- Helium’s daily chart appeared free of major hurdles, which could help the asset rally smoothly

- HNT’s Open Interest jumped by 7% over the past 24 hours, suggesting growing demand and interest from investors

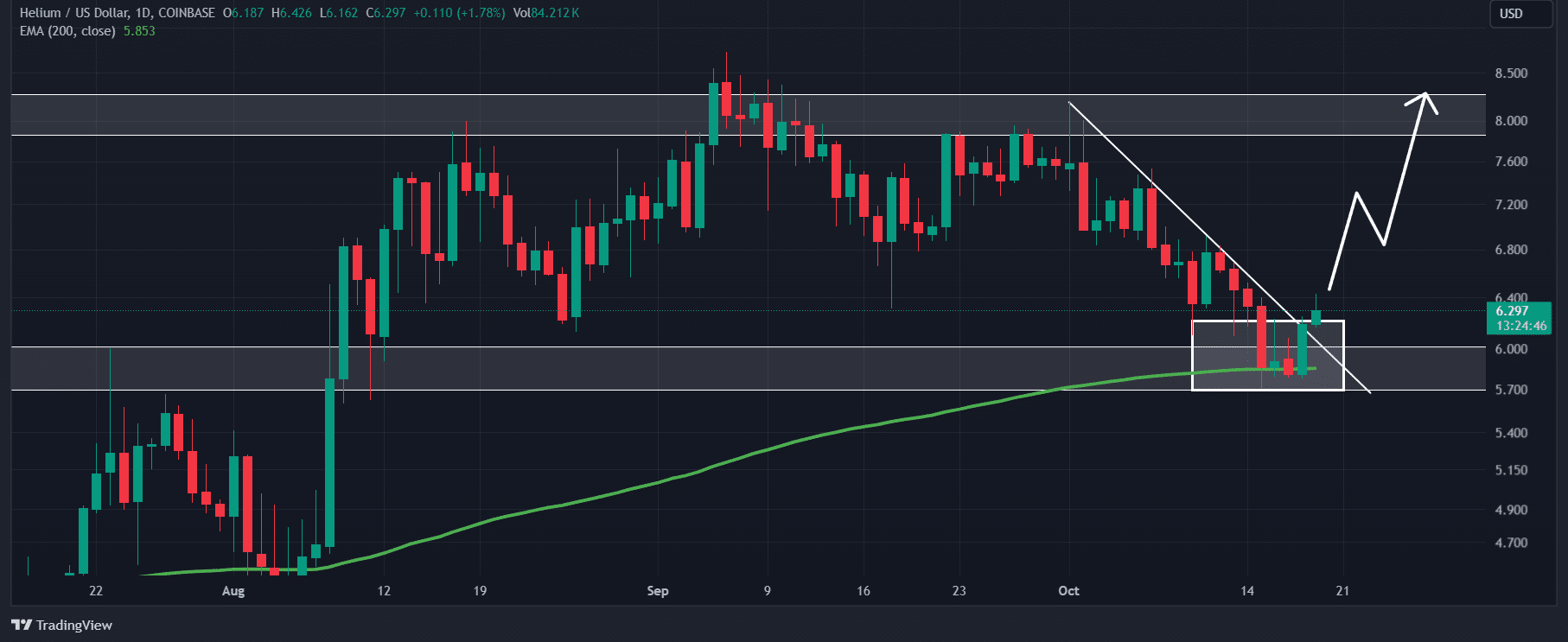

As a seasoned crypto investor with a knack for spotting lucrative opportunities, I find myself intrigued by the current state of Helium [HNT]. The daily chart appears to be a smooth highway leading towards potential gains, devoid of major obstacles that could derail the rally.

At the current moment, Helium (HNT) looks primed for a significant surge in price following its retest of a vital support level and breaching a downward trending line. This development appears to have completely flipped investor sentiment from bearish to bullish, transitioning from a downtrend to an uptrend.

Helium’s technical analysis

Based on AMBCrypto’s evaluation, HNT showed a positive trend following its breakout from the downward sloping trendline that functioned as resistance since October 1st, 2024.

In fact, the altcoin also broke the consolidation zone at $5.8 support.

Given this optimistic perspective and its current market trends, it’s quite likely that HNT may surge by approximately 30% to reach around $8.40 within the near future.

As I write this, Helium’s daily chart seems unencumbered by significant obstacles. This might facilitate a smooth rise for the asset in the near future.

Furthermore, the Relative Strength Index (RSI) of HNT, along with its 200-day Exponential Moving Average (EMA), suggested a positive trend and potential for substantial upward price movements, indicating a bullish prediction.

