- Bitcoin’s demand has dropped to its lowest levels in recent weeks as prices consolidated.

- However, the reducing Bitcoin supply on exchanges made the case against significant price drops.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I find myself both intrigued and concerned by the current state of Bitcoin [BTC]. The range-bound trading between $56K-$62K since early August, coupled with the dropping demand levels, paints a picture of uncertainty and consolidation.

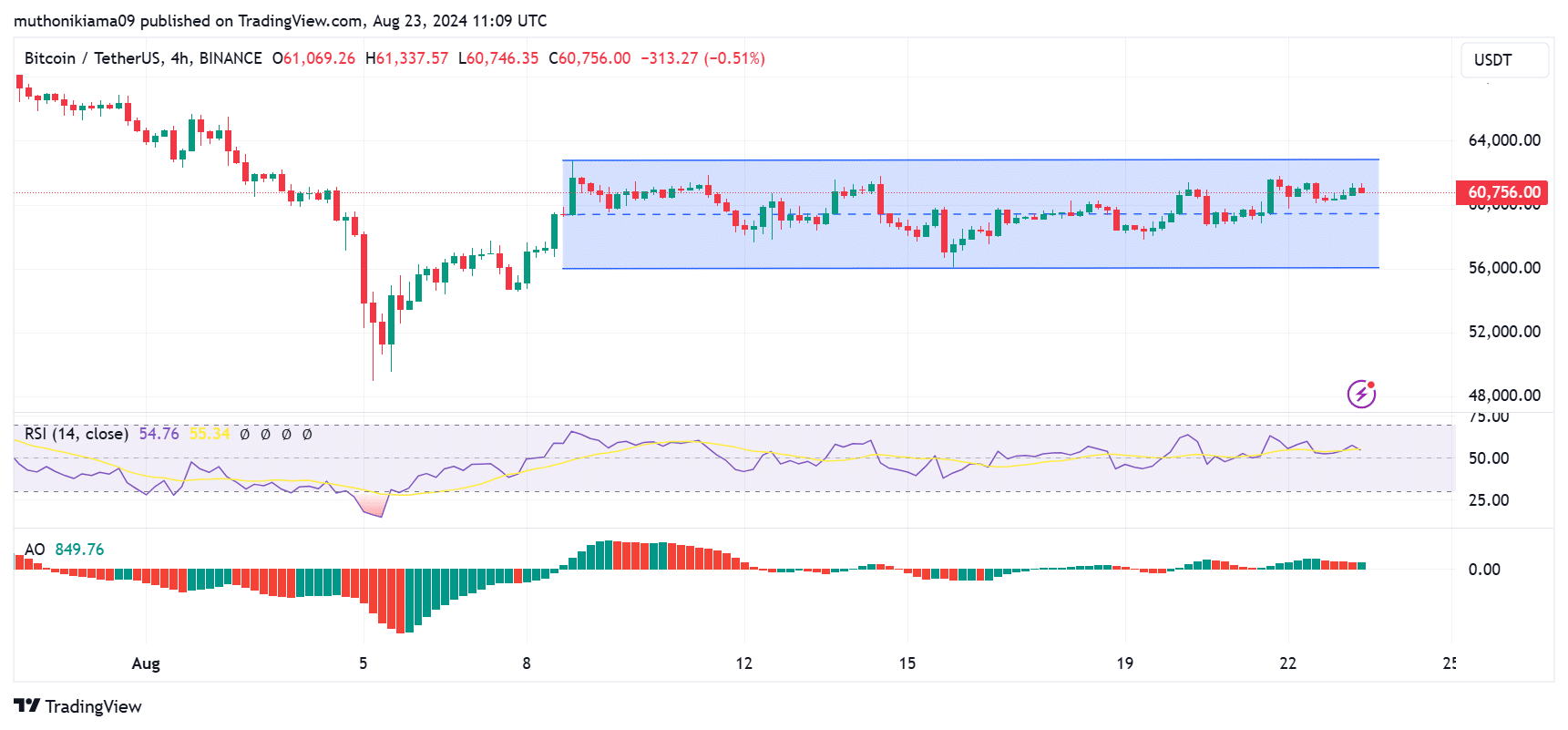

After bouncing back from its dip on August 5th, Bitcoin’s [BTC] price has been moving within a narrow band, fluctuating between approximately $56,000 and $62,000.

Since the 8th of August, the price hasn’t gone beyond this range, suggesting either a period of consolidation or some market uncertainties.

