-

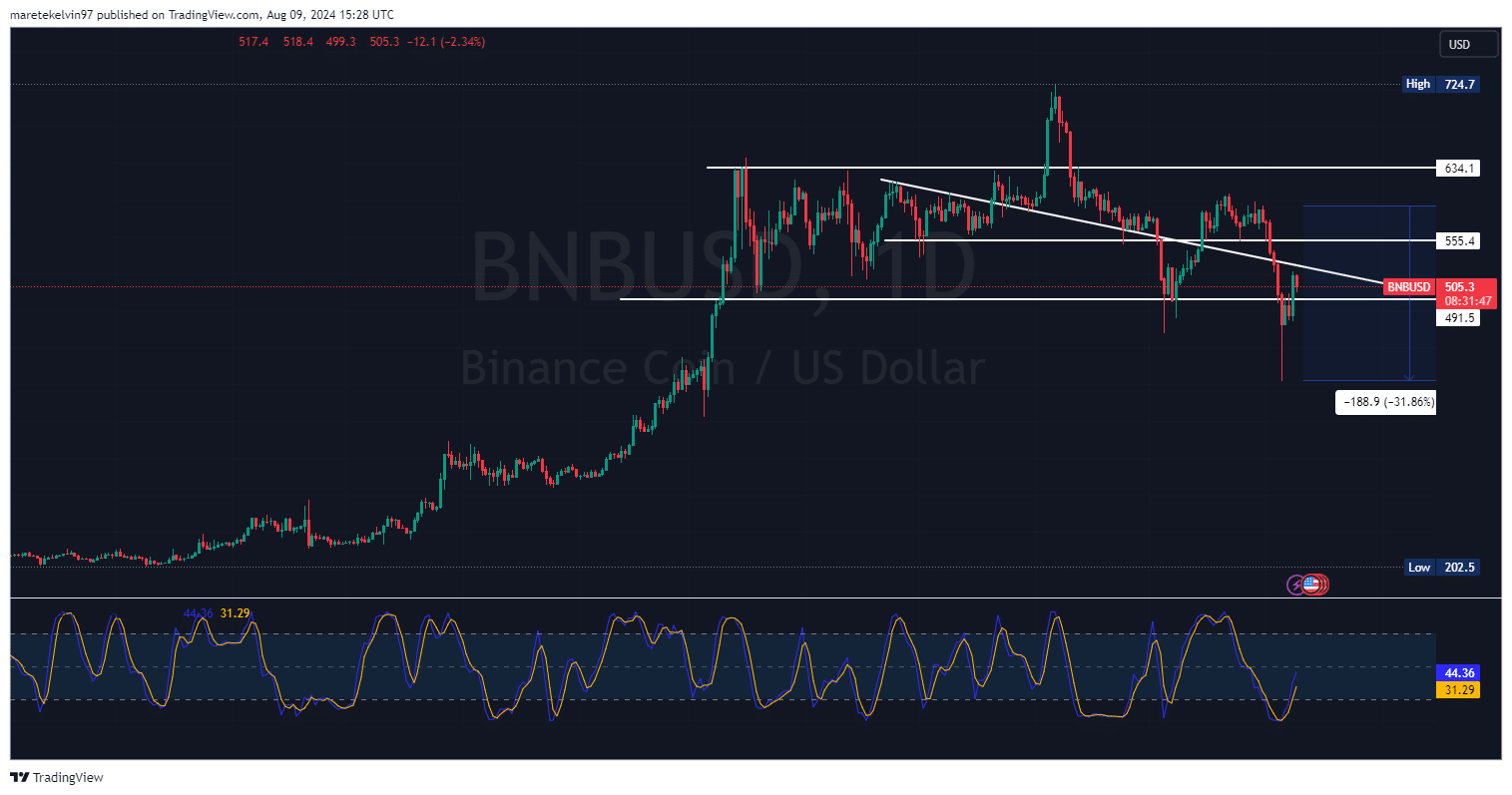

BNB, at press time, seemed to be retracing to a critical support level at $491

Price action and metrics suggested a potential bullish continuation

As a seasoned analyst with years of experience navigating the cryptocurrency market, I must admit that watching BNB at this critical juncture is like observing a high-stakes game of chess. The support level at $491 has been a battlefield, yet the bullish momentum suggests a potential continuation of the rally.

At the present moment, Binance Coin (BNB) appears to be moving back towards a significant support point approximately at $491. This area has proven to be robust in fostering bullish reversals over the past three months. However, BNB’s current price movements hint at potential continued growth. Despite this, the support level remains crucial because it has been tested on multiple occasions.

Potential for bullish continuation

The price of BNB nearing the support level of $491.5 might trigger an uptrend, provided the resistance is strong enough. This potential drop aligns with the overall downward trend in the larger market structure.

Furthermore, the Stochastic RSI showed signs of an oversold condition. In other words, it seems that many investors have adopted a ‘let’s observe and act’ stance, as they prepare to capitalize on the current market downturn.

