- BNB has gained 22% in November, fueled by a broader cryptocurrency upswing.

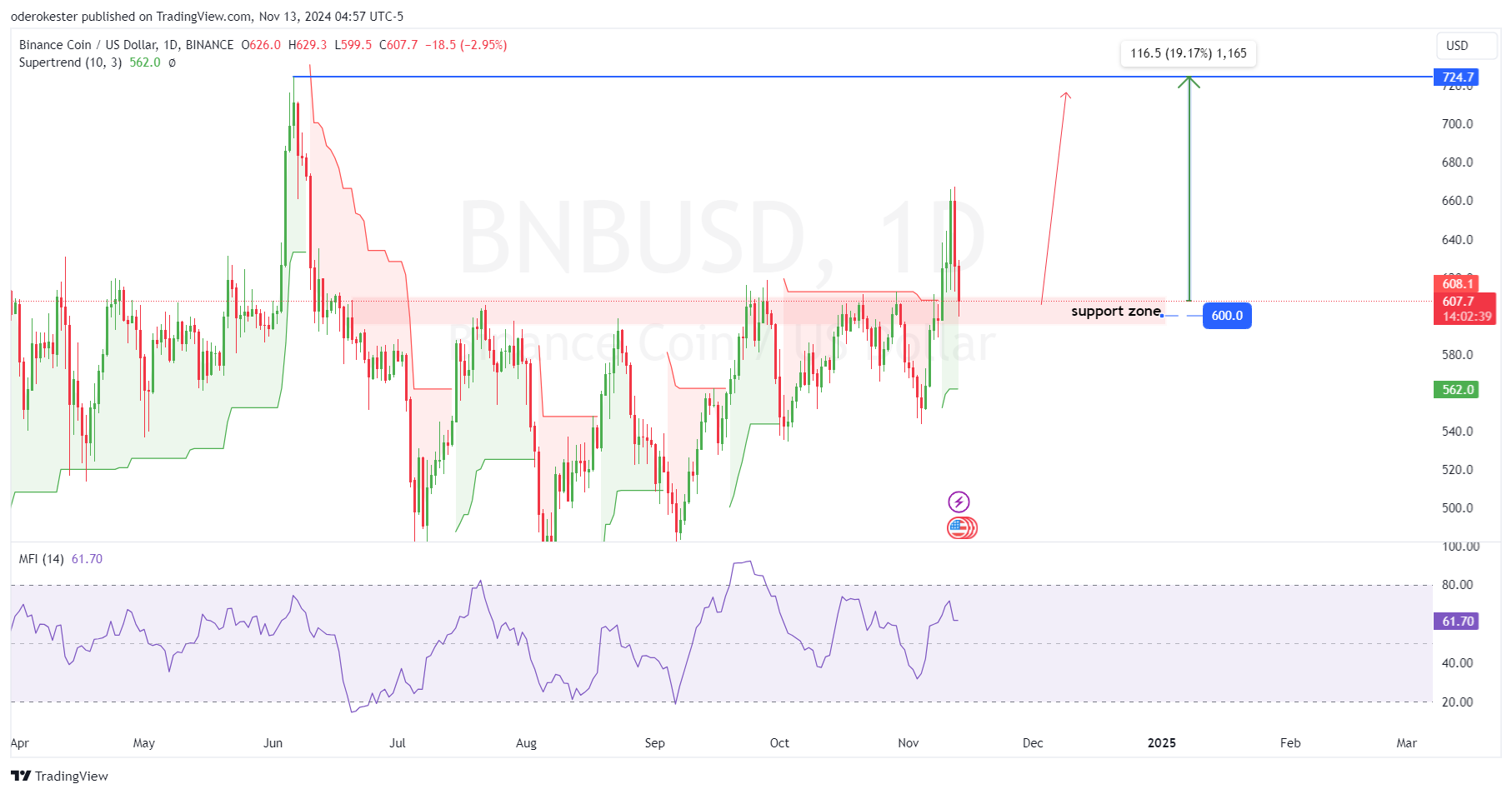

- Money Flow Index at 61 showed strong buying interest, with more room for gains.

As a seasoned researcher with years of experience navigating the dynamic world of cryptocurrencies, I find myself intrigued by Binance Coin [BNB]. The 22% surge it experienced in November, fueled by the broader crypto upswing following Trump’s win, caught my attention. However, the recent rollercoaster ride this week with a 7% drop to $606 has offered a unique opportunity for newcomers to jump on board before a major bull run.

