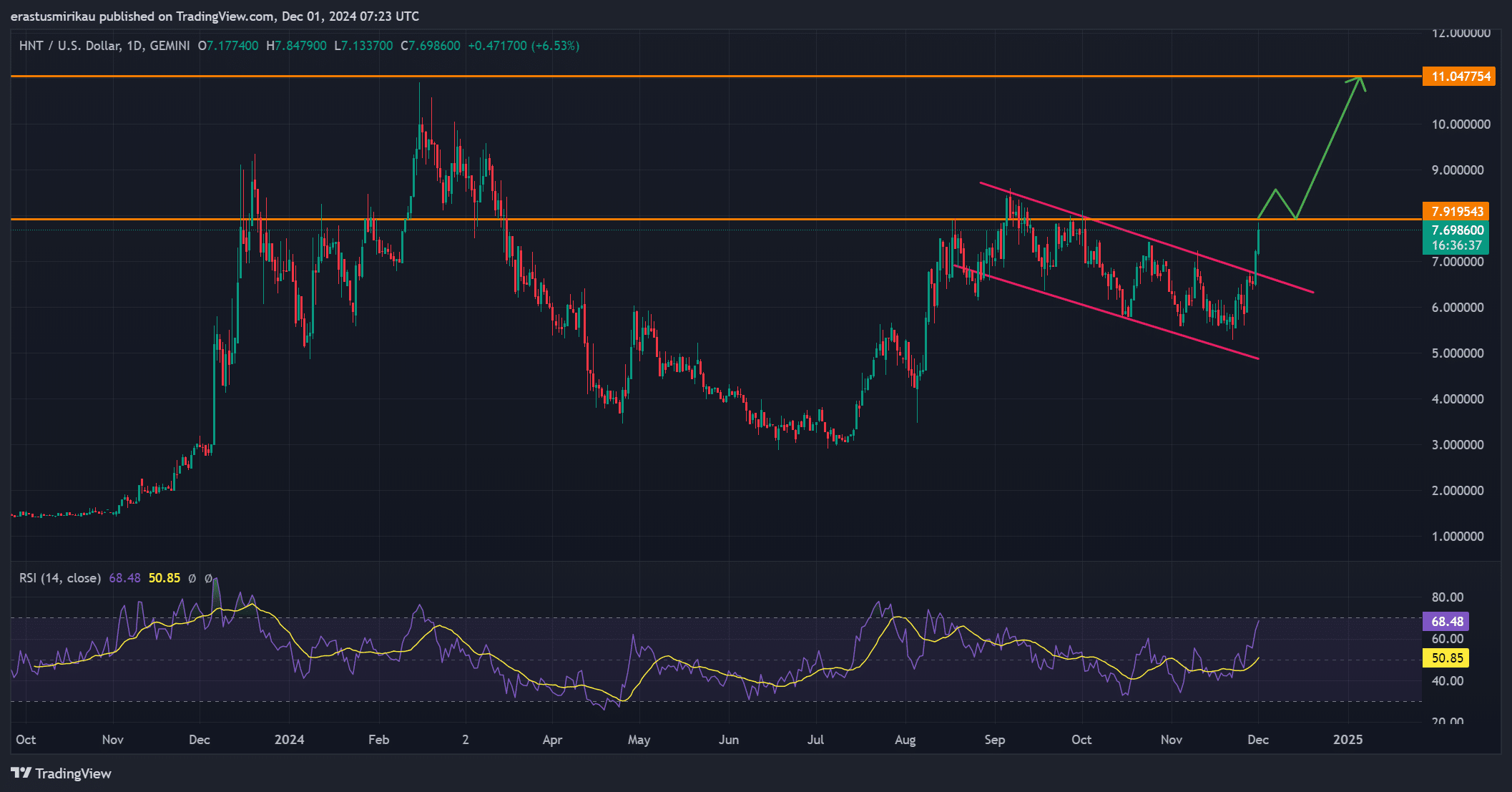

- HNT broke out of a bullish flag pattern, eyeing a key resistance at $7.90.

- Increased social dominance and rising Open Interest suggested continued bullish momentum.

As a seasoned analyst with over two decades of experience in the crypto market, I have seen my fair share of bull runs and bear markets. After closely examining Helium (HNT)’s recent price action, technical indicators, and social sentiment, I am cautiously optimistic about its potential to break through the $11 barrier.

Recently, Helium [HNT] has exhibited robust uptrend following its breakout from a bullish trend line formation on the daily graph, currently trading at $7.87, marking a 19.38% surge over the last 24 hours.

This surge is accompanied by a significant volume increase of 176.42%, bringing total trading volume to 51.86M.

As I find myself on the brink of a significant resistance point at around $7.90 with HNT, I can’t help but feel a sense of anticipation about potentially profitable growth ahead.