Bullish on-chain metrics

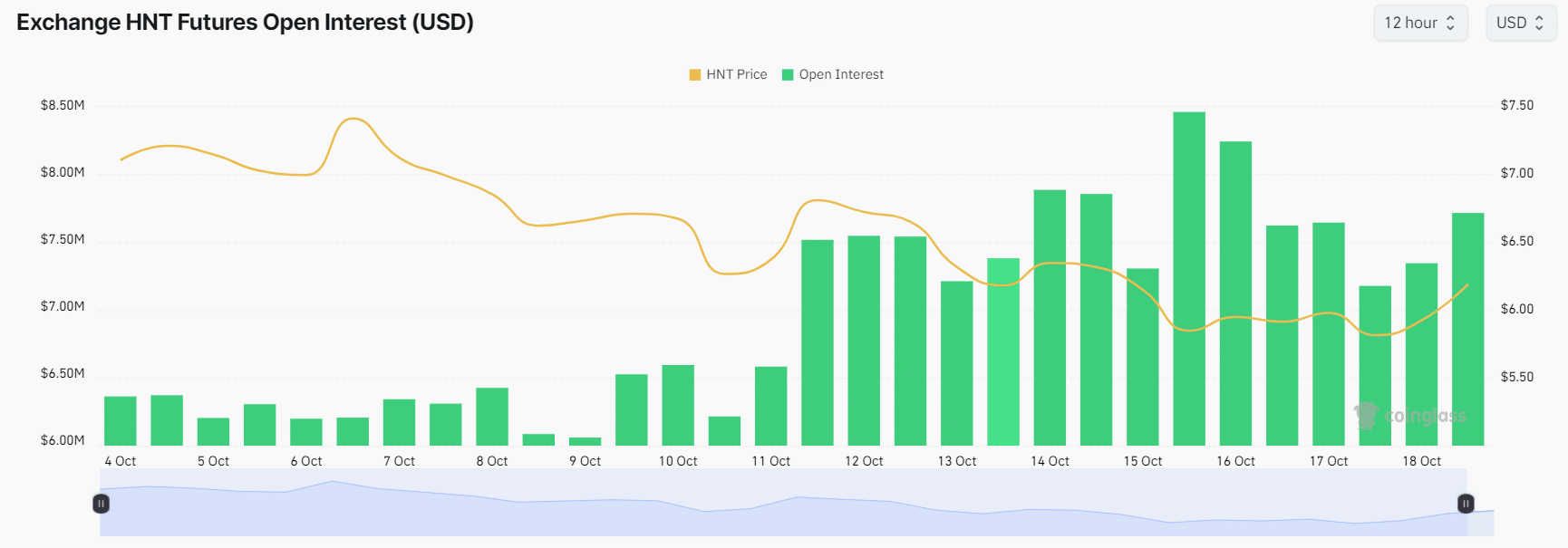

As I delve deeper into my analysis of Helium Network Token (HNT), it’s worth noting that its optimistic projection can be reinforced by its on-chain metrics. At this very moment, according to Coinglass, HNT’s Long/Short Ratio stands at 1.008. This ratio suggests a robust bullish sentiment among the altcoin’s traders, as it indicates more long positions than short ones, potentially signaling anticipation for an upward trend in the market.

The coin’s Open Interest (OI) hiked by 7% over the past 24 hours, with the same steadily increasing on the charts in the week prior too.

The increasing momentum in this cryptocurrency could be seen as an indication of escalating investor enthusiasm and demand, possibly fuelled by its recent surge and the positive market atmosphere surrounding it.

Many traders and investors frequently employ strategies that involve increasing Open Interest (OI) and a Long/Short Ratio greater than 1 when constructing long trades. In simpler terms, they tend to choose situations where there’s a higher number of buyers compared to sellers (Long positions) when the Open Interest is rising and the Long/Short ratio is above 1.

As reported by Coinglass, significant selling points (liquidation levels) were found at $6.06 on the downside and $6.5 on the upside. At these levels, traders were heavily leveraged, meaning they had borrowed a large amount of funds to increase their positions.

By merging these blockchain statistics with traditional analysis methods, we can deduce that at present, the bulls have the upper hand in managing this asset. Their efforts could potentially propel HNT towards the $8.40 mark in the approaching days.

Read Helium’s [HNT] Price Prediction 2024-25

Currently, Helium Network Token (HNT) is close to $6.37 per token, following a substantial increase of approximately 8.2% within the past day.

During that timeframe, there was a 20% increase in trading activity, suggesting a greater involvement of traders and investors, as opposed to the recent past.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-10-19 16:07