- Shiba Inu’s daily price chart had a bullish outlook as the memecoin traded under a resistance zone from June

- Liquidation levels overhead could induce a short squeeze, before a bearish reversal in the second half of October

As a seasoned crypto investor with battle scars from the wild west of DeFi and meme coins, I find myself intrigued by the current state of Shiba Inu [SHIB]. The bullish outlook on its daily price chart, with the memecoin trading under resistance since June, has my attention.

At the moment of reporting, Shiba Inu [SHIB] was on an upward trend, however, its trading volume decreased by 4.4% within the previous 24 hours before this report. This decrease also corresponded with a drop in significant investor (whale) activity, suggesting less demand from prominent Shiba Inu investors.

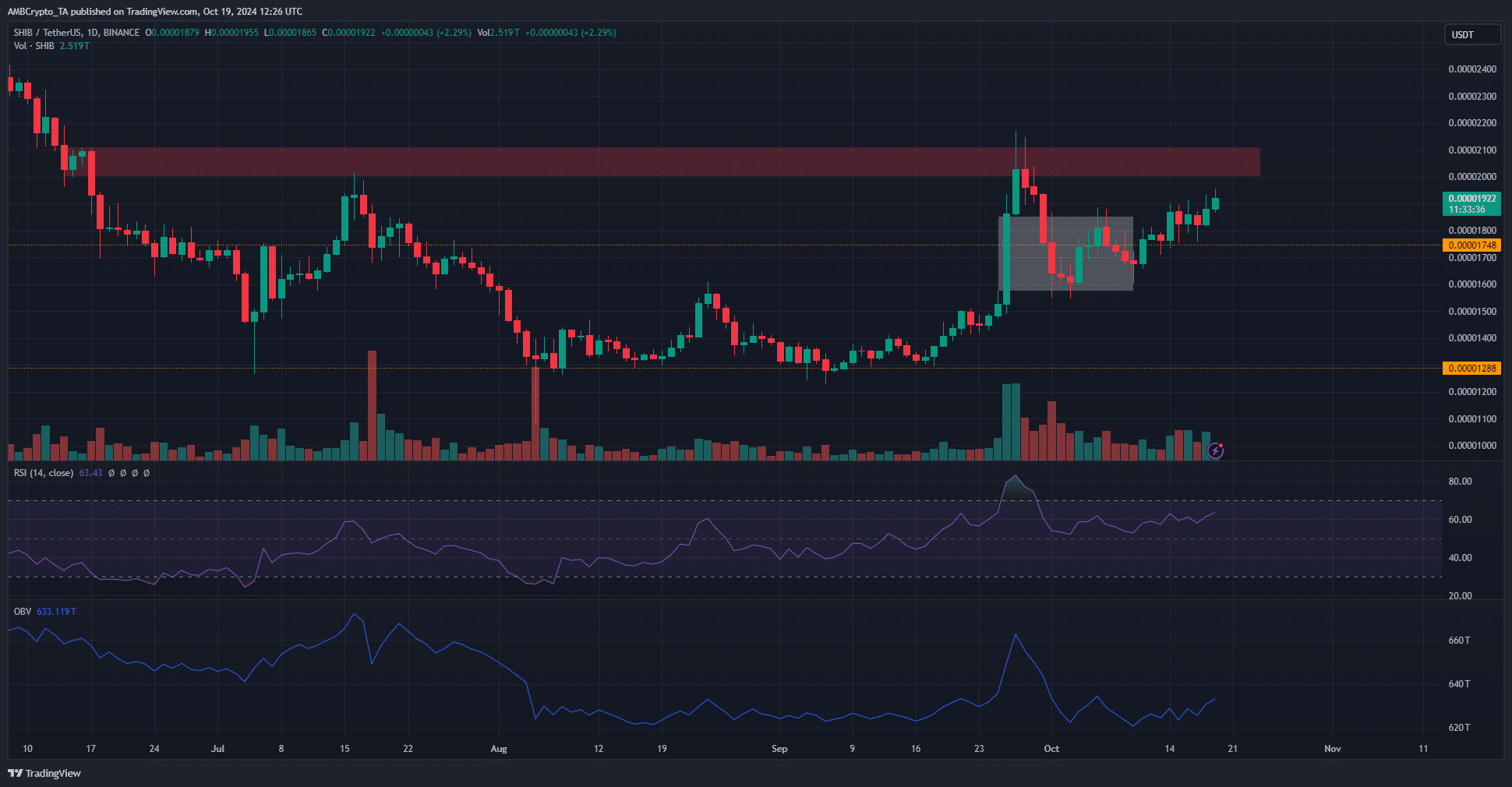

In October’s early dip, the memecoin’s bullish investors bounced back strongly from testing a fair value gap. Notably, trading volume has consistently surpassed the averages observed in August and September. However, the significant resistance level at $0.00002 remained an obstacle for the bulls to overcome.

