- The cryptocurrency is currently trading within an ascending channel, signaling a potential bullish breakout.

- Despite the presence of a pattern that typically precedes a rally, HNT’s low trading volume reflects a notable lack of enthusiasm.

As a seasoned researcher with years of experience navigating the intricacies of the cryptocurrency market, I find myself both encouraged and cautious regarding Helium [HNT]. The ascending channel hints at a potential bullish breakout, but the low trading volume serves as a significant red flag.

For the last week, Helium (HNT) has experienced a 9.80% growth, which has fueled optimism about further price rises. Yet, this asset has faced strong opposition in its uptrend, resulting in a recent decline.

Although these optimistic chart patterns usually draw more trading activity, AMBCrypto observes an unusual situation where the anticipated liquidity levels are not being met.

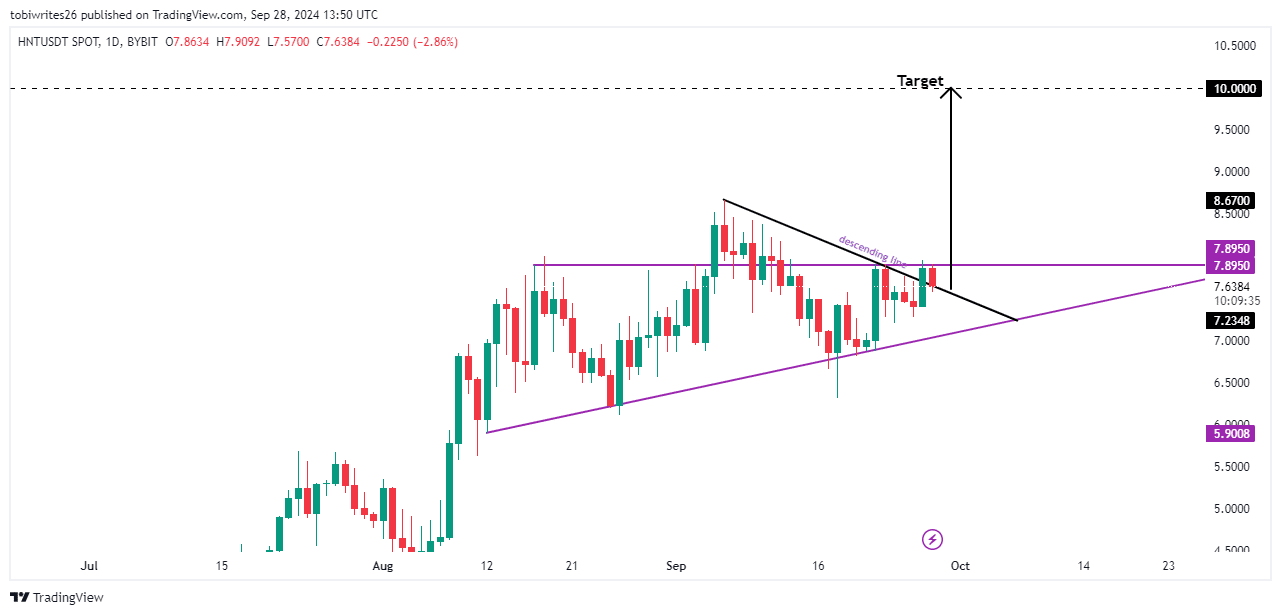

Resistance level at $7.8950 triggers a price decline for HNT

Helium (HNT) has faced selling pressure at around $7.8950, causing a noticeable drop in its value as this level appears to be a significant resistance point.

In this context, the resistance serves as the upper limit for the ascending triangle formation that HNT’s trading has been contained within.

Normally, the cost tends to fluctuate within the upper limit (resistance) and lower limit (support) of this pattern before possibly bursting through towards higher prices.

Breaking away from its current trend for HNT might be encouraged if the downward trendline functions as a base of support, pushing HNT towards the $10 range or even higher. On the flip side, if the momentum isn’t sustained, HNT could retrace to the pattern’s lower support level instead.

According to AMBCrypto, it’s predicted that the current downward trend will continue for a while.