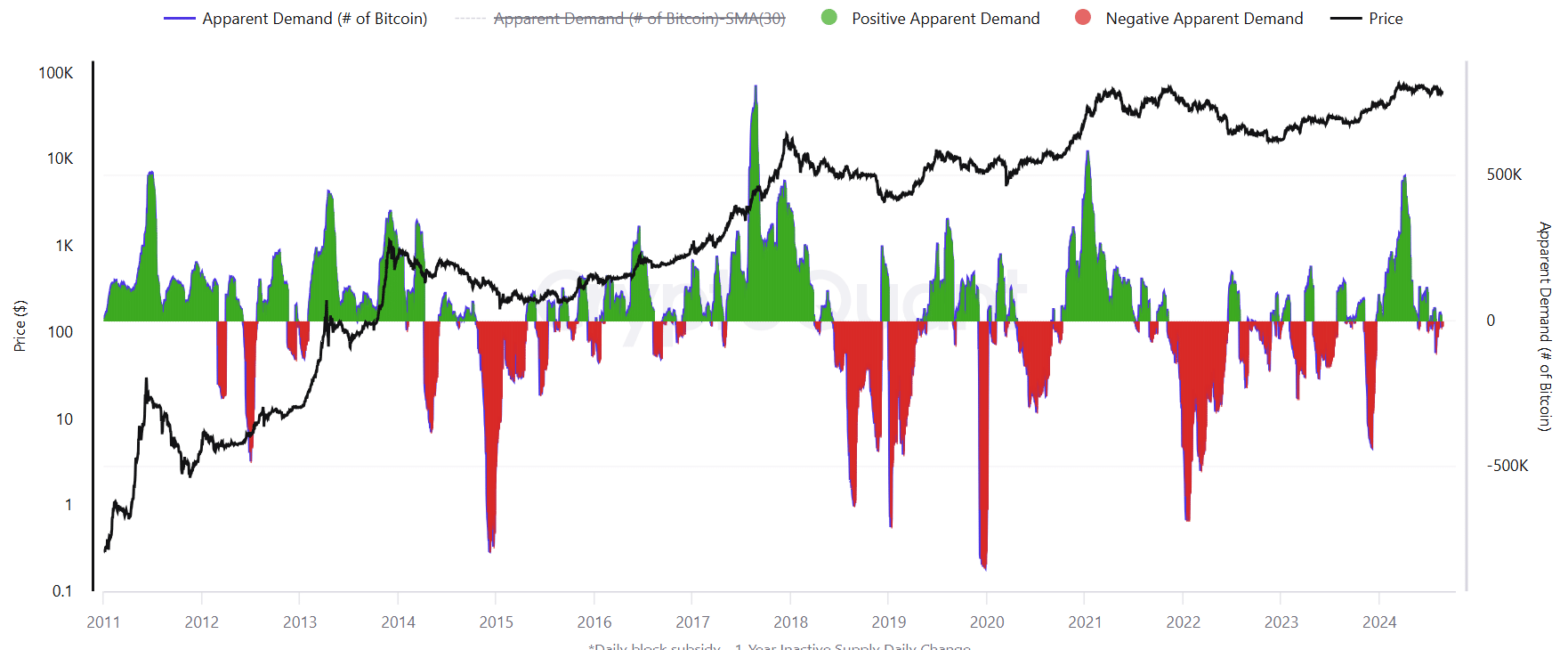

One significant reason for Bitcoin struggling to surge past this level is the sluggish expansion in its demand, as indicated by CryptoQuant. In fact, this growth has been quite stagnant and has even shown a decline over the past few weeks.

In April 2024, Bitcoin’s popularity reached its highest point in three years, aligning with the Bitcoin halving. Yet, since then, it has plunged to its lowest point of the year.

So why is Bitcoin’s demand falling?

Looking at ETF and whale activity

The analysis pointed out the drying inflows into spot Bitcoin ETFs. In March, as BTC surged to all-time highs, the average daily purchases into Bitcoin ETFs stood at 12,500 BTC.

This dropped to 1,300 BTC last week.

Since August 9th, the amount flowing into Bitcoin Spot ETFs has consistently stayed below $100 million, according to SoSoValue. Despite holding over $55 billion in total assets, a rise in purchasing activity is necessary to stimulate broader demand.

It seems that whales are lowering the amount of Bitcoin they hold. Over the past month, their average holding has decreased significantly, going from 6% in February down to 1%. This represents the steepest decline since February 2021, according to data from CryptoQuant.

