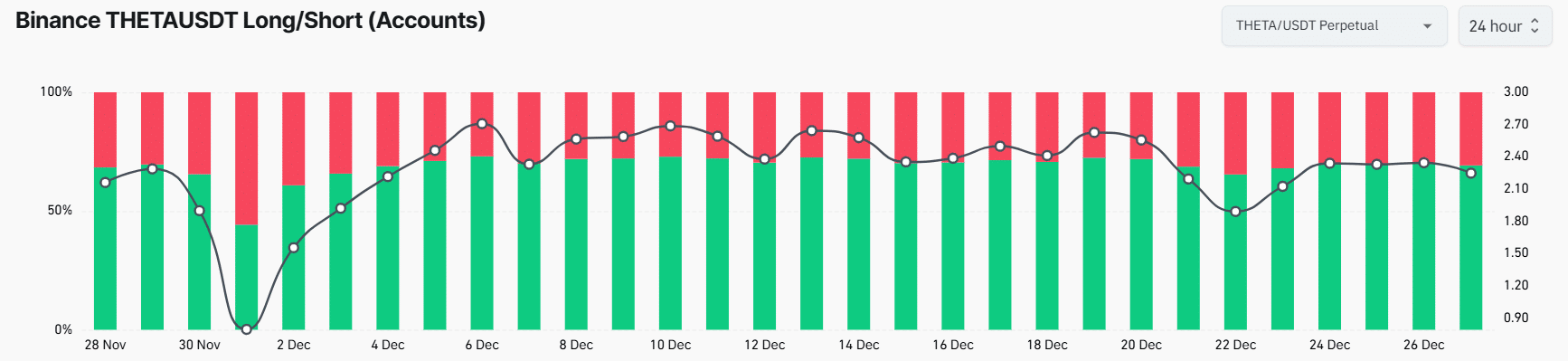

- At press time, 69.2% of top traders on Binance held long positions in THETA

- THETA’s Relative Strength Index (RSI) stood at 43, indicating a potential for upside momentum

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by the current state of THETA. Despite the broader market turbulence, this altcoin seems to be carving out its own bullish path, reminiscent of a lone sailor navigating stormy seas while the rest of the fleet is struggling.

As an analyst, I’ve noticed a surge in interest towards THETA, the native token of Theta Network, due to the emergence of a bullish price action pattern on its daily chart. Interestingly, the broader crypto market, which includes heavyweights like Bitcoin, Ethereum, and XRP, seems to be grappling with some challenges at this moment.

Amidst the turbulent market landscape, I find myself drawn to examine the factors bolstering a bullish perspective for THETA. These elements stem from an escalating curiosity among traders and the continued accumulation by ‘whales’ – significant investors. Nevertheless, these events transpire post the price reaching a pivotal level that brushes against the breakout point.

