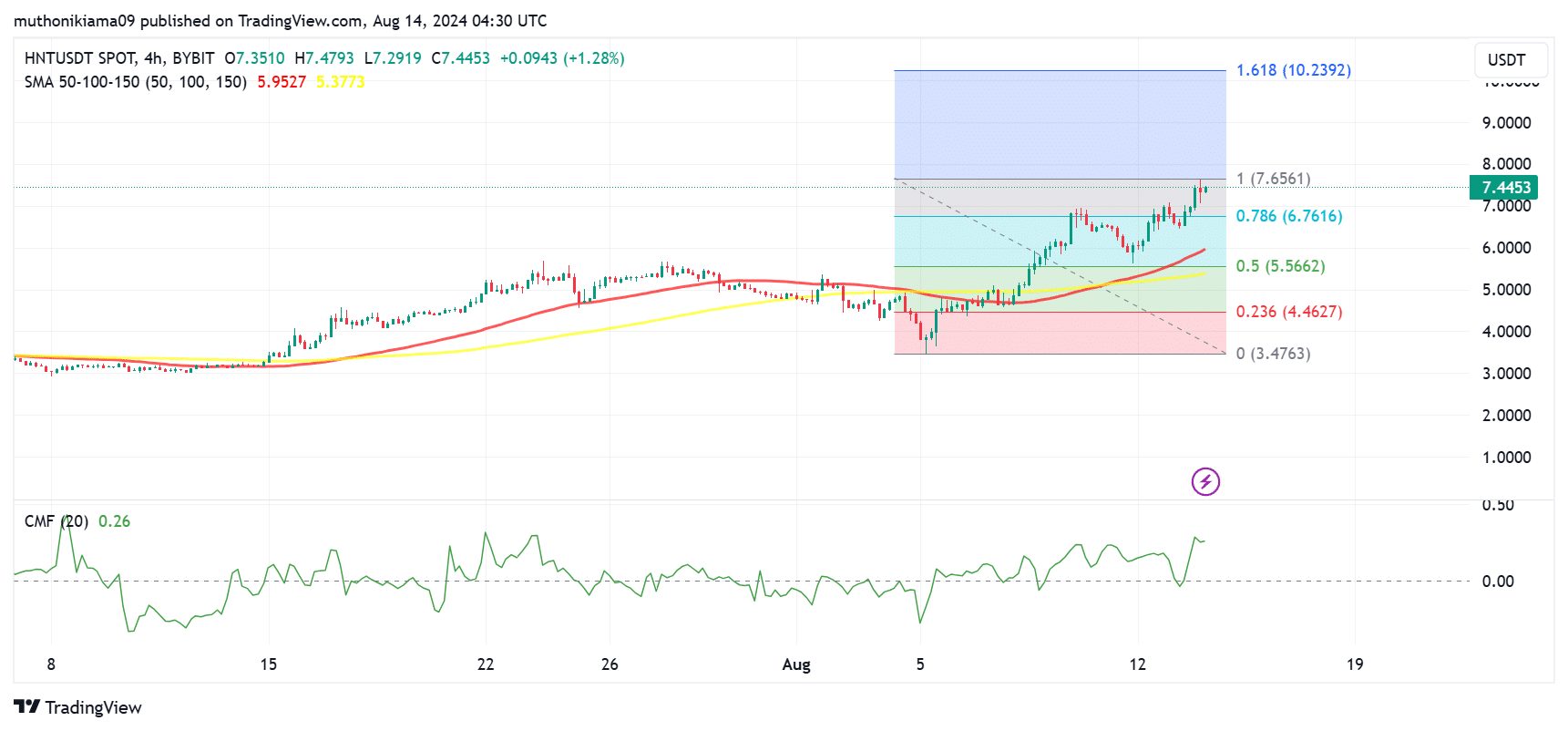

- HNT has formed a bullish crossover after the 50-day SMA crossed above the 100-day SMA.