As a researcher, I’ve observed an intriguing pattern in the daily performance of Binance Coin [BNB]. Since August, it has been consistently hitting higher peaks and troughs, which is a strong indication that we might see fresh all-time highs before this year concludes.

During the initial week of November, BNB experienced a 22% increase, primarily driven by the surge in the cryptocurrency market that occurred after Donald Trump’s victory.

Nevertheless, BNB experienced a turbulent ride this week, sliding by 7% to find stability at the crucial support level of $606. This dip presents an opportunity for traders and investors to join in before a significant upward trend.

Indicators show room for further BNB upside momentum

At the current moment, BNB was maintaining its position above a significant support area priced around $600. In the past, this level had demonstrated robustness as both a point of support (where the price bounced back) and resistance (where the price struggled to rise above).

This backing provides a foundation that could lead to a rise aimed at the $724.7 resistance level, which represents BNB’s past maximum and record high, approximately 19% higher than its current value.

Moreover, the Supertrend indicator continues to indicate a bullish trend since the price is currently situated above the green Supertrend line at approximately $562, providing a supportive level during potential market corrections.

With a Money Flow Index of 61.70, there’s strong evidence of active buying activity, but it hasn’t quite reached the point of being overbought. This leaves some scope for continued positive price movement.

So, if BNB keeps its value above the $600 mark, it could signal an upward trend towards the resistance at $724.7. This is particularly possible if the bullish momentum persists.

BNB open interest and market sentiment outlook

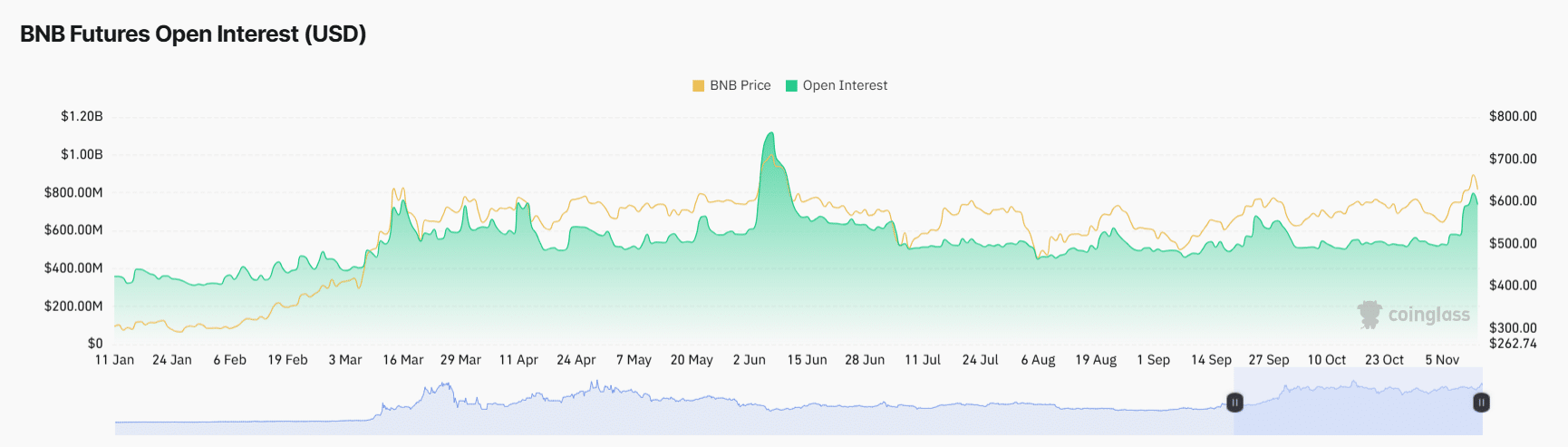

Since August, Binance Coin (BNB) has exhibited robust bullish tendencies, consistently creating new highs followed by even higher lows on its daily chart. This pattern, coupled with the increase in open interest from August up to now, indicates a growing level of market engagement and faith in the upward trend.

Despite a continuous rise in OI, it hasn’t surpassed the high points recorded in June so far, suggesting that there is still potential for an increase in both interest and market activity.

