- Open Interest in Toncoin grew materially over the last few weeks

- Network growth dipped, indicating a decline in the interest shown by new addresses

As a crypto investor with some experience under my belt, I’ve been keeping a close eye on Toncoin [TON]. Its recent success story has been nothing short of impressive, with the token hitting new all-time highs and garnering significant interest from both retail and institutional investors. The association with Telegram, a messaging app with over 1 billion users, has undoubtedly played a role in fueling this growth.

As a successful crypto investor, I’ve noticed that Toncoin (TON) has been an exceptional performer in the market recently. Despite the volatility and bearish sentiment that have affected many other cryptocurrencies, TON has managed to hold its ground. This piqued my interest and led me to explore the reasons behind its success and the extent of the attention it’s receiving.

A peek into TON’s interest

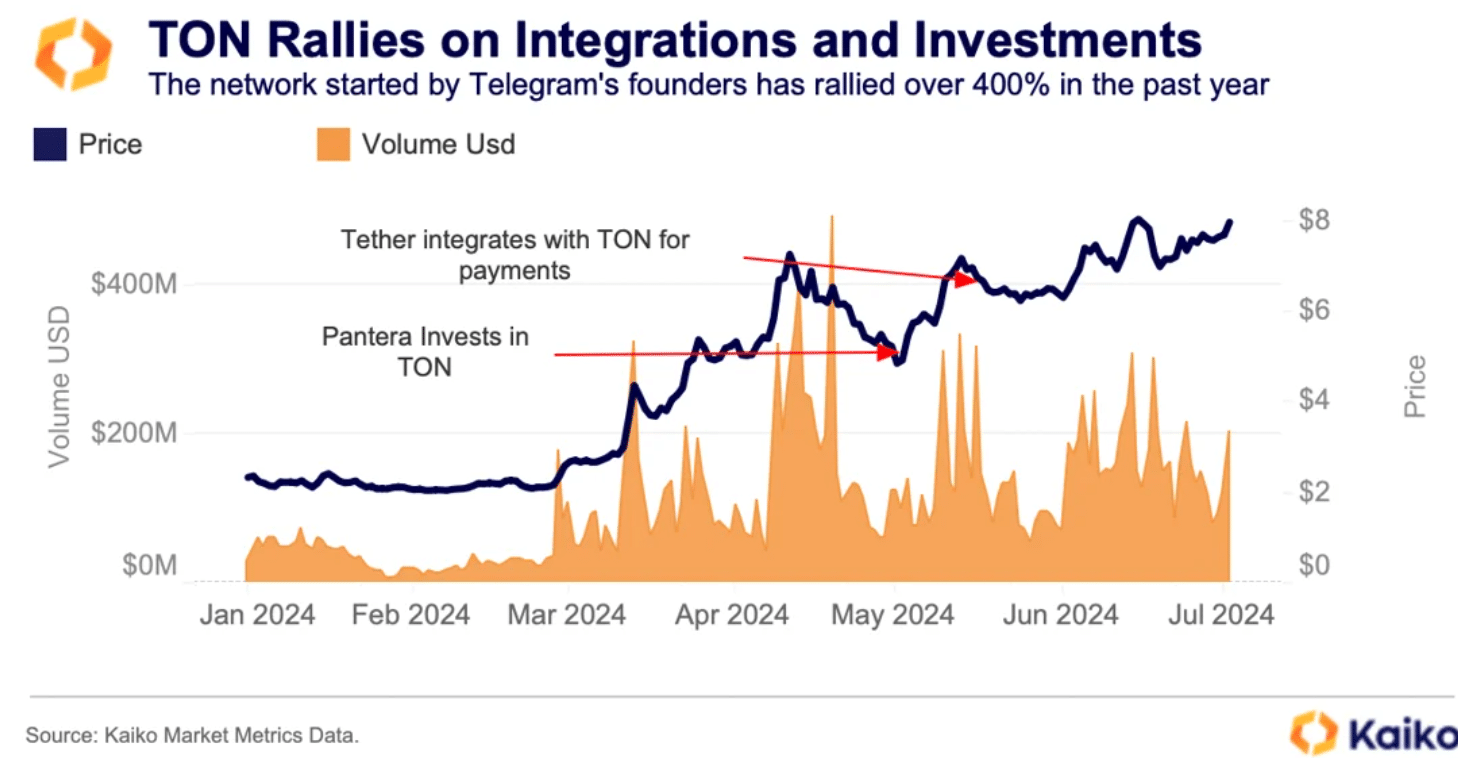

As a researcher, I’ve noticed an impressive rise in TON‘s value recently, reaching a new record high of over $8.20 in mid-June. This achievement surpasses most other altcoins since the 2021 bull run. The significant attention drawn to TON during the past year can be largely explained by its strong connection to Telegram – A messaging platform with an impressive user base exceeding one billion people.

