- Bitcoin’s volatility hit a 3-month high on the charts

- Buying pressure on the coin increased, hinting at a price hike soon

As a seasoned crypto investor who has weathered numerous market storms and navigated through various cycles, I can confidently say that the recent surge in Bitcoin’s volatility, fueled by the upcoming U.S elections, is nothing new under the sun. While it might be a bumpy ride, I’ve learned to embrace the rollercoaster nature of this exciting market.

With U.S. Election Day approaching, various industries have shown distinct reactions, and cryptocurrency was no exception.

Indeed, the volatility of Bitcoin’s (BTC) price has reached its highest point in the past three months. This leads us to ponder – Might this significant fluctuation extend its influence across the entire cryptocurrency market?

U.S elections affecting crypto?

The level of unpredictability in the cryptocurrency market began to increase as the date for the U.S election results drew near. According to AMBCrypto’s findings, the overall crypto market’s volatility spiked and reached 66.7 at the time of writing. As anticipated, Bitcoin spearheaded this shifting trend, with Bitcoin’s volatility reaching a three-month peak.

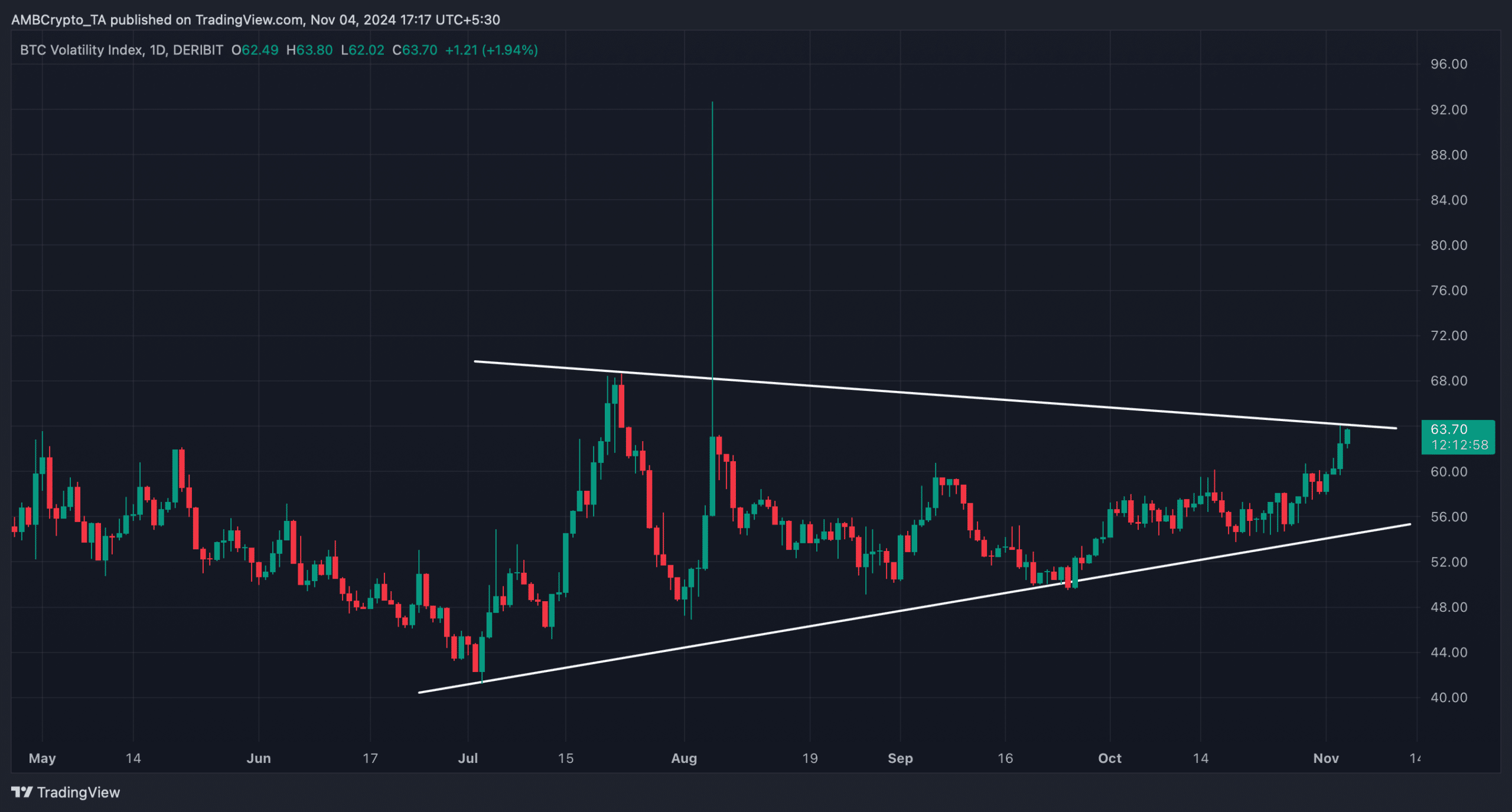

In this case, what stood out was the emergence of a pattern on the volatility graph. To clarify, this pattern became visible in July, and since then, the volatility graph has been narrowing within these boundaries.

Currently, when I’m composing this text, Bitcoin’s (BTC) volatility was challenging the resistance level since its worth was approximately 63.72. Should the graph surpass this resistance, investors may encounter increased volatility following the election outcomes.

Apart from this, AMBCrypto also found that liquidations in the crypto market rose.