Net flows and liquidation insights

As an analyst, I’ve observed that Binance Coin (BNB) currently holds a strong market position. The inflow and outflow data for BNB on exchanges provide insights into investor sentiment. Typically, when there is a significant increase in outflows, it suggests accumulation – traders anticipate the price to rise based on their actions, stockpiling BNB in expectation of potential price increases.

On the other hand, inflows might indicate selling activity as well. Interestingly, net flow data gave ambiguous indications, with recent outflows hinting at possible stockpiling near the $491 support zone.

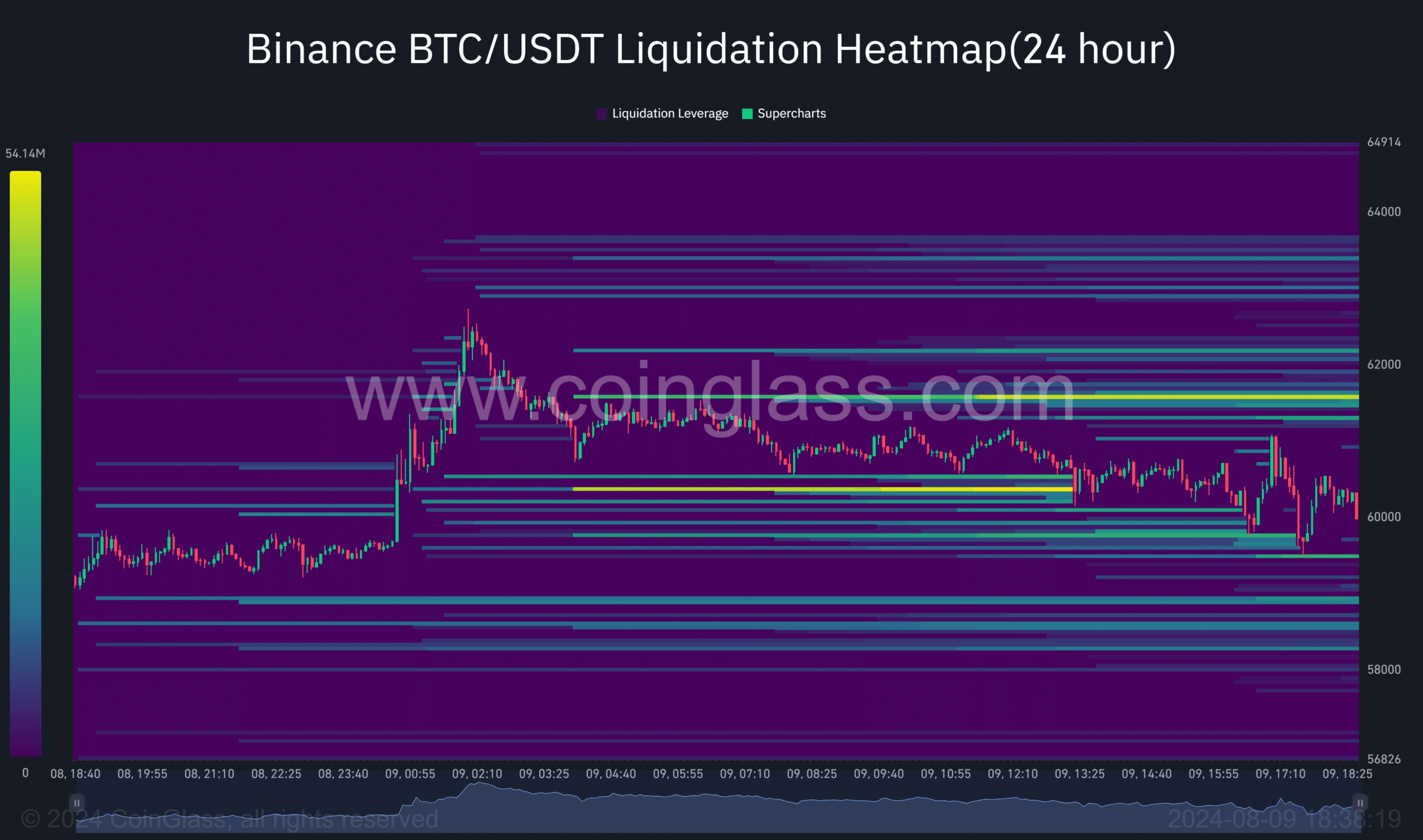

Additionally, AMBCrypto’s examination of liquidity data from Coinglass revealed spots with significant liquidation pressure, frequently resulting in sudden increases in market volatility.

Coinglass’s heatmap highlights concentrated regions of price-based liquidations, which may lead to significant market fluctuations in either direction. These intense liquidations might signal a potential shift in trends, as margin calls become more frequent, suggesting a possible trend reversal.

What is next for BNB?

Currently, BNB has surpassed its significant support point at $491. Yet, there’s a substantial possibility of a turnaround. Regardless, investors are keeping a close eye for indicators suggesting possible upcoming bullish trends.

Currently, BNB stands at a crucial juncture. It’s facing high liquidation levels and is showing signs of being overbought according to technical analysis. However, there’s a possibility that it might undergo a turnaround.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-08-10 15:03