The trading of the token has experienced a notable increase, as both dollar and asset-backed trade volumes have surged considerably. This significant rise suggests a strong demand for TON that goes beyond simple price speculation. Additionally, TON’s liquidity pool has grown dramatically, with its 1% market depth jumping from $2.5 million in January to an impressive $8 million by July.

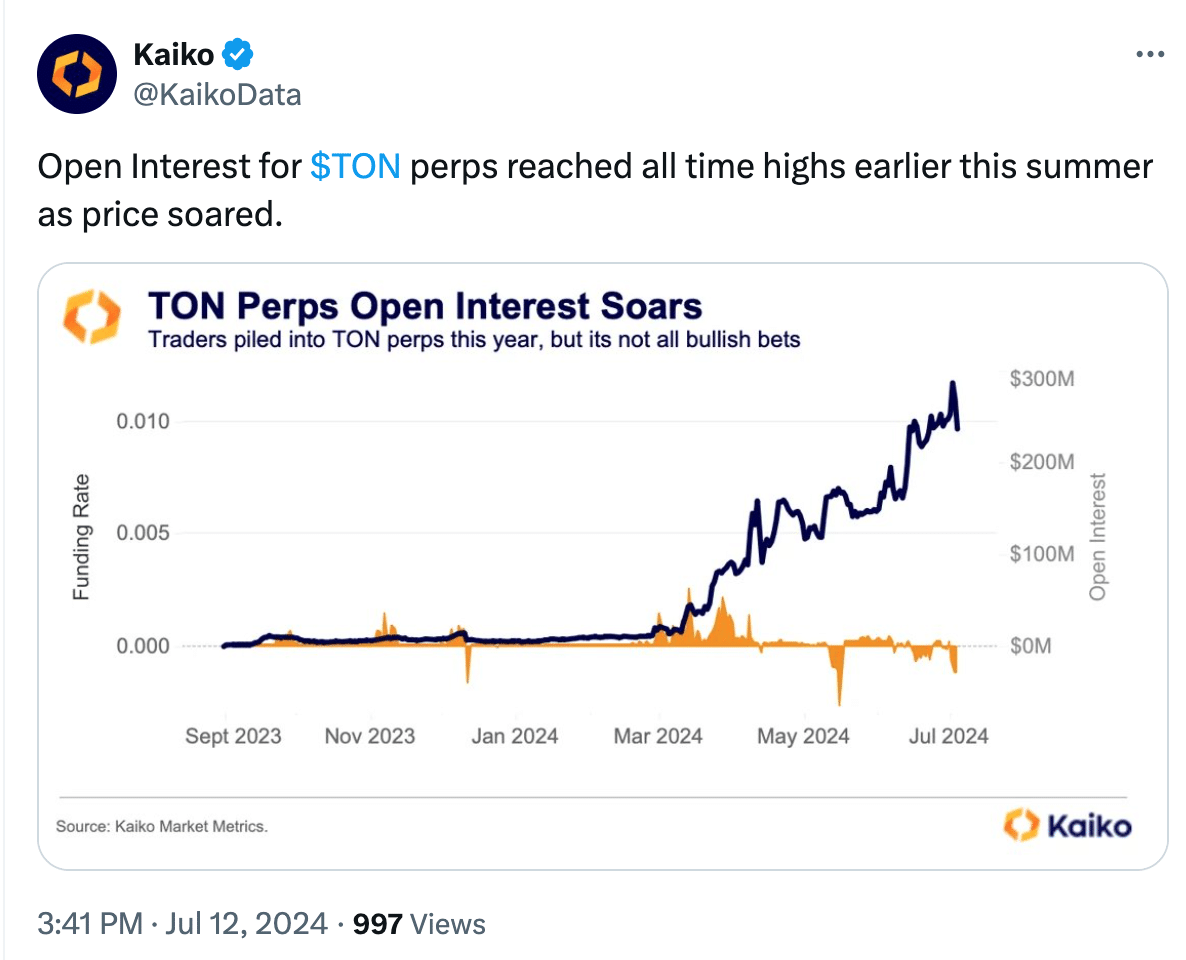

The Open Interest of TON reached a new peak of $287 million in early July, demonstrating substantial investment in the token. The market has seen fluctuations in funding rates, moving between positive and negative zones throughout the year. This indicates that traders hold contrasting views, with some being bullish while others are bearish.

