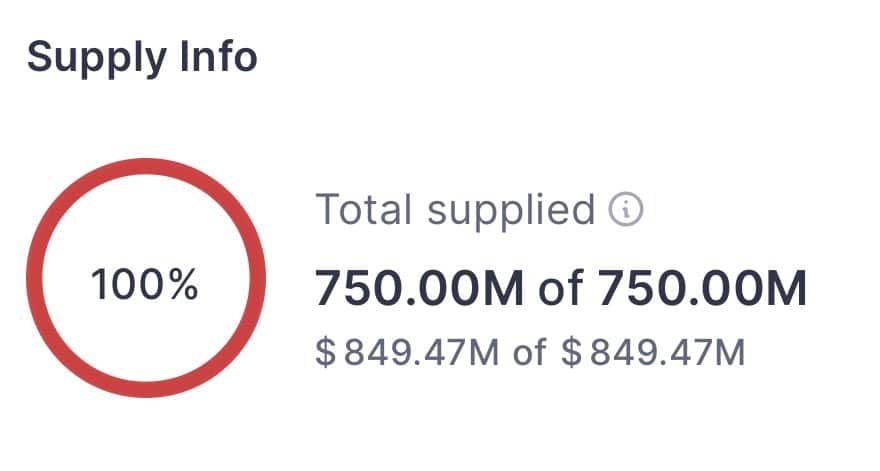

- The supply of sUSDe, a stablecoin unique to the Aave ecosystem, has been fully utilized

- At the same time, the protocol’s Total Value Locked (TVL) has reached its highest level since its inception

As a seasoned researcher with years of experience in the cryptocurrency market, I must say these developments in the Aave ecosystem are intriguing and promising. The fact that sUSDe has reached its supply cap within 24 hours is a testament to its growing popularity and utility, despite the temporary dip in AAVE‘s price.

Although progress continues on the Aave protocol, the value of AAVE dropped by 1.01% within the past day, defying predictions that it would build upon its remarkable 30.47% surge over the previous week.

As a researcher, I’ve recently come across some intriguing insights from AMBCrypto’s analysis. They hint towards a potential increase in the altcoin’s price, an upward trend that seems to stem from growing investor interest and enhanced liquidity conditions. These elements could potentially set the stage for a more robust performance by this asset in forthcoming trading sessions.

Supply cap reached – What does it mean for AAVE?

Based on reports from Macro Mate (previously known as Twitter), the market supply of the Aave-native sUSDe stablecoin reached its maximum limit of $850 million in just a day.

Aave’s choice to limit the production of their stablecoin is a tactical method aimed at reducing potential risks and enhancing the usefulness of the asset. Consequently, since the supply is now fixed, this action has led to an increase in the cost of borrowing sUSDe because of its increased demand and scarcity.

As I observe increased interactions within the Aave protocol, I can’t help but feel excited. This heightened user engagement usually signals a growing interest in the platform, and that often translates to increased demand for the Aave token. Such demand could potentially shape a favorable path for its price movement.

Additionally, AMBCrypto pointed out that these advancements have impacted various sectors within the Aave environment.

TVL hits all-time high

According to the latest figures from DeFiLlama, the total value locked (TVL) in AAVE has seen a significant increase, now exceeding $21.55 billion. This marks the highest TVL for the platform since it was first launched.

This trek showed a surge in investor involvement within the environment, with behaviors like securing and committing assets becoming more frequent.

Since the protocol’s core activity revolves around the coin, an increase in user interaction with the protocol may also impact the value of its associated tokens.

In the upcoming days, it’s anticipated that more investors will gather AAVE, potentially influencing its market behavior.

Long traders bet on AAVE as supply tightens

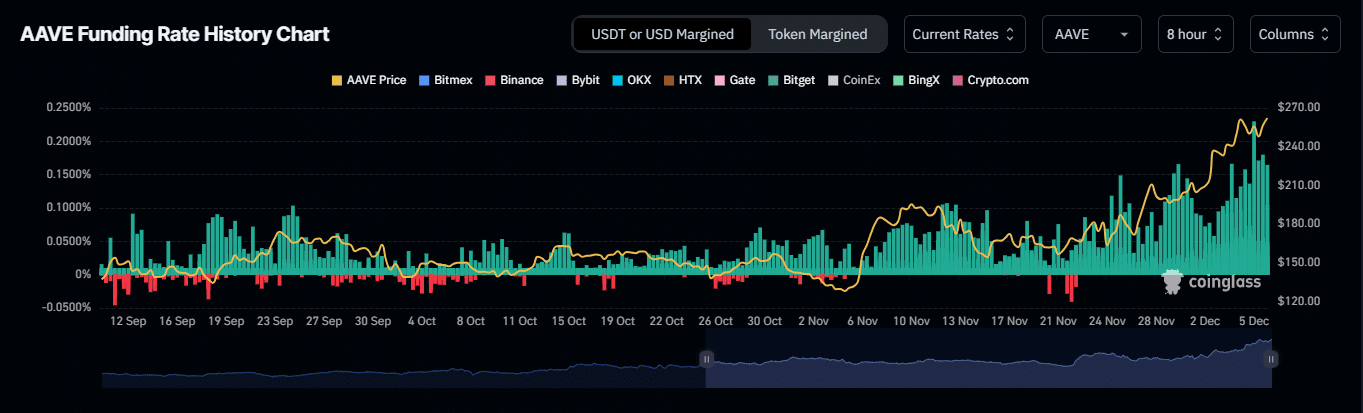

As a crypto investor, I’ve observed an uptick in trading activities, particularly from derivative traders. Interestingly, data from Coinglass shows that long positions are progressively gaining traction in AAVE, with the funding rate reaching a significant level of 0.0393%.

When a funding rate is favorable, it indicates that long-term traders are being charged regular fees in order to keep the prices aligned between an altcoin’s spot and futures markets. This fee payment suggests that these traders anticipate the asset’s value to increase over time as depicted on price charts.

Over the past two days, it appears that spot traders have been showing a positive, or “bullish,” pattern. This is indicated by a substantial withdrawal of the coin from exchanges during this period.

Read Aave’s [AAVE] Price Prediction 2024-25

3,372 million dollars’ worth of AAVE has been shifted into personal wallets, possibly for long-term storage. Such a transfer might cause scarcity in the market, potentially boosting the value of this asset.

If the current pattern persists and the amount of AAVE in circulation decreases, it’s reasonable to expect a rise in demand. This increased demand could reinforce the upward movement in the value of AAVE.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-07 12:07