Given positive technical signals and increasing investor attention, there’s a strong possibility that the value of this coin might surge substantially, potentially reaching around $11 within a short period.

What does the bullish flag breakout mean for HNT?

Breaking out from a ‘bullish flag’ shape in helium indicates an escalating positive trend is underway. This pattern usually appears after a strong rise, followed by a phase of stability or sideways movement, and then resumes its upward trajectory.

This suggests that it could continue its uptrend.

Yet, the price encounters significant obstruction near $7.90. If it manages to surpass this barrier, it might head towards $11, which makes this area crucial for traders’ attention.

At the moment of reporting, Helium Nano Token’s Relative Strength Index (RSI) stood at 68.48, edging closer to overbought territory. This potentially signals a brief reversal, but it’s important to note that an RSI between 70-80 is usually associated with robust bullish tendencies.

Therefore, unless Helium experiences a sharp correction, the coin could continue to climb.

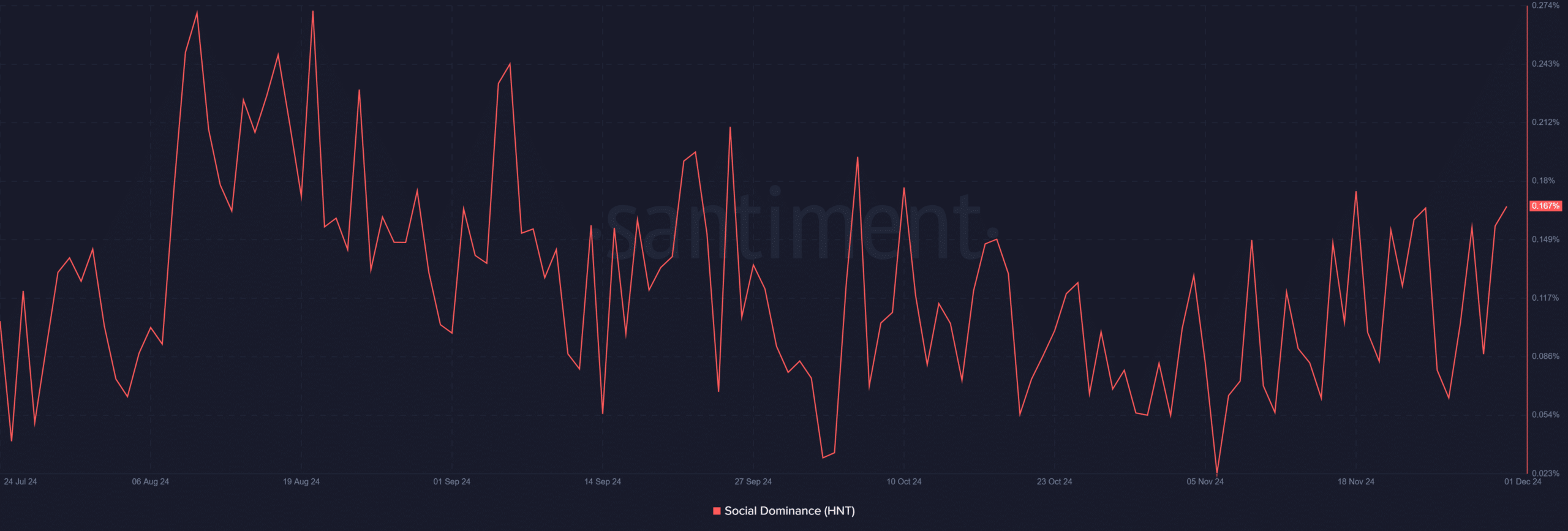

How is HNT’s social dominance impacting its price?

In the last day, the social dominance of this coin has climbed from 0.156% to 0.167%. This rise implies a heightened level of attention and conversation about the coin, potentially leading to an increased market focus.

Therefore, increased Social Dominance tends to influence price fluctuations among tokens, as traders pay attention to its expanding influence.

An increase in social interest might serve as a catalyst, propelling Helium Network Token (HNT) further and potentially pushing its prices upwards.