In June, this area presented a tough challenge, and it’s continued to do so. Despite the Relative Strength Index (RSI) and market structure suggesting bullish strength, the On-Balance Volume (OBV) was not as persuasive. This weak demand in October might impede attempts to overcome the bearish order block above us.

Falling volatility could aid investors

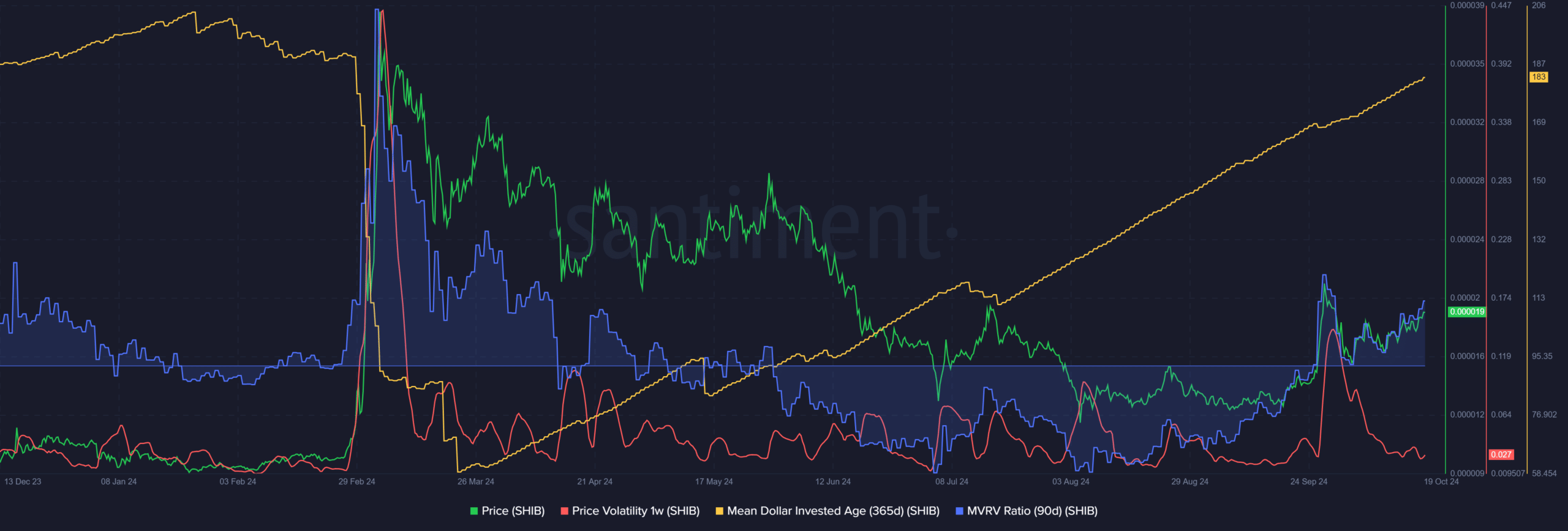

Over the last week of September, there was a significant increase in market turbulence, but it’s calmed down recently. This decrease in instability indicates a period of consolidation, similar to what we experienced during the first half of September before the substantial surge.

Over the past 90 days, the Shiba Inu MVRV (Maker’s Value to Realized Value) ratio has been increasing in tandem with its price. This suggests an increased likelihood of profit-taking actions and potential selling pressure. However, it does not necessarily indicate a threat to the possibility of a breakout.

Currently, the Average Age of Money Invested was steadily increasing as we speak. This suggested that investors were holding onto their existing assets instead of reinvesting or spending them.

When this indicator starts decreasing, it might signal a decrease in stagnation and possibly mark the beginning of a strong upward trend. This was observed in February and March this year, and we may witness a similar pattern repeat itself.