As a crypto investor, I found it encouraging to see that the majority of liquidations in Bitcoin were primarily from long positions – a bullish indication. This suggests that there’s a stronger bullish sentiment prevailing throughout the market as more investors are taking long positions.

Will BTC’s rising volatility push it up?

Recently, Bitcoin’s volatility has increased significantly, leading AMBCrypto to examine its on-chain data to predict whether this trend will result in gains for investors or losses. Upon studying CryptoQuant’s statistics, it appears that Bitcoin’s exchange reserves have been decreasing, suggesting a strong demand and buying pressure for the cryptocurrency.

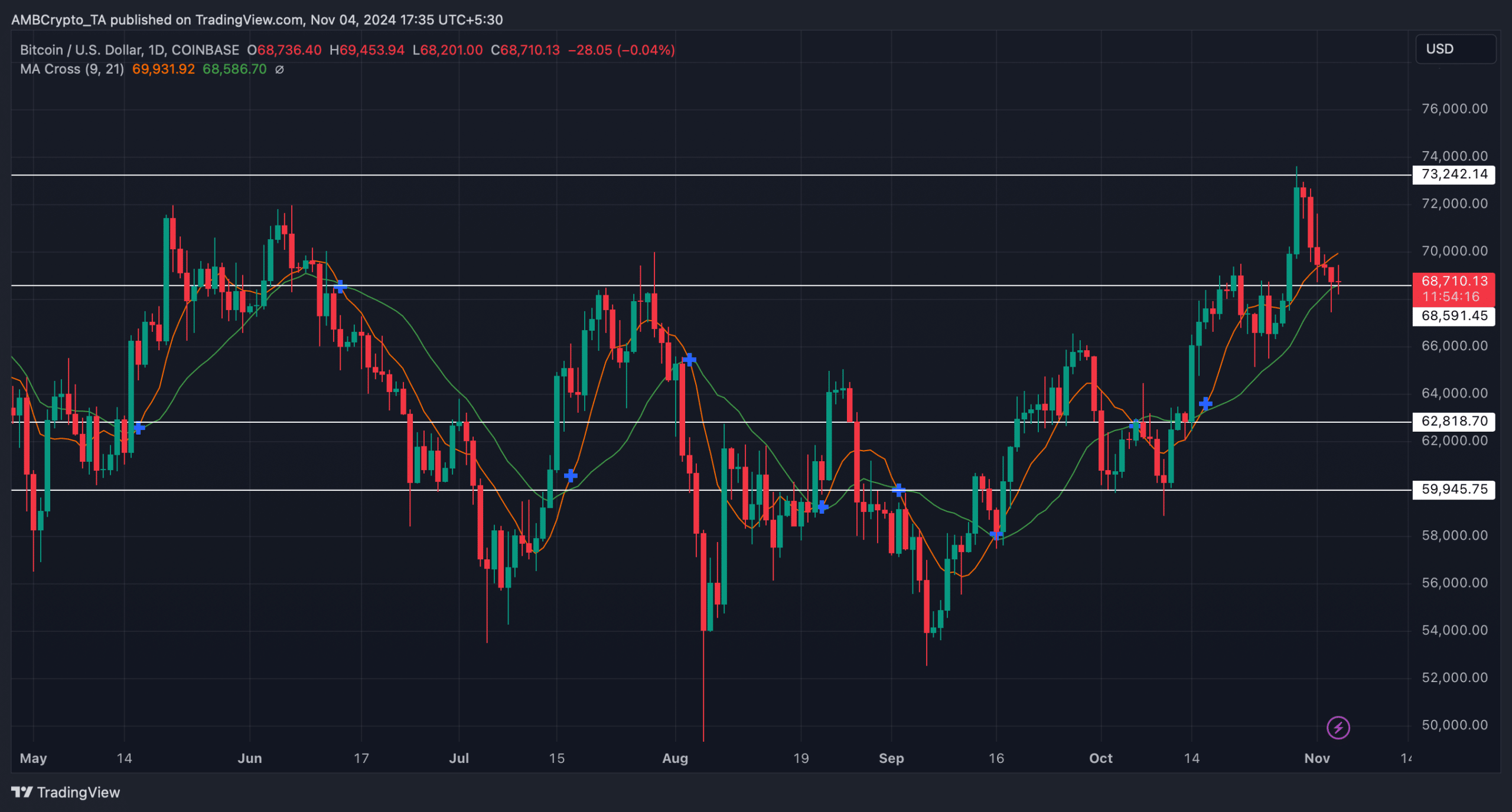

A hike in buying pressure generally translates into price hikes. In fact, over the last 24 hours alone, BTC witnessed a marginal price hike and was trading at $68.75k.

Yet, despite the king coin’s advantageous position, some factors were working against it. The accumulated selling by investors as indicated by BTC’s realized price to sell ratio suggested an increase in profits being taken off the table. This trend, occurring amidst a bull market, could potentially signal the approach of a market peak.

Moreover, as the U.S elections continue to generate a lot of discussion, it appears that investors are refraining from purchasing Bitcoin, as suggested by the negative Coinbase premium.

Ultimately, we examined the daily Bitcoin chart for a clearer perspective. Based on our evaluation, it appeared that Bitcoin was undergoing a test of a potential support area.

Read Bitcoin (BTC) Price Prediction 2024-25

As a researcher studying Bitcoin’s market trends, I’ve observed that the Moving Average Cross indicates the bulls have been in control, signifying a positive test of the market. If Bitcoin’s volatility escalates further, it could potentially push its price back towards the $73k mark.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-05 02:15