, it’s quite noticeable that there’s been a steady upward movement in Helium’s price. This upward movement is reinforced by a rising trendline that traces back to Helium’s recent bottom prices around $2.8.

Right now, the cost of this altcoin is getting close to the $8.2 support point, a barrier that previously functioned as the resistance level in an ascending triangle chart pattern.

Quickly, the token appears poised for a possible upswing within brief periods, evident from its recent 10% spike.

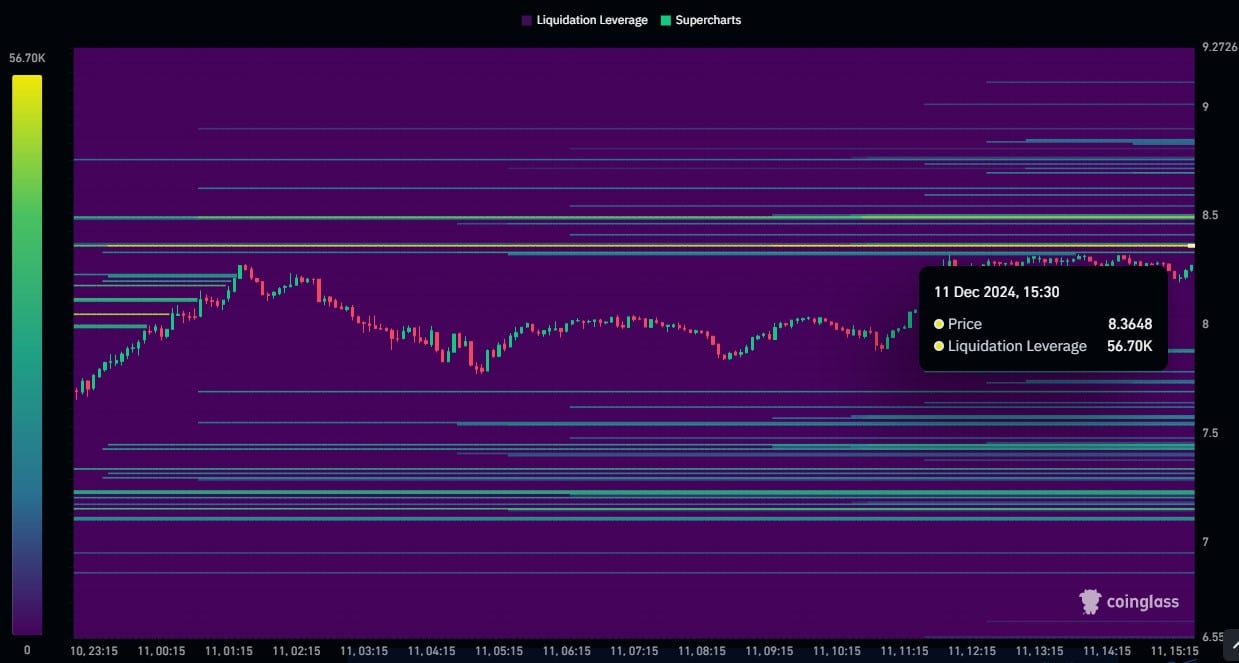

Furthermore, the liquidation data from Coinglass indicates a rise in high-leverage trading positions. This data shows a liquidation pool of approximately 56,700 units at the price point of $8.3648.

This indicates an increasing danger for heavily indebted traders, as well as a positive sentiment that might drive the price toward a substantial value.

As a researcher, I’ve noticed an upward trend in Open Interest (OI), which indicates a rise in investor confidence regarding Helium’s price dynamics. The persistently increasing OI numbers suggest optimism and faith in the market’s perception of Helium’s future movement.

At the same time, the trading volume of this token matches these observations, increasing as its price rises. This is often a sign of strong bullish tendencies.

In simpler terms, the overall financial climate has been advantageous for cryptocurrencies. The consistent value of Bitcoin has boosted altcoins like HNT, but the main issue lies in whether Helium can surge beyond its significant barrier at around $9.5.

When Helium nears the $9.5 barrier, strong purchasing power from buyers will be essential to keep the upward trend going.

At this point, the market’s reaction is pivotal. If it breaks out, we might see a quick surge heading towards $10. Conversely, if it gets rejected, the price may retreat to the $7.8-$8 range, serving as potential support.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-12-12 11:03