As a researcher studying market trends, I’ve noticed that May showed a clear preference for bearish bets based on the heavily negative funding rates. However, in recent months, the market has shifted towards a more even balance between long and short positions.

With its steep price tag, rising transaction activity, and expanding market fluidity, TON may pique the interest of not only individual but also institutional investors. Consequently, this could result in a larger and more diverse investor pool, possibly driving up the demand for TON.

What does the on-chain data say?

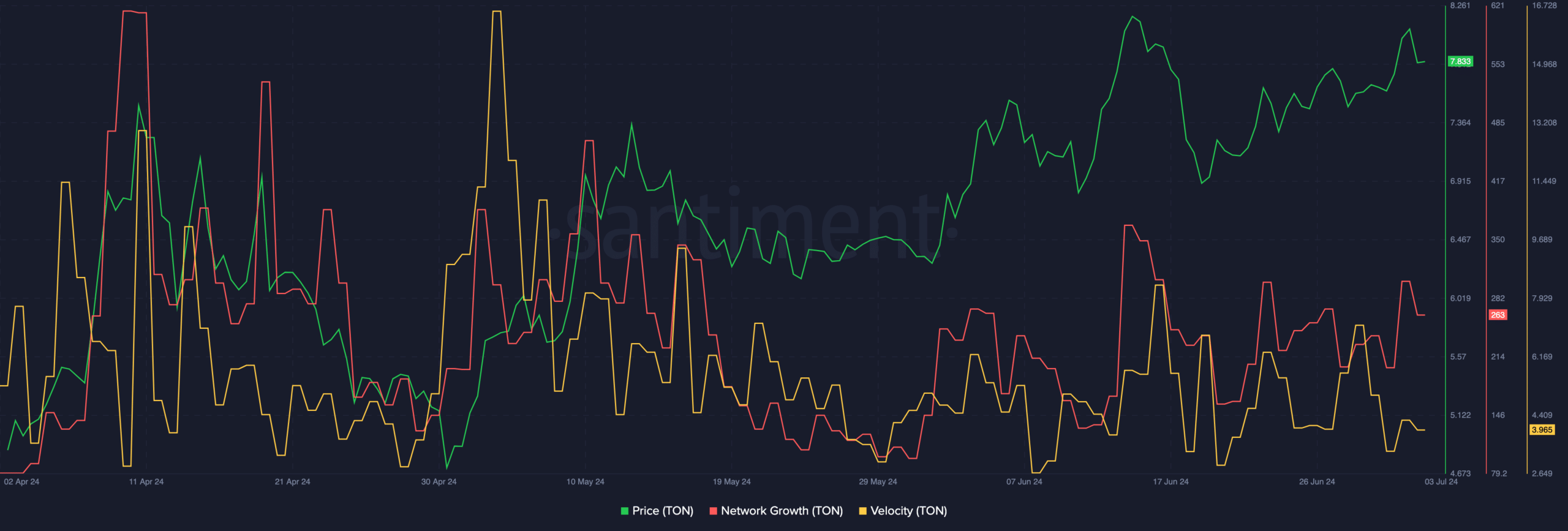

As of now, the value of TON was at $7.36 during our latest check, representing a 0.12% increase over the previous 24-hour period.

It’s worth noting, however, that AMBCrypto’s analysis of Santiment’s data revealed that the network growth for TON declined. This implied that the interest showed by new addresses for TON has significantly fallen of late.

Read Toncoin (TON) Price prediction 2024-25

The velocity at which TON was trading also decreased, indicating that the frequency at which TON was trading fell materially.

The current situation indicates that TON may experience some price fluctuations in the near future, preceding significant cost changes.

Read More

2024-07-13 20:07