Market sentiment skews bullish for HNT as traders dominate

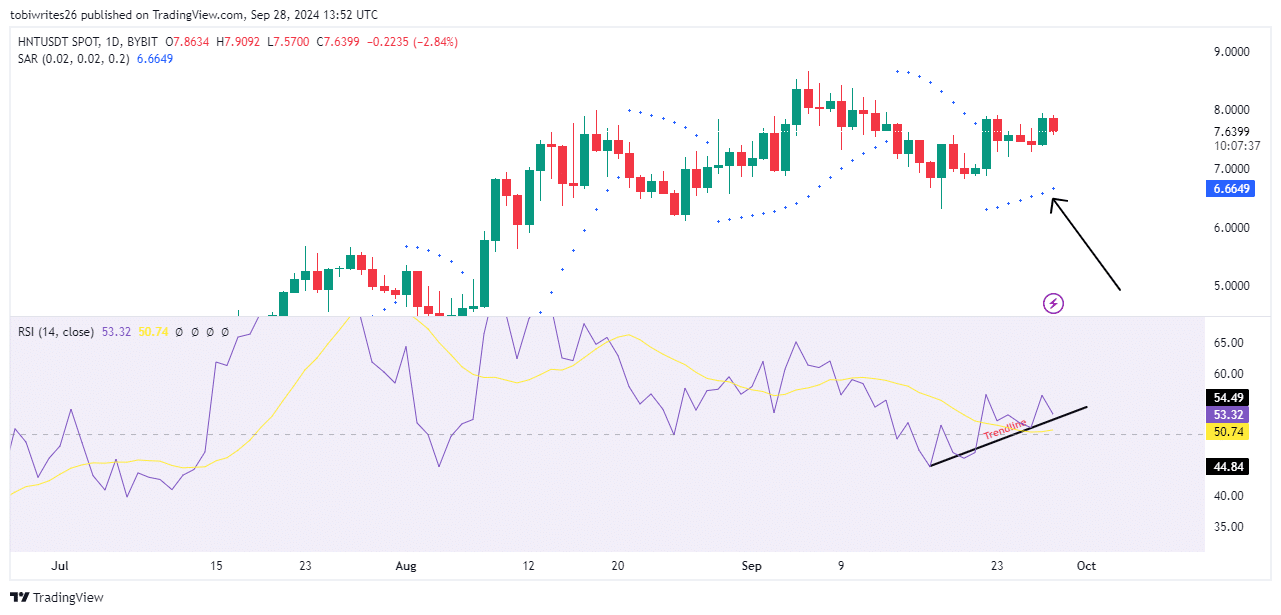

The behavior in the market suggests a widespread optimism towards HNT, which is evident through signals such as the Parabolic Stop and Reverse (PSAR) and the Relative Strength Indicator (RSI).

In a downtrend, the Parabolic Stop and Reverse (SAR) is found below the HNT price bars at the moment. This means that even though there have been some recent pullbacks at the resistance level, this placement suggests a setup for potential price increase.

As a researcher, I’m observing that the Relative Strength Index (RSI) aligns with my bullish perspective. At present, it stands at 53.30, surpassing the neutral level, indicating potential for further upward momentum.

As I delve deeper into the analysis of the Relative Strength Index (RSI) trend line, it appears there might be a subtle pullback towards the support trend line for HNT. This temporary dip could potentially influence a drop in HNT’s market price, but it is also likely to pave the way for an uptick in both the RSI and HNT’s price trajectory in the near future.

HNT’s upward Movement will face a delay

Although the market appears conducive for growth, Helium Network Token’s advancement might be held back because of a substantial decrease in trading activity.

Read Helium’s [HNT] Price Prediction 2024–2025

According to CoinMarketCap, the trading volume of HNT has dropped by about 46%, now standing at approximately $9.07 million. This places HNT at number 347 in terms of trading volume among all cryptocurrencies.

The decrease in trading activity, along with a stable price trend, indicates that traders have yet to significantly boost the expected surge for HNT. As a result, it seems that the HNT price will not increase until we witness a spike in market engagement and fluidity.

Read More

2024-09-29 11:35