- HNT has extended its losses amid intense selling pressure.

- After losing support at $6.70, HNT risks a steeper downtrend below $6 if buyers fail to step in.

As a seasoned researcher who has witnessed the crypto market’s ebb and flow for years, I can’t help but feel a sense of deja vu when observing Helium (HNT). The extended losses and intense selling pressure are all too familiar signs that have often preceded correction phases in the past.

Over the past day, Helium [HNT] exhibited indications of a prolonged downtrend, having decreased by approximately 6%. This decline was driven primarily by increased selling activity that tightened its grip on the price.

At the moment, Helium Network Token (HNT) is being exchanged for approximately $6.52, marking its lowest price point within the last month. This decline follows a surge that took the token’s value above $8, a significant peak reached just a few days ago.

HNT’s recent rally came amid the growth of the decentralized physical infrastructure network (DePIN) sector, whose market capitalization has ballooned to surpass $17 billion per Coingecko.

Will HNT drop below $6?

Investors who purchased Helium during its surge may now be cashing out their gains. If this pattern persists, the HNT price could face a potential drop.

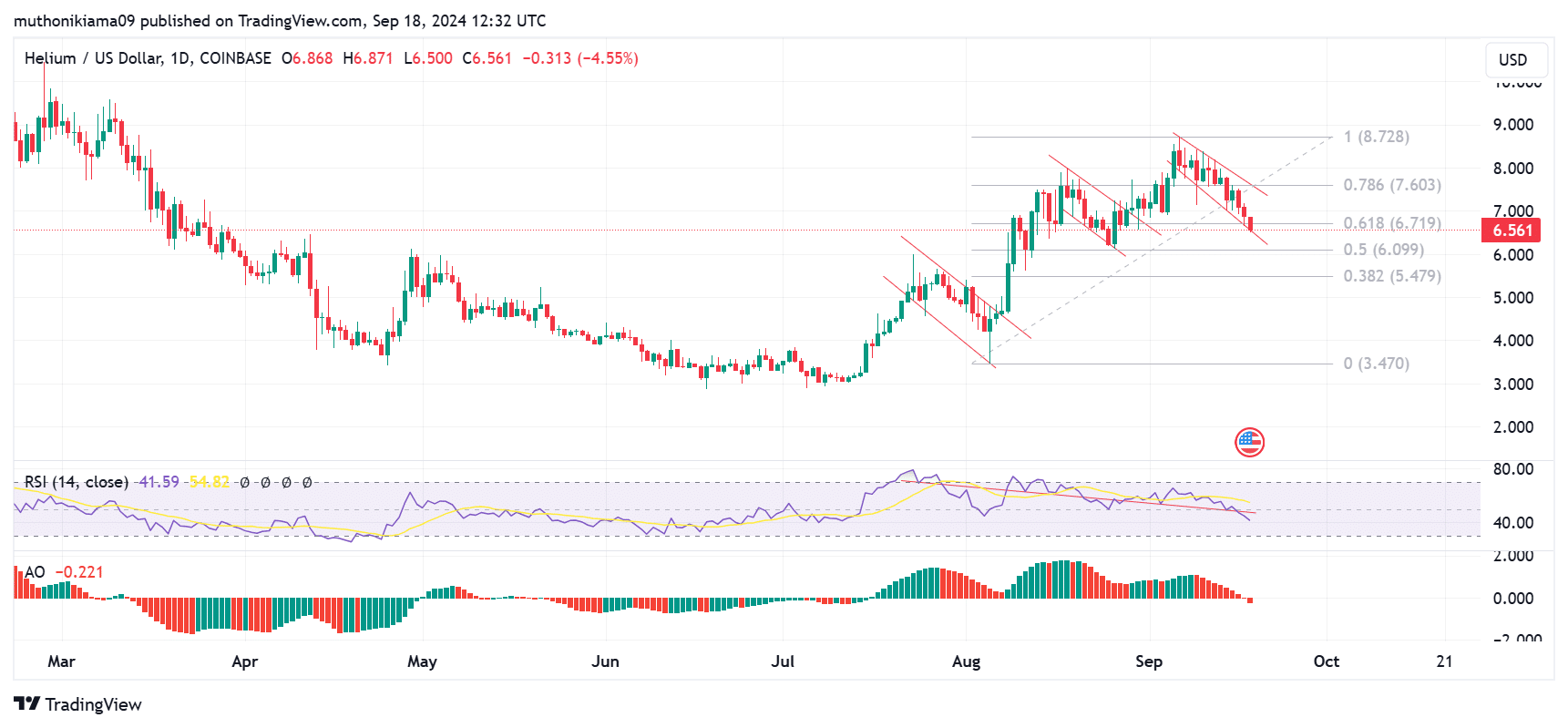

Today’s daily chart indicates a series of progressively decreasing trends for HNT, as it experiences a pullback following quick upticks. This downward pattern suggests a bearish market, where sellers have consistently thwarted price increases by cashing out their gains each time the price tried to climb.