As a researcher studying cryptocurrency markets, I have observed that large investors, often referred to as ‘whales,’ significantly influence the price dynamics of Bitcoin. A decrease in their holdings could signal a broader negative sentiment prevailing among traders and investors, potentially indicating a bearish trend for the market.

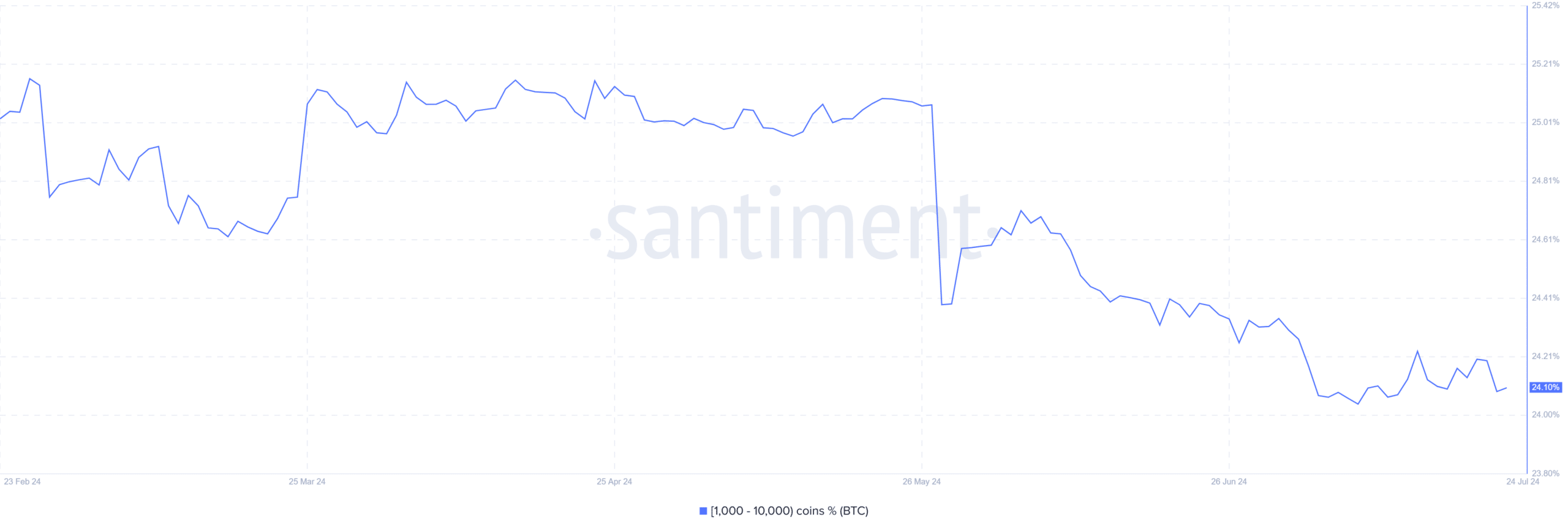

The decrease in whale activity became more apparent with data from Santiment, indicating a substantial drop in the number of Bitcoin wallets holding between 1,000 and 10,000 coins since March.

Regardless of reduced whale behavior, long-term Bitcoin investors have actually been expanding their holdings. On average, they’ve been adding approximately 391,000 Bitcoins to their portfolios each month.

Will Bitcoin breakout of its range?

With Bitcoin demand appearing to plateau, one cannot help but wonder if it’ll manage to surpass the current price range of around $56K to $62K. Diving into blockchain data presents a less optimistic scenario.

As reported by IntoTheBlock, roughly 3 million wallets purchased Bitcoin within this price bracket. These newcomers who acquired Bitcoin at these levels have yet to experience substantial returns on their investment.

Therefore, breaking out past $62K will be met with selling pressure as they rush to take profits.

technical indicators don’t provide strong evidence to suggest a breakthrough, as the Relative Strength Index (RSI) continues to fluctuate within a specific range without any substantial increases in purchasing energy.

The Awesome Oscillator, being in the positive zone, indicated an upward trend. Yet, the brief histogram bars hinted at a potential softening or possible reversal of this uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In the near future, it’s improbable that we’ll see a significant drop in Bitcoin prices falling outside the current range, mainly because the amount of Bitcoin held in exchanges is decreasing.

According to CryptoQuant, the Exchange Supply Ratio has dropped dramatically in the last year. This means that even though demand is quite low, the amount of cryptocurrency available on exchanges is also reduced, decreasing the likelihood of sharp price corrections.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-24 08:08