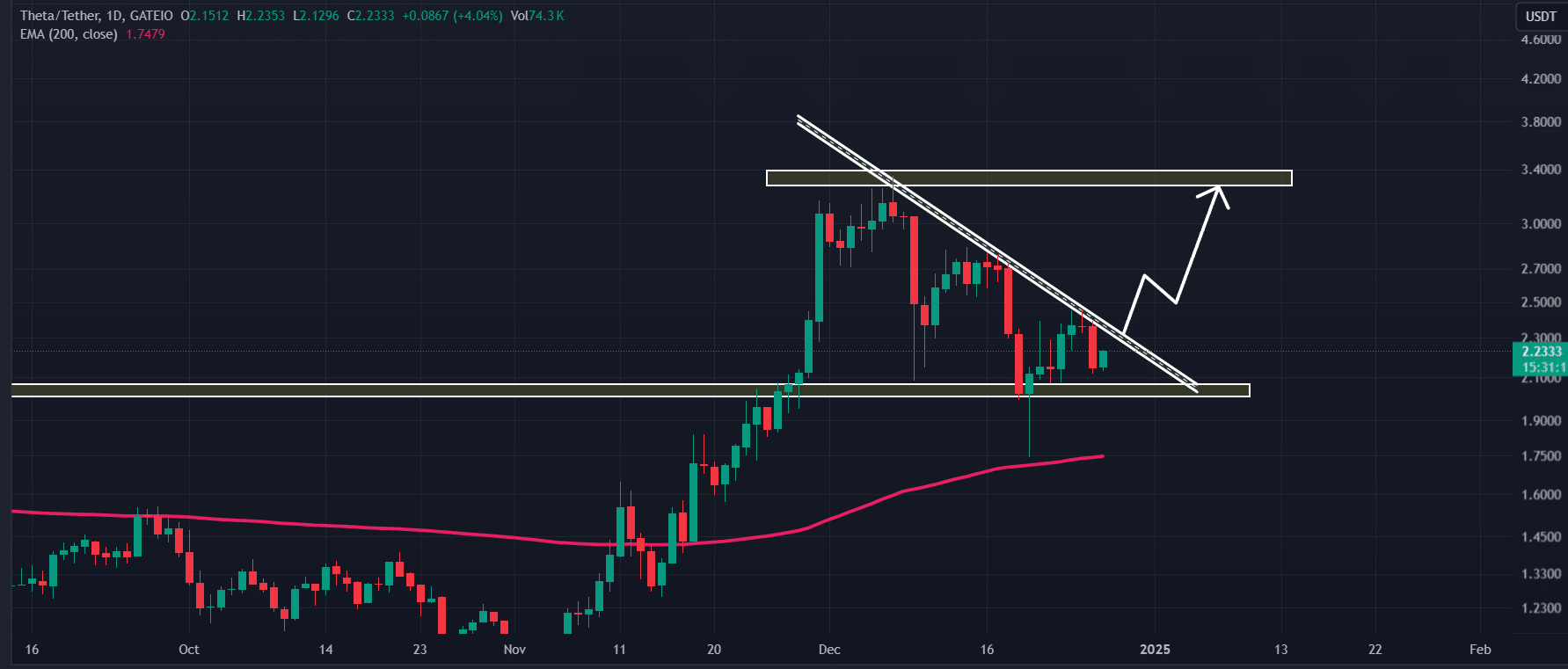

Theta Network (THETA) technical analysis and key levels

As a crypto investor, I’ve been closely watching THETA, and based on my own technical analysis, it appears to be forming a descending triangle price action pattern on the daily chart. This setup suggests that a breakout could be imminent.

Despite the recent drop in prices, it managed to test a vital support level derived from the 200 Exponential Moving Average (EMA), on the same chart.

If the AI token manages to surge past the current daily closing price of $2.41 and maintains this level, there’s a high probability that its value could spike by approximately 37%, potentially reaching around $3.33 in the upcoming days.

On a positive note, THETA’s Relative Strength Index (RSI) was at 43, suggesting a possible increase in positive momentum.

Bullish on-chain metrics

The strong upward price trend of this altcoin has drawn both traders and investors, according to Coinglass’s reporting. Over the past day, data from THETA’s spot inflow/outflow shows that exchanges experienced approximately $2.02 million in THETA withdrawals.

The amount of assets transferred from exchange platforms to long-term holder’s wallets, indicated by the outflow, suggests a possible increase in demand and upward trend.

In addition to long-term investors, there’s been significant enthusiasm and trust demonstrated by traders on Binance towards the token. At this moment, the long/short ratio for THETA/USDT on Binance was 2.25, suggesting a predominantly bullish attitude among traders.

Right now, 69.2% of top traders on Binance hold long positions, while 30.8% hold short positions.

Current price momentum

Currently, THETA is close to $2.21 in value. Over the past 24 hours, it has seen a decrease of 1% in price. Meanwhile, the trading volume decreased by 5.75%, suggesting fewer traders are actively participating in its market compared to the day before.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-27 21:11