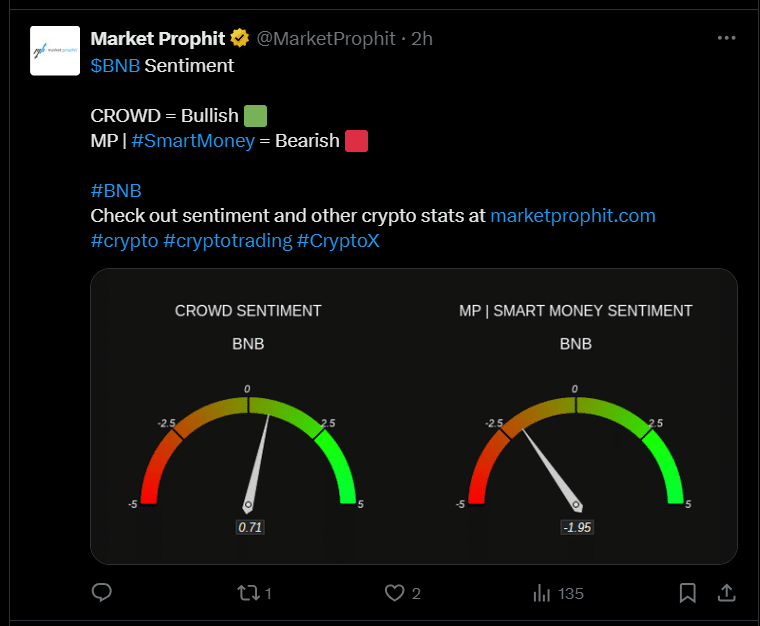

This sentiment analysis reveals contrasting views on BNB. The crowd sentiment leans bullish, with a score of 0.71, suggesting general optimism among retail traders.

On the flip side, the attitude of seasoned or institutional investors, as indicated by their smart money sentiment, leans towards pessimism, with a score of -1.95.

This difference shows that experienced investors are being cautious, which might suggest hidden worries, whereas casual traders seem to be more hopeful in their perspective.

BNB transaction activity rebounds in Q4

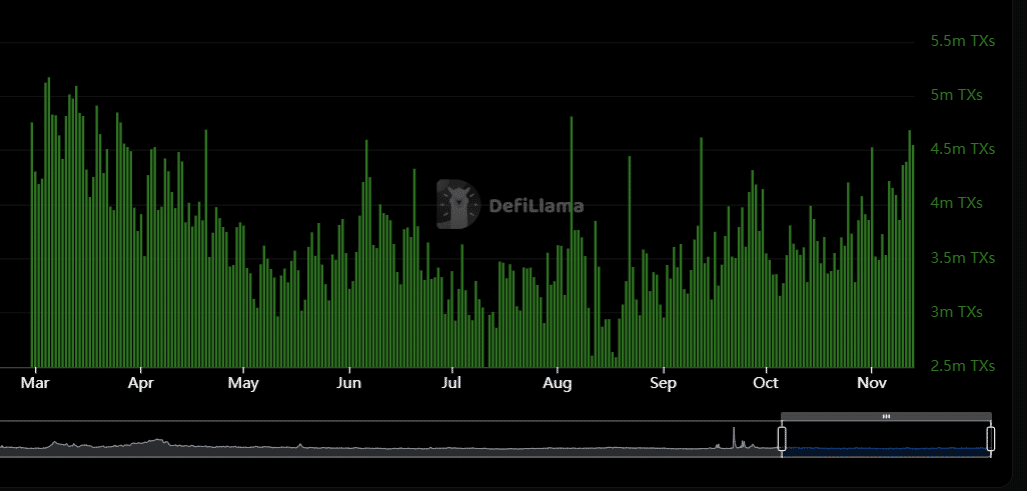

In March, we often saw more than 5 million transactions taking place, which suggests it was a particularly active and involved time.

After hitting this high point, the number of transactions progressively decreased from April to May, eventually settling at a less active rate during the summer months.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Starting in July, the number of transactions began to rise once more, although not as significantly as it did in March. However, since October, there’s been a consistent upward trend in transactions, with many days seeing approximately 4.5 million transactions.

The steady rise in this activity indicates a revived curiosity or higher utilization, possibly stemming from market developments or system updates.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-14 13:44