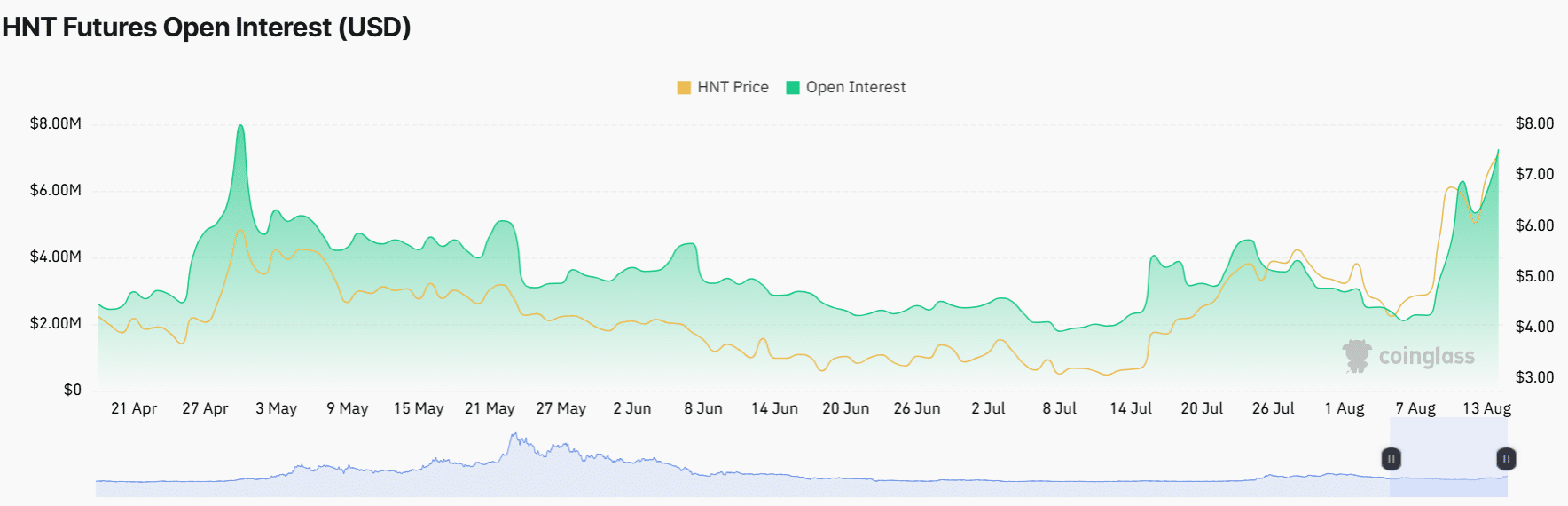

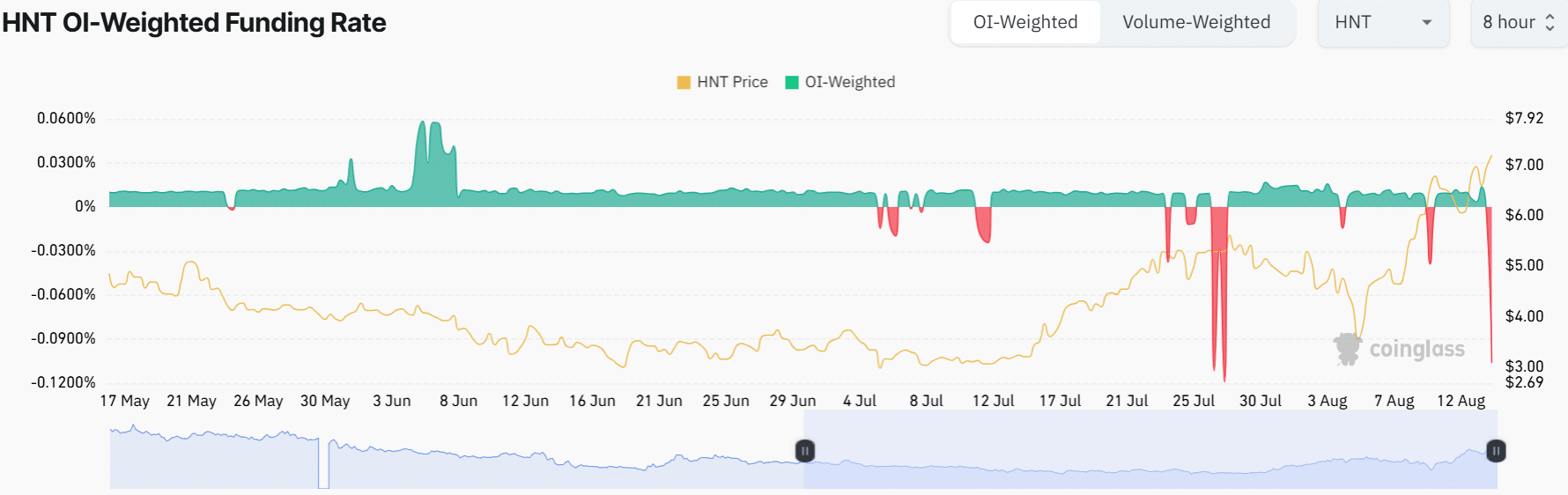

- Open Interest has increased to multi-month highs, but the negative Funding Rates showed a spike in short positions.

As a seasoned researcher with years of experience navigating the complex world of cryptocurrencies, I find myself intrigued by the current state of Helium [HNT]. The bullish crossover and the soaring open interest are certainly captivating indicators, suggesting that we might be witnessing a sustained uptrend.

