- Binance’s delisting of WRX reflects unresolved disputes and regulatory risks, causing a 56% price crash.

- Market metrics confirm WRX’s bearish trend, with oversold RSI and critical support nearing $0.0869.

As a seasoned crypto investor with scars earned from more than a few bear markets, I can’t help but feel a sense of deja vu as I watch WRX tumble following Binance’s decision to delist it. The 56% plunge within 24 hours is reminiscent of the wild rollercoaster rides we’ve all been on before.

Due to Binance’s action of removing WazirX [WRX], Kaon [AKRO], and Bluzelle [BLZ] from its platform, the value of these cryptocurrencies has significantly dropped. At the moment of reporting, WRX had fallen a staggering 56% to $0.1006.

The impact of this announcement goes beyond just market movements, bringing attention to the ongoing disagreement between Binance and WazirX, and sparking concerns over potential regulatory hazards related to these digital tokens.

What happened between Binance and WazirX?

The Binance-WazirX relationship has been controversial since Binance claimed to acquire WazirX in 2019, only to deny full ownership in 2022.

Tensions increased for WazirX following an examination of their practices by Indian regulators, sparking accusations of money laundering and $235 million in security breaches. More recently, the Delhi High Court has mandated a new probe into WazirX’s security lapse, further complicating matters for the exchange.

Removing WRX from Binance’s platform suggests a worsening partnership between the two entities. This action significantly impacts WRX since it represents a major trading platform for the token, leading to reduced liquidity and attractiveness for potential investors.

WRX’s freefall: What do the charts say?

As an analyst, I find it noteworthy that within just 24 hours, the value of WRX dipped by a substantial 56%. Currently, the token is being traded at $0.1006, and its market cap stands at approximately $38.42 million – a decrease of 56.27%. The surge in trading volume by an impressive 550% indicates a high level of panic selling among investors.