Short liquidations building up above SHIB’s press time price

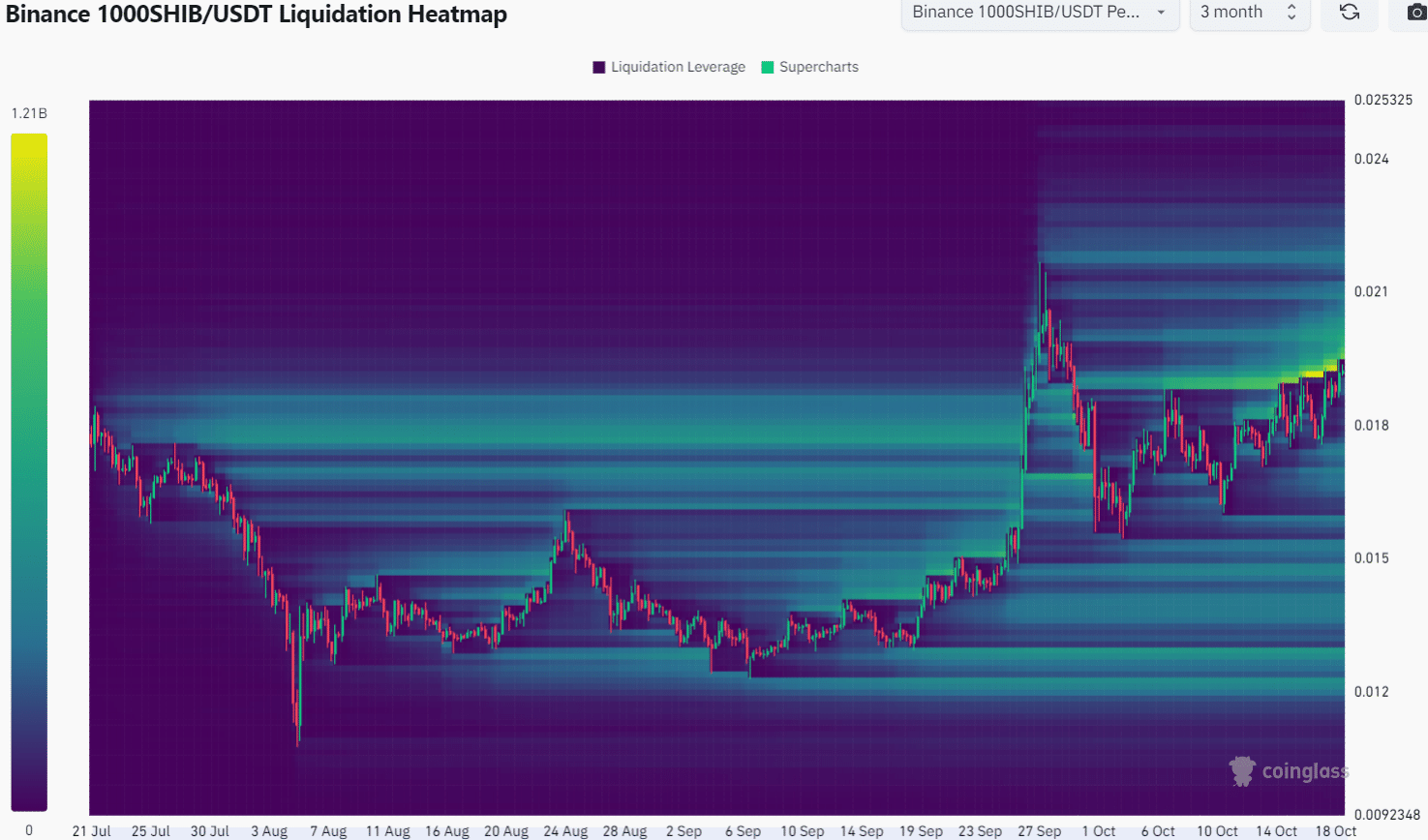

The 3-month liquidation chart highlighted a significant region between $0.0197 and $0.0202, which attracted attention. This potentially influential zone might propel Shiba Inu upward.

Is your portfolio green? Check the Shiba Inu Profit Calculator

It appears that speculators were quite eager to wager on the possibility of Shiba Inu (1000SHIB) encountering another refusal at $0.02. This conviction might spark a short squeeze, but it’s crucial for actual demand to support the memecoin’s surge beyond its current level.

Read More

2024-10-20 06:15