At the current moment, Helium [HNT] is surging, having increased more than 50% over the past week. The increase in both the spot and futures market’s trading volumes indicates growing enthusiasm among investors, as prices reach levels not seen for several months.

Helium Network Token (HNT) was priced at $7.28 during this write-up, marking an approximately 10% increase over the past day. Notably, the Open Interest has climbed to its peak in several months.

Bulls are showing strength

The HNT rally was not showing signs of weakening as bullish signals dominate.

On the four-hour scale, there was a brief bullish pattern where the 50-day moving average surpassed the 100-day moving average. This change suggested a prolonged upward momentum might occur.

According to data from CoinMarketCap, there was a 30% increase in Helium Network Token (HNT) trading activity. This surge might be due to increased buying interest, as indicated by the Chaikin Money Flow (CMF), which stood at a favorable 0.26.

This metric indicated that the buying pressure was outweighing selling pressure.

At present, the initial Fibonacci level ($7.65) is serving as an immediate barrier for potential increase. If buying activity persists along with robust fundamentals, Helium Network Token (HNT) might surge towards a future objective of 1.61 Fibonacci level ($10.23).

One such fundamental is Helium’s involvement in the fast-growing decentralized physical infrastructure (DePIN). The network’s usage has also increased significantly over the past year.

HNT Open Interest hits multi-month highs

According to data from Coinglass, the Open Interest for HNT has surged by 19%, reaching a peak of $6.85 million – the highest it’s been since May 2024.

This metric indicated a rise in market participation as Futures traders increased their positions.

An increasing Open Interest (OI) along with a price hike generally suggests a bullish trend. Yet, a closer examination of the Futures market indicates a potentially bearish scenario.

The OI rose as Funding Rates flipped negative, suggesting that traders were opening short positions.

Short traders anticipate that HNT has peaked after the recent rally and the uptrend will weaken.

If purchasing in the spot market persists, it could lead to a potential short squeeze situation. This would compel short sellers to liquidate their positions, causing HNT prices to potentially rise further.

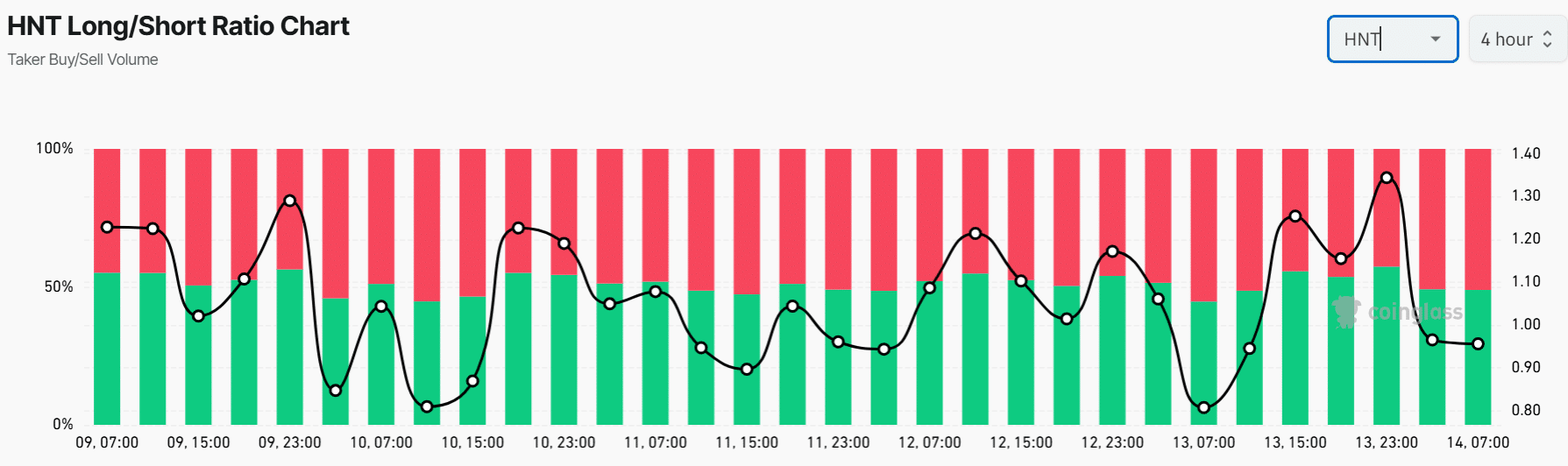

In simpler terms, when the HNT’s long/short ratio was 0.97, it meant that there were still many traders holding long positions (betting on price increases) in HNT futures. This suggests that a considerable number of traders believe the HNT price will continue to rise.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-15 06:19