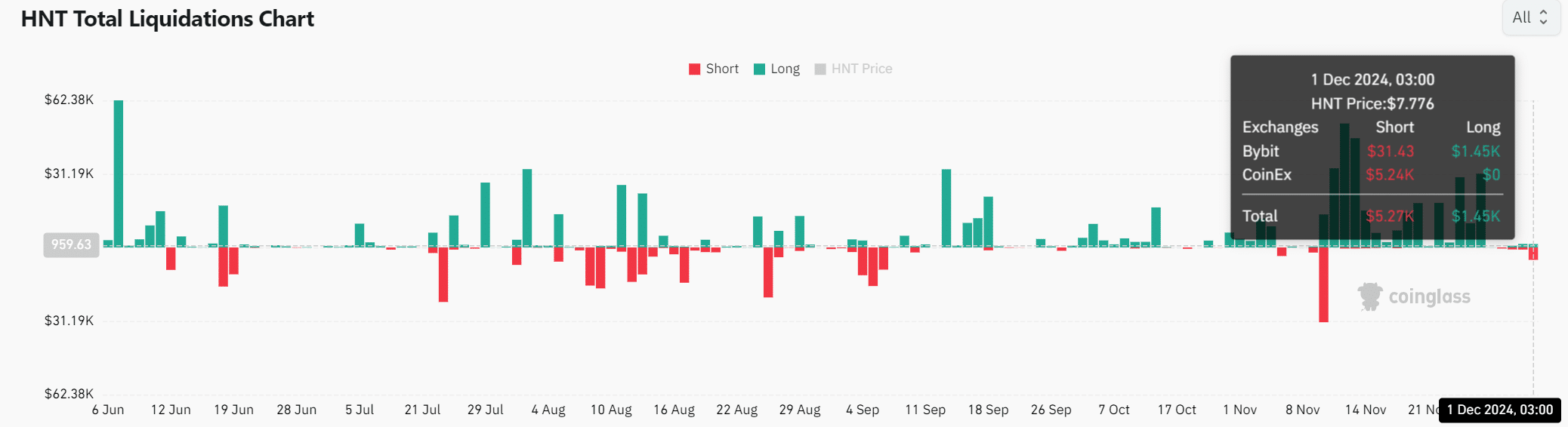

What does the liquidation data indicate about market sentiment?

As an analyst, I’m observing a positive market sentiment based on the liquidation data of HNT. The short positions were liquidated at approximately $5,270, whereas the long positions were liquidated at a lower figure around $1,450. This indicates that more traders are holding long positions than short ones, which is often a sign of a bullish trend.

It appears that a greater number of traders are preparing for an increase in prices, strengthening the existing positive (bullish) market direction. As a result of this, those who have shorted the market may be compelled to buy back, which could potentially boost the price even further.

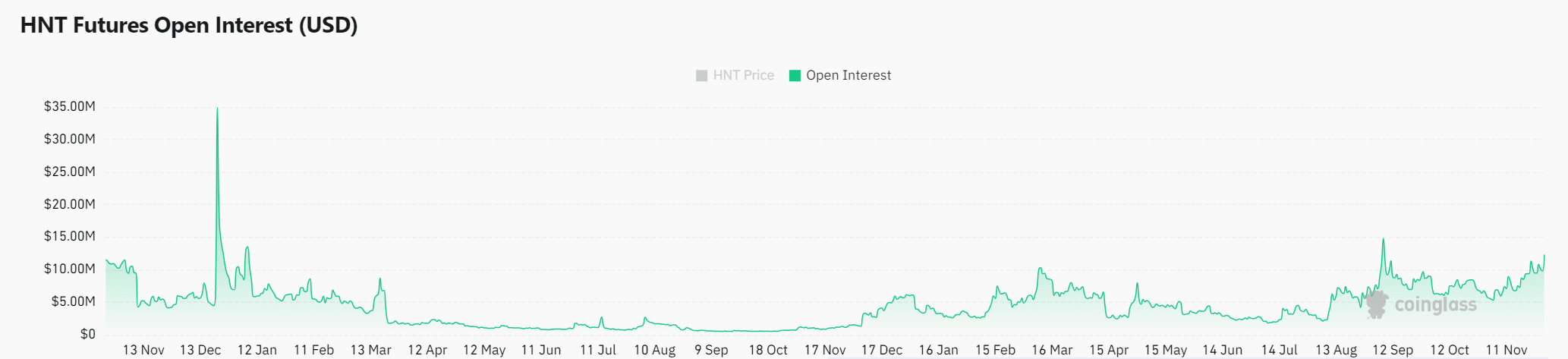

Surge in Open Interest

The interest among traders for HNT has significantly grown by 18.29%, now standing at a total of approximately $12.27 million. This notable increase indicates higher trader involvement and a strengthened belief in HNT’s potential to bring about additional profits.

With an increase in available positions, the rise in Open Interest provides a stronger argument for sustained bullish trends.

Conclusion: Can HNT break through to $11?

The Helium Network Token (HNT) appears to be showing signs of a robust upward trend based on its emergence from a bullish flag pattern, growing social influence, and escalating trading interest. If HNT successfully surpasses the current resistance at around $7.90, it could potentially reach targets near $11.

On the other hand, the Relative Strength Index (RSI) suggests there might be a brief reversal in the near term. But if the bullish trend remains strong, HNT could carry on rising.

Read More

2024-12-02 05:12