The consistent selling action can be observed in the fluctuations of the Relative Strength Index (RSI), where it’s forming lower troughs. Moreover, the RSI line has dipped more deeply beneath the signal line, suggesting that the downward trend’s strength is substantial.

Even though the Relative Strength Index (RSI) stands at 41 for HNT, it hasn’t reached an oversold state just yet. But be mindful, after breaking its support at the 0.618 Fibonacci level ($6.70), HNT’s price may continue to fall below $6. It’s worth noting that this same level has historically provided strong support for HNT, but if it can’t hold in the current situation, a potential decline towards $5.47 could occur.

Based on the latest data from the Awesome Oscillator (AO), the downward trend appears to be reinforced, supporting the bearish outlook. For the first time since mid-July, the AO has fallen below the zero line, indicating that the selling pressure is growing. This could potentially lead to a further decline in HNT’s price movement.

On-chain data appears bearish

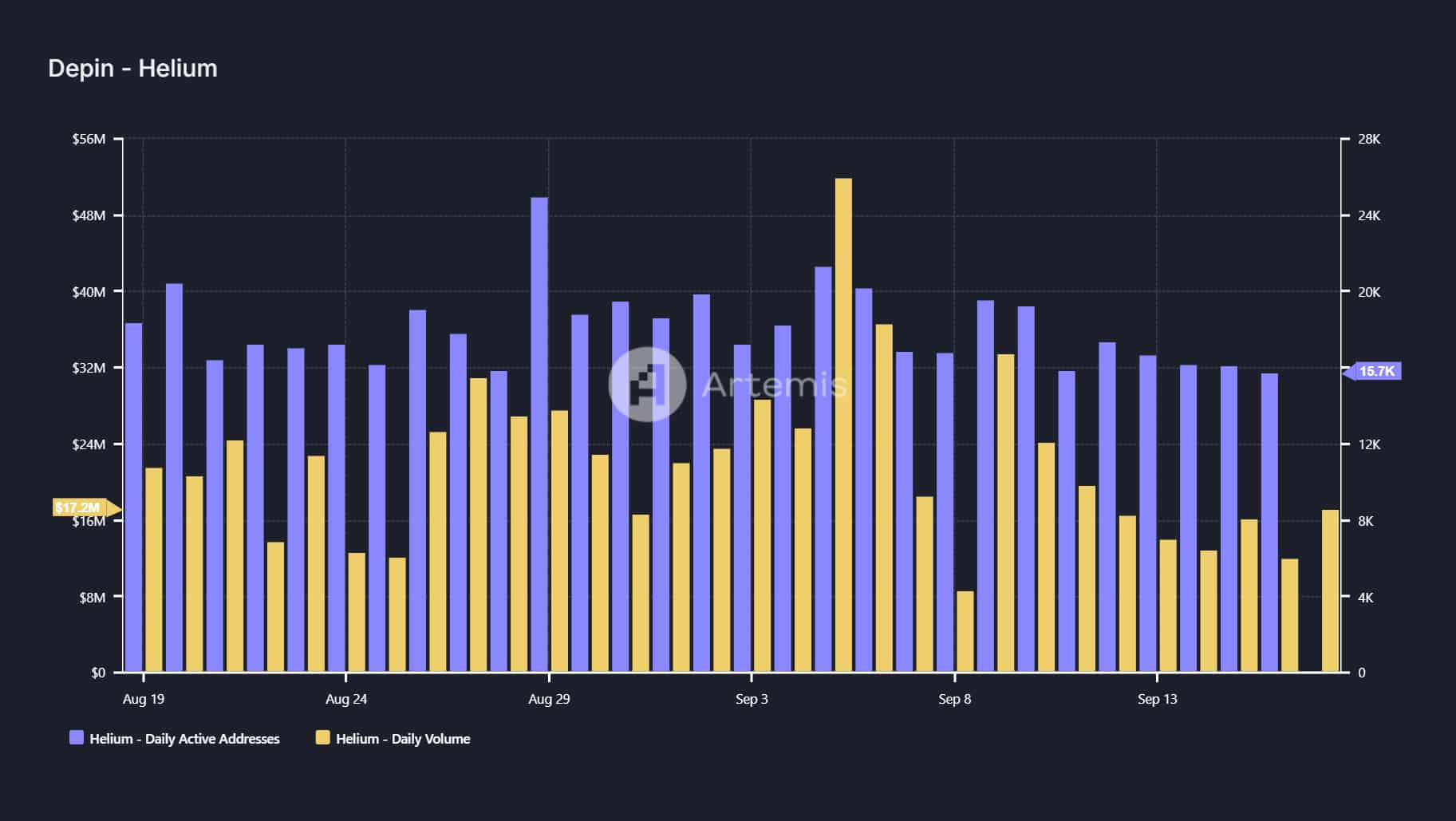

The activity on the Helium network is exhibiting signs of a downtrend as well. According to Artemis data, the number of daily active addresses has dropped to 15,700 – the lowest point for this month so far.

Simultaneously, we’ve seen a rise in daily volumes. To be specific, on September 17th, this figure climbed up from $12 million to $17 million, amounting to an additional $5 million.

Read Helium’s [HNT] Price Prediction 2024–2025

A surge in trading volumes indicates a lot of short-term trades are happening. Yet, if the price isn’t also increasing with these high volumes, it suggests there’s heavy selling going on, which weakens the long-term price prediction.

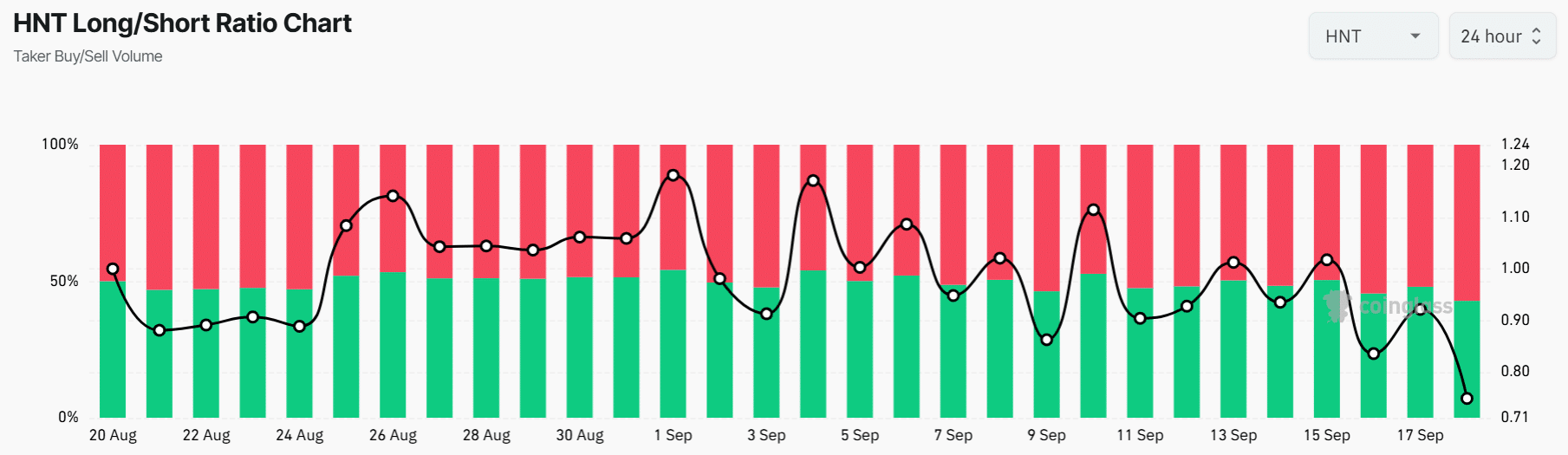

According to data from Coinglass, the long/short ratio currently stands at an all-time low of 0.74. This suggests that a majority of traders anticipate the HNT price to decline even more, as they’ve predominantly adopted a short position strategy for this cryptocurrency.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-09-19 08:07