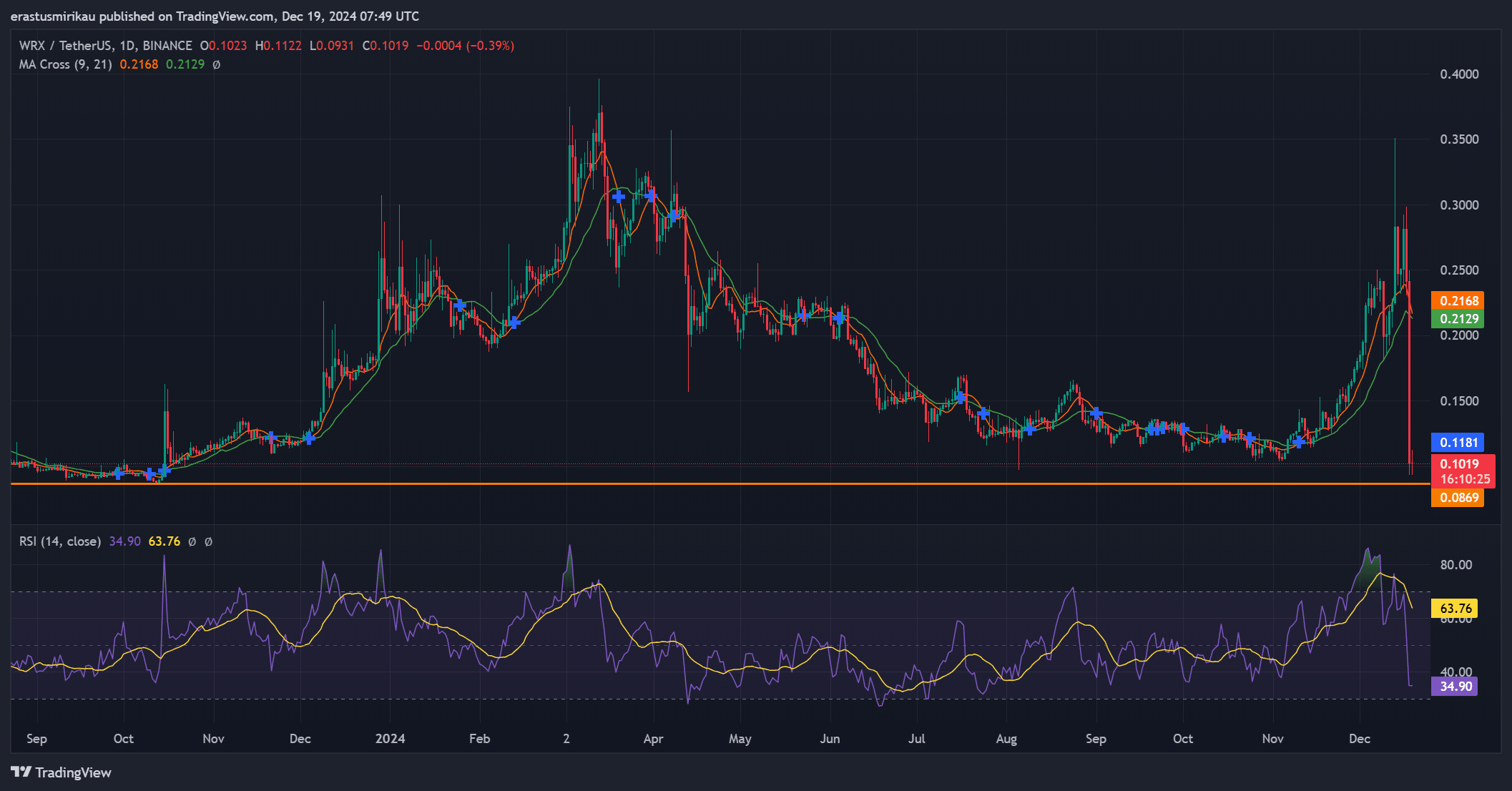

Looking at the technical side of things, the WRX has fallen below crucial support points, with a current support level at approximately $0.0869 and resistance at around $0.1181. The Relative Strength Index (RSI) dipped to 34.9, suggesting the market is oversold.

The Moving Average (MA) cross (9, 21) shows a sustained bearish trend at $0.2168 and $0.2129.

Removing WRX from the exchange listings, along with uncertainty about regulations, presents a grim outlook for WRX’s revival. Confidence among investors has plunged to its lowest point yet.

Why did Binance take this step?

Binance’s action demonstrates their focus on maintaining compliance as they face growing regulatory oversight. The token WRX, embroiled in various legal conflicts and ownership disputes, poses a risk that Binance prefers to avoid.

This action is a response to increased international examination of cryptocurrency exchanges, as authorities are pushing for stricter measures to prevent fraud and illegal activities. Removing questionable coins such as WRX shows Binance’s efforts to reduce risk and preserve a positive relationship with regulators.

What about AKRO and BLZ?

In the midst of WRX’s significant drop from listing, both AKRO and BLZ experienced substantial decreases as well. Specifically, AKRO tumbled by 38%, landing at $0.00238, while BLZ plummeted 42% to reach $0.07099 at the moment of reporting.

As a token analyst, I observe a distinct difference between these tokens and the WRX. Unlike them, these tokens are currently free from any regulatory uncertainties or disputes. Their recent downward trend seems to be driven predominantly by market forces, as investors have responded negatively to Binance’s recent announcement. Yet, their future outlook is uncertain, with a decline in liquidity and potential exposure to significant challenges due to reduced market presence.

As a crypto investor, I’ve learned a hard lesson from the Binance-WazirX situation: it underscores the significance of sound governance, transparency, and adherence to regulations in this dynamic market. For WRX holders like myself, overcoming the legal and reputational challenges ahead appears to be an uphill battle.

As an analyst, I would advise proceeding with caution when considering investments, especially in areas where platform disagreements and regulatory stressors are present. It’s crucial to thoroughly evaluate these potential hazards before making any commitments.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-12-20 03:03